Overview

Queensland’s infrastructure investment is significant. Recognising the need for a fundamental shift in how infrastructure was planned and delivered, the Queensland Government established Building Queensland in 2015. Since then, Building Queensland has developed best practice frameworks and worked with government agencies to improve the quality of business cases in Queensland. Tabled 5 May 2020.

Auditor-General’s foreword

The Queensland public sector, local governments, and wider community are facing unprecedented challenges during COVID-19.

Government-led responses need to be supported by sound controls to manage any additional risks, and continued, effective governance and leadership is needed. Trust and confidence in our system of government is important for it operate effectively.

The Queensland Audit Office’s role in providing independent oversight over matters of public concern or importance during periods of significant change is key. We are continuing our efforts around improving state and local government governance, internal controls, financial management, reporting and performance. During this demanding time, we continue to give our clients and the Queensland public confidence in government accountability and transparency.

We have been working with entities on how best to deliver our work. We know that some are facing difficulties as they change how they do their work and deliver their services, and we are changing our activities as needed.

I have adjusted my reporting program, including extending some timelines for client consultation and resultant tabling dates. Over the next six months, I expect we will table most of our planned reports, with some changes to performance audits as we respond to new priorities set by state and local governments.

It is important we apply the insights from our audits across government, including to new and emerging programs being delivered in response to COVID-19. In my reports, there are learnings that are useful to all entities around administration of government as we act on COVID-19 impacts.

Brendan Worrall

Auditor-General

Report on a page

This audit assessed whether Building Queensland (BQ): (1) effectively leads and/or assists agencies to deliver robust business cases for major infrastructure projects, (2) provides agencies with expert advice, (3) operates efficiently and effectively. We selected five business cases for review.

Developing business cases

Since its inception in 2015, BQ has developed best practice frameworks and worked with government agencies to improve the quality of business cases in Queensland. As a result, government now receives more robust analysis to support investment decisions.

BQ’s frameworks are generally sound, and the business cases we reviewed generally aligned with its frameworks. However, BQ does not always effectively apply its frameworks, and some business cases could be more robust. Four of the cases we reviewed assessed options using qualitative analysis only, without the required quantitative analysis. Social infrastructure projects, in particular, need better-developed processes for quantifying benefits. Three of the cases we reviewed were endorsed on benefits that could not be monetised.

BQ’s assurance activities are well planned but not always fully implemented. Some assurance activities were informal and others were not conducted at the optimal time, limiting their assurance. BQ uses peer review to challenge high-risk assumptions and assessments. In some cases, issues raised by peer reviewers remained unresolved and peer review logs were not always fully maintained.

The timing of infrastructure investment announcements affects the value of business cases. Early announcements create risk and lead to undue pressure to progress. There are currently no guidelines for scenarios when government announces its preferred option before the business case is complete.

Providing infrastructure advice

BQ provides infrastructure advice about the business cases it develops and the projects that agencies propose. However, it has not necessarily fulfilled its legislative role to provide expert advice about infrastructure to government. BQ’s pipeline report overlaps with the State Infrastructure Plan. BQ does not identify proposals through research and does not publish the criteria used to identify priorities.

Operating efficiently and effectively

BQ effectively delivers and/or facilitates robust business cases, but could be more efficient. BQ’s significant use of external consultants limits its ability to develop its internal capability by ensuring skills and knowledge are transferred from one assessment to the next.

Unlike agencies in other jurisdictions, BQ has two roles—developing business cases and providing assurance. This affects how BQ’s stakeholders perceive its independence. Central government agencies value its independent assurance role, but agencies with extensive business case experience question its role in leading business cases.

Audit recommendations

We provide six recommendations to improve the effectiveness and efficiency of BQ, including improved application of BQ’s frameworks, improved transparency of criteria used to identify new proposals, review of the overlap between BQ’s infrastructure pipeline and the State Infrastructure Plan, and clarification of BQ’s dual role in leading business cases and providing project assurance.

1. About the audit

This audit examined whether Building Queensland (BQ) effectively and efficiently led and/or assisted agencies to deliver robust business cases for major infrastructure projects and provided agencies with expert advice about infrastructure.

We assessed whether BQ:

- developed robust business cases that informed government’s decisions about major infrastructure projects

- provided independent expert advice to government and agencies about infrastructure in Queensland

- operates efficiently and effectively.

We conducted interviews, reviewed key documents, and selected five business cases for detailed review.

We spoke with BQ and the Department of State Development, Manufacturing, Infrastructure and Planning (DSDMIP) as the portfolio agency responsible for BQ. To understand central government agencies’ perspectives on BQ’s role, we spoke with the Department of the Premier and Cabinet and Queensland Treasury.

We also spoke with the relevant agency for each of the business cases selected for detailed review, including the Department of Transport and Main Roads, Department of Education, Cross River Rail Delivery Authority, and Queensland Corrective Services.

Appendix B contains further details about the audit objectives and our methods.

Building Queensland

The Queensland Government established BQ in 2015 as an independent statutory authority to improve public sector infrastructure outcomes. It recognised the need for a fundamental shift in how infrastructure was planned and delivered in Queensland.

Queensland’s infrastructure investment is significant. The Queensland Government’s infrastructure program over the next four years is around $49.5 billion, including planned expenditure of $12.9 billion in 2019–20.

To improve infrastructure planning and assessment of major infrastructure projects, BQ’s key roles as defined in the Building Queensland Act 2015 (BQ Act) include:

- develop a framework for assessing infrasructure projects

- assist in the preliminary preparation of proposals, assist with or lead the preparation of business cases, and evaluate infrastructure proposals

- prepare and maintain an infrastructure pipeline report

- provide independent expert advice to the state and government agencies about infrastructure

- lead the procurement or delivery of infrastructure projects where directed to do so by the minister

- promote public awareness by publishing information, project summaries, and summaries of cost-benefit analyses.

Developing business cases

BQ partners with agencies to develop business cases to inform government decision making. BQ is required to lead the development of business cases for projects with an estimated capital cost of $100 million or more and assist with those between $50–$100 million. This threshold is higher for road transport projects that do not incorporate a toll road, with BQ leading business cases for projects over $500 million. Where a toll road is included, BQ’s $100 million threshold applies. For rail transport projects, BQ is required to lead the development of business cases over $100 million.

While BQ’s role is to assist and lead the development of business cases, agencies retain overall responsibility for presenting business cases to the government for funding consideration and approval.

Providing infrastructure advice

To enable better infrastructure decisions, BQ is required to advise government on infrastructure proposals that it considers to be priorities for meeting the state’s needs. BQ is also required to advise government on broader issues and challenges relevant to Queensland’s infrastructure sector.

Infrastructure pipeline

Under the BQ Act, BQ is required to prepare and maintain an infrastructure pipeline document to provide information on each infrastructure proposal it considers to be a priority for the state.

Expert infrastructure advice

Section 10 of the BQ Act states that BQ is to provide independent expert advice to the state and government agencies on:

- the state’s current and future needs and priorities relating to infrastructure

- policy, pricing, and regulatory issues that may impact on the use of infrastructure

- impediments to the efficient use of infrastructure

- options and reforms, including regulatory reforms, to make the use of infrastructure more efficient

- emerging national and international trends in policies about infrastructure

- the needs of users of infrastructure

- procurement, project finance, and other emerging national and international trends in the delivery of infrastructure projects

- the delivery of infrastructure projects.

