Overview

In Queensland, state government owned corporations generate, transmit, and distribute most of the state’s electricity needs. They aim to ensure an affordable and reliable energy supply to households and businesses.

Tabled 4 February 2021.

Report on a page

This report summarises the audit results of Queensland’s six energy entities. These entities generate (CleanCo, CS Energy and Stanwell), transmit (Powerlink) and distribute (Energy Queensland) most of Queensland’s electricity; while Ergon Energy Queensland is the electricity retailer for most customers in regional Queensland.

Financial statements are reliable

The financial statements of all entities in the energy sector are reliable and comply with relevant laws and standards. All entities prepared their financial statements in a timely manner.

Entities should strengthen the security of their information systems

While we were able to rely on the entities’ internal controls, we identified some deficiencies. Most involved the security of information systems, including high-risk issues relating to the security and authorisation of online payments. These high‑risk issues required immediate action and were resolved in a timely manner.

Sector profitability continues to decline

While the energy sector is still financially viable, its profits have declined significantly.

Queensland continues to have the lowest wholesale electricity prices in the National Electricity Market, and they have reduced further this year. This influences the price customers pay, but also contributes to the significant reduction in revenues and values of assets for the generators.

The profits of the transmission and distribution businesses continue to decline. This is largely driven by decisions of the Australian Energy Regulator to reduce the revenue they can earn from their core business activities. We expect to see this trend continue in the next financial year.

Future challenges

The energy sector is undergoing significant change. Our electricity system needs to adapt to these changes to ensure affordable and reliable electricity supply for Queenslanders.

Coal-fired power plants are scheduled to progressively be retired over the next 26 years. As this occurs, their capacity is expected to be replaced by more renewables. The generators need to adapt to this changing mix to ensure they remain profitable and continue to deliver electricity reliably.

Integrating renewables and new technology into the electricity network is also a challenge. With reduced regulated revenues, transmission and distribution entities need to manage their costs while maintaining network strength and stability.

Recommendations for entities

We have identified the following recommendation:

Strengthen the security of information systems (all entities) |

|

|

We recommend all entities strengthen the security of their information systems. They rely heavily on technology, and increasingly, they have to be prepared for cyber attacks. Any unauthorised access could result in fraud or error, and significant reputational damage. Their workplace culture, through their people and processes, must emphasise strong security practices to provide a foundation for the security of information systems. Entities should:

Entities should also self-assess against all of the recommendations in Managing cyber security risks (Report 3: 2019–20) to ensure their systems are appropriately secured. |

|

1. Overview of entities in this sector

In Queensland, state government owned corporations generate, transmit, and distribute most of the state’s electricity. The following diagram shows the state-owned entities’ roles in the Queensland energy sector supply chain.

Note:

- The National Electricity Market is the cross-state wholesale electricity market where generators and retailers trade electricity. Stanwell and CS Energy also participate in the retail market.

- Energex, Ergon, and Ergon Energy Queensland are subsidiaries of Energy Queensland Limited.

Compiled by Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions for each entity in the energy sector. It also provides conclusions on the effectiveness of the systems and processes (internal controls) entities use to prepare financial statements.

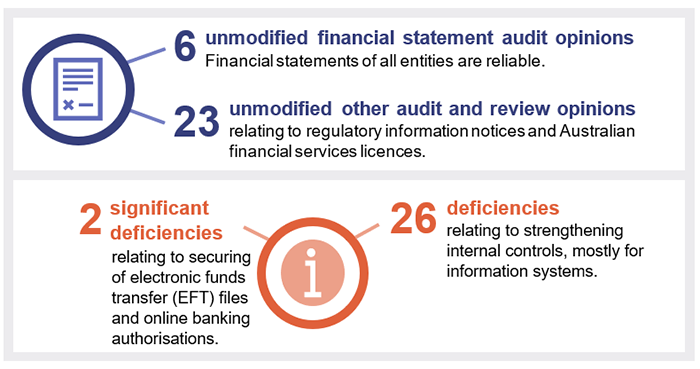

Chapter snapshot

Note:

- Regulatory information notices are used to collect information from the transmission and distribution entities to assist the Australian Energy Regulator in deciding how much these entities can earn.

- Entities must have Australian financial services licences if they enter into contracts to manage the risk of fluctuating electricity prices. These entities must lodge an annual compliance form with the Australian Securities and Investments Commission.

Financial statements and other reports are reliable

We issued unmodified audit opinions for all six energy entities in Queensland, which means we believe the results in their financial statements can be relied upon. All entities met their legislative deadlines for issuing their annual reports. Appendix C details the audit opinions we issued for energy entities in 2019–20.

Not all entities in the energy sector need to prepare financial statements. Appendix D lists the entities that do not prepare financial statements and the reasons why.

