Overview

Queensland’s public investment in vocational education and training (VET) provides individuals with training and employment opportunities aligned to the state’s employment, skilling and economic priorities. It offers Queenslanders vocational pathways to job and career outcomes, and addresses the skills needs of industry and employers. Access to quality, supportive, and affordable VET helps grow the Queensland economy, create jobs, and reinvigorate regional communities. Tabled 8 August 2019.

Audit objective and scope

This audit examined whether the Department of Employment, Small Business and Training (the department) is achieving successful learning and employment outcomes through its public and private providers.

The audit addressed this by assessing whether public investment in vocational education and training (VET) is:

- meeting Queensland’s skilling needs

- achieving student learning and employment outcomes

- cost-effective.

We focused on the department, which has overall responsibility for managing the public investment in VET. The department aims to provide individuals with training and employment opportunities aligned with Queensland’s employment, skilling, and economic priorities.

We also examined a sample of public and private VET providers who receive government funding and/or subsidies. We included in our audit:

- TAFE Queensland

- Central Queensland University (a provider of VET services since 1 July 2014 when Central Queensland University merged with Central Queensland Institute of TAFE)

- five private VET providers that receive state subsidies

- four community-based organisations that receive funding under the Skilling Queenslanders for Work initiative (which provides support for disadvantaged people to access training and find employment).

Scope exclusions

We did not include as part of this audit:

- VET in Schools (which allows students to undertake VET studies at school, through a registered training organisation or as a school-based apprentice or trainee)

- regulation of registered training organisations (which is the role of the Australian Skills Quality Authority)

- Jobs Queensland.

Further details about the scope and approach are in Appendix B.

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to the relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are in Appendix A.

Glossary

| Term | Definitions |

|---|---|

| Australian Skills Quality Authority (ASQA) | The national regulator for Australia’s vocational a and training sector. ASQA regulates courses and training providers to ensure nationally approved quality standards are met. |

| Certificate III Guarantee | A program providing training support for Queenslanders to complete their first post-school certificate III qualification. It also supports school students to access training and helps Queensland's Year 12 graduates to transition to employment by providing free training in high-priority qualifications. |

| Community-based organisation | Eligible non-government, community-based organisations funded under Skilling Queenslanders for Work that assist and support disadvantaged people who face complex barriers to learning. |

| Contestable VET market | In the contestable, competitive market, eligible private and public training organisations can apply for government subsidies to deliver the Queensland Government’s priority VET courses. |

| Creating public value | How a public sector entity uses its resources to create value that contributes to society. In the context of VET, this means the value created for students (including disadvantaged people), employers, and the community. |

| Higher Level Skills | A program of subsidised training for eligible individuals in selected certificate IV or above qualifications and for priority skill sets. |

| National Agreement for Skills and Workforce Development | Identifies the Commonwealth, state and territory governments’ long term objectives for skills and workforce development, recognising the interest of all governments in ensuring the skills of the Australian people are developed and utilised in the economy. Term of agreement: 2009–2020. |

| National Partnership Agreement on Skills Reform | A time-limited agreement that expired on 30 June 2017, directed at achieving the reform directions agreed under the National Agreement for Skills and Workforce Development. |

| Pre-qualified suppliers | Registered training organisations approved by the department as pre qualified suppliers in Queensland to receive government training subsidies to deliver training and assessment services. |

| Registered training organisations | Public and private training providers that deliver VET services. |

| Skilling Queenslanders for Work | A program to support disadvantaged people through targeted skills and training programs to gain the skills, qualifications, and experience needed to enter and stay in the workforce. Funding is primarily available for community-based not-for-profit organisations. |

| State Contribution Grants | Government funding to support public providers in the contestable VET market. |

| User Choice | A program of public funding contributing to the cost of training and assessment services for eligible Queensland apprentices and trainees. |

Introduction

Vocational education and training (VET) provides education and training in job-related and technical skills. It covers many careers and industries such as traditional trades, office work, retail, hospitality, community services, health, and the technology sector. VET plays a key role in increasing the workforce participation of people who lack foundational language, literacy, and numeracy skills.

Queenslanders need access to quality, supportive, and affordable VET in order to grow the economy, create jobs, and reinvigorate regional communities. The main objectives of government investment in VET are to provide vocational pathways that lead to job and career outcomes for students and to address the skills needs of industry and employers—both large and small.

The Department of Employment, Small Business and Training (the department) administers the publicly funded, contestable, demand-driven VET market. The contestable market opens government funding to both public and private providers, with the aim of stimulating the efficient use of public funds. The department is essentially the state training purchaser, contracting out and funding VET programs that are subject to the market forces of supply and demand.

The five public providers of VET in Queensland are: TAFE Queensland, Central Queensland University, Aviation Australia (consolidated into TAFE Queensland from October 2017), Queensland Agricultural Training Colleges (which will cease to operate after 2019), and the Aboriginal Centre for Performing Arts.

