Overview

Entities within Queensland's education sector aim to help individuals make positive transitions from early childhood through all stages of schooling, providing the knowledge and skills to prepare them for future education, training, or the workforce. The education sector, for the purposes of this report, includes the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; 7 universities; 8 grammar schools; and other statutory bodies.

Tabled 16 June 2022.

Report on a page

This report summarises the results of our audits of the entities in Queensland’s education sector, including the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; 7 universities; 8 grammar schools; and other statutory bodies.

The financial statements are reliable

All education entities’ financial statements are reliable and comply with relevant reporting requirements. The entities have mature financial statement processes, and they were able to prepare good quality financial statements, despite the ongoing challenges presented by the COVID-19 pandemic.

The security of their information systems needs to improve

We continue to identify weaknesses in the entities’ information systems. While the entities are continually improving the security of their systems, the risk of cyber attacks continues to increase. The sensitive nature of information the entities hold about students and research makes them an attractive target. In response to this evolving risk, we have expanded our testing and identified more weaknesses. Given how much entities rely on their information systems, they all need to strengthen their security.

Universities’ revenues have improved

This year, revenues for universities increased by $497.1 million because of changes in Australian Government funding, and higher investment revenue due to improved market conditions. They also received assistance through Australian Government-funded research programs. Some of these revenue streams may not be guaranteed in the future. Revenue from international students decreased again this year – by $186.7 million. Australia's borders reopened in 2022, but it remains uncertain whether international student numbers will return to their pre-pandemic levels. Universities continue to adapt to changing times to ensure they remain viable.

TAFE Queensland’s financial sustainability remains a risk

TAFE Queensland’s financial results have been deteriorating over the last 4 years, and based on current projections, this is expected to continue. It faces significant financial challenges in meeting government’s service expectations while operating in a contestable market.

Reforms to the vocational education and training sector are currently being discussed, with a new national skills agreement expected to be developed in 2022. TAFE Queensland will need to reflect any changes from this in its longer-term strategy.

Investment in schools is aligned with population growth

The Department of Education is investing in construction and expansion projects for schools, focusing on regions expected to have strong population growth. However, it needs to keep up-to-date information on the condition of its assets to maintain them properly. This will help in planning the timing and cost of maintenance, and in decisions on building and expanding schools in future.

Some of the information in both the department’s last asset condition assessment of schools and TAFE campuses is 5 years old, and another assessment is currently being performed.

Recommendations for entities

This year, we are making the following recommendations for education sector entities.

Understand the cost of service delivery to make informed decisions about future services and efficiencies in operations (TAFE Queensland) |

|

|

In order to remain sustainable in the longer term, TAFE Queensland needs to continue to develop its understanding of the value of its services and the cost of delivering them. It should use this understanding to decide whether to invest in training that is more efficient or of greater value to students, standardise processes, and continue to implement strategies for increasing its student revenue and market share. TAFE Queensland should continue to work alongside the Department of Employment, Small Business and Training and Queensland Treasury to design and implement strategies to support its broader financial sustainability. |

|

Complete regular and timely assessments of the condition of assets (Department of Education and Department of Employment, Small Business and Training) |

|

|

Both departments should ensure that condition assessments for their buildings are completed as soon as possible. The information from these assessments should be used to inform their maintenance budgets and long-term asset management strategies, which should consider both physical assets and digital infrastructure. These assessments should be undertaken regularly to ensure existing assets continue to be fit for purpose and to address changing learning styles. |

|

Education entities need to take immediate action regarding the security of their information systems

We strongly recommend the education entities address the security of their information systems. We made the same recommendation last year in Education 2020 (Report 18: 2020–21).

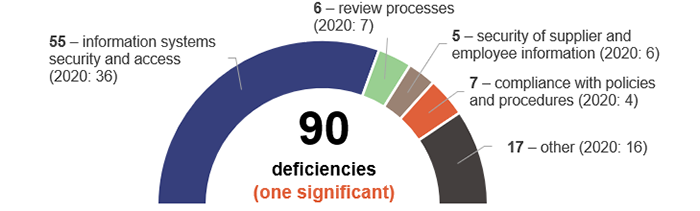

We identified 55 weaknesses this year in the security of information systems. All entities need strong security practices and must emphasise the importance of them – in their processes and to their staff – in protecting against fraud or error and significant reputational damage.

