Overview

Entities within Queensland's education sector aim to help individuals make positive transitions from early childhood through all stages of schooling, providing the knowledge and skills to prepare them for future education, training, or the workforce.

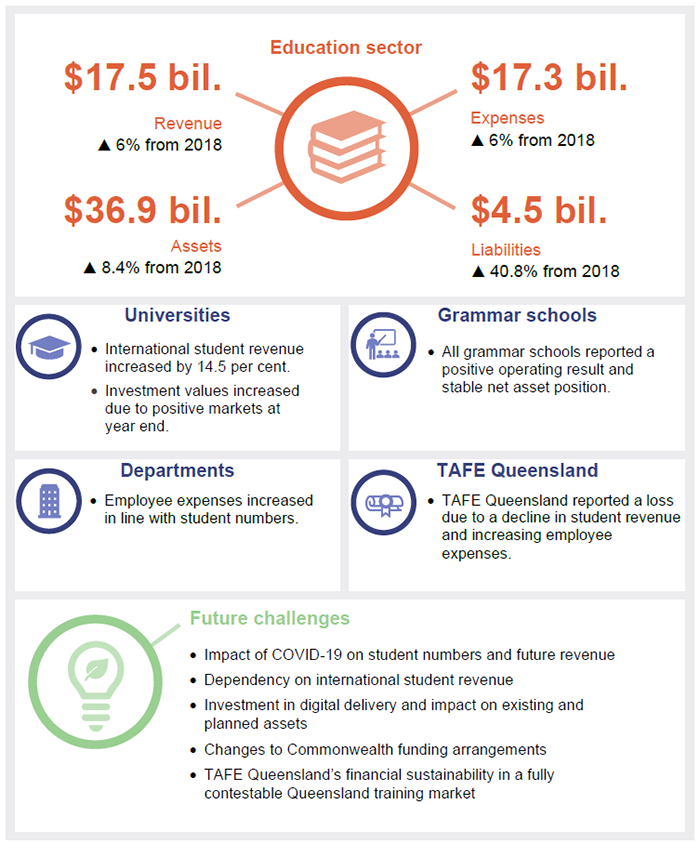

The education sector, for the purposes of this report, includes the Department of Education; the eight grammar schools; the Department of Employment, Small Business and Training; TAFE Queensland; and the seven public universities. Tabled 21 May 2020.

View our interactive map of Queensland education entities, which allows you to explore financial information and compare to other regions: 2019 education dashboard.

Auditor-General’s foreword

The Queensland public sector, local governments, and wider community are facing unprecedented challenges during COVID-19.

Government-led responses need to be supported by sound controls to manage any additional risks, and effective governance and leadership must continue. Trust and confidence in our system of government is important for it to operate effectively.

The Queensland Audit Office’s role in providing independent oversight over matters of public concern or importance during periods of significant change is key. We are continuing our efforts around improving state and local government governance, internal controls, financial management, reporting and performance. During this demanding time, we continue to give our clients and the Queensland public confidence in government accountability and transparency.

We have been working with entities on how best to deliver our work. We know that some entities are facing difficulties as they change how they do their work and deliver their services, and we are changing our audit activities and services as needed.

I have adjusted my reporting program, including extending some timelines for client consultation and resultant tabling dates. Over the next six months, I expect we will table most of our planned reports, with some changes to performance audits as we respond to new priorities set by state and local governments.

It is important we apply the insights from our audits across government, including to new and emerging programs being delivered in response to COVID-19. In my reports, there are learnings that are useful to all entities around administration of government as we act on COVID-19 impacts.

Brendan Worrall

Auditor-General

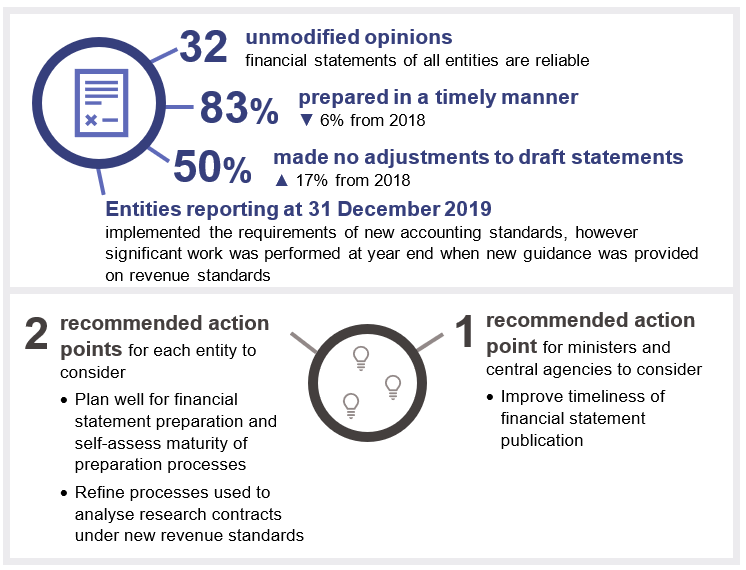

Report on a page

Financial statements are reliable

The financial statements of all education entities are reliable and comply with relevant laws and standards. Universities have improved the quality of their financial statements through early work and use of proforma financial statements.

Universities changed the way they reported revenue this year when implementing new revenue accounting standards, particularly for research contracts and consultancy arrangements. They did significant analysis of individual contracts late in the year, as a result of new guidance being issued. We have asked them to continue to refine their processes to improve the efficiency and consistency of revenue recognition in line with the new standards.

Education entities’ controls for financial systems and processes are generally effective, which means they can be relied on when preparing financial statements.

Entities are responding to risks from COVID-19

Universities received over 25 per cent of their student fee revenue from international students in 2019. They were among the first organisations to be impacted by the COVID-19 pandemic, with students unable to travel to start their 2020 study. They have enough cash to continue to operate, however are focusing on reducing their costs to ensure they continue to be a going concern beyond 2020.

TAFE Queensland was already facing financial challenges. It will be further impacted by restrictions on practical face-to-face training delivery and international students. It is continuing to assess its service delivery and expenditure.