The government expects public providers to provide strong leadership in the delivery of quality VET services, offering access to training across regional and remote areas of Queensland. They are also expected to deliver services in VET market gaps where needed, such as low demand or additional priority qualifications.

In 2018–19, the Queensland Government committed $777.9 million to VET through the 2018–19 Annual VET Investment Plan. This includes about $333.5 million contributed by the Australian Government.

The annual VET investment plan includes:

- demand-driven funding (with no limits to student numbers) for

- Certificate III Guarantee (training for Queenslanders without a post-school qualification)

- Higher Level Skills (training in selected certificate IV or above qualifications)

- User Choice qualifications (training for apprentices and trainees)

- support for disadvantaged Queenslanders—a defined amount of funding through the Skilling Queenslanders for Work initiative

- support for public VET providers—State Contribution Grants to public VET providers to help meet the extra costs of operating as a public provider in a contestable market.

The department subsidises some VET qualifications delivered by public and private registered training organisations. It prioritises the qualifications to determine the subsidy it will pay to each, giving the highest priority to qualifications that:

- address the demand for certain skills and long-term workforce-planning priorities identified in consultation with industry

- are assessed as highly effective in generating outcomes for graduates, based on a range of factors, including

- occupational demand and supply

- projections for employment

- relative earnings of qualified and unqualified people employed in relevant occupations.

Summary of audit findings

Vocational education and training investment outcomes

Each year, the National Centre for Vocational Education Research (NCVER) surveys student and employment outcomes Australia wide. Over the last five years, Queensland’s results in the VET-outcomes survey have been consistently in line with the average of other states or slightly above. In 2018, 82.7 per cent of Queensland students surveyed after exiting the VET system reported they were employed or had moved on to further study.

Queensland increased VET investment by $130.2 million (21 per cent) from 2014–15 to 2017–18, but the number of Queensland students participating in VET and completing qualifications has remained static. A significant proportion of the investment increase was allocated to two priorities: 1) assisting disadvantaged cohorts of students to participate in training, and 2) helping public providers maintain their quality and service levels now that they must compete for students and funding (which is referred to as a contestable market).

The department uses nationally agreed VET outcome and output measures to track student outcomes, including students’ participation in demand-driven training programs, employment outcomes, and cost efficiency in supporting students to successfully complete individual study units. The department has decreased the cost of unit completions from $701 in 2009–10 to $614 in 2018–19 (based on its estimate as part of the state budget process for 2019–20). Based on recent analysis of NCVER data and the efficiency of the department’s investment in VET programs (excluding public provider grants), relative to other jurisdictions, the department was more efficient than other jurisdictions in delivering its VET programs.

In 2017–18, the government allocated 29 per cent of total VET investment to State Contribution Grants. However, the department does not currently measure the public value derived from the government’s investment in public providers through State Contribution Grants. The grants aim to support quality training and skills delivery by subsidising public providers in areas of competitive disadvantage in comparison to private providers.

Measuring public value is complex, due to the different dimensions of VET outcomes—including economic growth, social equity, sustainability, government expectations of public providers and different benefits for multiple stakeholders. However, the department should consider developing a framework to assess the effectiveness of investment in public VET providers to measure performance and inform future investment.

Prioritising VET investment to skilling needs

The department does not currently have a VET strategy. However, it is developing a Skills Strategy that will outline priorities for Queensland’s VET sector. In the absence of a strategy, the annual VET investment plan currently outlines the Queensland Government’s short- to medium-term priorities, initiatives, and investment in VET programs.

The annual VET investment plan does not outline the government’s long-term strategies to:

- develop and sustain the VET sector

- define the roles, responsibilities, and purpose of public VET providers to meet government expectations

- define the expected public value of the State Contribution Grants.

We found that the department directs funding toward the skills and qualifications needed in the labour market by setting training priorities and administering government subsidies aligned to those priorities. This helps to achieve the Queensland Government’s aim of offering students either affordable and accessible training that leads to real job outcomes, or further training to meet career aspirations.

By allocating subsidies based on the skills that Queensland’s industry needs, the government encourages training providers to deliver priority training and helps to make training affordable and attractive, thereby encouraging more students to enrol.

The department consults broadly with industry to identify the skills Queensland needs. It conducts its own research and analysis to inform the annual plan, but it does not clearly document how the results are pulled together, what the sources of information are, and how the data has been used. As a result, decision-making is not always transparent. In addition, in the absence of a clearly documented annual investment-plan process, the department may be over dependent on personnel who have critical information and knowledge.

Supporting disadvantaged people in obtaining skills for the workforce

Skilling Queenslanders for Work includes seven programs that support disadvantaged people to access and complete VET and to find employment.