Other prior year recommendations also require further action

While progress has been made on the other 2 recommendations from last year’s report, some entities still need to take further action. As a result, we have made separate recommendations to individual entities.

We have included a full list of prior year recommendations and their status in Appendix C.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

1. Overview of entities in this sector

This report summarises the financial audit results for education sector entities as at their year-end dates for preparing financial statements. For the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; and some statutory bodies, this was 30 June 2021. For universities, grammar schools, and other statutory bodies, it was 31 December 2021.

We provide 41 opinions in this sector. The analysis in this report focuses on the 18 entities highlighted in Figure 1A (some appear twice), representing 99.1 per cent of the revenue within the education sector.

Note: Yellow outer circles indicate the entities included in this report.

CQU – Central Queensland University; DoE – Department of Education; DESBT – Department of Employment, Small Business and Training; GU – Griffith University; JCU – James Cook University; QUT – Queensland University of Technology; TAFEQ – TAFE Queensland; UQ – The University of Queensland; USQ – University of Southern Queensland; USC – University of the Sunshine Coast.

Compiled by the Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions for entities in the education sector. It also evaluates the effectiveness of the systems and processes (internal controls) the entities use to prepare financial statements.

Chapter snapshot

Audit opinion results

We issued unmodified audit opinions for all education entities in Queensland, within their legislative deadlines (with the exception of one that was not finalised at the date of this report). Readers can rely on the results in the audited financial statements.

We express an unmodified opinion when financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

The details of our audit opinions are provided in Appendix D.

Entities not preparing financial statements

Not all Queensland public sector education entities produce financial statements. The full list of entities not preparing financial statements and the reasons are provided in Appendix E.

Internal controls are generally effective, but improvement is needed for information systems

We assess whether the internal controls used by entities to prepare financial statements are reliable, and report any deficiencies in their design or operation to management for action. Those simply rated as ‘deficiencies’ are of lower risk and can be corrected over time. Those rated as ‘significant deficiencies’ are of higher risk and require immediate action by management.

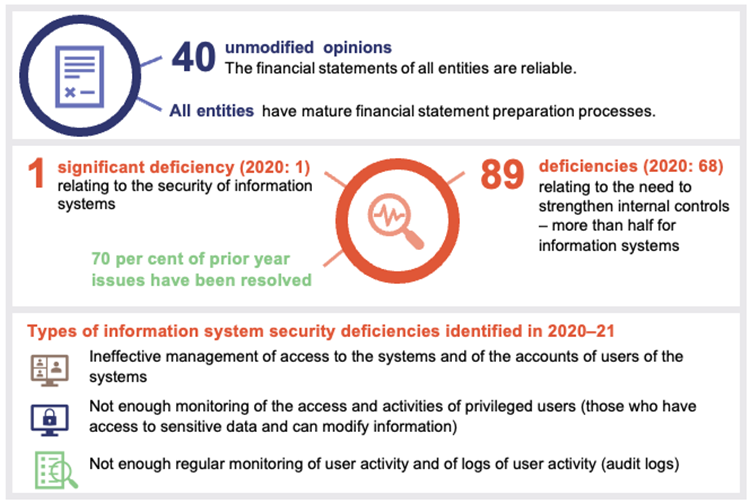

Overall, we found the internal controls education sector entities have in place are generally effective but can be improved. We were able to rely on the internal controls for the purposes of our audit, but we identified one significant deficiency relating to information systems security and access.

Figure 2A shows the nature of internal control deficiencies reported this year.

Compiled by the Queensland Audit Office.

The majority of education sector entities have either addressed their identified control deficiencies or are on track to do so by the agreed dates. However, our prior year recommendation relating to information systems remains relevant as we have identified additional issues. Proactive and timely resolution of deficiencies indicates a strong foundation for the effective operation of internal controls.