Some grammar schools will be impacted by a downturn in the economy and any resulting decline in student numbers.

Asset management must include digital strategies

Asset management plans provide strategies for investments in physical assets, such as teaching buildings. The sector, however, continues to change how it educates students, including moving to online learning as part of its digital and contemporary learning strategies. In response to the COVID-19 pandemic, those asset management plans should be updated.

Security of information needs to improve

This year, some education entities had significant issues relating to changes to supplier and employee information, access to information systems, and security of electronic funds transfer files. These remain the most common internal control weaknesses identified across the public sector, and they unnecessarily increase the risk of fraud.

The collaborative environment required for universities to deliver education means they may be more exposed to cyber security attacks. They continue to balance their need for information sharing and security, while investing in strong access controls.

Actions for entities

Plan well for financial statement preparation, particularly in times of change

Where entities are experiencing significant change (for example, changes to their operations from the COVID-19 pandemic, organisational changes, or implementation of new accounting standards), they should reflect this in their financial statement forward planning, and ensure they resource their plan appropriately.

Preparing a quality set of proforma statements, that are tailored to include disclosures on the impact of significant changes, and using the financial statement preparation maturity model, can help entities continue to improve the timeliness and quality of draft statements.

Improve asset management planning for digital learning platforms

The education sector can improve its planning for asset management by further reflecting the changes required for digital learning platforms and responses to the COVID-19 pandemic. This will include assessing how much entities should be investing in physical infrastructure over the long term, especially if they have digital strategies.

Refine processes for recognising research revenue under new accounting standards

Universities should consider refining existing systems and processes used to manage research contracts, to efficiently and consistently analyse research contracts throughout the year, and recognise revenue in accordance with new revenue standards. The analysis should be supported by frameworks and policies to ensure consistency between similar contracts. This should minimise additional work required during the financial statement preparation process.

Strengthen security of information systems

Entities should self-assess against the recommendations in our report Managing cyber security risks (Report 3: 2019–20) to ensure their systems are appropriately secured and they are not unnecessarily exposed to a cyber security attack.

Important risk mitigation strategies include strong password practices, multifactor authentication, restricting user access, encrypting information, patching vulnerabilities in systems, and cyber security training for employees.

Review changes to employee and supplier details

With continuing fraud attempts, entities need to remain vigilant and treat all requests to change employee and supplier details cautiously. Entities should phone the supplier using a contact number obtained from an independent source, and check the request for likely errors. It is important changes are reviewed prior to payments being made.

Actions for ministers and central agencies

Improve timeliness of financial reporting to the public

We encourage relevant ministers and central agencies to explore opportunities to improve the timely release of the audited financial statements of public sector entities.

This could be through providing guidelines on the maximum number of days between financial statement certification and tabling, or allowing publication of entity financial statements on their website prior to tabling of their annual report in parliament.

This will ensure the information in the financial statements is provided to the public while it is still up to date and impacts of major events, such as COVID-19, do not result in financial information needing to be reassessed (or potentially updated).

1. Overview of entities in this sector

This report summarises our financial audit results for education sector entities at their respective balance dates. For the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; and some statutory bodies, this was 30 June 2019. For universities, grammar schools, and some other statutory bodies, it was 31 December 2019.

We provide 32 audit opinions in this sector. The analysis in this report focuses on the 18 entities highlighted in Figure 1A, representing 99.3 per cent of revenue within the education sector.

Note: Yellow outer circles indicate the entities included in this report.

DoE—Department of Education; DESBT—Department of Employment, Small Business and Training; TAFEQ—TAFE Queensland; CQU—Central Queensland University; UQ—The University of Queensland; QUT—Queensland University of Technology; GU—Griffith University; USQ—University of Southern Queensland; JCU—James Cook University; USC—University of the Sunshine Coast.

Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions for each entity in the education sector and evaluates the timeliness and quality of their financial reporting.

Chapter snapshot

Chapter summary

We issued unmodified audit opinions for the financial statements of each entity, within the legislative timeframe. Readers can rely on the results in the financial statements.

Overall, the quality of draft financial statements improved this year, largely due to universities’ effective use of proforma financial statements. Half of the education entities still made changes to their draft financial statements, with most grammar schools adjusting their disclosures for new accounting standards.

Universities and grammar schools implemented three new accounting standards this year. The implementation required complex judgements and extensive financial statement disclosures. While universities prepared well, the complexity resulted in the Australian Accounting Standards Board providing new guidance for research contracts at the end of the year.

This new guidance meant universities had to review a significant number of research contracts and change their accounting for some contracts and the related disclosures in their financial statements.

The Department of Education; Department of Employment, Small Business and Training; and TAFE Queensland have taken appropriate action to understand the requirements of the new accounting standards and their impact. They will need to draft their financial statement disclosures early for 30 June 2020.

Audit opinion results

We issued unmodified audit opinions for 32 education entities, including the entities they control, which means the results in their financial statements can be relied upon. All entities met their legislative deadlines for finalising their financial reports. Appendix C provides details of the audit opinions we issued for education entities in 2019.

We express an unmodified opinion when financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

This year we included an emphasis of matter in our audit reports for eight entities to highlight that only certain accounting standards were used in the preparation of their reports, and that their reports were not intended for other users. This did not modify the audit opinion.

Entities not preparing financial statements

Not all Queensland public sector entities produce financial statements. The full list of entities not preparing financial statements and the reasons are detailed in Appendix E.

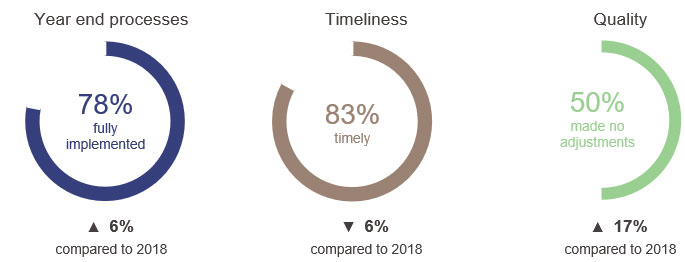

Quality of financial statement preparation

Education entities have implemented year end processes that improved the quality of draft financial statements. The timeliness of draft financial statements reduced for only one entity this year.

