Overview

In Queensland, state government-owned corporations generate, transmit, and distribute electricity. They work to ensure affordable and reliable supply of electricity against the backdrop of fluctuating demand on the power grid, shifting coal and gas prices, and the supply of renewable energy sources.

Tabled 6 December 2023.

Report on a page

This report summarises the audit results of Queensland’s energy entities. These entities generate, transmit and distribute electricity for Queensland.

Financial statements are reliable

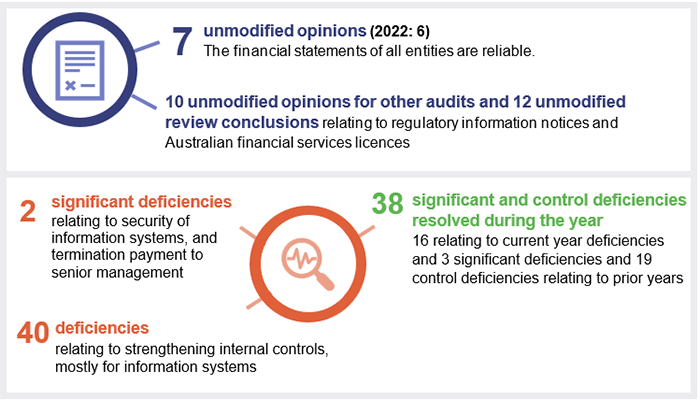

We issued 7 audit opinions for the energy sector. The financial statements of the energy entities are reliable and comply with relevant reporting requirements. All energy entities met their legislative deadlines for signing their financial statements.

Internal controls can be strengthened

Energy entities must actively implement strong controls to protect their information and assets. Energy sector entities need to strengthen the security over their systems and processes (internal controls). This continues to be the area where we identify an increasing number of issues, particularly in relation to access to systems. We identified 2 deficiencies that were significant (which means they need to be addressed immediately). These related to managing full access to information systems and making termination payments to senior management.

Energy Queensland has been implementing its digital transformation program since 2016. The complexity of integrating multiple systems has caused delays in implementing the asset management and payroll system components. The program was originally scoped with a budget of $238 million and due for completion in June 2020. The approved budget was revised to $717 million in 2022. The program is now expected to be completed in June 2026 with the revised scope and at an estimated cost of $952 million.

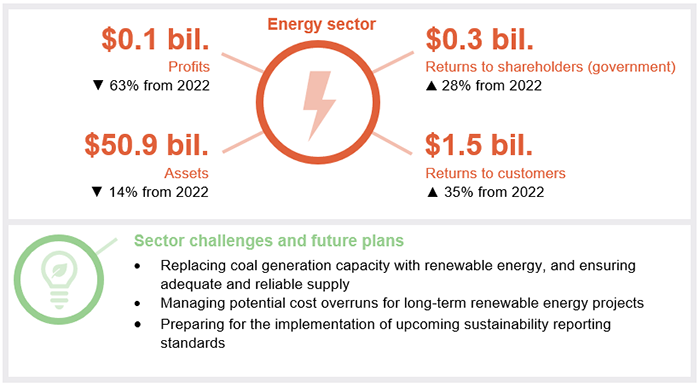

Sector profitability continues to decline

Total profits have declined by $211 million to $121 million in 2022–23. Current year profits of the energy sector were affected by the volatility in electricity prices, a decline in the value of the power stations, higher operating costs, and a reduction in transmission and distribution revenues due to lower tariff rates. The generators’ profits increased, but this was not enough to offset the reduction in profits in the other parts of the energy supply chain.

Although profits declined, the shareholder returns to the Queensland Government increased. This is due to the recommencement of dividends from the transmission entity, which resulted in an increase in dividends of $142 million. Generators continued to retain dividends for investment in future energy projects.

The sector faces challenges in achieving Queensland Energy and Jobs Plan targets

The Queensland Government’s Queensland Energy and Jobs Plan sets a pathway for achieving 80 per cent renewable energy generation by 2035. Several renewable energy projects are underway to reduce Queensland’s reliance on coal, along with pumped hydro energy storage projects which will support the energy transformation. Any delays in delivering the renewable projects, and any increase in construction costs or environmental concerns, could affect the viability of the projects and the achievement of the plan’s targets.