Immediate action needs to be taken to address ongoing security weaknesses in information systems

We continue to identify control weaknesses in the security of information systems. This is a critical issue for education entities, particularly universities, considering they hold attractive information like student details and research information. Cyber risk vulnerabilities and exposures must be continually assessed with appropriate oversight by and reporting to those charged with governance.

In our education report last year, we found the security of information systems was the most common internal control weakness across the public sector. Across all our public sector reports, we made the same recommendation for entities to strengthen the security of their information systems.

This year, we looked at more systems, databases, and networks for education entities than we have previously, to respond to the growing cyber security risk. This led to us identifying additional weaknesses, including:

- ineffective management of user accounts and access to systems

- insufficient monitoring of the access and activities of privileged users

- audit logs and user activity not being regularly monitored and reviewed.

Some education entities have taken steps in recent years to strengthen their information systems, which include:

- increasing password complexity and security

- implementing multi-factor authentication systems (for example, a username and password, plus a code sent to a mobile)

- implementing software that helps detect fraudulent emails

- refreshing cyber security strategies to address identified risk

- performing assessments of their cyber security frameworks to determine how effective they are.

All entities need their people and processes to demonstrate strong security practices so their information systems are promptly updated, they can respond to changes within their entity, and they can protect against external threats.

Not all the education entities have fully addressed our recommendation from last year. We recommend all entities continue to act on the recommendation.

Appendix C provides the full recommendation and its status.

Assessment tools for internal controls

We are developing new assessment tools for internal controls relevant to public sector entities. They will provide the entities with greater insight into the strength of their internal control processes.

These tools focus on asset management, change management, culture, governance, grants management, information systems, monitoring, procure-to-pay (the whole procurement process), record keeping, and risk management.

We are currently consulting with our clients on these tools and intend to begin using them in our audits from 2021–22. Our reporting on internal control deficiencies will not change.

3. Financial performance of education sector entities

This chapter analyses the financial performance, position, and sustainability of the 18 education entities. In our discussion of sustainability, we consider both financial sustainability and emerging issues relevant to the sector.

Chapter snapshot

The financial performance of universities has improved

In Queensland there are 7 public universities – Central Queensland University, Griffith University, James Cook University, Queensland University of Technology, The University of Queensland, University of Southern Queensland, and University of the Sunshine Coast.

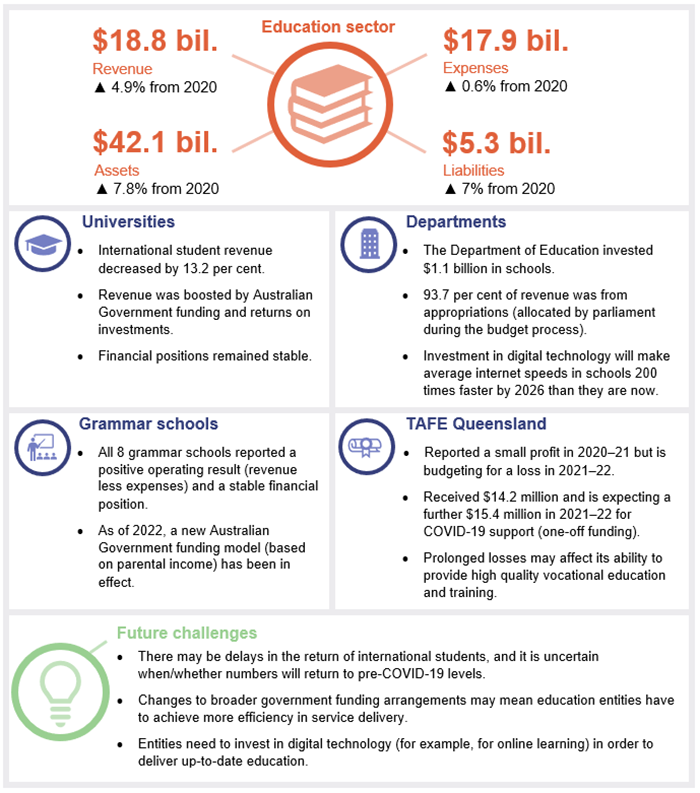

Out of the 7 universities, 4 had budgeted for a loss for 2021. As it turned out, only one of them (Central Queensland University) made a loss. Despite continuing to face challenges from the COVID-19 pandemic, universities’ surpluses increased by $584.2 million (397.1 per cent) in 2021. They received increased Australian Government funding and better investment returns during the year, which helped them perform better than expected.