Our assessment criteria for year end processes, timeliness, and quality are outlined in Appendix D. Figure 2A provides a summary of our assessment of education entities’ financial statement preparation processes.

Queensland Audit Office.

All universities invested in preparing good quality proforma financial statements. This drove the increase in overall quality across the sector, with most universities not requiring adjustments to their draft financial statements.

The complexity of the implementation of new standards resulted in most grammar schools making adjustments to improve their disclosures in their draft financial statements. Grammar schools have smaller finance teams, and less capacity to invest in early drafting of disclosures. This emphasises the importance of planning early and well for the implementation of new accounting standards, including changes to disclosures.

The Department of Employment, Small Business and Training, and TAFE Queensland experienced significant change this year, which placed pressure on their financial statement preparation processes. We encourage entities experiencing significant change to ensure enough resources are dedicated to their financial statement preparation to reduce the impact on the quality.

Action for entities

Where entities are experiencing significant change (for example, changes to their operations from the COVID-19 pandemic, organisational changes, or implementation of new accounting standards), they should reflect this in their financial statement forward planning, and ensure they resource their plan appropriately.

Preparing a quality set of proforma statements, that are tailored to include disclosures on the impact of significant changes, and using the financial statement preparation maturity model, can help entities continue to improve the timeliness and quality of draft statements.

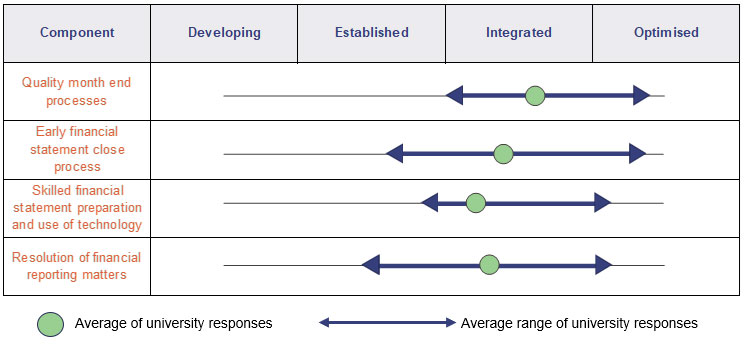

Introduction of the financial statement preparation maturity model

We have developed a new model for assessing the maturity of financial statement preparation, which will replace our ‘traffic light’ assessment processes from 2019–20 in the education sector. It is available on the QAO website. The new model provides scalability in response to the size and complexity of entities, and flexibility to respond to the qualitative factors that influence entities’ practices.

The model enables entities to set their target maturity level and focus on key areas for development and makes it easier to share better practices across the public sector.

It builds on our previous financial reporting assessment processes, fact sheets, and reports to entities and parliament. It also outlines the components that result in high-quality and timely financial reports and provides a maturity assessment for each component.

University outcomes

This year we worked with the universities as they undertook an initial self-assessment. Financial statement preparation processes across the university sector are mature. They assessed the majority of their processes as integrated or optimised (which are the highest levels of maturity).

Queensland Audit Office.

Strengths across the sector included:

- good quality proforma financial statements, with disclosures tailored to meet the needs of users

- management challenging valuers on the methodology adopted for valuing property, plant and equipment

- early assessment of key accounting issues that affect financial statements

- clearly defined roles and responsibilities within finance teams

- strong month end financial reporting processes, with financial and non-financial measures analysed and explained.

Most universities identified an opportunity to improve the use of specialised reporting software and automated processes to prepare financial statements. Any investment in automation to optimise processes will need to be considered against the benefits to be derived.

Delay in publishing financial statements meant reassessment of COVID-19 impacts was needed

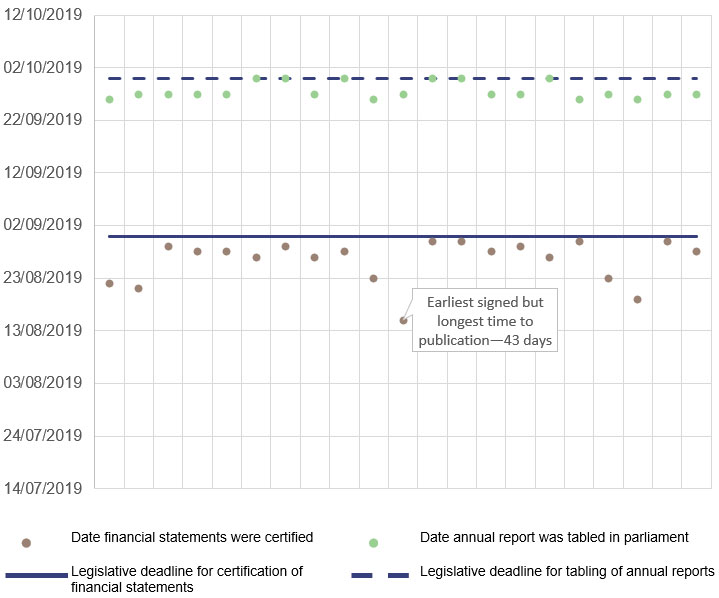

The audited financial statements are an important accountability document for public sector entities with a large public interest. Yet we commonly observe delays across the state sector between the date the financial statements are certified and the date they are made publicly available.

In recent years, we have worked closely with public sector entities to improve the timeliness of their financial statements and, to their credit, they have and continue to respond well to improving timeliness. The true measure of timeliness is when the audited financial statements are made publicly available, as information in the financial statements becomes less relevant to readers the further away it is from the end of the financial year.

On average, the 21 Queensland Government departments’ financial statements were published 32 days after they were signed. Their annual reports for 2018–19 were tabled over a three-day period at the end of September 2019 to ensure the tabling deadline of 30 September was met. In 2018, the vast majority of, if not all, department annual reports were tabled on Friday 28 September.

Given the public interest in these entities, this is significantly later than listed companies that are required to publish within two months of their year end.

Note: The 21 Queensland Government departments referenced in this analysis are listed in Report 8: 2019–20 Queensland state government entities: 2018–19 results of financial audits.

