To ensure we select audit topics that matter most to Queensland, we apply a strategic planning approach to identify the risks and opportunities facing public service delivery, and align our audit topics in response. In this post, we share our high-level overview of the Queensland Budget 2023–24 and how key budget initiatives relate to our upcoming audits and reports to parliament in our Forward work plan 2023–26.

Highlights from the state budget

What is the expected result for 2022–23?

A surplus is the money left over after expenses. The Queensland budget identifies that the state is expecting to achieve a record $12.3 billion surplus this year, with estimated revenue ($87.6 billion) being greater than estimated expenses ($75.3 billion).

This is a significantly better result than forecast in last year’s budget (a $1.0 billion deficit) and reflects a $10.5 billion increase in royalty revenue. This increase in royalties was due to historically high coal and oil prices and changes to the coal royalty rates applied by the government from 1 July 2022.

What is the forecast result for 2022–23 and onward?

A forecast predicts what is likely to happen based on past and present finances. The budget forecasts a deficit (negative balance between spending and revenue) of $2.2 billion for the 2023–24 financial year, as expenses are expected to increase by $8.9 billion and revenues decrease by $5.5 billion.

The increase in expenses in 2023–24 largely relates to:

- $3.6 billion increase in grant expenses

- $1.5 billion in additional support to electricity bills for households and small businesses

- $1.9 billion increase in employee expenses.

The forecast increase in employee expenses reflects:

- a 4 per cent annual wage increase

- an expected increase in full-time equivalent (FTE) employees of 4,666

- a Cost of Living Adjustment (COLA) payment for employees where inflation exceeds headline wage increases, established in agreements.

The forecast decrease in revenue in 2023–24 is due to a $11.0 billion fall in royalties, reflecting an expected drop in prices for coal and oil. This is expected to be partially offset by a $3.2 billion increase in Australian Government funding from grants and GST revenue, and a $1.4 billion increase in tax revenue.

Revenues and expenses are estimated to increase at more normal levels from 2024–25 onward, with budget surpluses forecast for 2024–25 ($135 million), 2025–26 ($205 million) and 2026–27 ($377 million).

What about capital investment and borrowings?

Capital investment is the expenditure of money to purchase or build long-term assets. In 2022–23, the government spent an estimated $14.7 billion on its capital program – $2.1 billion more than forecast in the 2022–23 budget. This additional investment was funded without the need to increase borrowings (loaned money). In fact, the additional revenue earned in 2022–23 meant the government borrowed approximately $11.8 billion less than it estimated in last year’s budget. Total borrowings are estimated to be $54.7 billion as at 30 June 2023.