Most have realised the benefits from financial sustainability measures they implemented in their response to the pandemic in 2020, particularly from lower employee costs.

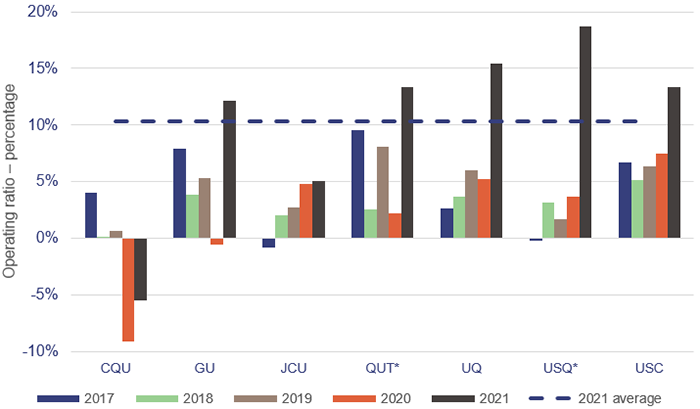

To assess the long-term financial sustainability of universities, we calculate their operating ratios (revenue less expenses expressed as a percentage of total revenue) as an average over time. In Figure 3A, the operating ratios for the universities indicate most are in a sound position and that their positions have improved since last year.

Universities received more Australian Government funding and higher returns on investments this year. These are not guaranteed in future years

This year, the Australian Government changed the funding arrangements. Universities’ funding increased by $110.1 million under the Commonwealth Grant Scheme and by $170.3 million from Australian Government research packages. While this eased the financial pressures caused by COVID-19, this funding is not guaranteed in future.

Through the Commonwealth Grant Scheme, the Australian Government subsidises tuition costs for higher education students across a wide range of study disciplines and qualification levels.

In 2021, investment income significantly increased by $301 million (164.2 per cent). This can fluctuate from year to year depending on external market conditions. Last year, this movement was lower due to impacts from COVID-19. Increases in investment income will not translate into actual cash until the universities receive payments (for example, dividends) from their investments or sell them.

Central Queensland University performed better than budgeted but still incurred an operating loss of $22 million (2020: loss of $40.8 million). Prior to 2020, it had the highest reliance on international course income, and it continues to be the hardest hit by border closures and travel restrictions, with 2021 international student revenue decreasing by $75.7 million (2020: decrease of $53.7 million). This has been offset by increases from other revenue sources, including from domestic students and Australian Government grants, resulting in an overall decrease in revenue of $45.6 million. The university continues to take steps to grow its international student market by expanding education to offshore markets in Indonesia and regain market share in Australia with the reopening of international borders.

Education Australia Limited is a company owned by 38 Australian universities that went through a major restructure in 2021. This resulted in each university receiving shares in IDP Education Limited (a listed company) and a cash dividend. They presented the impact of this restructure in one of 2 ways (depending on their accounting treatment of the initial investment) – through equity or revenue. The University of Southern Queensland achieved a significant increase in operating results driven by investment income of $83.4 million. The Queensland University of Technology also recorded investment income of $44.1 million. This will not significantly affect their cash balances unless they sell their investments. Other Queensland universities recorded this through equity, which does not impact their operating results.

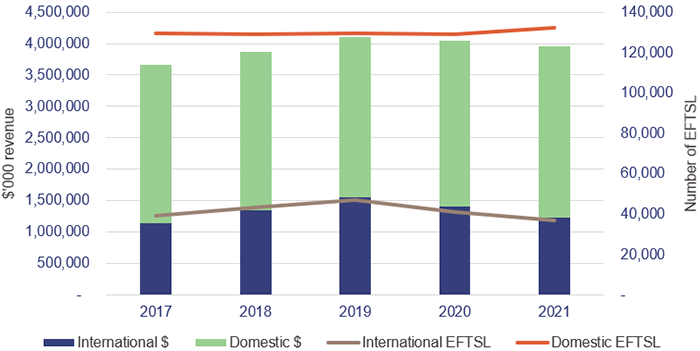

Revenue from international students decreased further in 2021

In 2021, total revenue recorded by the university sector from international students decreased by $186.7 million (13.2 per cent) (2020: $134.1 million – 8.7 per cent), due to the ongoing impacts of COVID‑19.