Amendments to the Building Queensland Act 2015

In April 2019, the Queensland Government amended the BQ Act to implement its response to the recommendations of the 2017 Administrative Review of Building Queensland’s Operating Arrangements.

These amendments include:

- revising the threshold for BQ-led business cases to remove high-cost but low-risk road infrastructure proposals

- reducing the publication frequency of the infrastructure pipeline reports from six monthly to annually

- allowing proxies for government board members to be nominated for any length of time

- allowing for an increase in the monetary value of thresholds for determining BQ’s role in preparing business cases.

Key facts

| Business cases completed | Since its inception, BQ has completed 29 business cases for major infrastructure projects. This includes nine road and five rail transport projects. |

| Infrastructure pipeline reports | BQ has published seven infrastructure pipeline reports, including the latest report published in August 2019. |

| BQ’s operating costs | In 2018–19, BQ’s total operating costs were $22.2 million, of which it spent $15.5 million (70 per cent) on external consultants and contractors, primarily to deliver business cases. |

|

We selected the following five business cases for our detailed review: |

|

| Arthur Gorrie Correctional Centre Expansion (Arthur Gorrie Expansion) | Business case assessed the construction of 628 additional cells to meet growth in remand prisoner numbers across Queensland’s corrective services system. |

| Brisbane Live Entertainment Arena (Brisbane Live) | Business case assessed the development of a new arena located on a large deck structure built over railways, roads, and property, bounded by Albert and Roma streets. This project originated from the government’s previous market-led proposal initiative. |

| Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way | Business case assessed upgrades to the 11-kilometre section of the Bruce Highway between Caboolture-Bribie Island interchange and the Steve Irwin Way interchange. |

| Gold Coast Light Rail Stage 3A | Business case assessed the extension of light rail from Broadbeach South station to Burleigh Heads (Stage 3A) involving approximately 6.7 kilometres of dedicated dual light rail track. |

| Inner City South State Secondary College | Business case assessed options to establish a new high school in Brisbane’s inner south. |

| Sector | Project owner | Estimated capital cost* $ mil. |

Business case completion | Status | |

|---|---|---|---|---|---|

| Arthur Gorrie Expansion | Justice & public safety | Queensland Corrective Services | 604.4 | August 2017 | Queensland Government announced this project is part of the approved South Queensland Corrections Capacity project |

| Brisbane Live | Arts, culture, & recreation | Cross River Rail Delivery Authority | 2,118 | October 2018 | Queensland Government announced a market sounding exercise for this project (December 2019) |

| Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way | Road transport | Department of Transport and Main Roads (TMR) | 614.9 | April 2018 | Approved for delivery |

| Gold Coast Light Rail Stage 3A | Rail transport | TMR | 709.4 | December 2018 | Approved for delivery |

| Inner City South State Secondary College | Education | Department of Education | 175.7 | March 2019 | Approved for delivery |

Notes: * Estimated capital cost—represents nominal capital cost estimate as a P90 figure (meaning the probability of the estimated cost being exceeded is estimated to be less than 10 per cent).

Queensland Audit Office using information from respective business cases.

2. Audit findings

Developing business cases

Building Queensland (BQ) has worked with government agencies to improve the quality of business cases in Queensland using its better practice frameworks. As a result, BQ has provided the government with more robust analysis to support investment decisions.

The five business cases we reviewed generally aligned with the frameworks. However, we noted some areas for improvement, such as options analysis, economic assessments, and financial assessments. The business cases we reviewed varied in the adequacy of their analysis and did not always align with the scale, complexities, and risks associated with each project.

The timing of infrastructure investment announcements affects the value of developing business cases. Early government infrastructure investment announcements can create risk and lead to undue pressure to progress an infrastructure proposal. This can also create community expectations about the viability and likely success of a proposal. At present, there are no guidelines to deal with scenarios when government has already announced its preferred option. Our previous performance audit report on infrastructure, Market-led proposals (Report 12: 2018–19), emphasised the importance of completing a thorough analysis of infrastructure proposals before publicly announcing them.

How well did the business cases we reviewed align with the Business Case Development Framework?

Service need

The business cases we reviewed defined and articulated the service needs. The business cases used a range of methodologies, such as investment logic mapping, to identify the problem, opportunity, and potential benefits. Service needs were supported with appropriate data, assumptions, and analyses. The business cases identified the current state (the base case) and included scenario analysis of what might occur if no action was taken.

Options assessment

The business cases outlined how options were identified and shortlisted, but not all used quantitative analysis for assessing the options (as recommended by BQ’s Business Case Development Framework (BCDF)). Four of the five business cases we reviewed assessed options based on qualitative analysis only—they did not include financial or economic analysis of the options. In two of the five business cases, the extent of options analysis was impacted by how projects had progressed before BQ’s involvement.

While the extent of options analysis should be proportionate with the scale, complexity, and risk of the project, the BCDF requires business cases to include both qualitative and quantitative techniques. This is to provide a more robust basis for assessing the options and to better inform investment decisions.

Detailed analysis of reference (preferred) project

All business cases included analysis of reference projects, including assessments such as social impact, risk, economic viability, and financial viability. However, for two of the five business cases, the peer reviewers challenged how some of the inputs to the economic and financial assessments were estimated and analysed.

The social impact assessments for all five business cases used sound analytical approaches to ensure the validity of the outcomes. The assessments complied with BCDF guidelines. The business cases appropriately defined the social costs and benefits, and, where possible, monetised relevant social impacts.

All business cases assessed the reference projects’ economic and financial viability. In most instances, the business cases appropriately identified and considered relevant revenue and costs in the assessments. However, in some instances the issues raised by peer reviewers, relating to how key revenue and costs were estimated and the basis for some assumptions, remained unresolved. One of the five business cases was incomplete for decision making due to unresolved peer review issues and matters raised by the BQ Board.

For social infrastructure projects (which have less-developed datasets than other types of projects), the process for quantifying and monetising benefits requires further work. While infrastructure projects like transport have well-established, nationally agreed cost-benefit analysis guidance, equivalent guidance is not currently available for education and health projects.

We found that the business cases generally considered risks appropriately and accounted for the varying scale and complexity of different projects. The process of identifying, assessing, and capturing risks largely complied with the BCDF guidelines. Those business cases with multiple risks registers would benefit from an overarching risk register, which draws together all risks, treatments, ratings, and responsibilities for delivering the mitigation strategies, to ensure they are addressed as the project progresses.

How effectively does Building Queensland apply its assurance framework?

BQ planned assurance activities for the selected business cases in line with its assurance framework. However, project teams did not implement all assurance activities as planned and did not adequately address some issues identified from the assurance activities. This limited the level of assurance provided, resulting in the business cases not being as robust as they could be for decision making.

According to BQ’s assurance framework, key assurance deliverables include a project health review report and a governance review report. However, for all five business cases, these activities were undertaken informally (such as ad hoc reviews of project governance arrangements) rather than as formally documented reviews.

The timing of some assurance activities, such as BCDF alignment reviews and gateway reviews, was not optimal because some reviews were performed before the business cases were adequately complete. This led to incomplete review findings due to the unavailability of some chapters or key elements of a business case.

Peer reviews for all five selected business cases were undertaken in high-risk areas of the business cases and the process identified a number of issues. While most of these issues were addressed, we found several instances where the peer reviewers and the project team were unable to agree on matters that affected key business case assessments. It was unclear how BQ addressed some of the issues identified by peer reviews before they finalised the business cases. We found three of the five business cases did not have peer review logs to record how all the issues were addressed.

