Classifications will be reduced from 4 to 2.

The rules being introduced by AASB 9 Financial Instruments will also remove the need to separate out embedded derivatives. This should reduce the complexity for accounting for financial assets.

The former classifications under AASB 139 Financial Instruments: Recognition and Measurement were:

- loans and receivables

- held to maturity

- available-for-sale

- fair value through profit or loss.

The 2 new classifications under AASB 9 are:

- amortised cost (using the effective interest rate method)

- fair value through profit or loss.

However, each of the 2 new classifications has a sub‑classification that might require accounting through reserves (that is, other comprehensive income). The 2 sub-classifications differ as to how the reserve accounting operates, and both differ to current available‑for-sale accounting. These sub-classifications are not discussed in this article due to their additional complexity.

Broadly, the old loans and receivables held to maturity classifications have been combined into one classification (amortised cost), though with a different definition. The new definition includes a cash flow characteristic test, known as ‘solely payments of principal and interest’ (SPPI). The main characteristics are receipt of principal and interest, with interest being adjusted for time, value of money, credit risk, term etc.

If you have loans and advances (as a financial asset) you will need to focus on the new criteria. Some loans and advances need extra effort and analysis, including those to other public sector entities. These may have one or more of the following features:

- are interest-free

- are non-recourse

- do not have a set repayment date

- are repayable at call.

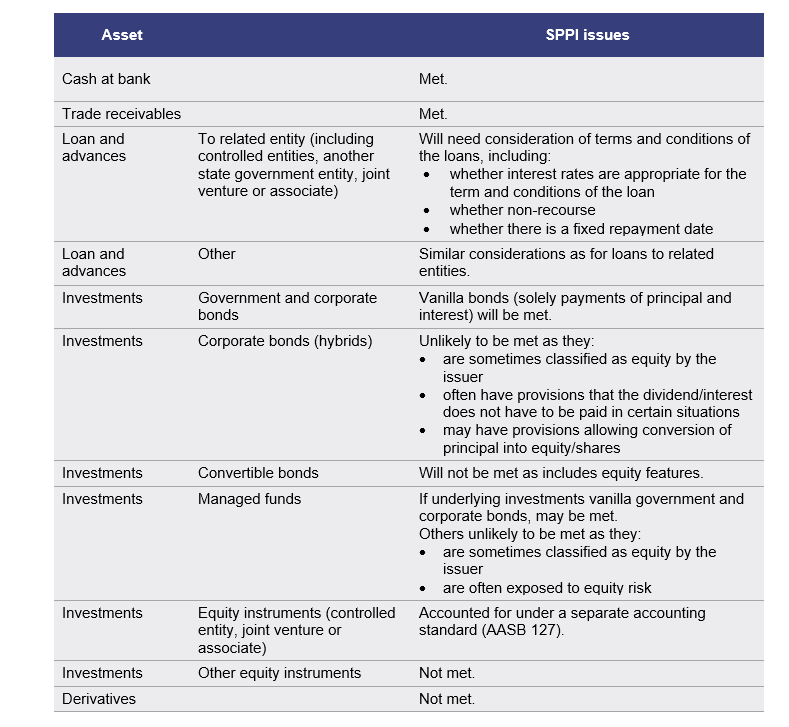

The table below gives some indicative expectations of classification issues for the SPPI test.

You will also need to consider the business model test that requires that you intend to collect the contractual cash flows, rather than trading the instruments – though some sales are permitted. Depending on your level of sales, you may need to follow the sub-classification accounting requiring fair value movements through other comprehensive income (OCI, that is, reserves), which allows recycling (recognition of profit on sale).

If you have investments, you are also affected. You will need to classify the investments between those that meet the new amortised cost criteria (for example, government and corporate bonds) and the rest. The accounting for investments that appear debt like, such as hybrid instruments, may change.

If the loan or investment fails the SPPI test, or the business model test is not met, then you must account for the financial instrument at fair value through profit or loss. However, for financial instruments that are classified as equity by the issuer, you can choose to recognise fair value movements through OCI (reserves) with no recycling (no profit or loss on sale). This election is available for each financial instrument.

If you have financial assets classified as available-for-sale, then you will need to determine how those assets will be accounted for under the new standard, as that classification has been removed.

If you have specifically designated certain debt financial instruments (such as investments) to be accounted for using fair value through P&L, you will need to make sure you want to keep using that approach and whether you continue to meet the criteria.

Impact of the SPPI test

The following are indicative expectations of classification issues for the SPPI test under AASB 9. Actual treatment will depend on consideration of the facts and circumstances of the specific arrangements. If the SPPI test is met, further assessment will be required of the business model, and whether any instruments have been specifically designated as fair value through P&L.