Other audit certifications

We also provided assurance over regulatory information notices and Australian Financial Services Licences.

For the regulatory notices, if the information is based on actual data, we conduct an audit. If the information is based on estimated data, we conduct a review. We have issued eight unmodified audit opinions and 11 unmodified review conclusions for these audits.

The information included with the regulatory information notices can be relied upon and the entities fulfilled their obligations under their financial services licenses during the year. Appendix C lists the audit certifications we issued.

Entities assessed their financial statement preparation processes as mature

We worked with the energy entities as they undertook a self-assessment of their financial statement preparation processes using the maturity model on our website. The entities concluded that their strengths across the sector included quality month-end processes and timely resolution of financial reporting matters. Most entities identified an opportunity to minimise manual adjustments to their financial statements.

Entities should strengthen their information systems

In 2019–20, we found the internal controls energy entities have in place (to ensure reliable financial reporting) are generally effective. While we were able to rely on them, we identified two significant deficiencies (high-risk issues) in internal controls—both related to security of online payments. These issues have been resolved.

Figure 2A shows the nature of the internal control deficiencies reported during the year.

Compiled by Queensland Audit Office.

The number of deficiencies (lower-risk matters) increased at energy entities this year, largely due to the implementation of new information systems.

We found nine issues relating to Energy Queensland’s ongoing implementation of a new system. These related to the need to secure financial data, implement strong password controls, and ensure users have only the appropriate access to the system.

The new system project is expected to be finalised by 2021–22 and is currently expected to cost four per cent more than the $229 million approved by the Australian Energy Regulator (which sets the prices for network services). If Energy Queensland spends more than the approved funding, it may not be able to recover the excess by increasing its customer network charges. Financial returns to government (the shareholder) may be affected.

The security of information systems is the most common internal control weakness across the entire public sector. All entities need their people and processes to demonstrate strong security practices so information systems are promptly updated, to respond to changes within their entity and protect against external threats.

Recommendation for all entitiesStrengthen the security of information systems (REC 1) |

|

We recommend all entities strengthen the security of their information systems. They rely heavily on technology, and increasingly, they have to be prepared for cyber attacks. Any unauthorised access could result in fraud or error, and significant reputational damage. Their workplace culture, through their people and processes, must emphasise strong security practices to provide a foundation for the security of information systems. Entities should:

Entities should also self-assess against all of the recommendations in Managing cyber security risks (Report 3: 2019–20) to ensure their systems are appropriately secured. |

3. Financial performance of energy entities

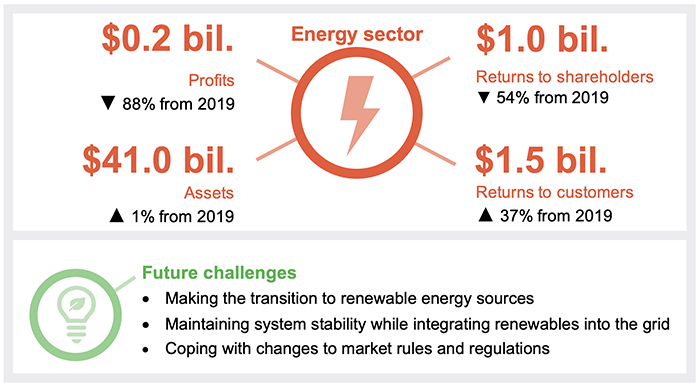

Chapter snapshot

Sector profits have declined

In 2019–20, the energy entities recorded a combined profit of $204 million. This was a decrease of $1.5 billion (88 per cent) from the previous year. Figure 3A shows that this profit reduction was largely due to the generators (CleanCo, CS Energy and Stanwell), because of lower electricity prices.

|

Lower electricity prices resulted in combined net losses of $367 million for the generators. Lower electricity prices resulted in less generation revenue and a decline in the value of power stations. Transmission, distribution, and retail entities all reported net profits, but they were 26 per cent lower than the previous year. |

Compiled by Queensland Audit Office.

Lower electricity prices caused coal and gas power stations to decline in value

The generators assess the value of their power stations annually. During the year, they determined that the future amounts they can recover from the use or sale of their coal and gas power stations are less than their current recorded value. As such, each of the generators wrote down (decreased) the value of their power stations as follows:

- Stanwell: $720 million (19 per cent of total assets)

- CS Energy: $353 million (15 per cent of total assets)

- CleanCo: $35 million (eight per cent of total assets).

Although Stanwell and CS Energy decreased the value of their coal power stations, they expect them to remain profitable until their scheduled retirement over the next 26 years. The reduction in value was largely due to declining electricity prices attributed to:

- reduced electricity demand as a result of COVID-19

- increased generation from renewable sources

- lower gas prices—which increased the electricity supply from gas power stations.