1. Recommendations

Prior year recommendations need further action

In our Energy 2020 (Report 11: 2020–21), Energy 2021 (Report 7: 2021–22), and Energy 2022 (Report 8: 2022–23) reports, we recommended that the energy sector entities address the security of their information systems. Although they have acted on our recommendations, we continue to identify similar internal control deficiencies.

Entities cannot take a ‘set and forget’ approach to keeping their information systems secure. They must be vigilant and respond promptly to change. Otherwise, there is an increased risk of cyber attacks, loss of sensitive information, non-compliance with security policies to safeguard critical infrastructure assets, and reputational damage.

We recommend energy sector entities actively implement controls that respond to changes within their entities and protect their systems from external threats.

|

Strengthen information system controls |

We also recommend energy entities continue implementing the following recommendations, which we made in our Energy 2020 report:

|

We have included our prior year recommendation and status in Appendix D.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

2. Entities in this report

In Queensland, state government owned corporations generate, transmit and distribute electricity. The following diagram shows their roles in the Queensland energy sector supply chain.

Notes:

- The National Electricity Market is the wholesale electricity market through which generators and retailers from the eastern and southern Australian states and territories trade electricity. The Australian Energy Market Operator is responsible for operating the wholesale and retail markets. CleanCo, CS Energy, and Stanwell also participate in the retail market, providing energy solutions to large commercial and industrial organisations.

- Energex, Ergon, Ergon Energy Queensland, and Yurika are subsidiaries of Energy Queensland Limited.

- Yurika provides a range of energy-related and infrastructure services to the generation, distribution, and transmission entities. These services do not form part of the electricity supply chain outlined above.

Compiled by the Queensland Audit Office.

3. Results of our audits

This chapter provides an overview of our audit opinions for entities in the energy sector. It also provides conclusions on the effectiveness of the systems and processes (internal controls) entities use to prepare financial statements.

Chapter snapshot

Notes:

- A deficiency arises when internal controls are ineffective or missing, and are unable to prevent, or detect and correct, misstatements in the financial statements. A deficiency may also result in non-compliance with policies and applicable laws and regulations and/or inappropriate use of public resources. A significant deficiency is a deficiency, or a combination of deficiencies, in internal controls that requires immediate remedial action.

- Regulatory information notices are used to collect information from the distribution entities to assist the Australian Energy Regulator (AER) in deciding how much these entities can earn.

- Entities must have Australian financial services licences if they enter into fixed-price contracts to manage the future risk of fluctuating electricity prices. These entities must lodge an annual compliance form with the Australian Securities and Investments Commission.

Audit opinion results

We issued unmodified audit opinions for all energy entities in Queensland. This means the financial statements can be relied upon, as they are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

We also issued an unmodified audit opinion on the financial statements of Yurika Pty Ltd, which we audited for the first time in 2022–23. These statements were prepared to comply with the Queensland Building and Construction Commission licence that Yurika Pty Ltd holds to perform building works.

All entities reported their results within their legislative deadlines. Appendix E provides details on the audit opinions we issued for energy sector entities in 2023.

Other audit certifications

Appendix E lists the assurances we performed during the year on regulatory information notices and Australian financial services licences.

The regulatory information notices are prepared for the Australian Energy Regulator and include actual and estimated financial and non-financial information. We issued 6 unmodified audit opinions for actual financial data and 12 unmodified review conclusions for estimated financial and non-financial data.

To trade in electricity financial products, energy entities must hold Australian financial services licences and comply with the conditions of their licences. We issued 4 unmodified audit opinions relating to these licences.

Entities not preparing financial statements

For each state public sector company, other than government owned corporations, the board of directors considers the requirements of the Corporations Act 2001 and the company’s constitution to determine whether financial statements need to be prepared.

When entities are part of a larger group and are secured by a guarantee with other entities in that group (that they will cover their debts), the Australian Securities and Investments Commission allows them to not prepare a financial report. In addition, dormant or small companies that meet specific criteria under the Corporations Act 2001 are not required to prepare financial statements. Appendix F lists the energy entities for 2023 that are not required to produce financial statements.

Entities should further strengthen their internal controls

We found the internal controls for preparing financial statements were effective in producing reliable financial statements; however, they can be improved.