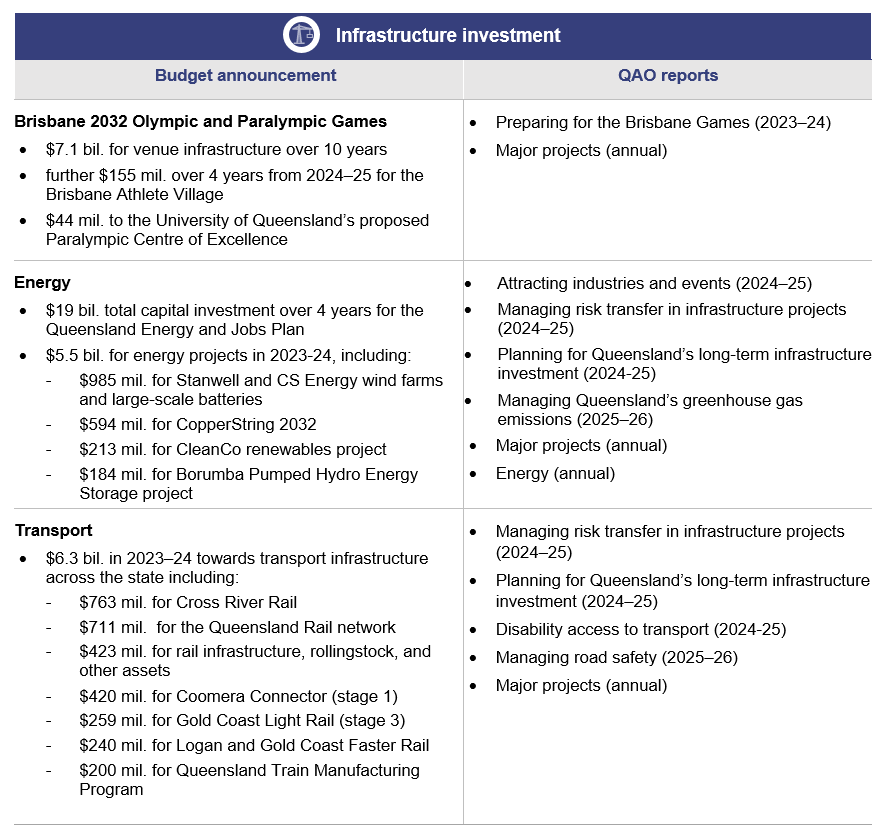

The 2023–24 budget identifies capital commitments of $88.7 billion between 2023–24 to 2026–27. This is a significant increase on the prior budget. In 2023–24, the government estimates it will make capital purchases of $16.4 billion. The most significant purchases are budgeted to occur in the following areas:

- transport ($6.2 billion)

- energy generation, transmission, and distribution ($5.5 billion)

- health ($1.6 billion)

- education ($1.5 billion)

- water distribution and supply ($1.0 billion).

These projects will be partially funded through additional borrowings. Borrowings are expected to increase by $10.9 billion in 2023–24 and by $40.1 billion over the 4 years to 2026–27. Total borrowings are forecast to reach $94.8 billion by 30 June 2027.

How will QAO consider these results in future audits?

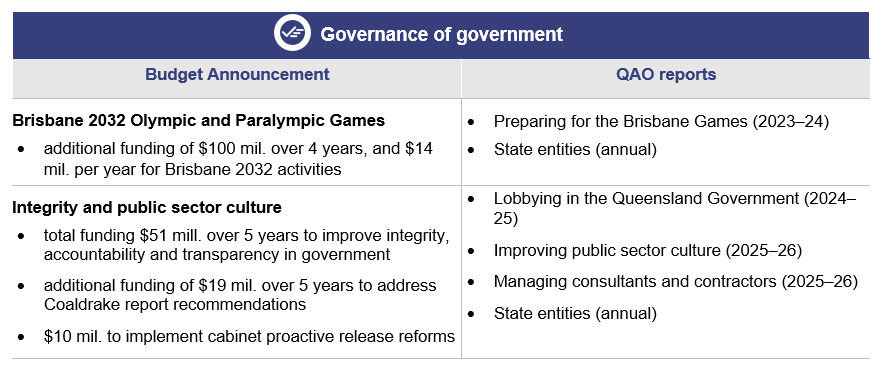

Each year, QAO develops a 3-year forward work plan to share our planned audit topics and reports to parliament with our clients and stakeholders. As part of our planning, we identify ‘focus areas’ that guide our work across all our services – performance and assurance audits, and the results of our financial audits.