The initiative is on track to meet its target of investing $420 million to assist 54,000 Queenslanders into work over six years (2015–16 to 2020–21) at an anticipated cost of $7,778 per student. So far, the initiative has supported 41,568 Queenslanders at a cost of $296.56 million—an average of $7,134 per student.

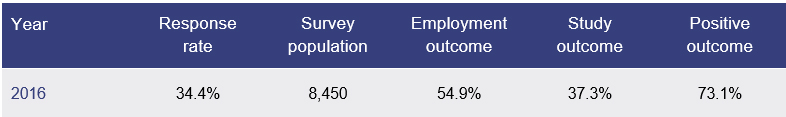

The 2016 exit survey results (latest available) show that 73.1 per cent of Skilling Queenslanders for Work participants reported they were either employed, engaged in further study, or both. This is above the positive outcome targets set for individual programs within the Skilling Queenslanders for Work initiative, which range from 55 per cent to 70 per cent of participants gaining employment or engaging in further study.

Funding under Skilling Queenslanders for Work is fully contestable. The department manages a competitive application process with funding rounds held twice-yearly on a statewide regional basis. The department has well-controlled processes for distributing and monitoring funding to community-based organisations that support individual participants.

However, the time frame between opening the funding round and announcing successful applicants is long, taking an average of five months. While the department needs appropriate governance processes, the long time frame creates uncertainty for community-based organisations, making it difficult to plan resources and service delivery.

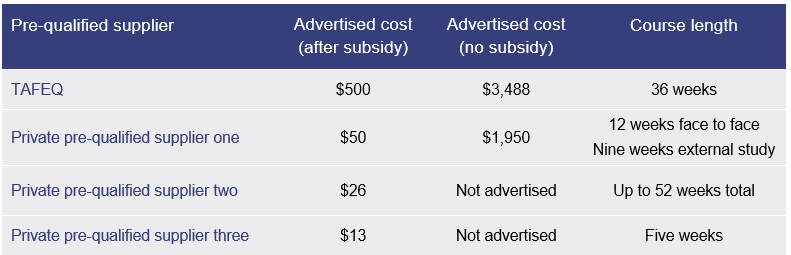

Most programs within Skilling Queenslanders for Work include accredited training, funded under the Certificate III Guarantee or User Choice programs. Pre-qualified suppliers partner with funded community-based organisations to deliver the nationally recognised training and assessment-service components of Skilling Queenslanders for Work. The pre-qualified suppliers who deliver the training claim government subsidies separately from the department.

The department's funding guidelines strongly recommend, but don’t mandate, that community‑based organisations consult with their selected pre-qualified supplier before submitting their funding application. During the audit, public and private providers, regional department staff, and community-based organisations all told us of instances where community‑based organisations had either not adequately consulted the pre-qualified supplier or the pre-qualified supplier had not delivered what was verbally agreed. This potentially reduces the effectiveness of the program for the participant and the ability to achieve positive outcomes.

Investing in state training infrastructure

In the five years to 2018–19, the ownership and strategic direction for Queensland’s training infrastructure changed several times. The changes included the:

- creation of the Queensland Training Asset Management Authority (QTAMA) to manage state training assets (for example, buildings and campuses)

- transfer of state training assets from the former Department of Education and Training to QTAMA

- transfer of state training assets out of QTAMA to the Department of Education and Training

- transfer of state training assets after machinery of government changes to the Department of Employment, Small Business and Training.

Under-investment in maintenance, repairs, and capital in Queensland’s training assets has occurred over the same period. Many buildings and campuses are not in the condition or nature needed for modern, fit‑for‑purpose, and flexible learning environments. The department and TAFE Queensland (TAFEQ) have been working on a memorandum of understanding to define who does what in managing and maintaining the training assets that TAFEQ occupies. They endorsed and finalised the memorandum of understanding in July 2019.

In 2017, the government made an election commitment through the Advancing Our Training Infrastructure initiative to invest up to $85 million to revitalise six VET campuses/regions. In 2018 and 2019, in addition to managing the delivery of that election commitment, the department undertook regional infrastructure planning for state-owned training infrastructure. The regional plans will eventually inform master plans for infrastructure investment to cover the state. The department expects to complete the master plans within three years.

In the 2019–20 budget, the department has committed to invest $105 million in upgrades and improvements in Queensland's training infrastructure to ensure that it provides fit‑for‑purpose assets.

Managing risks in a contestable market

As the administrator of government training subsidies, the department is responsible for maintaining the integrity of the subsidised training market. It does this in two ways: 1) by approving registered training organisations as pre-qualified suppliers in Queensland to receive state government training subsidies, and 2) by monitoring their compliance with contractual obligations.

To be eligible to apply for pre-qualified supplier status, the applicant must be registered with the Australian Skills Quality Authority (ASQA) as a registered training organisation.