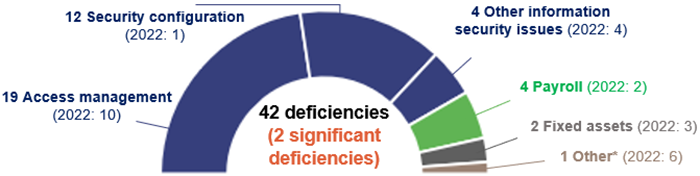

We identified 42 deficiencies in internal controls. Of these, we assessed 2 as significant, which means they require immediate action from management. The remaining 40 represented a lower risk, which can be corrected within 12 months.

The significant deficiencies related to the following:

- A termination payment made to senior management was not in accordance with the Queensland government owned corporations policy on Chief Executives and Senior Executive Employment Arrangements issued by Queensland Treasury. We also identified similar weaknesses in other public sector entities and we will report these in our upcoming state entities 2023 report to parliament.

- A number of internal and external users had been given unrestricted (full-system) access to information systems.

Figure 3A highlights that internal control weaknesses over information systems represented the majority of the deficiencies we reported to management in 2022–23. The most common weaknesses we identified related to how users access systems (access management), and how automated controls or security settings are implemented (security configuration), including:

- not restricting access provided to staff and third-party contractors in line with their job roles

- not adequately monitoring the activities of users who can access sensitive data, and at the same time make changes within the system

- implementing new security controls but inadvertently creating security gaps needing to be addressed

- not updating security settings in line with the entities’ security policies and better practices.

Note: *Other issues related to weaknesses identified over inventory and forward contracts.

Compiled by the Queensland Audit Office.

We identified the following contributors to the increase in information system controls weaknesses during the year:

- high staff turnover, resulting in inconsistent or inadequate implementation of control

- lack of staff awareness of existing policies

- higher reliance on third-party service providers, and not clearly restricting access to only those who need it.

The energy sector needs to continue to improve the security of its systems

The energy sector operates critical infrastructure assets that power the economy and nation. As a result, it is a frequent target for cyber attacks. Energy entities have implemented processes to uplift their security practices in managing their critical assets. In addition to these practices, the entities also have to comply with the requirements of the Security Legislation Amendment (Critical Infrastructure Protection) Act 2022 (Cth). This Act outlines the framework for managing security risks relating to the critical infrastructure assets.

In its 2022 Annual Cyber Threat Report, the Australian Cyber Security Centre reported the following findings:

- Critical infrastructure networks globally were targeted at phenomenal rates during 2021–22.

- Eight per cent of all cyber incidents that it responded to affected critical infrastructure assets.

- The electricity, gas, water, and waste services sectors are included in the top 10 industry sectors impacted by the cyber security incidents it responded to.

It is critical that energy sector entities implement strong security controls to protect their data and assets from cyber attacks. Our Forward work plan 2023–26 includes an audit on responding to and recovering from cyber attacks, which will provide insights and lessons learned on entities’ preparedness.

The nature and the causes of the weaknesses we identified in information system controls highlighted that energy sector entities cannot ‘set and forget’ security controls. The controls should be continuously reviewed, improved, and strengthened to maintain operating effectiveness.

Our audit focuses on the information systems used to prepare financial statements. However, it is important that the same security principles and recommendations are applied to all systems used – the strength of the entities’ internal controls is only as good as its weakest link. Entities must remain vigilant and ensure all their information systems are properly secured.

|

Recommendation for all energy entities – strengthen information system controls |

|

Consistent with last year, we continue to recommend that energy sector entities implement appropriate controls over access to their systems and systems security to protect their information systems.

|

We recommend all entities continue to act on the recommendation from our prior years' reports to strengthen the security of their information systems. Appendix D provides the status of the prior year recommendation as at 30 June 2023.

Energy Queensland’s Digital Transformation Program

Energex and Ergon Energy (Energy Queensland’s distribution entities) commenced their Digital Transformation Program with an approved budget of $238 million in 2016. The original budget aligns with the Australian Energy Regulator’s funding allocation for the regulatory period 2015–20. The original scope of the program was to replace the distribution entities’ outdated information technology systems, and with an expected completion date in June 2020. The distribution entities were combined to form Energy Queensland in June 2016. Following the merger, the revised scope of the program included additional components to align the distribution network systems, which resulted in the increased costs for the program. As at 30 June 2022, the approved budget for the program was $717 million.