Providing infrastructure advice

How effectively does Building Queensland develop its infrastructure pipeline?

While BQ’s infrastructure pipeline reports provide a high-level snapshot of proposals it considers to be priorities for the state, the same proposals (since 2017) are also included in the State Infrastructure Plan (SIP)—Part B. While BQ’s infrastructure pipeline provides more analysis on unfunded proposals, it creates duplicate reporting obligations for agencies.

When developing its infrastructure pipelines, BQ does not conduct its own research to identify infrastructure priorities. It relies on government agencies to put forward ideas on infrastructure priorities for the state. BQ is also not as transparent as it used to be on its criteria for deciding which proposals it considers to be a priority.

Does Building Queensland provide infrastructure advice to government as per s. 10 of its Act?

BQ has provided infrastructure advice to the government and agencies in the context of the business cases it develops, but not as specifically stated in s. 10 of the Building Queensland Act 2015 (BQ Act). BQ advised that it also provides infrastructure advice informally through requests from agencies.

However, stakeholders have highlighted a need for BQ to take a more holistic view and conduct research to address the challenging infrastructure policy issues for government. BQ has not explicitly focused on its expert infrastructure advice role because, to date, it has focused primarily on improving the way infrastructure proposals are developed in Queensland.

Operating efficiently and effectively

Is Building Queensland’s lead role for developing business cases well understood and applied?

While BQ is required to lead the development of business cases for major infrastructure projects, we found that it did not explicitly lead three of the five selected business cases, as required by its legislation. While the BQ Board endorsed these business cases, key deliverables (such as leading and developing all aspects of a business case, excluding assurance activities) were primarily undertaken by the project owner rather than BQ.

BQ has created a risk categorisation framework to guide how it uses its limited resources to lead or assist agencies in developing business cases. By developing and using its risk categorisation framework, BQ has improved its ability to better target its resources for developing business cases. This framework assists BQ to determine its level of involvement by considering factors such as project complexities, risks, and project owners’ experience in developing business cases. But BQ’s risk categorisation framework is not consistent with the BQ Act, which requires BQ to lead the development of business cases for projects with an estimated capital cost of $100 million or more.

Amendments to the BQ Act (in April 2019) have allowed the Department of Transport and Main Roads (TMR) to lead business cases for most of its road transport projects. This helps to avoid duplicating efforts with BQ. It also releases some of BQ’s capacity to focus on areas where its resources are needed more.

How effective is Building Queensland’s operating model?

BQ’s current operating model enables it to access external consultants to manage the variability in workloads when developing business cases. It also allows BQ to utilise external expertise to assist in developing business cases that require technical and sectoral knowledge and skills.

However, as BQ primarily engages external consultants for developing and assuring business cases, this affects BQ’s ability to develop its internal capability by ensuring skills and knowledge are transferred from one assessment to the next. By developing internal capability, BQ could reduce its reliance on external consultants, reduce the costs of delivering business cases, and provide more effective expert infrastructure advice to government and agencies.

Unlike its jurisdictional peers, BQ performs two key roles—developing business cases and providing assurance activities on business cases. As BQ is responsible for managing and overseeing all business case activities, this affects how BQ’s stakeholders perceive the independence between these two roles. BQ could improve the independence of business case delivery by playing a greater role in assurance activities and a lesser role in developing business cases. The 2017 Administrative Review highlighted that most stakeholders felt benefits to government are diminished when BQ provides assurance activities on business cases for which it has led the development.

How well does Building Queensland measure cost efficiency?

BQ does not analyse the cost efficiency of its business case development activities. We found it difficult to analyse BQ’s costs of developing business cases because of issues with how it recorded some of these costs.

BQ records the costs of external consultants used to develop business cases and recovers these costs from project owner agencies. However, it does not capture and analyse its internal costs.

By ensuring all relevant costs and time spent are adequately captured and analysed, BQ could improve its understanding of business case development and assurance costs, and better identify opportunities for efficiency gains.

How do agencies value BQ’s services?

Central government agencies value BQ’s role in providing independent assurance on the robustness of business cases for decision making. Non-central government ‘user’ agencies have different perceptions of the value BQ delivers in developing business cases. This usually depends on the agencies’ internal capability and capacity to develop business cases.

Agencies with limited experience in developing business cases mostly place a higher value on BQ’s services. However, TMR, which is highly experienced in developing business cases, questions the value of BQ’s role in leading its business cases. It does, however, see the value in the independent assurance role BQ undertakes.

Though the operating model between BQ and TMR has evolved over time, TMR has some ongoing concerns with BQ’s overall value for money, costs of assurance reviews, and duplication of effort in developing business cases. Recent changes to the threshold for road transport projects should help to address some of these concerns.

BQ’s use of its risk categorisation framework also assists in addressing some of TMR’s concerns. The framework enables BQ to allocate business case development workload between the project owner agencies, including TMR, and itself. This assists in minimising duplication of effort and costs in developing business cases.

3. Audit conclusions

Since its establishment, Building Queensland (BQ) has been primarily focused on developing decision-making frameworks and improving the quality of Queensland government infrastructure business cases. It has, in most of the cases we audited, effectively delivered and/or facilitated robust business cases for major infrastructure projects. However, there are concerns this quality is not achieved as efficiently as it could be.

While BQ has provided advice to agencies through the business cases it develops, it has not necessarily fulfilled its legislative role to provide expert advice about infrastructure to government. BQ’s stakeholders expect it to play a greater role in providing expert advice to improve infrastructure planning and delivery in Queensland.

Given BQ’s infrastructure advisory role and the opportunity it has to have a holistic view across all sectors, BQ is well placed to play a more influential role in addressing Queensland’s infrastructure challenges. BQ’s legislative functions refer to considering infrastructure issues and potential solutions across government agencies.

While BQ has established generally sound frameworks for developing and assuring business cases, it does not always effectively apply these frameworks. This resulted in some business cases not being as robust as they could be for decision making. BQ could realise more value from its assurance activities by conducting them after key sections of the business cases are complete.

Central government agencies value BQ’s services because it is independent of project owners and does not advocate for project funding. However, other stakeholders perceive that BQ’s dual role of developing business cases and providing assurance activities on business cases affects BQ’s ability to demonstrate adequate independence between these two important roles. In our view, BQ’s value to these stakeholders could increase if it was able to focus more on project assurance for entities that have demonstrable experience in business case development, while continuing to support entities that have minimal resourcing and experience in business case development. BQ also needs to build its internal capability to enable it to more effectively undertake its functions, including providing expert infrastructure advice to government and agencies.

Recommendations

Building Queensland

We recommend that Building Queensland:

1. improves the design and application of its frameworks for developing business cases and providing assurance activities on business cases (Chapter 4)

This should include:

- reviewing and refining its assurance framework to better reflect its current practices (that is, ensuring there is clearer alignment between Building Queensland’s assurance framework and its actual assurance activities)

- improving how it manages any risks to its independence when it both leads the development of a business case and performs project assurance activities

- improving the process for quantifying and monetising benefits for social infrastructure projects that have less-developed datasets available

- improving timing and conduct of its assurance activities on business cases, to enable comprehensive reviews and timely resolution of issues before finalising a business case

- providing clear protocols for agencies to follow during the early stages of developing an infrastructure proposal to ensure announcements occur once sufficient assessment has been undertaken to determine the project is suitable and sufficiently viable

- establishing and applying internal guidelines for developing business cases for investment proposals where the government has already decided to deliver a project.

