Not-for-profit entities were given an extra year to get ready for these new standards. Don’t waste the benefit as you will need to deal with both these standards and at the same time deal with the new leasing standard AASB 16.

The biggest complaint about the current accounting for revenue in the not-for-profit sector, mainly in relation to grants, is the lack of ‘matching’ between revenue and expenses. While the concept of matching has not been reintroduced, a similar outcome may occur if revenue is required to be deferred under the new standards. However, many will be disappointed that capital grants will still usually require up-front revenue recognition (though spread over the construction period), and therefore not match the depreciation recognised over the life of the asset.

To achieve deferral, AASB 15 needs to be applied. AASB 15 is based on IFRS 15, which was written for the for-profit sector. The AASB expanded the scope of AASB 15 to apply to the not-for-profit sector. The expansion includes guidance on how to apply the standard to arrangements in the not-for-profit and public sectors, including the five-step model. However, applying AASB 15 is likely to be challenging.

Two fundamental issues for not-for-profit entities to be within the scope of AASB 15, and which will require significant judgement, are:

- whether the arrangement is enforceable

- whether the arrangement is sufficiently specific.

Enforceable will usually be met when there is an obligation to return unspent funds.

Sufficiently specific broadly means that the terms are specific enough for you to know what goods you will be providing, or services you will perform, and to what extent you have completed those promises. AASB 15 calls these performance obligations. You must determine how far along you are in meeting these performance obligations to determine how much revenue to recognise or defer to future periods.

Sufficiently specific will require particular attention, as the term needs to be applied in accordance with the standards and related guidance, and not the dictionary definition. If revenue is received in advance, deferral is achieved as you recognise the proportion of the performance obligation not performed as a contract liability at balance date, and then recognise it in the next reporting period when you perform those activities.

If both criteria are not met, then the arrangement will likely be accounted for under AASB 1058 as up-front revenue.

Our experience so far is that the sufficiently specific requirement has caused the most difficulty. The example in AASB 1058 of providing counselling sessions for a given number of hours per week for the entire year is an example of being sufficiently specific. Some examples we have considered are:

- A department that includes proposed activities in its Service Delivery Statement. On investigation, the listing of proposed activities is analogous to a statement of intent, and entitlement to funding is not linked to the actual number of activities performed. Therefore, the sufficiently specific criteria is not met.

- Financial Assistance Grants to local councils (general component) are not expected to meet the criteria, as the grants are untied in the hands of local government. This allows councils discretion to spend the grants according to local priorities.

- Financial Assistance Grants to local councils (roads component) are not expected to meet the criteria. Even though the grants are specifically for roads, the grants are similarly untied in the hands of local government.

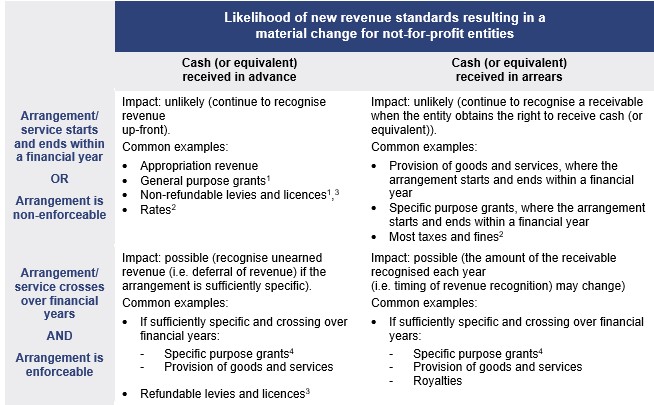

The table below gives some indicative expectations of issues arising from the new standards.

We also expect difficulties with the expanded disclosures when people put their minds to this aspect. We encourage you to prepare draft disclosures under the new standards, tailored for your entity using focused financial reporting, well before next year’s pro-forma financial statement deadlines.

Impact of revenue standards

The following are indicative expectations of issues arising from the new standards. Actual treatment will depend on consideration of the facts and circumstances of the specific arrangements. This consideration will include the other requirements in AASB 15 beyond sufficiently specific and the five-step model, for example, principal versus agency.

Notes:

- Amounts received prior to the start of the financial year for the following financial year are still recognised as revenue on receipt, assuming they are non-refundable at balance date. Further analysis is required if such receipts are refundable at balance date.

- When the new standards commence, AASB 9 will be amended to require the recognition of statutory receivables at fair value, which may be different to current accounting. Accounting for rates in advance may change as the right to receive the rates revenue is in the future.

- Licences are subject to proposed additional specific requirements issued by the Australian Accounting Standards Board. These amendments are expected to be finalised before the new standards commence.

- For specific purpose grants received in advance, note that:

- capital grants are recognised over the construction period

- determining whether research grants are sufficiently specific also requires consideration of whether intellectual property transfers to the grantor.