Energy Queensland continues to experience delays in implementing components of the program, which include asset management and payroll systems. While various key components of the program have been delivered, the final implementation of the current scope is now expected to be in June 2026. As of 31 August 2023, $699 million had been spent on the program. In 2022–23, Energy Queensland commenced a comprehensive replan, scoping, and budget review, which are expected to be completed in calendar year 2024. Based on current forecasts, the total rescoped program is estimated to cost $952 million at completion.

The increase in the program costs is due to changes in program scope and implementation delays. The complexity of integrating multiple systems resulted in the original asset management system design being too complicated for the staff to use.

The replan program included:

- reviewing the total costs incurred and writing off $43 million for components of the project that were no longer expected to deliver benefits

- simplifying the implementation approach by proposing to roll out the project over a series of releases instead of on a single release date.

In August 2023, the board of Energy Queensland approved that $225 million of information and communication technology expenditure, including Digital Technology Program expenditure, would not be recovered from its customers. This expenditure is more than the regulatory allowance that the Australian Energy Regulator (AER) had approved. This board decision was made as part of the assessment of capital expenditure overspend, in preparation for the next regulatory determination submission to AER. The next regulatory determination is a review of the amount of revenue that the entity can recover from its customers in the period 2025–30.

The delays and cost increases will affect the cost savings and the financial returns to the Queensland Government (the shareholder).

The implementation of complex systems does not come without risks and challenges. Entities need to ensure that information technology projects continue to be aligned with business outcomes, and that proposed benefits are still being achieved.

Appropriate governance was put in place by management, however, various challenges and weaknesses in the implementation contributed to the delays and higher implementation costs. These challenges and strengths are outlined in Figure 3B against the 5 critical success factors identified in our report Delivering successful technology projects (Report 7: 2020–21). Energy Queensland has also advised the actions it is undertaking in response to these weaknesses.

|

Critical success factors |

Strengths and weaknesses |

|---|---|

|

Senior leaders actively lead and challenge |

Strengths:

Weakness:

Action in progress:

|

|

Projects are aligned to business outcomes |

Strength:

Weaknesses:

Actions in progress:

|

|

Internal and external teams work towards the same goals |

Strength:

Weaknesses:

Actions in progress:

|

|

The team has the skills and capacity to match challenge |

Strength:

Weakness:

Actions in progress:

|

|

Learnings are identified and acted on |

Strength:

Weakness:

Action in progress:

|

Compiled by the Queensland Audit Office from responses from Energy Queensland’s management.

4. Financial performance of energy sector entities

This chapter analyses the financial performance and position of energy sector entities. We consider emerging issues relevant to the sector as part of this.

Chapter snapshot

There has been a significant decrease in the sector’s profits due to a lower average wholesale electricity price

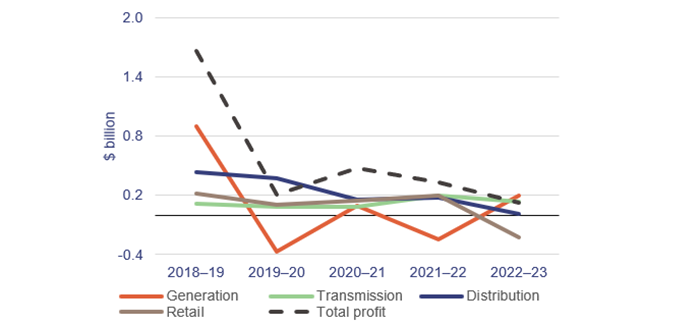

Figure 4A outlines the profits of state-owned energy entities. The supply chain includes generators, transmitters, distributors, and retailers.

|

In 2022–23, the energy sector entities recorded a total profit of $121.3 million, which is a decrease of $210.9 million (63 per cent) from the previous year. The overall decline in the sector profits is driven by the following factors:

|

Compiled by the Queensland Audit Office from energy entities’ financial statements.

To manage the effect of wholesale electricity price volatility on their financial results, generators and retailers enter into contracts with each other and with commercial and industrial customers. Prices for future electricity purchases and sales are specified in the contracts, and these contracts are valued using future (estimated) electricity prices. The estimation of future electricity prices requires significant judgement. This includes assumptions about weather, coal and gas prices, power station outages impacting capacity, government policies, and retirement plans for coal-fired plants.