2. publishes information in its infrastructure pipeline reports on how it uses its assessment criteria to identify infrastructure proposals that it considers to be a priority for the state (Chapter 5)

3. develops and implements a strategy to improve its internal infrastructure knowledge and capability, so it can more effectively undertake its functions as required under the Building Queensland Act 2015 (BQ Act) (Chapter 6)

The strategy should include plans for developing, retaining, and using internal capacity to undertake its core responsibilities, and optimising its mix of internal and external resources.

4. performs cost-efficiency analysis of its business case development activities to enable efficiency improvements (Chapter 6)

This should include:

- monitoring costs and time of internal resources used in developing business cases

- improving the process for recording costs of external consultants used in developing business cases to ensure all costs are appropriately categorised.

Building Queensland and the Department of State Development, Manufacturing, Infrastructure and Planning

We recommend that Building Queensland (BQ) and the Department of State Development, Manufacturing, Infrastructure and Planning (DSDMIP) work together to:

5. assess the merits of developing both BQ’s infrastructure pipeline and DSDMIP’s State Infrastructure Plan (Chapter 5)

6. review and clarify BQ’s role and obligations in fulfilling what is required under the BQ Act to enable it to more effectively manage its functions (Chapter 6)

This should include reviewing the BQ Act and, where necessary, recommending to the Minister for State Development, Manufacturing, Infrastructure and Planning to amend the BQ Act and clarify its role of leading and developing business cases to ensure:

- there is clearer alignment between BQ’s current practices and the obligations stated in the BQ Act (that is, BQ considers its role in developing business cases based on project risks and agencies’ capability)

- there is clarity on the distinction between BQ’s role in leading business cases and providing project assurance.

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to relevant agencies. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the agencies are at Appendix A.

4. Detailed findings—Developing business cases

This chapter is about how effectively Building Queensland leads and/or assists agencies to deliver robust business cases for major infrastructure projects.

Introduction

Building Queensland (BQ) has developed a suite of documents known as the Business Case Development Framework (BCDF) to assist with the development of infrastructure proposals. The BCDF supplements Queensland Treasury’s Project Assessment Framework (PAF) by providing detailed guidance on how to complete the assessments required to develop robust business cases.

The BCDF focuses on the development of the following core business case documents:

- Strategic Business Case (SBC)—aims to ensure the service need is substantiated and effectively articulated, and the benefits sought are achieved through the proposed initiatives

- Preliminary Business Case (PBC)—aims to progress the concept documented in the SBC through an options assessment, which results in a preferred option/s for analysis within the Detailed Business Case

- Detailed Business Case (DBC)—aims to provide evidence for investing in the reference project (that is, the preferred project option selected for detailed analysis).

The process and the level of analysis required in developing a business case can vary, depending on the complexities and risks associated with the project. By using its BCDF, BQ aims to ensure there is a consistent and rigorous approach taken to government infrastructure proposals. The BCDF guides a proposal from strategic assessment of service need to options analysis, and finally to detailed analysis of a preferred option.

In addition to developing business cases, BQ facilitates assurance activities (such as Gateway and peer reviews) on business cases to ensure they are robust and provide a sound basis for government to support an investment decision.

During our audit, BQ engaged external consultants to assist in reviewing the BCDF and business case assurance processes. BQ intends to finalise both reviews in early 2020.

This chapter assesses the effectiveness of BQ and relevant agencies in developing the five detailed business cases we selected. To assess effectiveness, we examined whether the business cases:

- clearly defined and articulated the service need

- adequately analysed options and documented the basis for selecting the preferred option

- included detailed analysis of the reference project, such as assessment of social impact, financial and economic viability, and risks.

This chapter also covers BQ’s assurance processes over the five business cases we selected.

How well did the business cases we reviewed align with the Business Case Development Framework?

We found that the business cases we reviewed generally aligned with the BCDF; however, we noted some areas for improvement, such as options, economic assessments, and financial assessments. This resulted in business cases not being as robust as they could be for decision making. We found:

- service need—all business cases identified the service need of the respective investment proposals, which resulted mostly from an identified problem

- options analysis—all the business cases outlined how options were identified and shortlisted, but not all used the BCDF- and PAF-recommended quantitative analyses for assessing the options. We also found instances where the decisions from the options assessments did not fully align with the results of the analyses

- detailed analysis of reference project—all the business cases included assessments such as social impact, risk, economic viability, and financial viability of the reference projects. However, for some business cases, we noted that certain inputs to the economic and financial assessments could have been better defined.

Peer reviews were used to challenge assumptions, inputs, and analyses, particularly relating to options analyses, economic assessments, and financial assessments of some of the business cases. While most of the issues were resolved, we found that for two business cases (Brisbane Live and Inner City South State Secondary College), there was a lack of clarity on how BQ addressed some of the issues raised by peer reviewers before it finalised the business cases.

Timing of infrastructure investment announcements

The timing of infrastructure investment announcements affects the value of developing business cases. Early government infrastructure investment announcements, particularly prior to a business case being completed, can create community expectations about the viability and likely success of a project. Therefore, the timing of announcements is significant.

Of the five business cases we selected, the Queensland Government publicly announced two project investments (Inner City South State Secondary College and Brisbane Live) before BQ began to develop the business cases.

Our previous performance audit report on infrastructure, Market-led proposals (Report 12: 2018–19), emphasised the importance of completing a thorough analysis of infrastructure proposals before publicly announcing them. The announcements create pressure that infrastructure proposals should progress because government has announced them.

The timing of investment announcements may also influence whether all stages of the BCDF are completed. The BCDF recommends that an SBC and PBC be completed and approved prior to developing a DBC, as they support the integrity and quality of the DBC. However, as illustrated in Figure 4A, only two of the five detailed business cases were informed by an SBC and PBC.

| Business case | Strategic | Preliminary | Detailed |

|---|---|---|---|

| Arthur Gorrie Expansion | ✓ | ☓ | ✓ |

| Brisbane Live ^ | ☓ | ☓ | ✓ |

| Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way* | ✓ | ✓ | ✓ |

| Gold Coast Light Rail Stage 3A | ✓ | ✓ | ✓ |

| Inner City South State Secondary College | ☓ | ☓ | ✓ |

Notes: * Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way—the strategic and preliminary business cases were developed under PAF

^ Brisbane Live—a pre-feasibility study for the proposed entertainment arena was undertaken in April 2018.

Queensland Audit Office.

The reasons for not following the BCDF’s recommended three-stage business case process varied:

- Arthur Gorrie Expansion—a PBC was not developed due to time constraints. Because of the project’s urgent priority, it progressed directly to the DBC stage

- Inner City South State Secondary College—no SBC and PBC were developed as the government had already publicly announced delivery of the school (by 2021) and committed funding

- Brisbane Live—originated from a market-led proposal process. Due to its risk profile, the Queensland Government decided that BQ and Cross River Rail Delivery Authority would lead the next stage of proposal development—DBC.

For infrastructure proposals where an SBC and/or PBC were not developed, their respective DBCs incorporated elements of service need and options assessments (that are normally considered during the SBC and PBC stage). However, for those projects that went through the full three-stage business case process, business cases could be progressively developed and the key elements considered at appropriate stages (rather than being all conducted as in-depth analysis in a single business case).

For example, the purpose of the SBC is to focus on identifying high-level initiatives only, leaving the process of identifying detailed options and shortlisting to the PBC stage. The SBC is designed to encourage the project team to focus on articulating the service need rather than potential solutions. It also minimises the work required in the SBC, before a decision is made to progress.