Queensland Audit Office.

Ministers are required to table the annual reports of departments and statutory bodies (including their financial statements) in parliament within three months of year end. This means departments and statutory bodies are not able to publish their financial statements as soon as they are signed—they must wait for them to be tabled in parliament first.

A delay in publishing the financial statements can mean the information is no longer the most relevant, because time has moved on. It can also mean events occur that require the financial statements to be reassessed.

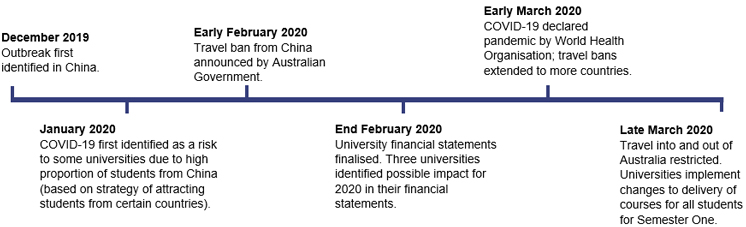

This year, an assessment of the impact of COVID-19 was performed for universities in February prior to the signing of the financial statements. At the time of signing, the impact to universities was limited to students from China being temporarily restricted from travelling to Australia. Since then, and before the financial statements were published, a pandemic was declared, and restrictions were placed on travel from all countries for an extended period of time.

As a result, while preparing their businesses for changes arising from the pandemic, universities had to divert resources to assess the impact of these updates on their 31 December 2019 financial statements, and on their ability to continue to operate sustainably.

Action for ministers and central agencies

We encourage relevant ministers and central agencies to explore opportunities to improve the timely release of the audited financial statements of public sector entities.

This could be through providing guidelines on the maximum number of days between financial statement certification and tabling, or allowing publication of entity financial statements on their website prior to tabling of their annual report in parliament.

This will ensure the information in the financial statements is provided to the public while it is still up to date and impacts of major events, such as COVID-19, do not result in financial information needing to be reassessed (or potentially updated).

3. Emerging risks associated with COVID-19

This chapter highlights emerging risks for entities in the education sector from the COVID-19 pandemic. We focus on the risks to the sustainability of education entities, and the effectiveness of their internal controls during a period of significant change.

Queensland Audit Office.

Chapter summary

The COVID-19 pandemic is expected to have a significant impact on the financial performance of entities in the education sector. Universities have made changes to the way they deliver teaching to students. They continue to assess the impacts to their income and decide how to manage their expenses.

The Department of Education is changing the delivery of teaching in 2020 in response to the COVID-19 pandemic. The focus of this work is on ensuring the continuity of education and minimising disruption to students and carers (particularly for Year 12 students). The Department of Education will not have the same impacts to its revenue as other education entities, as most of its revenue is appropriation funding from Queensland Treasury.

TAFE Queensland and grammar schools will also see impacts from the pandemic in 2020.

The sector will be impacted through changes to work environments for its staff, especially where many staff are working remotely. This will include additional risks relating to the oversight of manual controls and remote access to systems.

Sustainability risks for education entities from COVID-19

Reliance on international student revenue leaves universities vulnerable to global issues

Universities have significantly increased their reliance on revenue from international students in the last five years in response to changes to Australian Government funding and increased competition in the domestic student market. In 2015, 17.8 per cent of total revenue recorded by the university sector was received from international course fees. In 2019, this had grown to 25.3 per cent, primarily driven by increases at Central Queensland University, The University of Queensland, and University of the Sunshine Coast. The education industry was Australia’s third largest export in 2017–18 and contributed approximately five per cent to the Australian economy as at December 2019.

Note: Equivalent full-time student load (EFTSL) is a representation of the amount of study load a student would have if studying full-time for one year.

Queensland Audit Office.

The increasing reliance on revenue from international students means the sector is susceptible to shocks relating to foreign exchange rates, global politics and, more recently, global pandemics.

In early 2020, most universities have been extensively adversely affected by the COVID-19 pandemic, which has led to significant travel bans for international students. Because of the universities’ reliance on revenue from international students, we reviewed management’s assessments of the impact on their revenues, and their ability to continue to pay their debts over the following year. This included the strategies they identified to manage their budgeted operating and capital expenditure.

Management’s assessments were initially based on the information available on COVID-19 as at late February. This focused on each university’s exposure to international students from China, with these students not able to travel to Australia to study in Semester One 2020.

Three universities had a higher proportion of international students from China than other Queensland universities—The University of Queensland (56 per cent), Griffith University (31 per cent) and Queensland University of Technology (30 per cent). These universities disclosed in their financial statements that there would be an impact to their income in 2020.

The remaining universities had an average of nine per cent of international students from China, with Central Queensland University (CQU) the lowest at three per cent (with high reliance on other countries for international student revenue).

A range of factors influence a university’s ability to respond to the financial impacts of the pandemic, including its revenue sources, available cash and contracted expenditure. Figure 3C shows a university’s reliance on international course fees (and therefore exposure to reduced income from this revenue source).

Central Queensland University has the highest proportion of course fees coming from international students in Queensland. Consistent with other universities, Central Queensland University is identifying cost savings to mitigate the impact of losing a significant source of revenue.

Note: CQU—Central Queensland University; UQ—The University of Queensland; QUT—Queensland University of Technology; GU—Griffith University; USQ—University of Southern Queensland; JCU—James Cook University; USC—University of the Sunshine Coast.

Queensland Audit Office.

At 31 December 2019, universities had enough cash and investments to cover between four and nine months of their operating and financing cash outflows. This was before any actions were taken to reduce these outflows, and also did not include any cash inflows. Therefore, even without any additional funding (such as additional Commonwealth support) the universities would be able to support ongoing operations in the short term.

Universities are closely monitoring their cash flows in the rapidly changing environment, with deteriorating market conditions and evidence that government measures are expected to continue for a significant portion of 2020. They have taken immediate action to reduce operating expenses and are reassessing their capital projects. They are also reviewing the types and timing of courses they offer and the markets they target.