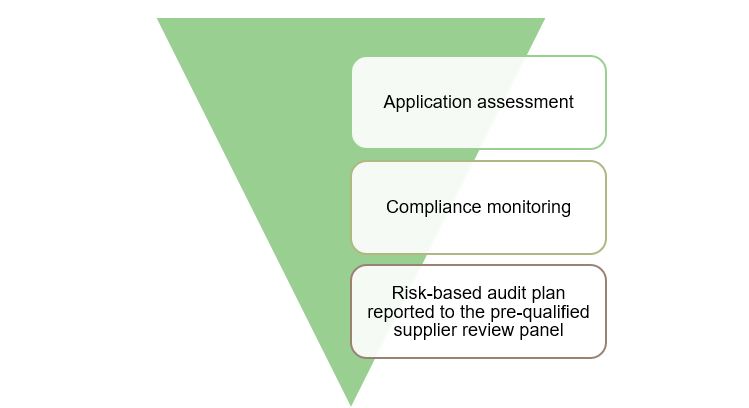

The Queensland VET Quality Framework outlines the department’s approach to overseeing the quality of publicly funded VET and provides assurance about the integrity of funding provided to pre-qualified suppliers. The framework is risk based and well managed, with a systematic monitoring and audit program.

Contract management

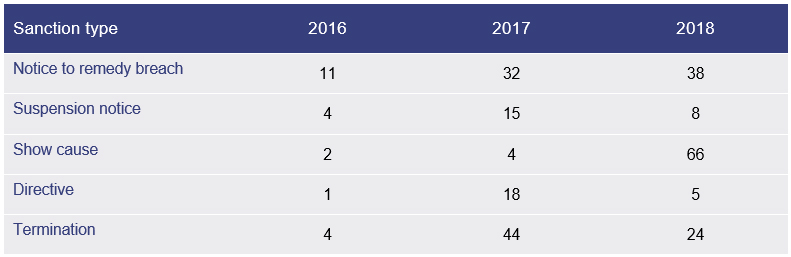

The department effectively manages the pre-qualified supplier system to provide a central register of pre-approved registered training organisations. It has sound contract-management processes supported by comprehensive policies, guidelines, and reporting functions. Contract managers monitor performance and compliance against pre-qualified supplier agreements. Non-compliance can result in sanctions such as recovering funds, suspending funding, or terminating the agreement.

The department reduces or removes funding from training providers that do not meet quality standards or that breach contract conditions. It renews the contracts of compliant providers. Since strengthening the assessment and monitoring of Queensland’s pre-qualified suppliers in 2016, the department has reduced the number of suppliers from 718 to 518, illustrating the effectiveness of the process.

Funding agreements run for one year. The department renews the agreements in mid-June (and sometimes later) to subsidise courses from 1 July. This offers pre-qualified suppliers little funding certainty and can impact negatively on their planning and financial stability. All suppliers we visited raised this issue, suggesting that a minimum of one month’s notice of contract renewal is a more appropriate time frame.

Improvements to the quality framework mean the department can more confidently identify lower-risk suppliers. It may be timely to consider extending contract time frames for those suppliers. Reducing the number of agreements renewed each year may also relieve the administrative burden on the department.

Audit program

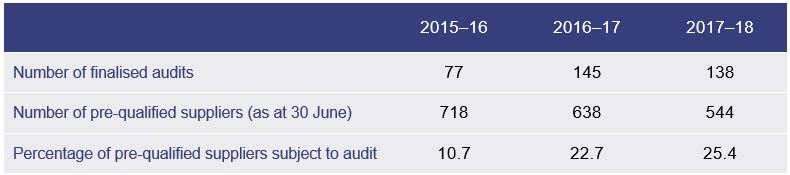

In 2015–16, the department implemented a risk-based audit program to manage market risk by auditing pre-qualified suppliers. The audits assess compliance with policy and agreement requirements, for example, by assessing whether pre-qualified suppliers have conducted enough student pre-enrolment eligibility checks.

With a view to providing effective audit coverage and minimising overlaps, the department maintains a communication protocol with ASQA to share information and work closely to better coordinate oversight activities. Where the department considers pre-qualified suppliers are not complying with national quality standards, it refers these to ASQA for investigation. This may lead to regulatory audits by ASQA that can result in cancellation and other sanctions.

The department uses a quarterly risk-indicator report as a basis for selecting providers for audit. In the 360 audits completed in the three financial years from 2015–16 to 2017–18, only two pre‑qualified suppliers audited were fully compliant. This indicates the value of audit activities in assessing pre‑qualified suppliers’ compliance and identifying areas for improvement.

The department has found that issues identified through audits are caused by a lack of understanding of requirements rather than deliberate misrepresentation of reported information. It has recently started communicating important themes and common issues to pre-qualified suppliers through monthly newsletters. However, some pre-qualified suppliers we met with suggested the department could more clearly communicate policy and agreement requirements and changes.