There was a greater impact this year due to a full 12 months of international border closure. This was mitigated last year, as some students enrolled in courses were already in the country when travel restrictions came into effect.

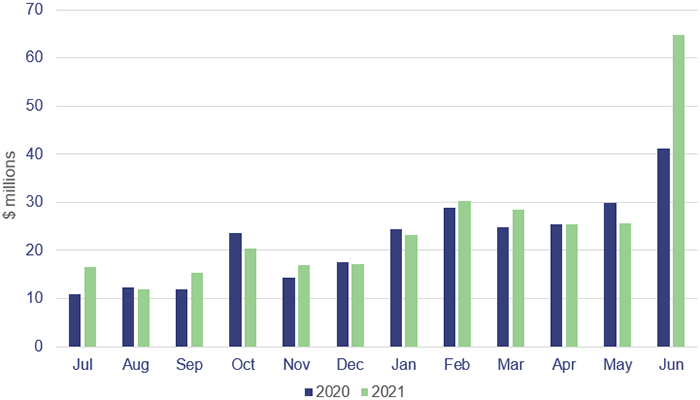

Figure 3B shows the breakdown between domestic and international revenue and the equivalent full-time student load (EFTSL) over the last 5 years.

Note: Not all students study full-time for a whole year. Equivalent full-time student load (EFTSL) is a way of representing the various study loads as a proportion of the study load the students would have if studying full-time for one year. ‘Number of EFTSL’ adds all these together.

Compiled by the Queensland Audit Office.

COVID-19 gave universities an opportunity to be more flexible about how they deliver education to their students. They were able to retain some offshore international students by making a rapid switch in 2020 to online learning. It is likely that the approaches they have introduced will be popular with students even once travel is back to normal.

The effects of COVID-19 are expected to continue to be felt by universities in the short to medium term. Lower international student enrolments since the start of the pandemic in 2020 will impact on revenue for at least 3 years (which is the minimum amount of time for a degree).

Five universities have budgeted for a loss in 2022, but revenue forecasts are being reassessed by all universities since the announcement of the reopening of international borders in 2022. The universities’ ability to attract and retain students and the timing of when international student numbers will return to pre-COVID-19 levels remain uncertain.

Reforms to the higher education sector

Australian Government university funding has been linked to the implementation of reforms designed to drive desired education outcomes across the country.

The Job-ready Graduates Package reforms came into effect from January 2021. The package aims to deliver more students in the fields and regions where they are most needed, and to help drive economic recovery from the COVID-19 pandemic. This has resulted in changes to the Commonwealth Grant Scheme funding based on the estimated cost of delivering teaching. This may lead to changes in the profile of courses that universities deliver. Universities will need to continue assessing the longer-term impacts of this in their strategic plans.

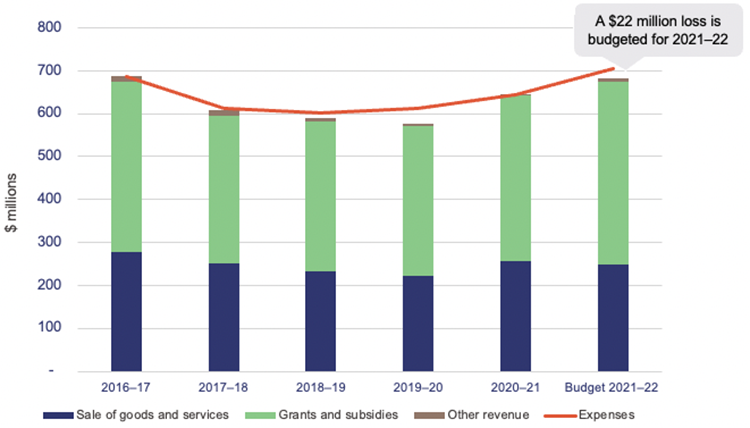

TAFE Queensland’s financial challenges continue

TAFE Queensland (TAFE) is the largest public provider of vocational education and training in Queensland. It services rural and remote areas of the state and thin training markets (where there is low demand), ensuring equitable access to all students across the state. TAFE has to meet its training commitments and service expectations as a public provider, while competing with private providers who do not have the same commitments and expectations. This poses significant financial challenges.