The movements between the contracted and future electricity prices are recorded in the profit and loss statement of the generators and retailer, in accordance with the requirements of the Australian accounting standards. On 30 June 2023, contracted electricity prices exceeded forecast electricity prices. This contributed to losses amounting to $594 million (2022: losses of $350 million) for the generation and retail entities. These losses are realised on future settlement of the contracts, and the amount could differ substantially from the losses recorded at 30 June 2023.

Returns to shareholders have increased

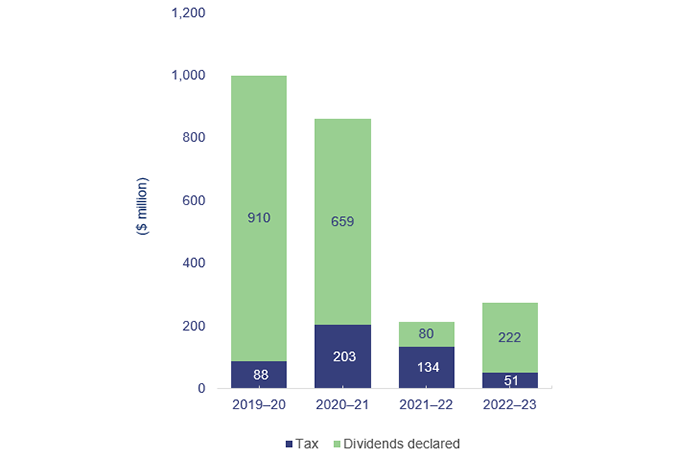

Returns to shareholders are made up of dividends payable (a share of profits paid to shareholders – state government) and income tax equivalents (which are taxes payable by commercial operators in government).

In 2022–23, total returns to the state government amounted to $273 million, an increase of $60 million (28 per cent) from the previous year. Figure 4B shows the increase in returns to shareholders in 2022–23.

|

Returns to shareholders improved in 2022–23, but they were still significantly lower than what they have been prior to 2021–22. The increase in returns to shareholders was driven by higher dividends. Over the last 2 years, the shareholders have only received dividends from Powerlink (a transmission entity). The dividends included a special dividend of $90 million, which is consistent with the payments made in prior years. The shareholding ministers approved the generators retaining their dividends in 2022–23 and they gave approval for all energy entities to do so in 2021–22. This is to support the entities’ investment in future energy projects and to maintain the viability of their businesses. The income tax equivalents payable to shareholders are based on taxable profits or losses. The decline in taxable profits of the energy entities resulted in the lower tax equivalents this year. |

Compiled by the Queensland Audit Office from energy entities’ certified financial statements.

Returns to customers have increased

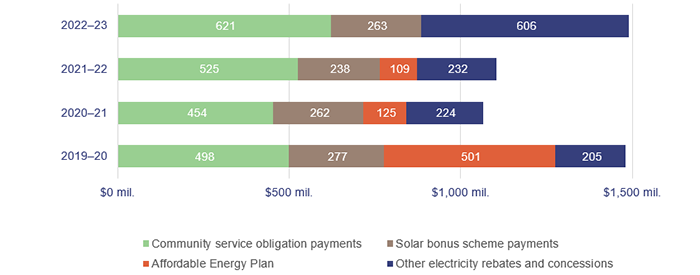

Total returns to customers amounted to $1.5 billion in 2022–23, an increase of $386 million (35 per cent) from 2021–22. Figure 4C shows the returns to customers from 2019–20 to 2022–23.

|

The government paid higher community service obligation payments to Energy Queensland to subsidise the high costs of providing electricity to regional Queensland. Without these payments, Ergon Energy Queensland would have recorded a loss after tax of $846.8 million in 2022–23. Other electricity rebates and concessions increased by $374 million in 2022–23 due to the $175 cost-of-living rebates for households introduced in September 2022. As part of the 2023–24 state budget, the government announced further electricity rebates of $1,072 for vulnerable households and $550 for other Queensland households. These rebates will be included as part of next year’s customer returns. The cost-of-living rebates replaced the Affordable Energy Plan. The plan included COVID-19 relief payments provided to households and eligible small businesses. |

Note: The Solar Bonus Scheme relates to payments made by Energy Queensland to customers for the power they contributed to the energy grid through their rooftop solar. The scheme has closed for new applicants and will cease for existing eligible customers on 1 July 2028. Other electricity rebates and concessions mostly consist of payments made to eligible pensioners and seniors and cost-of-living rebates.