Despite this, CleanCo reduced the value of its Swanbank E gas power station to zero. Due to declining electricity prices, forecasted revenues will not be sufficient to cover the increasing costs to operate the power station. CleanCo expects to earn net losses from running this power station until its expected retirement in 2036.

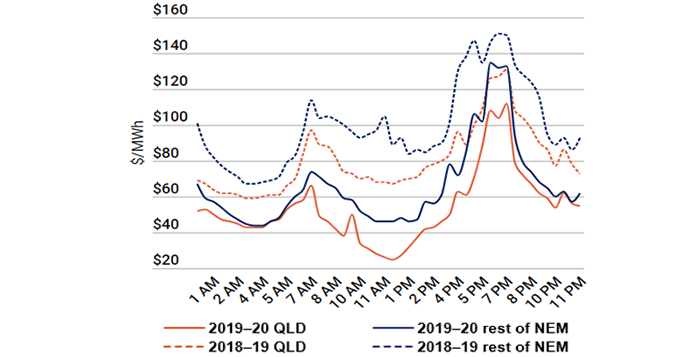

Queensland continues to record the lowest electricity prices in the National Electricity Market

Queensland’s wholesale electricity price fell on average by $27 per megawatt hour (33 per cent) compared to 2018–19. Figure 3B shows this decline in electricity prices compared to 2018–19 and also compared to the rest of the states in the National Electricity Market (NEM).

Note: MWh—a megawatt hour, which is equal to 1,000 kilowatts of energy used continuously for one hour.

Compiled by Queensland Audit Office from Australian Energy Market Operator (AEMO) data.

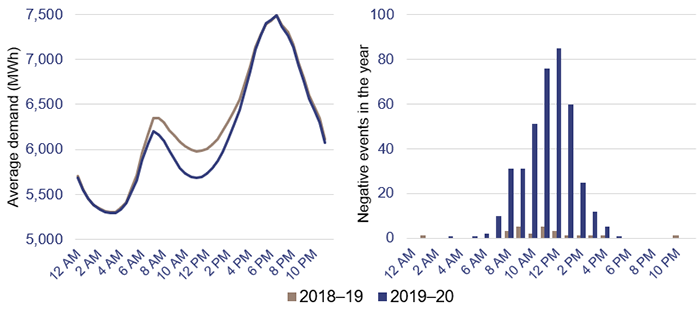

Increasing generation of solar power is affecting electricity demand and prices

Increased solar generation during the middle of the day has meant that, on occasion, supply for electricity is so much greater than demand that power generators have had to pay the market to take the electricity they generate. This is referred to as a ‘negative price event’.

Figure 3C shows the reduced electricity demand in the middle of the day, primarily due to increased rooftop solar generation, and the increase in negative price events.

Compiled by Queensland Audit Office from Australian Energy Market Operator (AEMO) data.

Lower energy prices in the middle of the day will result in increased losses for the energy generators if they cannot adapt to changes in energy demand.

Generators and retailers manage their risk from fluctuations in electricity prices by entering into contracts with each other. Typically, they lock in a fixed price for electricity they will sell (generators) and buy (retailers). Due to lower electricity prices, these contracts declined in value in the 2019–20 year. This resulted in a $331 million decrease in profits and a $618 million decrease in equity (overall value) for the sector.

Average electricity bills are expected to decrease due to lower network charges

The Australian Energy Regulator (AER) issues ‘revenue determinations’, which specify how much distribution and transmission entities can charge their customers for network services. The determinations last for five years and cap the amount of revenue network entities can earn from their core business.

In June 2020, the AER decided what the maximum allowed revenues for Energy Queensland’s distribution businesses (Energex and Ergon) would be for the next five years. This will reduce the revenues of Energex and Ergon by 15.8 per cent and 13 per cent respectively.

The AER estimates this will translate into lower average electricity bills in 2020–21 with:

- on average, residential customer bills reducing by $73 in 2020–21 and increasing by $3 annually for the next four years.

- on average, small business customer bills reducing by $82 in 2020–21 and increasing by $3 annually for the next four years.

Figure 3D shows the actual and expected regulated revenue for the transmission and distribution entities (Powerlink and Energy Queensland), based on AER decisions.

|

Distribution revenue will decline next year and will remain steady due to the AER price decision issued in June 2020. Should COVID-19 have a substantial impact on network operations, the AER will reconsider its decision. Transmission revenue will remain relatively flat for the next two financial years. The AER will issue a new price decision for Powerlink in 2022. |

Note: The forecasted revenue figures do not take into account inflation.

Compiled by Queensland Audit Office from Powerlink and Energy Queensland’s annual reports and AER determinations.

This reduction in distribution revenue will place further pressure on Energy Queensland to manage its operational and network costs. A reduction in revenue will likely result in decreased shareholder returns to the state government.