Supporting public vocational education and training providers

State and federal government policy decisions in the last 10 years have resulted in increased competition and, in turn, a decline in student enrolments for Queensland’s public VET providers and reduced fee revenue. Key changes include:

- July 2010: apprenticeship and traineeship funding through the Queensland Government User Choice program became fully contestable

- July 2014: move to allow full competition for government subsidies on all publicly funded priority training

- January 2017: replacement of VET FEE-HELP with VET Student Loans that restricted the courses eligible for student loans, and introduced loan caps and tighter student eligibility. This reduced affordability for some students and reduced enrolment numbers.

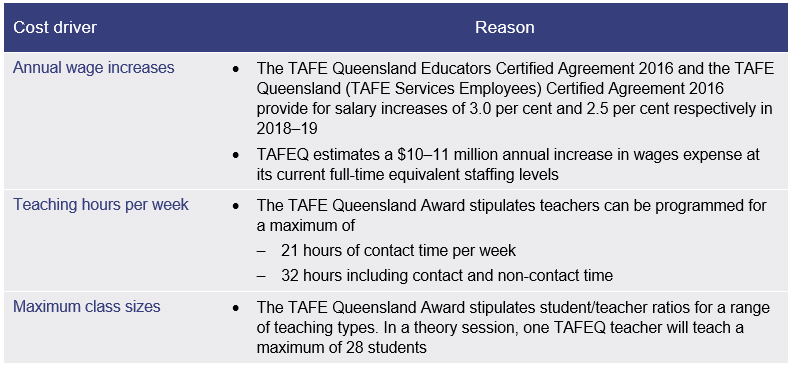

Since July 2014, public providers have lost a significant proportion of their previous market share to private pre-qualified suppliers. Private providers’ key competitive advantage is lower prices, because generally they have lower costs. Public providers’ costs are influenced by the expectation they will offer a broad range of qualifications and deliver training in remote and regional areas or where there is low demand. The government also expects public providers to provide strong leadership in the delivery of quality VET services and support displaced students following the collapse of a private registered training organisation.

TAFE Queensland

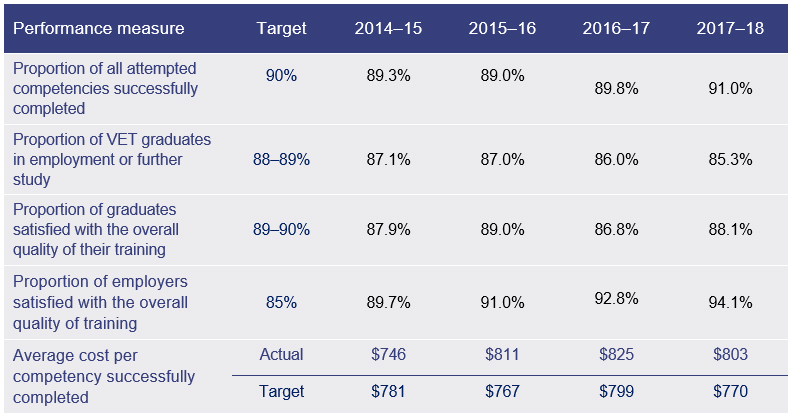

TAFEQ is the largest public provider of TAFE in Queensland. Employment outcomes for TAFEQ students has decreased slightly over the last four years, but this is consistent with the Queensland and national averages. Competency completion rates and student satisfaction have remained relatively stable, while employer satisfaction, sourced from the ASQA prescribed Australian Quality Indicator Learner Engagement and Employer Satisfaction (AQILEES) survey has increased from 89.7 per cent to 94.1 per cent over the last four years.