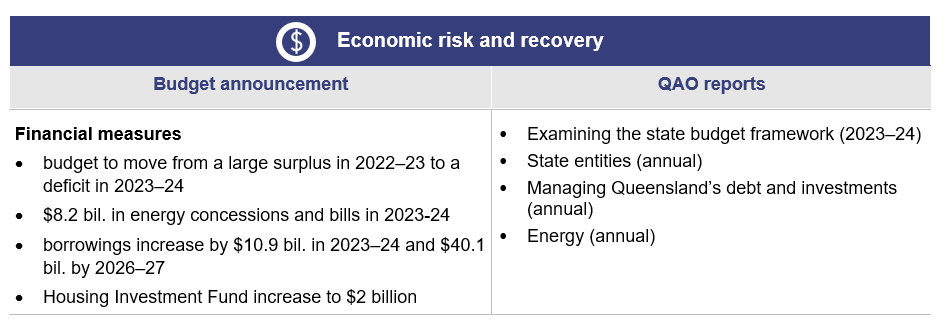

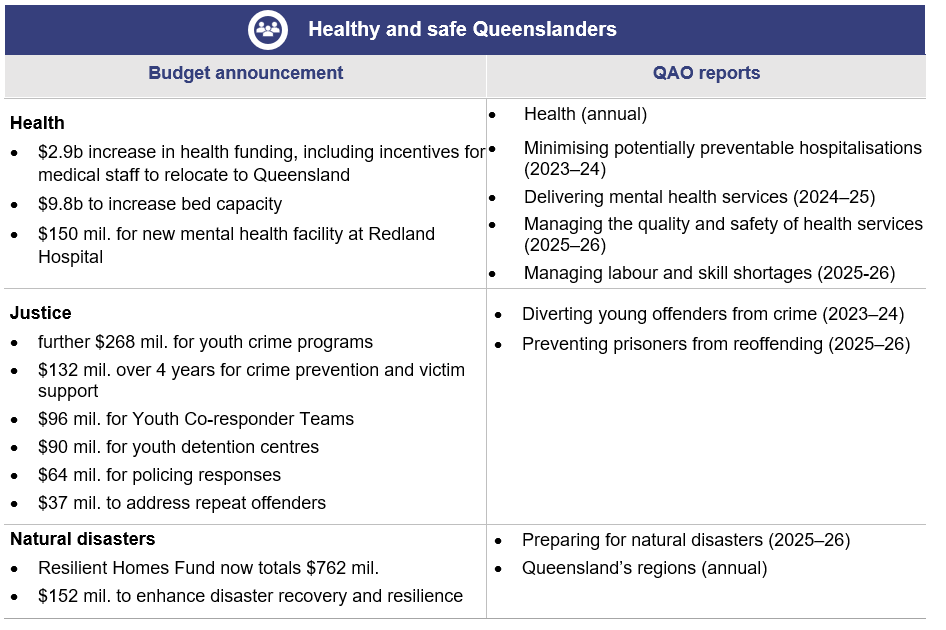

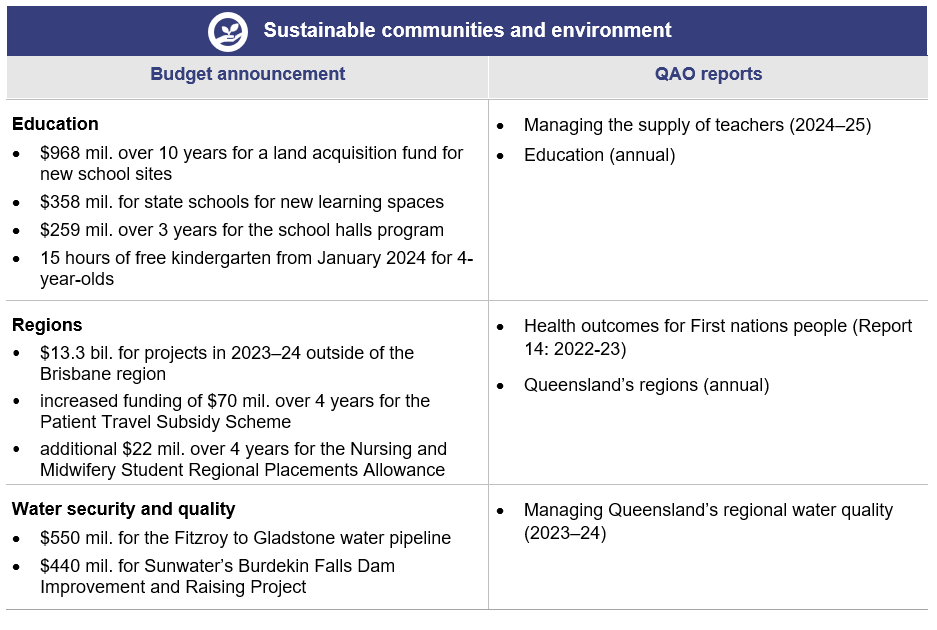

The following identifies how key aspects of the Queensland budget relate to some of the audit focus areas identified in our Forward work plan 2023–26.

*We did not include our focus area of technology risks and opportunities due to the nature of the risks in these areas not directly relating to the state’s budget.

We hope this blog is valuable to our readers by providing a useful overview of Queensland’s budget and how we consider it as part of our service delivery.

Further resources

- Fact sheet: Our forward work plan