For the Inner City South State Secondary College business case, BQ commenced developing the business case 14 months after the government announced the new school would be constructed. The Department of Education performed some analysis (in consultation with BQ), to select the school precinct and site, prior to BQ developing the business case. Figure 4B shows a timeline of key events and decisions during that time.

Queensland Government announced a new high school to be constructed in Brisbane inner south.

Department of Education engaged Building Queensland to provide advice on a suitable decision-making framework and process to identify a location for the new school.

Queensland Government announced that the school is planned to open in early 2021.

Queensland Government announced the location of the new school—Dutton Park.

Building Queensland commenced developing the business case for the new school.

Queensland Government purchased additional land for the school site.

Building Queensland’s Board endorsed the business case for the new school.

Queensland Audit Office.

Although the decision to construct the new school had been made, BQ was still required to develop a business case because the project cost is over $100 million. BQ spent $1.03 million and seven months developing the business case.

Given that this project had a pre-determined outcome (the decision to deliver the project had already been made), the value of developing the business case afterwards was limited. BQ advised that the purpose of the business case was to inform the government about the costs and risks of the project, rather than to inform on whether to proceed.

At present, BQ does not have any internal guidelines to deal with scenarios when government has already announced its preferred project option. Internal guidelines would be useful in identifying and assessing the purpose of developing a business case in such instances (for example, like preparing a short form business case rather than a detailed business case, for projects that already have funds committed). It could assist in specifying appropriate analysis to conduct in circumstances where the outcome is known. For example, the New South Wales Government’s guidance states that Cost Effectiveness Analysis (CEA) can be used where decision-makers have previously agreed on a specific outcome or objective and the business case preparer only wishes to compare options that meet the same objectives.

Service need

BCDF guidelines

The business case must clearly define and articulate the service need which may result from a problem or opportunity. The business case must include evidence of why it is necessary to address that problem or opportunity and be sufficiently robust to convey to decision-makers the level of detail and planning undertaken to support the identified service need.

The business cases we reviewed defined and articulated the service needs. The business cases used a range of methodologies, such as investment logic mapping, to identify the problem, opportunity, and potential benefits. The level of service need analysis varied, mainly to reflect the scale, complexities, and risks associated with each project.

Service needs were supported with appropriate data, assumptions, and analyses. For example, the Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way business case included analyses on traffic delays, crash incidents, and the cost of flooding. The Arthur Gorrie Expansion business case included analyses on overcrowding in prisons and related impacts.

For all selected business cases, the current state (base case) was identified, including scenario analysis of what might occur if no action was taken.

Options assessment

BCDF guidelines

The business case should clearly outline how options were identified, analysed, and shortlisted. The BCDF recommends documenting the economic, social, environmental, and financial viability of the shortlisted options, and how it supports the selection of the preferred option/s. The business case should provide the decision-maker with assurance that the most appropriate option/s is progressed for detailed analysis.

The options assessment is to use the most appropriate combination of qualitative and quantitative techniques, to enable a fully informed final option decision. The extent of analysis should be proportionate with the scale, complexity, and level of risk of the project.

We found that four of the five business cases assessed options based on qualitative analysis only. These business cases did not include financial or economic analyses of the options and relied on qualitative multi-criteria analysis (that is, evaluating options using a set of qualitative criteria). Applying qualitative multi-criteria analysis usually involves identifying the underlying policy objectives and then determining all of the factors (the criteria) that would indicate achievement of the objectives.

The options assessment for the Gold Coast Light Rail Stage 3A business case included both qualitative and quantitative multi-criteria assessment analysis, along with transport modelling and rapid economic assessment (cost-benefit analysis).

The BCDF states that quantitative techniques such as financial analysis (incorporating an analysis of cash flows and risks) should be performed for all options regardless of scale, as understanding of financial flows is critical to investment decision making. Both the BCDF and PAF state that quantitative assessments, including cost-benefit analysis, play a critical role in informing investment decisions, as they support evaluating various options. Cost-benefit analysis assists in understanding the net community benefits of various options using measures such as benefit cost ratio (BCR; a BCR greater than one is generally regarded as economically viable).

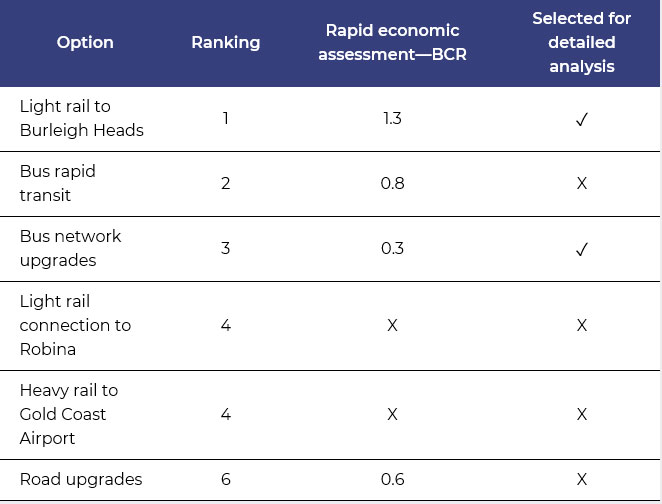

One of the key objectives of undertaking options assessments is to assist decision-makers to decide the most appropriate option/s that should progress for further detailed analysis. The Gold Coast Light Rail Stage 3A business case (Case study 1) provides an example of where the option decisions did not fully align with the results of the analysis.

| Gold Coast Light Rail Stage 3A |

|---|

|

The business case for the Gold Coast Light Rail Stage 3A investigated the extension of light rail from Broadbeach South station to Burleigh Heads. The options assessment process included both qualitative and quantitative multi-criteria analysis (MCA), with the objective of robustly assessing the delivery option most likely to achieve a value-for-money outcome. The methodology used for the options analysis was appropriate and aligned with the BCDF. However, some of the option decisions were inadequately explained and did not fully align with the analysis. The qualitative assessment considered a broad range of potential solutions to address the service need. From the initial long list, the following six options progressed to quantitative assessment. Based on the outcomes, four of these options were taken forward to the rapid economic assessment. Shortlisted options

The rapid economic assessment of the four shortlisted options identified Light rail to Burleigh Heads as producing the highest net benefits. Despite having the lowest BCR (0.3), the Bus network upgrades option was selected to progress with Light rail to Burleigh Heads through to detailed analysis, ahead of the other two higher-scoring projects. The business case did not provide sufficient reasoning for including Bus network upgrades as an alternative reference project for detailed analysis. The business case stated that, though Bus network upgrades had the lowest BCR, it may be an alternative option given it did not require the addition of another mode of transport, is a lower-cost option, and is consistent with the strategic focus of the project. More detailed reasoning would be useful to better align option decisions with analysis. |

Queensland Audit Office.

Undertaking comprehensive options assessments in line with relevant frameworks is still essential, even when the government has announced a particular project. Options assessments inform decision-makers on the most appropriate form and location of the project to ensure the government makes the most effective and efficient infrastructure decisions.

Business cases such as Brisbane Live would have benefitted from some level of quantitative economic assessment of the options, considering it had a very low BCR—0.36 (meaning the economic costs of the project outweigh the economic benefits). This could have resulted in a more robust assessment of the various options and, if necessary, enabled re-shaping of the investment proposal to better meet the intended service needs.