Compiled by the Queensland Audit Office from the certified financial statements of the energy entities; the Department of Treaty, Aboriginal and Torres Strait Islander Partnerships, Communities and the Arts; the Department of Energy and Public Works; and the Department of Child Safety, Seniors and Disability Services.

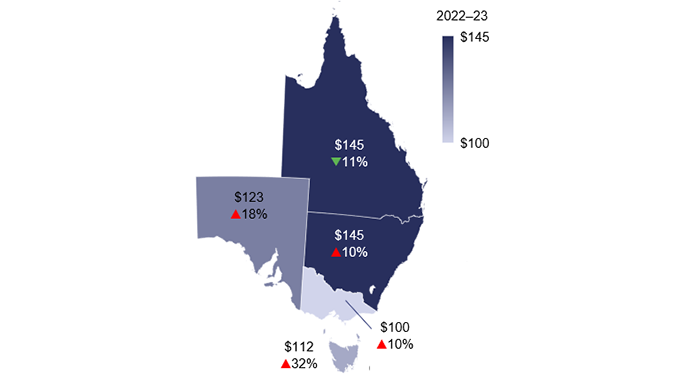

Queensland wholesale electricity prices have decreased

Wholesale electricity prices are determined every 5 minutes based on supply and demand. Although Queensland’s average annual wholesale price decreased, Queensland and New South Wales had the highest electricity price in Australia in 2022–23.

Figure 4D shows the changes in the wholesale electricity prices in Queensland and the other eastern and southern states and territories.

|

In 2022–23, wholesale electricity prices across the National Electricity Market increased by 11.8 per cent on average compared to those reported in 2021–22. Queensland was the only state to record a decrease in the average wholesale price. This was due to a combination of the following factors:

|

Notes:

- National Electricity Market (NEM) is the wholesale electricity market where generators and retailers from the eastern and southern Australian states and territories trade electricity.

- Wholesale electricity prices are one component of retail electricity prices (with the other components being network and retail costs).

- Refer to Appendix H – Figure H1 for further details.

Compiled by the Queensland Audit Office from Australian Energy Market Operator (AEMO) pricing data extracted on 1 September 2023.

The Queensland Energy and Jobs Plan’s target of 80 per cent renewable energy generation by 2035 presents challenges

The Queensland Government’s 2022 Queensland Energy and Jobs Plan outlines a pathway to achieving 80 per cent of renewable energy generation by 2035. On 24 October 2023, the Queensland Government introduced the Energy (Renewable Transformation and Jobs) Bill 2023 to parliament, which aims to put the Queensland Energy and Jobs Plan targets into law.

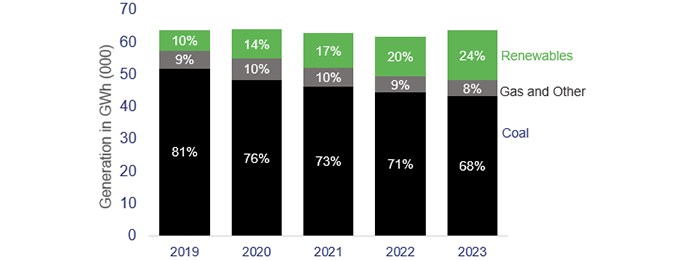

Figure 4E shows the change in proportions of Queensland’s energy generation by source for the past 5 financial years. In 2022–23, the state-owned generators supplied 47.8 per cent (2022: 49.2 per cent) of the total electricity generation in Queensland. This is different to the Queensland Government's commitment to public ownership of the energy system, which measures the percentage of large-scale generation owned by state-owned generators (so excludes electricity generated from rooftop solar). The Queensland Government reports this level to be 55 per cent in 2022–23.

|

The share of electricity generated from coal has decreased by 8,742 GWh (13 per cent) over the past 5 years. The reduction in coal generation in 2022–23 was driven by unplanned outages at CS Energy’s Callide C and Callide B coal stations, as well as by increases in renewable energy outputs. The contribution from gas has remained relatively stable |

Notes:

- GWh – a gigawatt hour, which is equal to 1,000 megawatts of energy used continuously for one hour.

- Energy generation in the figure includes rooftop solar but excludes battery storage.

Compiled by the Queensland Audit Office from AEMO and OpenNEM (National Energy Market’s information portal) generation data.