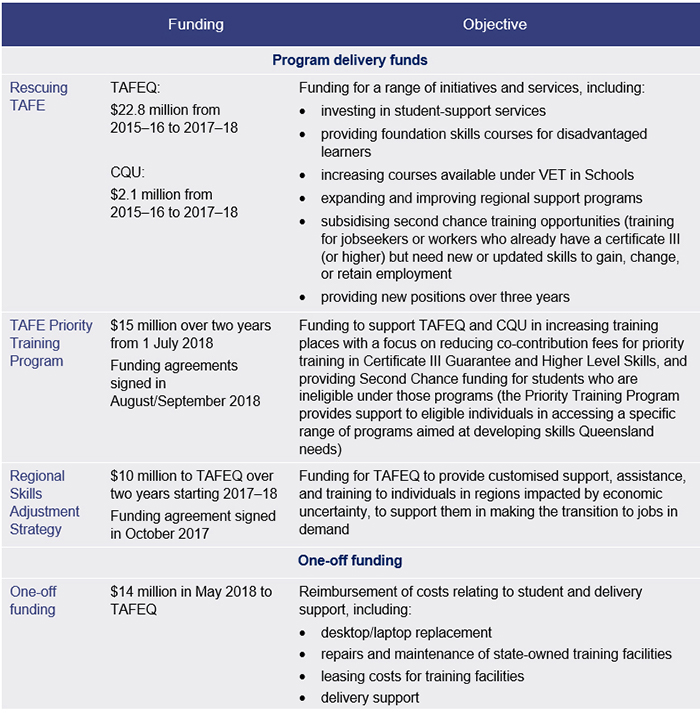

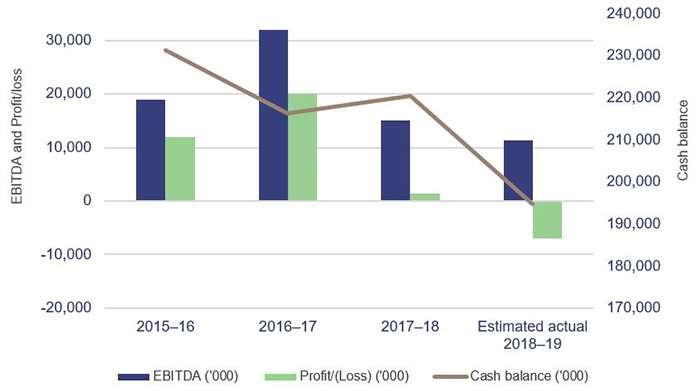

Its revenue includes student fees, state government training subsidies, state government grants, other grants, donations, and sponsorships. In 2018–19 it received 85 per cent of the total State Contribution Grants that the Queensland Government gave to public providers.

TAFEQ’s forecasted operating results indicate that, based on current trends and policy settings, it will not earn enough revenue to meet the ongoing costs of being Queensland’s main public training provider. This is despite efforts to reduce costs.

The Queensland Government’s current award and industrial relations agreements mean that TAFEQ is not able to significantly reduce its costs due to an employee-cost structure that it cannot fully control. It, therefore, cannot compete directly on cost with the private sector. In 2017–18, TAFE posted an annual profit of $1.4 million, but this was after a $14.1 million additional one-off contribution from the department to reimburse expenses for student and delivery support.

The decrease in TAFEQ’s student fee revenue means that the Queensland Government, through the department, is funding more than 30 per cent of TAFEQ’s operations. Since 2014–15, the department has paid grants to all public providers to contribute towards the costs associated with delivering quality training in a competitive market, including staffing costs, trainer development, and learning materials.

To improve its operating efficiency, TAFEQ is developing strategies and plans to increase revenue and reduce costs. While the move to one statewide registered training organisation from 1 July 2017 was driven by improving customer service, TAFEQ forecasts that these changes will also deliver financial savings over the next three years (TAFEQ had previously operated as six separately registered training organisations).

TAFEQ is implementing statewide processes and systems to adapt to the new model and reduce duplication across regions. It is currently allowing natural attrition to reduce its employee numbers in line with its new needs. It plans to develop workforce management plans to support program-delivery outcomes and financial sustainability.

Without any significant changes to student fee revenue or other revenue, TAFEQ will continue to rely heavily in the short to medium term on government grants to cover its operating expenses, particularly employee expenses.

Central Queensland University

In July 2014, Central Queensland University (CQU) merged with Central Queensland Institute of TAFE. It is Queensland’s first comprehensive dual-sector university (delivering both higher education and vocational education).

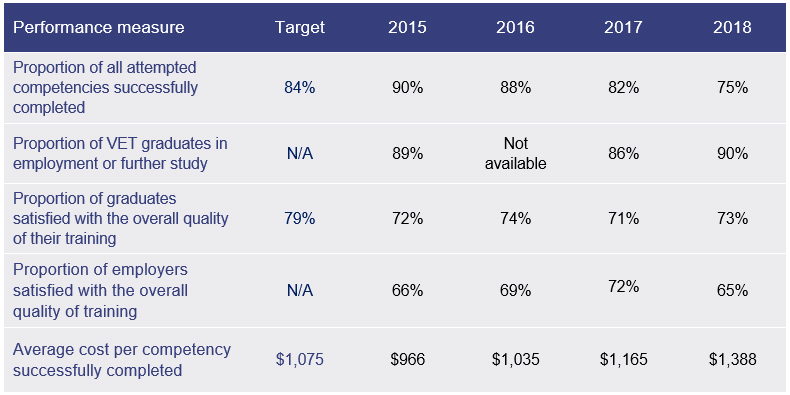

CQU is facing similar issues to TAFEQ: declining VET student numbers and not enough revenue to meet the ongoing costs of being a public training provider in Queensland.

In the last four years, the number of students enrolled in VET at CQU has decreased by 14 per cent, from 9,800 in 2015 (academic year) to 8,393 in 2018. Higher education student enrolments have increased by 21 per cent over the same period.