Apart from ensuring the appropriate level of analysis is performed for assessing options, it is also important to ensure that any key assumptions made in undertaking assessments are valid, reliable, and well supported. Overall, we found the assumptions made in terms of options assessments were well documented, with some business cases more clearly defining the assumptions than others.

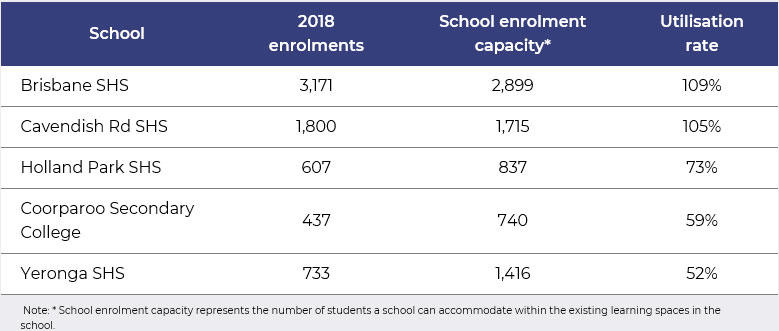

The business case for Inner City South State Secondary College (Case study 2) provides an example where the business case supported the preferred option using a key assumption that was not clearly defined, and a peer reviewer challenged it.

| Inner City South State Secondary College |

|---|

|

The business case for the Inner City South State Secondary College investigated options to establish a new high school in Brisbane’s inner south. Population growth and the preference to attend schools with a perceived positive reputation has resulted in two schools in Brisbane’s inner south operating over capacity—Brisbane and Cavendish Road State High Schools (SHS). Three of the other five schools in the area were operating at under-capacity. Network schools’ utilisation rates

The business case stated that the option of using the underutilised schools to full capacity might be considered an unlikely proposition over the short term, as it would likely take several years to improve the desirability of attending underutilised schools. The peer review challenged the assumption of limiting the supply capacity of the underutilised network schools and stated that it was not clearly explained. The business case recommended the Inner City South State Secondary College should be constructed. The new school is expected to alleviate capacity pressures until 2026, when extra capacity will be required in the network. The business case also recommended other measures, such as promoting the underutilised schools in the network to generate demand and assist in alleviating demand pressures after 2026. |

Queensland Audit Office.

Detailed analysis of the reference project

The objective of performing detailed analysis is to enable the decision-maker to decide whether to invest in the reference project. Detailed analysis includes assessing critical aspects such as social impact, financial and economic viability, and risks of the reference project.

Social impact evaluation

BCDF guidelines

BCDF defines social impacts as the effect the reference project has on the well-being of society. Social impact analysis is to be completed prior to the economic, environmental, and financial analyses as it can provide valuable input into those assessments.

BCDF recommends a three-step process for undertaking social impact analysis—identify social impacts, assess likelihood and severity of the impacts, and summarise the results. Quantifying social benefits is desirable where possible.

The social impact evaluations for the five selected business cases complied with the BCDF guidelines. The social impact evaluations used sound analytical approaches to ensure the validity of the outcomes.

The business cases appropriately defined the social costs and benefits, and, where possible, monetised relevant social impacts. The business cases also appropriately developed risk mitigation strategies, and recalculated risks after considering the mitigation strategies.

Financial analysis

BCDF guidelines

Financial analysis, incorporating an analysis of cash flows, should be carried out for the reference project regardless of scale. This enables an understanding of the project’s financial flows which is critical to investment decision making.

Financial analysis under the BCDF focuses on the financial costs, that is, the net financial impact to government including cash flow implications from an internal financing perspective. A key input to the financial analysis is a fully developed and articulated analysis of forecast demand.

The financial analysis must include all revenues generated by the project, capital costs, operating costs, and residual values (in the last year of the project). The evaluation period for the analysis should not exceed 30 years or extend beyond the demand modelling forecast period.

The selected business cases mostly applied the financial assessments in accordance with the BCDF guidelines. In most instances, the business cases appropriately identified and considered the relevant revenue and costs in the financial assessments.

However, for two of the five business cases (Brisbane Live and Inner City South State Secondary College), peer reviewers challenged how some revenues and costs were estimated and challenged the basis for some assumptions. Some issues raised by peer reviewers remained unresolved, for example:

- Brisbane Live—the business case is incomplete for decision making due to unresolved peer review issues and matters raised by the BQ Board. Issues raised in the peer review included timing, cost contingencies, and quantum of revenue items over the life of the project.

- Inner City South State Secondary College—the financial analysis excluded operational costs of the new school. The business case stated this was because the Department of Education will fund these costs separately. However, the peer review disagreed, stating that, to be consistent with the BCDF and PAF and to present the full picture of whole-of-life costs, the analysis should include ongoing operational costs and then identify the funding sources available to meet such costs. We acknowledge that the Department of Education has a process for capturing operational costs, but it was not included in the business case for the decision makers to fully understand what these costs are.

- Inner City South State Secondary College—the business case used an evaluation period of 20 years for economic and financial analysis. Limiting the evaluation period to only 20 years excludes future benefits and costs, including periodic and refurbishment costs. BQ stated the reason for using 20 years was due to a lack of recurrent and life cycle costs beyond 20 years. The peer review recommended BQ consults with other jurisdictions, such as New South Wales, which is using longer evaluation periods for its school projects. BQ advised that for future school business cases it could consider the use of longer evaluation periods.

Economic analysis

BCDF guidelines

The purpose of performing economic analysis is to provide an assessment of whether an investment proposal is economically viable. Economic analysis incorporates the outputs of the financial analysis but also focuses on the overall economic welfare of the community.

Economic analysis should also consider the work completed within the social impact evaluation and environmental impact areas, in terms of accounting for economic benefits and costs of the reference project.

Fundamental to economic analysis is that all benefits and costs are identified and documented as comprehensively as possible. It is useful to identify the people who are affected by a decision and whose costs and benefits should be considered in the cost-benefit analysis.

We found the business cases identified and considered various costs and benefits in their economic assessments. For example, the Gold Coast Light Rail Stage 3A business case clearly articulated the benefits sought from the project with adequate assessments of transport benefits and wider economic and urban renewal benefits. The project team appropriately considered and addressed the issues raised through assurance reviews.

Cost-benefit analysis plays a critical role in informing investment decision-making. The BCDF and PAF generally state that projects with a net present economic value (NPEV) greater than zero and a benefit cost ratio (BCR) greater than one should be recommended as economically viable. On purely economic grounds, projects with NPEV less than zero should be rejected, as the expected net positive community benefits are not derived from the investment.

The BCDF and PAF recommend considering both economic and financial analysis to inform investment decisions. A project’s net present financial value (NPFV) is the difference between the project’s present value of total cash inflows and outflows. An NPFV of at least zero indicates that a project is essentially financially viable. Figure 4C summarises the choice on proceeding with projects for given combinations of financial and economic benefits.

| Positive—NPFV | Negative—NPFV | |

|---|---|---|

| Positive—NPEV | Proceed with project option, as it is economically and financially viable | Could proceed with the project option if the economic NPV is sufficiently large |

| Negative—NPEV | Should not proceed, unless some economic costs can be mitigated | Should not proceed |

Notes: Net present economic value (NPEV)—the difference between the present value of total incremental benefits and costs. A project that yields a positive NPEV indicates that the incremental benefits exceed the incremental costs over the evaluation period.

Net present financial value (NPFV)—the difference between the present value of total cash inflows and outflows. A project that yields a positive financial NPFV indicates that the cash inflows exceed the cash outflows over the evaluation period.