Figure 3C shows that for the 4 years to 2019–20, revenue decreased due to declining student numbers and changes in funding arrangements with the Queensland Government. TAFE lost significant market share to private providers when Queensland moved to a fully contestable market in July 2014. Students are price sensitive and are often attracted to study with private providers, who have a lower cost base resulting in reduced fees. This has increased the pressure for TAFE to efficiently manage expenses, which grew at a higher rate compared to revenue. These expenses are largely due to employee costs under enterprise bargaining agreements that TAFE cannot fully control, which are not faced by its private competitors.

State Contribution Grants are provided to cover the extra costs that public providers incur due to their competitive disadvantage and other expectations as a public provider. This is not indexed or subject to changes in line with a consumer price index.

Compiled by the Queensland Audit Office.

TAFE reported a profit of $2.2 million in 2020–21. It achieved higher student enrolments in 2020–21, which was boosted by government stimulus and initiatives. This offset the decline in international student revenue due to the ongoing impacts of COVID-19. It also received one-off COVID-19 financial support from the Queensland Government. This funding totalled $29.6 million, with $14.2 million received in June 2021 and the remainder expected in the 2021–22 financial year. Without this, TAFE would have recorded an operating loss.

TAFE is budgeting for an operating loss of $22 million in 2021–22. The low performance of some campuses and courses, combined with cost increases from growing employee expenses and the end of a number of short-term funding agreements, means that TAFE’s losses are expected to continue in the future. While private providers have the option to stop delivering training that makes a loss, this is not consistent with the Queensland Government’s expectations of its public providers.

To improve its operating efficiency, TAFE is continuing to develop strategies and plans to increase revenue and reduce costs. It will continue to invest in infrastructure for information technology and digital capabilities in the 2021–22 financial year. This includes a medium-term project to build a single organisation-wide planning tool. Planning for education and decisions around changes (for example, class sizes and teacher capacity) is currently performed in each TAFE region. This tool will enable a consistent approach to planning and enhance reporting to inform decision-making and longer-term strategy.

TAFE continues to manage its corporate costs, with a current focus on engaging with customers, and centralising procurement and information technology activities. While these strategies enable operational efficiencies, they will not fully resolve the current financial challenges.

Without any significant changes in overall market settings, TAFE will continue to rely on government grants to cover its operating expenses, particularly employee expenses.

Recommendation for TAFE QueenslandUnderstand the cost of service delivery to make informed decisions about future services and efficiencies in operations (REC 1) |

|

In order to remain sustainable in the longer term, TAFE Queensland needs to continue to develop its understanding of the value of its services and the cost of delivering them. It should use this understanding to decide whether to invest in training that is more efficient or of greater value to students, standardise processes, and to continue to implement strategies for increasing its student revenue and market share. TAFE Queensland should continue to work alongside the Department of Employment, Small Business and Training and Queensland Treasury to design and implement strategies to support its broader financial sustainability. |

Reforms are in progress for vocational education and training providers

Negotiations are ongoing between the Australian and state and territory governments to develop a new national skills agreement, which is expected to be developed in 2022. If endorsed, it will likely bring changes that will affect funding for all vocational education and training providers – including TAFE and Central Queensland University.

Asset management at education entities

Property, plant and equipment (land and buildings) continues to be the most significant item on the balance sheet for education entities, accounting for 81.3 per cent of total assets. These assets are fundamental to the delivery of education. The entities need to ensure they efficiently and effectively manage their use and maintenance, so they remain fit for purpose, while minimising the total cost of owning these assets.