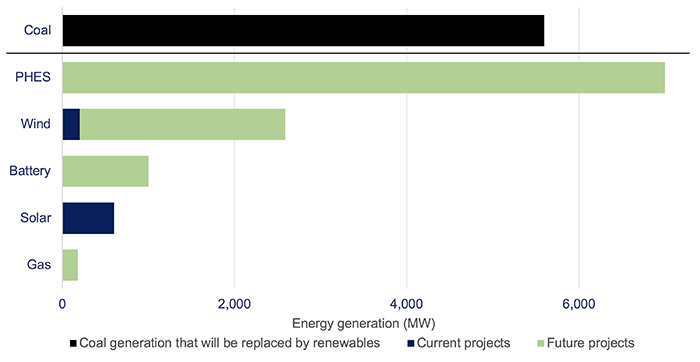

There is 8,130 megawatts (MW) of coal generation capacity in Queensland, of which 5,598 MW (69 per cent) comes from the government owned entities and the remaining from privately-owned generators. Under the Queensland Energy and Jobs Plan, capacity from all government-owned coal-fired power stations will be progressively replaced with reliable renewable energy sources by 2035 to meet the state’s renewable energy targets.

To date, several renewable projects are planned for the government owned entities to achieve the Queensland Energy and Jobs Plan target. Figure 4F illustrates renewable and gas projects that will replace the current coal generation capacity from government owned entities. These projects include electricity output that government owned entities will generate, and power purchase agreements (arrangements through which government owned entities will purchase electricity output from privately‑owned renewable energy generators).

Notes:

- PHES – pumped hydro energy storage.

- Government owned entities’ renewable projects shown in Figure 4F only include projects planned as at September 2023 and do not include existing renewable projects already in service prior to September 2022 (when the Queensland Energy and Jobs Plan was released).

- The generation capacity from the renewable projects is based on the projects owned by government owned entities and the portion of generation capacity that government owned entities will purchase from privately-owned renewable generators.

- MW – megawatts are used to measure the generation output of a power plant.

Compiled by the Queensland Audit Office from OpenNEM generation data (September 2023).

The Queensland Government’s 2022 Queensland SuperGrid Infrastructure Blueprint outlines the detailed plan to achieve the targets of the Queensland Energy and Jobs Plan and will be updated every 2 years to address emerging risks and opportunities. It indicates that government-owned coal generators will not be repurposed until sufficient renewable replacement generation is in place. This is heavily dependent on the construction and operation of 2 pumped hydro storage schemes, which are expected to store 7,000 MW of electricity.

Pumped hydro energy storage (PHES) stores energy. It uses 2 water reservoirs at different elevations to generate power as water moves down through a turbine from one to the other. It acts like a giant battery, storing power during the day and releasing it in peak periods or when needed.

Figure 4G outlines the status of the pumped hydro projects as at September 2023.

|

Pumped hydro projects – Borumba and Pioneer-Burdekin |

|---|

|

Queensland Hydro is planning to deliver pumped hydro storage projects at Borumba (near Gympie) and Pioneer‑Burdekin (near Mackay). The total cost for the Borumba project is estimated to be $14.2 billion, with the Queensland Government funding $6 billion and the remaining $8.2 billion to be funded by Queensland Hydro through borrowings. The Borumba project is expected to be constructed from 2025 and ready for first use by 2030. The project’s Environmental Impact Statement (assessment of social, economic and environmental impact of the project) is expected to commence in early 2024. This assessment is a critical step in determining whether the project is environmentally feasible. Final investment decisions are yet to be completed for the Pioneer-Burdekin hydro project, with the Queensland Government committing $1 billion as it progresses through a detailed feasibility study. Subject to a final investment decision, the construction for Pioneer-Burdekin is expected to start in 2027 and will be operational in 2 stages by 2032 and 2035. |

Prepared by the Queensland Audit Office from various publicly available sources.

The renewable energy projects that private companies are developing will also contribute to achieving the Queensland Energy and Jobs Plan targets. In addition to the planned renewable projects outlined in Figure 4F, the government owned corporations may enter into additional power purchase agreements with privately-owned companies as new projects are developed and commissioned. CS Energy and Stanwell are also exploring opportunities to develop hydrogen plants.

The achievement of the targets is dependent on these planned renewable energy projects being operational by 2035. In our report Managing Queensland’s transition to renewable energy (Report 5: 2021–22), we recommended the Department of Energy and Public Works formally assesses by 2025:

- its progress towards the government’s renewables target

- any further actions needed to support achieving the target.