Business Case Development Framework and Project Assessment Framework.

As shown in Figure 4D, by simply applying the BCDF’s and PAF’s recommended decision model, three of the five selected business cases have a BCR less than one and, based on the guidelines, should not proceed. However, the BCDF further states that, where qualitative economic, social, and environmental impacts are considered significant, these should be contrasted against the NPEV result to determine whether the decision rule needs to be qualified.

In assessing the overall viability of the audited projects, all business cases considered various analyses of economic, financial, and social outcomes. The three business cases (with BCR less than one), concluded that the low BCRs were offset by various benefits that could not be monetised. This makes it difficult to adequately assess and measure the overall viability of the projects, as the basis for endorsing a project relies heavily on benefits that could not be monetised.

| Benefit cost ratio* | Economic NPV $ mil. (negative) | Financial NPV $ mil. (negative) | |

|---|---|---|---|

| Arthur Gorrie Expansion | 0.12 | ($501.2) | ($941.4) |

| Brisbane Live | 0.36 | ($964.0) | ($1,844.4) |

| Bruce Highway – Caboolture-Bribie Island to Steve Irwin Way | 1.91 | $421.92 | ($566.4) |

| Gold Coast Light Rail Stage 3A | 1.08 | $56.0 | ($647.2) |

| Inner City South State Secondary College | 0.38 | ($108.08) | ($218.0) |

Notes: * Benefit cost ratio (BCR)—the ratio of the present value of total incremental benefits to total incremental costs. A BCR greater than one indicates that quantified project benefits exceed project costs.

Queensland Audit Office using information from respective business cases.

For social infrastructure projects (which have less-developed datasets available compared to other types of projects), it is difficult to adequately quantify and monetise benefits. Infrastructure projects like transport have well-established, nationally agreed cost-benefit analysis guidance (including Australian Transport Assessment and Planning). These business cases have a more robust basis to measure benefits to support investment decisions.

Equivalent nationally agreed guidelines are currently not available for education and health projects. Emerging guidance exists in several state jurisdictions, particularly in New South Wales.

An additional issue for BCR as a measure for social infrastructure projects is that costs are immediate, but benefits accrue over extended time.

BQ is aware of the need for alternate ways of calculating social benefits in business cases and has utilised learnings and frameworks from other jurisdictions to influence its assessments. However, the process for quantifying and monetising benefits for social infrastructure projects that have less-developed datasets available requires further work.

Peer reviews play an important role in challenging and improving the robustness of business case activities, including economic assessments. For two of the five business cases (Brisbane Live and Inner City South State Secondary College), peer reviewers identified some issues relating to economic assessments, including demand analyses and key assumptions.

While undertaking economic analysis, it is critical to ensure demand projections, particularly those provided by proponents or third parties, are appropriately considered and assessed. The Brisbane Live business case (Case study 3) provides an example of where the business case used demand projections and various assumptions provided by the proponent.

Peer reviewers challenged a number of these assumptions, such as those relating to demand forecasting, willingness to pay, pricing, and take up of some products and services. While some of the issues have been resolved, there remain differences in opinion between the project team and the costing peer reviewer. The project owner would need to fully consider and address issues raised by peer reviewers (and issues raised by the BQ Board) before the business case is ready for government review.

| Brisbane Live |

|---|

|

The Brisbane Live project was originally proposed by AEG Ogden through the Queensland Government's previous market-led proposal framework. The project involves development of a new arena located over railways, roads, and properties in the Brisbane CBD. BQ developed the business case in partnership with Cross River Rail Delivery Authority. The reference project had a benefit cost ratio of 0.36, which indicates that the economic benefits do not offset the large upfront capital costs of the project. The business case assessments included several key input data and associated assumptions that the proponent, AEG Ogden, provided. The project team considered the revenue and cost assumptions in its cost-benefit analysis, which Stadiums Queensland reviewed. The project team performed sensitivity analysis by varying key value and cost drivers under a range of alternative assumptions. Peer review challenged some of the identified benefits of the project, such as the increase in patronage from the new venue, and the significant uplift in demand during the last seven years of the project timeframe. Much of the economic benefit for this project derives from consumer surplus (uplift in willingness to pay). This assumption is based on comparison with a study in Melbourne, which considered the uplift in willingness to pay at live music venues across Melbourne (as opposed to events specifically held at an arena). The business case acknowledges that this study does not provide for the difference between shows in the inner city (for example, international shows) and a band performing in an outer suburb. While the project team was able to resolve a number of issues working with the peer reviewer, it is unclear whether all the issues were adequately addressed. BQ did not maintain a peer review log for this business case. The peer reviewer recommended that, where information such as demand forecasts are derived from third parties, processes should be developed to validate the information and/or conduct sensitivity analyses on the impacts of these parameters early in the business case development process. |

Queensland Audit Office.

Risk assessment

BCDF guidelines

An effective risk management approach should be used to identify and assess project and ongoing risks. Risk assessments are to be undertaken across all aspects of business case development, including:

- identifying proposal risks—risks associated with any changes to the proposal background, service need, stakeholders, options generated, or strategic and political context

- identifying business case development risks—including methodology, assumptions, and practices underpinning the assessments (social, economic, environmental, and financial), data reliability, accuracy, and currency

- identifying process risks—including stakeholder engagement activities and timing, to ensure the process for developing the business case maximises its outcomes

- identifying potential project risks—including timing, delivery, funding, and governance arrangements.

Risks should be captured in a risk register, and include information such as risk description, impact, rating for likelihood and consequence, overall risk rating, and control strategy.

For the selected business cases, we found the risks were generally considered appropriately and accounted for varying scale and complexities of different projects. The process of identifying, assessing, and capturing risks largely complied with the BCDF guidelines.

We found that the risks associated with the projects were assessed at different stages of the BCDF process and for different business case elements. In some business cases, this resulted in several risk registers for various purposes (for example process, project, peer, and costing reviews).

Those business cases with multiple risk registers would benefit from an overarching risk register, which draws together all risks, treatments, ratings, and responsibilities for delivering the mitigation strategies, to ensure they are addressed as the project progresses.

How effectively does Building Queensland apply its assurance framework?

For the selected business cases, BQ planned the assurance activities in line with its assurance framework. However, project teams did not implement all assurance activities as planned and did not adequately address some issues identified from the assurance activities. This limited the level of assurance provided, resulting in the business cases not being as robust as they could be for decision making.

Business case assurance reviews

BQ has developed guidelines and processes to provide decision-makers with assurance over business case development activities. BQ’s assurance framework aims to support the development of robust business cases and provide a sound basis for decision making.

BQ’s assurance framework requires all its detailed business cases to have an individual assurance plan that records the assurance activities to be undertaken during business case development. Figure 4E outlines BQ’s three-tiered assurance process.

| Tier 1 | Tier 2 | Tier 3 | |

|---|---|---|---|

| Purpose | To ensure business case is delivered as planned and as per BQ’s guidelines | To ensure business case aligns with the agency’s policies and procedures | To ensure elements of analysis are robust and independently assured |

| Examples of assurance activities |

|

|

|

Queensland Audit Office using information from Building Queensland’s Assurance Framework.

Tier 1 assurance reviews

For all business cases, BQ performed tier 1 assurance reviews at multiple stages of their development phases. However, we found that some of the assurance activities did not align with BQ’s assurance framework and the respective business case assurance plans.