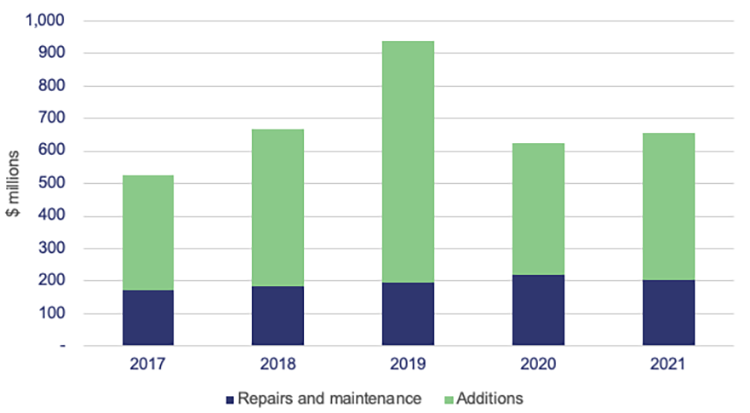

Universities monitor the service delivery of their assets

Universities have continued to assess the best use of their assets as their methods of course delivery change. With the growth in online learning as a primary method of delivering some courses, they have been assessing whether their assets are being used as well and as much as they should be. This has resulted in several universities revisiting their asset management processes to identify where changes are needed.

In 2021, universities spent $203.1 million on repairs and maintenance (2020: $219.1 million) and $450.8 million on new or refurbished assets (additions) (2020: $403.5 million).

Figure 3D shows that while overall investment in the universities’ assets has increased since last year, it is not growing at the same rate as it was before COVID-19. This indicates that universities are continuing to assess the impact of COVID-19 on their revenue.

Compiled by the Queensland Audit Office.

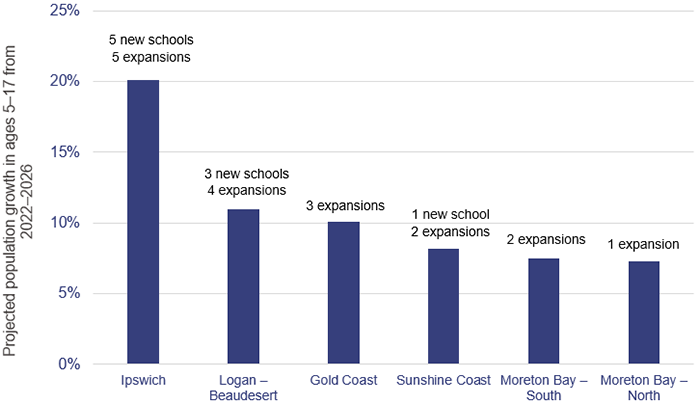

Population growth is influencing where and how schools are being built

Since 2011, the Department of Education has opened 41 new schools and closed 18 schools. Twenty‑eight of the new schools have been in areas with a population growth of over 20 per cent in the last 10 years. Despite this, the overall ratio of population to schools has increased by 14.4 per cent across the state, indicating that, rather than the number of schools matching population growth, schools have become larger – both in terms of numbers and physical size.

The population growth has affected the way schools are being built and buildings are being replaced. There is increased focus on efficient use of space and vertical building (multi-storeys) because available land for new schools or expansions will become harder to come by.

While population growth for the state has been 16.6 per cent over the last 10 years, growth has been stronger in the greater Brisbane area, at 20.2 per cent. Both the Ipswich and Moreton Bay – South regions have experienced growth of more than 30 per cent. To address this, the Department of Education has built 10 schools in Ipswich and 4 in Moreton Bay – South.

Figure 3E shows that the Department of Education continues to build new schools and significant expansions in the regions expected to have significant population growth. Three new schools have already opened in 2022.

Compiled by the Queensland Audit Office.

The department will open 11 new schools over the next 2 years and will receive additional funding of over $900 million spread over 7 years to support these schools. It also plans to deliver several significant expansions to existing schools to increase their capacity. The focus of these construction projects is primarily on areas with expected population growth of more than 10 per cent.

The departments are currently assessing the condition of their assets

In order to deliver the best possible services to the community in a cost-effective manner, the departments need to conduct regular condition assessments and have a thorough understanding of the maintenance required on assets – including the expected timing. With this knowledge, the departments should be able to achieve better value for money by grouping similar services (for example, painting several classrooms at the same time) and prioritising the order of work.