Department of Education’s response to COVID-19

While the Department of Education has stable revenue and a steady student base, the COVID-19 pandemic presents a number of challenges. For the first time, the department will provide remote learning for core content to most students for at least the first five weeks of Term Two in 2020. Challenges include converting curriculum content and investment in digital resources. Alternate learning resources need to be developed for students with limited or no access to a computer and/or the internet. Additional support for teachers to manage the workloads of catering to diverse learning groups may be required.

TAFE Queensland’s financial sustainability will be further affected by impacts of COVID-19

TAFE Queensland is likely to be significantly impacted by the COVID-19 pandemic, as the practical nature of its training delivery means that many courses cannot be quickly and easily transitioned to online/flexible delivery arrangements and many of its courses have significant mandatory vocation placement requirements before students can complete their studies and graduate.

Figure 3D shows that prior to COVID-19, the budgeted loss was expected to increase from $4.5 million in the 2019 financial year to $38.4 million in the 2020 financial year. This was largely due to lower revenue following changes in funding arrangements with the Queensland Government, and increases in employee costs under enterprise bargaining agreements. With a further decrease in revenue due to COVID-19, it is likely to realise a larger loss than originally budgeted.

Queensland Audit Office.

Wider economic impacts of COVID-19 may affect grammar schools

The impacts of COVID-19 are not yet fully realised, but economic impacts are expected across Queensland. This may result in enrolments declining at grammar schools. Figure 3E shows that over the last two years, the operating results of the grammar schools have varied significantly, with the Brisbane-based schools having consistently higher operating results.

The regional grammar schools have come closer to breaking even, with four of the schools having lower operating results in 2019 compared to 2018. As the economy and the ability of parents to contribute to school fees continues to be impacted by COVID-19, grammar schools need to plan for potential declines in revenue over the longer term and assess how this affects their sustainability.

Internal controls changing due to COVID-19

While education entities are adjusting their delivery of teaching, they are also changing their office environment by expanding work from home arrangements to support social distancing requirements.

With any change in working arrangements comes an increased risk of controls failing, particularly manual controls and where controls previously operated with a high level of management oversight within an office environment.

We encourage all entities to remain vigilant with their monitoring of internal controls during this time.

Key areas that entities need to consider as they change their working arrangements to respond to COVID-19 are highlighted below.

|

Information systems Changing to remote working arrangements may lead to additional strain on key information technology systems and resources, such as additional access to systems being required across an entity. All staff must ensure that system access controls continue to be followed, or where these cannot be fully implemented, additional monitoring of access and approvals is performed. |

|

|

Monitoring of manual controls The risk associated with controls, particularly manually performed controls, may change in a remote working environment. Entities may need additional oversight or checks to monitor these controls. |

|

|

Record keeping Evidence of controls operating may not be as easy to obtain or store for some entities when staff work remotely. Adherence to organisational policies and legislation is still needed during these arrangements. |

|

|

Changes to staff roles and responsibilities Some staff may take on additional or changed responsibilities to help facilitate business as usual operations. Processes to help staff get up to speed with the new responsibilities are important such that any key controls they are now responsible for are not missed or incorrectly performed. |

|

|

Supervision of roles performed remotely Risks around staff having more access to areas of the business may also increase the risk of fraud or error. This means supervision of staff in changed and existing roles is increasingly important. Technology should be used where possible to assist in this supervision, for example access exception reporting, and limiting ability to read, edit or amend data. |

|

|

Risk of external attacks External parties may see an increased opportunity to infiltrate systems while staff are working with remote working arrangements. Entities should monitor closely the use of new or changed systems to facilitate working remotely, to reduce the risk of external attacks. |

4. Areas of audit focus

We focus on areas with a higher risk of fraud or error in the financial statements. Risk increases when there is a higher degree of complexity or subjectivity (in terms of judgements, assumptions, and estimates), or when there are significant changes or developments.

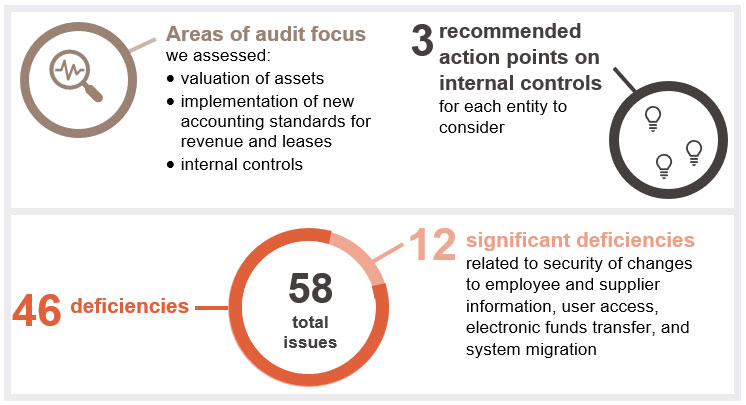

In the education sector, we focused on the valuation of assets, implementation of new revenue and lease accounting standards, and strength of internal controls.

Chapter snapshot

Chapter summary

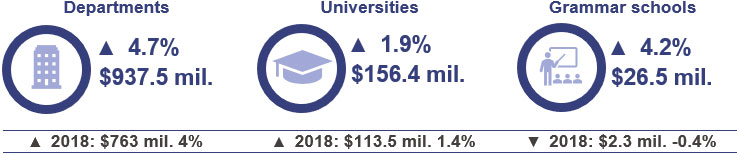

Overall, asset values across the sector increased in 2019 as a result of increases in land values and the cost to replace specialised buildings. Entities continue to improve their valuation processes, including obtaining more precise information on the cost to replace building components and how long they expect components to last before they need to be replaced.

Education entities are using this information to inform their asset management plans and investment decisions. With increasing moves to online learning, education entities must integrate their virtual asset strategies into their asset management plans. This will ensure assets continue to be fit for purpose and respond to changing learning styles.

This year, the universities and grammar schools implemented new revenue and lease standards, which change the timing of recognition of revenue and expense in the income statement. Universities were most impacted. In response to the new revenue standards, their net assets reduced by $470.9 million (4.7 per cent of 2018 net assets), and their operating result was $15.5 million lower this year (an impact of less than one per cent of overall revenue). They recognised new lease assets of $529.9 million and lease liabilities of $468.2 million (4.6 per cent of 2018 total assets).