In 2018, the State Contribution Grant of $16.6 million made up 46 per cent of CQU’s total VET revenue. Like TAFEQ, CQU’s TAFE operations are running at a loss. In 2018, CQU’s net loss in VET was $9.2 million (before depreciation). It has developed several strategies to control its costs and grow revenue.

Audit conclusions

Over the last five years, the Department of Employment, Small Business and Training (the department) has contributed to successful learning and employment outcomes for students and industry by providing students with greater access to and choice of qualifications that focus on the skills needs of industry. It has also effectively provided more support for disadvantaged students to get a job, and managed the transition to a fully contestable, demand-driven vocational education and training (VET) market.

The department can demonstrate that its annual VET investment is directed towards meeting Queensland’s skilling needs in a mostly cost-effective way. It measures student outcomes resulting from their participation in a demand-driven training program to track performance. However, it is not clear that the department is optimising all elements of its VET investment as effectively as it could. This is because it does not measure the outcomes or value created by the State Contribution Grant directed towards supporting Queensland’s public providers.

While there has been no measurable improvement in participation or employment outcomes for VET graduates overall in the fully contestable market, Queensland’s student and employment outcomes have been consistent and comparable with other states since 2013. In addition, the cost per completed competency in Queensland has reduced over the last 10 years.

The department is effectively managing the risks of funding private and public training providers in a contestable market. This provides students and the Queensland public with greater assurance that pre-qualified suppliers are delivering quality, industry-standard training that meets industry skill needs and supports employment opportunities.

The Queensland Government has increased funding support for disadvantaged cohorts to participate in training through the Skilling Queenslanders for Work initiative. The initiative provides fair access to training opportunities for individuals who face significant barriers to participation. The initiative is on track to reach its target of assisting 54,000 Queenslanders into work over six years (2015–16 to 2020–21).

The Queensland Government and the department are committed to maintaining the presence and offerings of its public providers, including Central Queensland University and TAFE Queensland. The department has demonstrated this commitment by investing approximately one-third of its VET budget in 2017–18 to support public VET providers to maintain a level of quality and service in the contestable market and cover declining training revenue. The Queensland Government often seeks additional services from its public providers, requesting they operate in inefficient parts of the system. This includes delivering training in rural and remote areas, low demand markets and as first response to emerging government priorities.

If public sector providers’ costs remain stable and their student fee revenue continues to decline as forecasted, the gap between revenue and expenses will grow. This means there is a risk the government will need to fund a greater proportion of public sector providers’ operations through grants for them to remain sustainable. With a potentially increasing investment to sustain public providers, it will be important to adequately measure the value generated by this investment.

The government needs strategies to determine how it intends to meet the future education and training needs of Queenslanders as cost effectively as it can.

Recommendations

The Department of Employment, Small Business and Training

We recommend that the Department of Employment, Small Business and Training:

1. finalises its draft Skills Strategy, ensuring it addresses:

- Queensland’s longer-term strategies for developing and sustaining the VET sector (Chapter 2)

- clear roles, responsibilities, and the future purpose of VET public providers (Chapter 4)

2. develops and applies performance measures supporting the expected public value of the State Contribution Grants (Chapter 2)

3. periodically reviews the methodology used to determine the value of State Contribution Grants to public providers to account for changes in the training environment and public providers’ costs (Chapter 4)

4. improves transparency over investment decision-making by clearly documenting information, data, and analysis used in developing and reviewing the annual investment plan and subsidy lists (Chapter 2)

5. increases the effectiveness of the Skilling Queenslanders for Work program by:

- improving the grant process with the aim of reducing the time frame between the funding round opening and the announcement of the successful applicants—to help grant recipients better plan resources and service delivery

- requiring community-based organisations to provide evidence with their application that they have agreed on training delivery expectations with the selected pre-qualified supplier (Chapter 2)

6. improves the efficiency and quality of the pre-qualified supplier contract-renewal process by:

- renewing the contracts at least one month before the new financial year start date to help suppliers better plan resources and training delivery

- extending the time frames of contracts for low-risk suppliers (Chapter 3).

TAFE Queensland

We recommend that TAFE Queensland, in consultation with the Department of Employment, Small Business and Training:

7. finalises specific and measurable strategies and plans to improve the financial sustainability of its training delivery, including:

- strategies for increasing its student revenue and market share

- workforce management plans that support program delivery outcomes and financial sustainability.

1. Context

This chapter gives the context needed to understand the audit findings and conclusions.

Vocational education and training system

Vocational education and training (VET) is a national system. All state and territory governments share responsibility with the Australian Government for funding industry-relevant training.

In Queensland, VET courses are either fee-for-service or government subsidised, with students and/or employers contributing towards the cost. In 2017–18, about half of the nationally recognised training delivered in Queensland received a level of government subsidy.