Outlined below are some of the significant risks in delivering significant infrastructure projects that the department and the energy entities should consider. Queensland Treasury and the Department of Energy and Public Works have advised they will continue to work with energy entities to implement governance and reporting processes in managing and addressing these risks.

Delays in commissioning of renewable energy projects may extend the life of coal-fired plants

Delays in the commissioning of new renewable energy projects may result in coal-fired power plants operating beyond the retirement period outlined in the Queensland Energy and Jobs Plan. Ageing coal‑fired power plants may require higher maintenance costs to continue operating, which can impact the reliability and affordability of energy. This could also lead to higher emissions, which can impact the achievement of emissions targets.

Instances of delayed closure of coal-fired power stations – while replacement renewable generation is being built – have been experienced in New South Wales, Victoria, and Western Australia. Figure 4H provides an example in New South Wales.

In Queensland, the government can use its authority to direct the closure or the repurposing of government owned coal-fired plants and better manage the risks in the transition to clean energy.

|

Delayed closure of Eraring (coal-fired) Power Station |

|---|

|

Eraring Power station (owned by Origin Energy) was originally set to close in August 2025. The 2023 NSW Electricity Supply and Reliability Check Up report found that there were potential reliability and price risks from closing Eraring in 2025 and recommended that the New South Wales Government engage with Origin Energy to delay the closure. In September 2023, the New South Wales Government announced that it will do so. |

Prepared by the Queensland Audit Office from various publicly available sources.

Higher construction costs could affect the economic viability of the projects

Infrastructure projects for renewable energy, transport, health, water security, the Olympic and Paralympic Games, and affordable housing are competing for resources. Higher costs resulting from inflation and increases in labour and material costs could affect decisions when determining which projects to invest in. This increases the risk of energy projects being cancelled. In Queensland, the development of CleanCo’s Karara Wind Farm has been paused due to high costs and connection delays.

The example of the Snowy Hydro 2.0 in Figure 4I demonstrates how cost estimates can increase as a project starts construction.

|

Cost overruns in Snowy Hydro 2.0 |

|---|

|

The federal government’s Snowy Hydro 2.0 is a pumped hydro project in New South Wales. As of August 2023, the project is estimated to cost $12 billion. This is a significant increase from the original budget of $5.9 billion when the final investment decision was made in 2018 to proceed with the project. The cost overruns have been attributed to higher costs of labour, materials, and issues with tunnel boring. |

Prepared by the Queensland Audit Office from various publicly available sources.

Impact on the environment

Communities have increasingly been expressing concerns about the impact of renewable energy projects on the environment, local businesses, and people’s livelihoods. Without proper consultation and community engagement, renewable energy projects could face regulatory and environmental hurdles.

Gasfields Commission Queensland, a statutory body, will take a lead in facilitating discussions between the landowners, communities, and renewable energy developers in managing the sustainable use of land.

The costs of obtaining a social licence (community trust and approval for an entity’s decisions) could result in projects being scaled down or cancelled. While specific to other jurisdictions, the scenario in Port Stephens windfarm in Figure 4J demonstrates the community and environmental challenges a renewable project can face.

|

Community protests against the development of an offshore windfarm |

|---|

|

The federal government proposed to develop a windfarm off the coast in Port Stephens. This is expected to contribute 5,000 MW of generation capacity in New South Wales. The community in the area has raised concerns that the construction and operation of the wind turbines will cause noise pollution, habitat loss, and disruption to marine life. The community protest has called for the federal government to conduct further community consultations and review the environmental and social implications of the project prior to issuing approval. |

Prepared by the Queensland Audit Office from various publicly available sources.

Sustainability reporting requirements for the energy entities

There is also a growing focus on sustainability reporting and on how entities manage and report on the impact of their operations on the environment and society. This is governed by new international sustainability standards that were issued by the International Sustainability Standards Board in June 2023.

Queensland Treasury is currently assessing the impact of these standards on public sector entities, and it will provide guidance in 2024.

2023 energy dashboard

This Queensland Audit Office interactive map of Queensland allows you to explore information on energy entities for 2023 and compare to other regions. You can find information on energy in Queensland by typing your address into the search bar or clicking on your local region or an entity.