The Department of Education, TAFE Queensland, and the Department of Employment, Small Business and Training have taken appropriate action to understand the requirements of the new accounting standards and their impact. They will be required to implement the standards and include disclosures in their upcoming 30 June 2020 financial statements.

We continue to identify significant (high-risk) control deficiencies relating to changes to supplier and employee information, access to information systems, and security of electronic funds transfers. All entities need to ensure these internal controls are operating effectively, as they are critical to preventing fraud and error.

Entities have made a considerable effort to take corrective action on the issues we reported. Overall, we found education entities generally have effective internal controls in place to ensure reliable financial reporting.

Assessing the value of assets

A number of asset categories for education entities (such as land, buildings, and infrastructure) are complex to measure, requiring judgements and assumptions to determine their values.

To confirm the values recorded in the financial statements can be relied on, we assessed the:

- competence, capability, and objectivity of experts used

- adequacy of management’s review of the valuation process

- appropriateness of the valuation methodology used

- assumptions used in the process

- changes to how assets are used and are expected to be used, and their remaining useful lives.

Queensland Audit Office.

In 2019, a number of entities across the sector saw movements in the value of their assets. This was driven in part by continued positive growth in the market value of land and less specialised buildings across Queensland, particularly in the south east and metropolitan regions. The cost to replace specialised buildings also increased across the sector.

We noted more detailed information being used by experts as part of the valuation process. This information allowed experts and education entities to be more precise in estimating the cost to replace assets and how long they are expected to be used. This is important for effective asset management and maintenance practices, and for informed investment decisions.

Asset management

The increasing value of assets in the education sector, and their importance in the delivery of education services, means entities need to carefully plan for their maintenance, upgrade, or replacement. Well-developed asset management plans, linked to entities’ overall strategies, can help with investment decisions and ensure assets continue to be fit for purpose and respond to changing learning styles.

Online courses are changing the way universities deliver teaching to students and the assets required. For example, large lecture theatres may be replaced by smaller ‘workshop spaces’ for intensive course periods.

Six of the seven universities in the sector provide some or most of their courses with a wholly online option, and all provide courses with online elements (such as lectures being recorded for live streaming/later viewing). Universities earned more than $250 million in student fees for wholly online courses in 2019, with most universities having a strategy to further develop this mode of course delivery.

Better integration of this strategy with asset planning is needed to ensure asset investments reflect how universities will provide services to students in coming years. Part of universities’ response to COVID-19 has been to move most courses previously delivered through face-to-face sessions to online delivery. The investment by universities to increase their online offering in recent years has allowed for this move to be undertaken quickly—in some cases over one week of the semester.

However, spending on new and renewed buildings and infrastructure at universities continues to be high. In 2019, two of the seven universities did not have a finalised or up-to-date asset management plan. A strong plan, linked to a university’s strategy, allows for considered planning and execution of capital projects that support the university in meeting its long-term strategic goals.

Other entities in the sector still have a heavy emphasis on face-to-face learning. Their focus for asset management is on construction and maintenance to support ongoing strategic priorities.

The Department of Education is increasing the number of classrooms and schools to meet student number growth. It is also continuing to implement the recommendations in our report Follow-up of Maintenance of public schools (Report 16: 2018–19), including the development of multi-year maintenance plans for schools. Maintenance expenses for the Department of Education to 30 June 2019 were enough to support the ongoing required maintenance for schools in the medium term.

TAFE Queensland and the Department of Employment, Small Business and Training have a memorandum of understanding (MOU) to allow TAFE Queensland to use the buildings that are owned by the department but have historically been allocated for use in vocational education. This MoU provides clarity around roles and responsibilities in key areas such as maintenance of, and improvements to, state-owned training infrastructure.

Action for education entities

The education sector can improve its planning for asset management by further reflecting the changes required for digital learning platforms and responses to the COVID-19 pandemic. This will include assessing how much entities should be investing in physical infrastructure over the long term, especially if they have digital strategies.

Significant impact of two new revenue accounting standards on universities

This is the first year universities and grammar schools have applied AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities.

The new standards are more complex than the previous equivalent standards. Their main impact is to change when revenue is recognised in the income statement. In the past, this was when the revenue was received. Now, it is recognised when the service is delivered. Certain complex criteria must be met to allow revenue to be deferred.

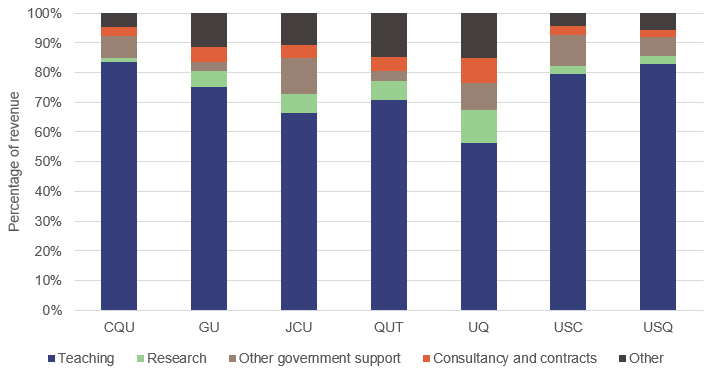

This year, Queensland universities recorded $6.1 billion in revenue. Research revenue and consultancy and contract revenue were the streams most affected by the introduction of the new standards.

Note: CQU—Central Queensland University; UQ—The University of Queensland; QUT—Queensland University of Technology; GU—Griffith University; USQ—University of Southern Queensland; JCU—James Cook University; USC—University of the Sunshine Coast.

Queensland Audit Office.

Revenue from research and consultancy and contracts is more complex, as the timing of recognition is dependent on clauses within individual contracts. Significant analysis of contracts was required to understand the services provided and when customers could access the benefit of the services.

In cases where the ownership of intellectual property from research was transferred to the body that provided the research grant, or where the university had to provide the grantor with access to research information upon request, we agreed that universities had met the requirements by recognising revenue as the research was performed.