In Education 2020 (Report 18: 2020–21), we reported that the Department of Education and the Department of Employment, Small Business and Training were in the process of assessing the condition of their assets (condition assessments) to support their future maintenance plans.

Over the last year, both departments have undertaken a pilot condition assessment process covering a small number of schools and TAFE campuses. These processes have identified some problems with the information that has been used; this will be corrected before the final programs are rolled out.

As the last condition assessments were undertaken between 2016 and 2018, some of the information they are using for their maintenance plans is 5 years old. Newer assets constructed since these assessments were undertaken are not included in this information.

The Department of Education spent $297 million on maintenance in 2021, while the Department of Employment, Small Business and Training spent $29 million.

Figure 3F shows that there is a significant increase in repairs and maintenance at the Department of Education towards the end of each financial year. A well-planned maintenance program should generally have consistent expenditure across the year, with any peaks in maintenance correlating to school holidays as these provide greater access to buildings and sites for the works to be completed.

Compiled by the Queensland Audit Office.

In our report – Follow-up of Maintenance of public schools (Report 16: 2018–19) – we recommended that the Department of Education supports all schools in developing 3-year maintenance plans for all buildings with a replacement value of greater than $100,000. Undertaking condition assessments will be a core component of developing these maintenance plans.

The Department of Education must also continue to ensure that its knowledge of the condition of its assets remains up to date to determine if its plans are effective at maintaining its buildings at the desired level, or if further investments are required.

We will report on the status of this recommendation as part of our 2022 status of Auditor-General’s recommendations report.

Recommendation for Department of Education and Department of Employment, Small Business and TrainingComplete regular and timely assessments of the condition of assets (REC 2) |

|

Both departments should ensure that condition assessments for their buildings are completed as soon as possible. The information from these assessments should be used to inform their maintenance budgets and long-term asset management strategies, which should consider both physical assets and digital infrastructure. These assessments should be undertaken regularly to ensure existing assets continue to be fit for purpose and to address changing learning styles |

The March 2022 flood event did not have a major impact on the assets of education entities

In March 2022, South East Queensland was impacted by a major flood event, which resulted in school and university closures for the impacted local government areas. Since the floods, entities have been assessing the damage to the impacted campuses and schools, with the majority able to fully reopen shortly after the event.

Some did experience some damage to their buildings and infrastructure, and this is in the process of being assessed. Any material impacts for TAFE; the Department of Employment, Small Business and Training; and the Department of Education will be included in their 30 June 2022 financial statements.

The overall impact of the damage to assets at universities and grammar schools is not significant and has not resulted in any changes to their financial reports.

Enabling digital learning for state schools

In Enabling digital learning (Report 1: 2021–22), we shared information about how the Department of Education is reliably connecting students and staff of state schools to digital resources and online content. We reported that the department’s benchmark for internet speed was 25 kilobits per second (kbps) per student, which was well below that of other states.

The Department of Education began a procurement process in April 2021 to increase the internet speed in schools and announced in March 2022 that it is investing nearly $190 million in this over 5 years. It expects to increase average internet speeds to 1,000 kbps per student by the end of September 2023.

Phase 2 of this contract will see internet speeds increase to an average of 5,000 kbps for each student by 2026, which will be comparable with the current New South Wales benchmark.

The Department of Education has also reviewed its digital strategy, and is continuing to:

- work with the Queensland Government Chief Customer and Digital Office and suppliers to improve the digital infrastructure across the state – for example, providing a fibre optic connection to 40 out of 227 schools that have not had a fibre connection, and upgrading telecommunications exchanges

- provide guidance and support to schools to ensure students have access to the devices they need for digital learning and the internet

- enhance its technology infrastructure to support digital learning in schools.

We intend to report on the department’s progress in implementing these changes as part of next year’s report.

2021 education dashboard

Our interactive map of Queensland allows you to explore information on education entities and compare to other regions, including data on revenue, expenses, assets, liabilities and other measures like student and staff numbers.