Returns to shareholders declined but returns to customers increased

Returns to the state government are made up of dividends (a share of profits paid to shareholders) and income tax equivalents. Total returns to the state government amounted to $1.0 billion, a decrease of $1.2 billion (54 per cent) from the previous year.

In 2019–20, the Queensland Government returned $1.5 billion to customers in rebates, concessions, and payments—up $403 million from the previous year. This increase is largely due to the electricity bill relief provided by the government during COVID-19. Figure 3E shows the returns to customers for the last three years.

Note: The Affordable Energy Plan amount for 2019–20 includes the additional utility relief payment (residential) made under the Queensland Government’s COVID-19 economic relief package.

Compiled by Queensland Audit Office.

The government continued to support regional customers

The state government subsidises the cost of providing electricity in regional Queensland through what is known as community service obligation payments to Ergon Energy Queensland. The cost is high because a relatively small number of customers are spread across a large area. Ergon Energy Queensland is the electricity retailer for most of regional Queensland’s electricity.

In 2019–20, the community service obligation payments to Energy Queensland were $498 million, a $36 million increase from the prior year. This was due to an increase in the average retail tariffs, which are independently set by the Queensland Competition Authority. Without community service obligation payments, Ergon Energy Queensland would have recorded a loss of $204 million in 2019–20. Average retail tariffs are expected to reduce next year.

Solar Bonus Scheme funding will cease

In 2019–20, Energy Queensland paid customers $277 million for the power they contributed to the energy grid through their rooftop solar. This included eligible customers under the state government’s Solar Bonus Scheme who receive 44 cents per kilowatt hour.

The state government has funded the scheme in the last three years, but has not extended the funding beyond 30 June 2020. From next financial year, electricity customers will pay for this in their bills as part of network charges.

The government provided electricity bill relief during COVID-19

As a result of the COVID-19 pandemic, the Queensland Government helped some households and small businesses to pay electricity costs. Through the Department of Communities, Disability Services and Seniors, it spent $404 million to assist eligible households and $86 million to assist eligible small businesses.

Future challenges for the energy sector

Renewable energy sources will replace coal as the main source of energy

Stanwell’s and CS Energy’s coal-fired power stations generated 68 per cent of the state’s electricity, while CleanCo generated two per cent. The shift to renewable energy sources, along with the planned retirement of existing coal power stations over the next 26 years, will see a change in the generation mix in Queensland. We also plan to issue a report to parliament on how the state government is managing the transition to renewable energy.

Figure 3F shows when coal power stations in Queensland are due to be retired and how generation of renewables is expected to replace them. This change will impact on the generators’ operations and asset investment decisions.

Note: The figure above does not include Callide C, as this information is yet to be submitted to AEMO. Forecast renewable capacity includes committed and anticipated projects.

AEMO generating unit expected closure year—July 2020 and AEMO 2020 Integrated System Plan—Central scenario.

In response to this shift, the generators are investing in renewable energy, mostly by entering into agreements to purchase power.

During the year, CleanCo announced it will purchase:

- 400 megawatts from the Macintyre Wind Farm, located in the Darling Downs region

- 320 megawatts of solar energy from Neoen’s Western Downs Green Power Hub.

In August 2020, Stanwell and CS Energy announced they had signed two new agreements:

- Stanwell will purchase 348 megawatts from the Clarke Creek Wind Farm, which will be constructed in the Isaac and Livingstone Shire areas.

- CS Energy will purchase 162 megawatts from the Columboola Solar Farm, which will be constructed in the Western Downs Regional Council area.

In addition, CleanCo plans to build and operate its own 18-turbine wind farm at the same site as the Macintyre Wind Farm. CS Energy and Stanwell are also investing in hydrogen projects.

Integrating renewables into the electricity networks

With the shift towards renewable energy sources, electricity generators are becoming smaller and more geographically dispersed, which means they need more transmission connections to the network. As mentioned earlier, an increasing number of households also produce their own electricity through rooftop solar panels. If households do not consume this electricity, it is sent back into the network.

These changes affect the stability of the network. The network entities need to accommodate these changes while maintaining a reliable electricity supply.

Rules are changing in the electricity market

From 1 October 2021, wholesale electricity prices will be determined every five minutes (instead of every 30 minutes). Over time, the Australian Energy Market Commission expects this change to result in lower wholesale costs, which should lead to lower electricity prices. Wholesale costs make up around one third of a typical electricity bill.

To implement this change, Queensland energy entities need to reconfigure their existing information technology systems. The estimated total cost of implementation for all energy entities is $42 million.

2020 energy dashboard

Find your region in this Queensland Audit Office visualisation to explore information on energy entities for 2020 and compare to other regions. This interactive tool includes data on revenue, expenses, assets and liabilities. Data is included for the six government owned energy entities in Queensland.