The analysis completed in the first year by some universities involved manual assessments of individual contracts. In future years, universities should consider refining these processes to make better use of systems and processes already in place to manage the contracts—improving the efficiency and consistency of this analysis.

At 1 January 2019, the initial application of the new standards resulted in universities reducing their retained earnings from prior years by $470.9 million. This represents a decrease of revenue recognised in prior years for contracts still in progress, as the revenue will now be recognised when those services are delivered.

If revenue had continued to be recognised under the old standard, the overall net result of universities would have been $15.5 million higher, and net assets would have been $488.3 million higher.

For grammar schools the main impact from the new revenue standards was the delayed recognition of confirmation fees (paid to confirm a student’s place at the school) for some schools. This did not significantly affect revenue for any of the grammar schools individually.

Action for education entities

Universities should consider refining existing systems and processes used to manage research contracts, to efficiently and consistently analyse research contracts throughout the year, and recognise revenue in accordance with new revenue standards. The analysis should be supported by frameworks and policies to ensure consistency between similar contracts. This should minimise additional work required during the financial statement preparation process.

Assets and liabilities have increased as a result of the new lease standard

From 1 January 2019, universities and grammar schools recognised leases on their balance sheets as assets they do not own but have a right to use (right-of-use assets) and lease liabilities, under AASB 16 Leases.

The initial application of the new standard resulted in universities recognising $529.9 million of right-of-use assets and $468.2 million of lease liabilities. Central Queensland University holds over half of these assets and liabilities due to the university’s strategy of leasing rather than purchasing its campuses outside Central Queensland.

The impact on grammar schools was not individually significant.

Other education entities will be required to include new disclosures in their upcoming 30 June 2020 financial statements. The impact on the Department of Education and the Department of Employment, Small Business and Training will not be significant due to the nature of their accommodation arrangements with the Department of Housing and Public Works, whereby the state leases all office space on behalf of departments.

TAFE Queensland has a number of leases in place for its campuses, as well as various other arrangements. Initial recognition of these leases will result in an anticipated $70.1 million increase in its assets (18.1 per cent increase to total assets) and a $78.9 million increase in its liabilities at 1 July 2019 (94.7 per cent increase to total liabilities).

Internal controls

Internal controls are the people, systems, and processes that ensure an entity can achieve its objectives, prepare reliable financial reports, and comply with applicable laws. Features of an effective internal control environment include:

- a strong governance framework that promotes accountability and supports strategic and operational objectives

- secure information systems that maintain data integrity

- regular management monitoring and internal audit reviews.

We assess whether the systems and processes (internal controls) used by entities to prepare financial statements are reliable. We report any deficiencies in the design, implementation, and operation of those internal controls to management for their action.

We rate each as either a significant deficiency (higher risk, requiring immediate action by management) or a deficiency (lower risk, that can be corrected over time). We also provide areas of focus for entities to improve their internal controls.

Overall, to the extent that we have tested them, we found the internal controls education entities have in place (to ensure reliable financial reporting) are generally effective but require some improvement. We did not identify any systemic issues that would indicate their systems of internal control could not be relied upon.

Identified internal control weaknesses mostly relate to information systems

This year, we identified 12 significant deficiencies and 46 deficiencies. Almost half of all issues raised were in relation to information technology (IT) systems. Entities rely heavily on their IT systems and controls, and weaknesses in these systems increase the risk of undetected fraud or error.

Report 3: 2019–20 Managing cyber security risks identified entities are not effectively managing their cyber security risks. Universities in Australia have recently been shown to be particularly vulnerable to cyber security attacks. Their information security is complicated by the importance of information sharing and collaboration in a positive learning environment.

We encourage entities to have a strong governance framework in place that addresses how they manage information security. As part of this, entities should ensure they have implemented risk mitigation strategies for IT systems, in particular with respect to cyber security and controls over access to their systems.

We have identified ways in which entities can identify and assess cyber security risks in our audit Managing cyber security risks (Report 3: 2019–20) and more briefly in our blog article Learnings from our cyber security report to parliament.

The issues we identified within these types of controls are consistent with those we have raised in prior years and remain the most significant area for improvement across the public sector. All entities should proactively consider sector-wide issues and take measures to reduce their occurrence, for example, by seeking assurance on key controls through internal audit activities.

Action for entities

Entities should self-assess against the recommendations in our report Managing cyber security risks (Report 3: 2019–20) to ensure their systems are appropriately secured and they are not unnecessarily exposed to a cyber security attack.

Important risk mitigation strategies include strong password practices, multifactor authentication, restricting user access, encrypting information, patching vulnerabilities in systems, and cyber security training for employees.

Changes to employee and supplier information require constant vigilance

We identified six significant deficiencies and two deficiencies due to a lack of review of changes made to employee or supplier information. This is an important fraud risk for all entities, given the number of attempted and actual frauds that have occurred within government entities recently.

To reduce this risk, entities must ensure they check all change requests with an independent source, confirming the requested change to employee or supplier bank account details is valid.

Action for entities

With continuing fraud attempts, entities need to remain vigilant and treat all requests to change employee and supplier details cautiously. Entities should phone the supplier using a contact number obtained from an independent source, and check the request for likely errors. It is important changes are reviewed prior to payments being made.

User access controls should be strengthened across all systems used

This year we identified four significant deficiencies and 13 deficiencies around user access to a range of information systems used by education entities. They included inappropriate access to systems and a lack of regular monitoring of the actions of privileged users (users who can access sensitive data and create and configure within the system).

If inappropriate user access is granted to systems, fraud may go undetected because the controls in place over segregation of duties could be undermined (because important stages of the process may be performed by the same person). These controls are fundamental to the protection of sensitive information and to ensuring changes are appropriately reviewed.

We recommend entities further restrict privileged user access and proactively perform independent reviews of changes made by these users, to ensure they are consistent with the expectations of their positions. Controls over system access are increasingly important due to the evolving ways hackers can obtain access to sensitive data or redirect payments to themselves.