For example, BQ’s assurance framework requires that reports for project health review and project governance review be developed as part of tier 1 assurance activities. However, for all five business cases, these activities were undertaken informally (such as ad hoc reviews of project governance arrangements), rather than as formally documented reviews.

It may be appropriate for these assurance activities to be performed as ‘business as usual’, particularly if they adequately cover their intended purposes and formal documented reviews do not provide additional value. Such an approach and flexibility should be appropriately reflected in BQ’s assurance framework and the respective individual business case assurance plans.

BQ’s assurance process also requires that a BCDF alignment review is undertaken for each business case. The purpose of this review is to assess compliance with the BCDF guidelines. For the Brisbane Live project, the BCDF alignment review was not undertaken due to the short timeframe for developing the business case. BQ advised that the alignment with BCDF was undertaken progressively through the development of the business case, but not formally documented.

The timing of some BCDF alignment reviews was not optimal, with some reviews being performed before the business case was adequately complete. This led to incomplete review findings due to the unavailability of some chapters or key elements of the business case.

Tier 2 assurance reviews

Most of the selected business cases included a Gateway review as a tier 2 assurance activity. Gateway reviews provide an additional level of independent review of business cases. For the Brisbane Live business case, a Gateway review was not undertaken as it was not at the readiness for market stage.

We found that, for some business cases, Gateway reviews were performed when the business cases were not adequately complete. For the Inner City South State Secondary College business case, some of the key components were not available for review, including economic/benefit cost analysis and project affordability analysis. As with the BCDF alignment reviews, timing of assurance reviews is critical to ensure business cases are at a sufficiently complete stage to enable comprehensive and robust reviews.

Apart from BQ’s assurance processes, some project owner agencies, such as TMR, also have their own internal assurance processes for business cases. TMR regularly plans and manages multiple infrastructure projects and has its own internal assurance processes, frameworks, and manuals. For BQ-led business cases involving TMR projects, we found that tier 2 assurance activities also included reviews performed by TMR’s Infrastructure Investment Committee. We discuss duplication of effort in delivering business cases in Chapter 6.

Tier 3 assurance reviews

Overall, tier 3 assurance activities have been performed in accordance with BQ’s assurance processes. The peer reviews for all five selected business cases were undertaken in high-risk areas of the business cases.

As part of their review, peer reviewers identified various issues with the business cases. While most of these issues were addressed, we found several instances where the peer reviewers and the project team were unable to agree on matters. For business cases such as Brisbane Live, it is also unclear whether all the issues identified through the peer reviews were appropriately addressed.

We found three of the five business cases did not have peer review logs to record how all the issues raised by peer reviewers were addressed. Developing peer review logs is important in ensuring all key issues are tracked and resolved in a timely manner.

Tier 3 assurance activities also includes BQ Board’s review of business cases. We found the BQ Board’s review of the selected business cases was appropriate. Through its reviews, the BQ Board noted and accordingly advised government on any issues or matters that needed to be considered or where further work was required before government made a decision on the investment proposal.

For example, the BQ Board, in endorsing the findings of the Brisbane Live business case, advised government that there were a number of areas that require further analysis before the project is market ready.

5. Detailed findings—Providing infrastructure advice

This chapter is about how effectively Building Queensland provides independent infrastructure advice to government.

Introduction

Building Queensland’s (BQ) role is to provide objective and transparent advice to support the Queensland Government in making infrastructure decisions. This includes advising government on infrastructure projects that BQ considers to be priorities to meet the state’s needs.

BQ’s infrastructure pipeline reports outline the priority infrastructure proposals under development by government agencies. The pipeline reports are presented in two parts:

- Part one—identifies priority Queensland Government unfunded infrastructure proposals with a minimum capital cost of $50 million. The report outlines whether these proposals are ready for consideration by government or require further analysis

- Part two—features BQ-led business cases that are supported by Queensland Government funding commitments for delivery, either in part or in full. The estimated capital cost of delivery is $100 million or more and is dependent on a detailed analysis confirming the viability of the project.

During our audit, BQ engaged an external consultant to assist in reviewing its infrastructure pipeline process. BQ intends to finalise this review in early 2020.

BQ is also required to advise government on broader issues and challenges relevant to Queensland’s infrastructure sector.

This chapter assesses whether BQ effectively:

- advises government on the priorities relating to infrastructure

- provides government and agencies with independent expert advice.

How effectively does Building Queensland develop its infrastructure pipeline?

Building Queensland’s infrastructure pipeline

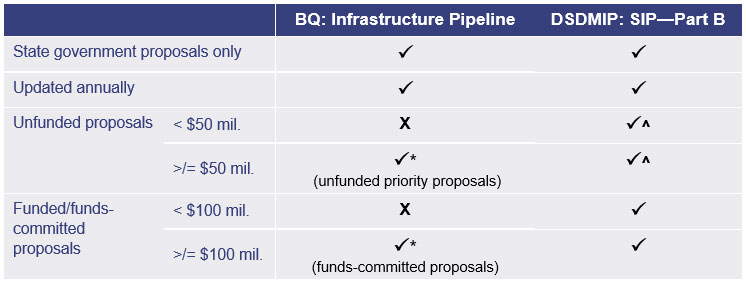

While BQ’s pipeline reports are professionally presented and provide a high-level snapshot of selected proposals, the same proposals (since 2017) are also included in the State Infrastructure Plan (SIP)—Part B. While BQ’s infrastructure pipeline provides more analysis on unfunded proposals, it creates duplicate reporting obligations for agencies.

There are also other infrastructure pipeline-related sources that provide information about infrastructure projects to industry, potential investors, and government. This requires additional effort from agencies to ensure they provide consistent project information to various pipelines, which are then publicly available. Figure 5A shows the key infrastructure pipeline-related reports.

The SIP—Part B is the most comprehensive source of information about potential public infrastructure investments in Queensland. It outlines the state’s infrastructure program over the next four years. It includes both funded and unfunded proposals, with no minimum capital cost threshold.

BQ’s pipeline provides more information compared to SIP—Part B for unfunded proposals. BQ’s pipeline includes its analysis of unfunded proposals and their estimated costs of delivery, whereas the SIP—Part B only lists unfunded proposals by their stage of development.

The 2017 Administrative Review of Building Queensland’s Operating Arrangements (2017 Administrative Review) found that the benefits of the pipeline could be improved by increasing communication to external stakeholders about the rationale for separating the development of BQ’s pipeline from the development of the SIP—Part B.

Figure 5B compares BQ’s infrastructure pipeline with the SIP—Part B.

Notes: * BQ’s infrastructure pipeline part one covers unfunded priority proposals, while part two covers funds-committed proposals.

^ Department of State Development, Manufacturing, Infrastructure and Planning (DSDMIP) SIP—Part B—no project cost estimates are included for unfunded proposals.

Queensland Audit Office.

Identifying infrastructure proposals

BQ relies on government agencies to put forward ideas about infrastructure priorities for the state. It does not conduct its own research to advise government on infrastructure priorities.

The Explanatory Notes to the Building Queensland Act 2015 (BQ Act) state that BQ may identify infrastructure proposals for its pipeline through its research. This research may be a result of providing advice to government agencies during the preliminary evaluation stages of infrastructure development or gathered when assisting or leading the preparation of business cases.

A study commissioned by BQ in December 2018 to inform its future direction found varied stakeholder views about its role in identifying infrastructure priorities. While some stakeholders stated that BQ should continue to request infrastructure proposals from agencies, others identified some scope for BQ to also independently identify infrastructure priorities.