Security of electronic funds transfer files

We identified one significant deficiency and two deficiencies in relation to entities’ security of electronic funds transfer files. In these instances, the payment files were not appropriately secured prior to being transferred to a bank for payment. Insufficient controls over the security of payment files can increase the risk of bank account details being accessed inappropriately and unauthorised changes being made.

Other internal control deficiencies

The majority of the remaining deficiencies related to:

- payroll—a lack of sufficient monitoring of payroll processes, including review of fortnightly payments and reports

- inadequate review of reconciliations—including follow-up of long-outstanding items and monitoring of key accounts

- procurement—including users not adhering to procurement policies and procedures, untimely review of corporate card expenses, and limited controls in place over contract management

- risk management and fraud monitoring procedures.

We also identified a significant deficiency regarding governance processes in migrating three existing finance systems to one. We have included more information in Queensland state government entities: 2018–19 results of financial audits (Report 8: 2019–20).

5. Financial results of education sector entities

This chapter analyses the financial performance, position, and sustainability of the 18 education entities that account for 99.3 per cent of education sector revenue. We also consider financial sustainability and emerging issues relevant to the sector.

Chapter snapshot

Chapter summary

When the preparatory (Prep) year was introduced in 2007, it reduced the number of children who were due to go to Year One. This had an impact on the numbers due to graduate in 2019, reducing university students and revenue for universities in 2020. By 2008, a full Prep year was underway.

The Department of Education estimates the number of high school students in 2020 will rise by 17,000, increasing demand for teachers and capital infrastructure. In anticipation, throughout 2019, the department has focused on increasing the number of teachers, and it has delivered $250 million in new classrooms and educational infrastructure under the 2020 Ready Program.

Commonwealth funding for schools has been linked to policy reforms including compliance with the bilateral agreement, which over time will lead to increased revenue for schools. Commonwealth funding for universities has been linked to performance measures.

Consequences of introducing Prep in 2007

The introduction of the preparatory year (Prep) in 2007 saw a change to the cut-off date for children starting school. Children who were due to go into Year One attended Prep instead. This reduced the cohort due to graduate in 2019, reducing the number of university-eligible students in 2020.

The reduction in university-eligible students was originally estimated to result in a decrease to university revenue of $155.8 million. Each university has continued to monitor the expected impact and the original assessment has not changed significantly.

In 2008, a full Prep year started. The Department of Education estimates that having full cohorts of students across Years Seven to Twelve will increase high school student numbers by 17,000 in 2020. This should have a flow-on effect to universities in 2021.

Since 2007, student numbers have increased by 1.4 per cent each year and teacher numbers have increased by 2.2 per cent each year. This has led to an overall decrease in the number of students to teachers from 14.4:1 in 2007 to 13.33:1 in 2019.

In anticipation of growing student numbers, the Department of Education has committed to employing more than 3,700 extra teachers by 2021–22. If the rate of student growth continues and this commitment is met evenly over the next two years, there will be a slight increase in the department’s student–teacher ratio to 13.46:1.

Note: * 2015 was the first year in which Year 7 became part of high school.

** 2020 marks the first year the initial Prep half-cohort was no longer in the school system.

Queensland Audit Office.

In response to growing student numbers, the Department of Education has established the 2020 Ready Program, designed to deliver $250 million in new classrooms and educational infrastructure. As of October 2019, 61 schools have benefited from the project.

Changes to Commonwealth funding arrangements for schools, vocational education training providers, and universities

Australian Government education funding is being progressively linked to the implementation of policy reforms (for schools) and performance measures (for universities) designed to drive desired education outcomes across Australia. These measures have now been implemented for school and university funding.

School funding from the Australian and Queensland governments is increasing

The bilateral agreement between the Australian and Queensland governments came into effect on 1 January 2019. It outlines state-specific activities designed to further support students and teachers and enhance the national evidence base.

The bilateral agreement also specifies that Commonwealth school funding is now contingent on the state meeting or exceeding its total funding contribution requirements. This is designed to increase school funding by providing a base amount per student and additional funding for disadvantage.

The Schooling Resource Standard (SRS) provides an estimate of how much total public funding a school needs to meet its students’ educational needs. In 2020, this is $11,747 for primary students and $14,761 for secondary students.

Commonwealth and state funding are calculated as a percentage of the SRS. In 2019, the target set for the state was 69.26 per cent for government schools and 22.70 per cent for non-government schools.

The minimum state funding is based on the final SRS figure, which is confirmed once school census counts are finalised in approximately October each year. The National School Resourcing Board has been established to monitor compliance.

University funding caps amended from 2020

University funding caps at 2017 levels were imposed over 2018 and 2019. Previously, funding was based on a demand-driven model.

Funding caps are being removed under the Commonwealth Grant Scheme (CGS) funding reform. From 2020, universities were expected to be able to increase their CGS funding in line with the national 18–64-year-old population growth, if they met four specified and weighted performance measures, which are shown in Figure 5B. In response to COVID-19, the Commonwealth has decided to delay the implementation of performance‑based funding for universities.

Queensland Audit Office.

Measurement of the performance indicators includes statistical techniques to attempt to smooth out areas where factors outside of a university’s control may skew performance data, such as the effect of economic conditions on graduate employment rate. The model is not punitive. If a university does not meet its target it will be helped to improve its performance. The four performance measures largely integrate with performance measures already monitored by universities.

Commonwealth funding for vocational education and training is declining

The Queensland Government declined to sign a new performance-based funding agreement following expiration of the National Partnership Agreement on Skills Reform on 30 June 2017. The performance-based funding model was primarily rejected by the state due to the conditions it would have placed on Queensland, and because it did not provide any funding certainty.

Commonwealth investment in vocational education and training (VET) has continued to decline following cuts announced in the latest Australian Government budget, which saw the Skilling Australia Fund decreasing by $649 million—a reduction of more than 50 per cent.

As outlined in our Investing in vocational education and training (Report 1: 2019–20) report to parliament, TAFE Queensland faces significant financial challenges in meeting government’s service expectations while operating in a contestable market.

2019 education dashboard

Our interactive map of Queensland allows you to explore information on education entities and compare to other regions, including data on revenue, expenses, assets, liabilities and other measures like student and staff numbers.