In July 2014, the Queensland Government implemented reforms to move to a fully contestable, demand-driven funding framework. This meant that eligible private training organisations could now apply for government subsidies to deliver the Queensland Government’s priority courses.

Prior to July 2014, Queensland offered contestable funding for the User Choice program (training and assessment services for apprentices and trainees) but not for other training programs.

On 1 January 2017, the Australian Government replaced the VET FEE-HELP scheme with VET Student Loans. VET Student Loans are only available for approved courses at the diploma level and above. This means that students can't get a loan for a certificate IV course or below. Not all registered training organisations are approved to offer VET Student Loans and there is a limit to how much students can borrow, called the 'loan cap'. The loan cap differs, depending on the course studied. Some providers may offer courses that cost more than the loan cap. In these cases, students must pay the difference between the course cost and the loan cap.

VET is delivered by approximately 4,200 public and private providers nationally. In Queensland, there are five public providers and around 520 private providers who deliver qualifications and skill sets that attract a state government subsidy.

Roles and responsibilities

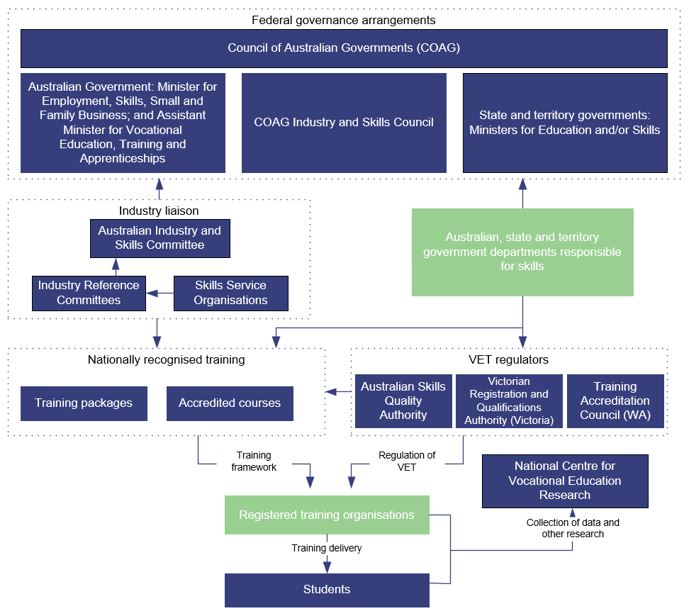

Figure 1A outlines the governance arrangements, roles, and responsibilities of government, industry, and other key stakeholders in the VET system.

Note: Functions highlighted in green are included in the scope of this audit.

Report on Government Services 2018 produced by the Australian Productivity Commission.

Federal governance arrangements

The National Agreement for Skills and Workforce Development and the National Partnership Agreement on Skills Reform (which concluded on 30 June 2017) outline government roles and responsibilities as follows:

- state and territory governments supply approximately two-thirds of government funding to VET and manage VET delivery within their jurisdiction (including the effective operation of the training market)

- the Australian Government provides financial support to state and territory governments to sustain national training systems and provides specific incentives, interventions, and assistance for national priority areas

- the Australian Government and state and territory governments work together to progress and implement national policy priorities.

Industry liaison

The Australian Industry and Skills Committee provides government departments with industry advice on the implementation of national VET policies. It also approves the nationally recognised training packages that registered training organisations in the VET system deliver. The committee draws advice from its network of industry reference committees, which have industry sector experience, skills, and knowledge. It also develops training packages that meet the needs of Australian industry.

Regulation of the quality of VET

The Australian Skills Quality Authority (ASQA) accredits courses and registered training organisations using nationally approved quality standards. ASQA has jurisdiction over all registered training organisations, except for those operating solely in Victoria or Western Australia.

To ensure high-quality training is provided, the Queensland Government works closely with ASQA by sharing information to better coordinate its oversight activities. The department refers potential non-compliance of registered training organisations to ASQA, which may lead to regulatory audits.

Registered training organisations

Registered training organisations are training providers that deliver VET services. They include:

- public VET providers—such as technical and further education (TAFE) institutes, agricultural colleges, and universities

- community education providers

- other registered providers—such as private training businesses, industry and community bodies with a registered training organisation, employers that have registered training organisation status to train their own staff, group training organisations, or apprenticeship network providers that also deliver VET services.

Nationally recognised training

Registered training organisations deliver nationally recognised training through:

- training packages and skills standards against which training delivery and assessment of competency can take place; these are developed through a process of national consultation with industry

- VET courses that enable nationally accredited training in niche areas or in response to rapidly emerging industry needs, where training needs are not covered by existing qualifications.

Registered training organisations issue nationally recognised VET qualifications or VET statements of attainment to students who fully or partially complete a qualification from a training package or VET-accredited course.

Apprenticeships/traineeships combine employment and competency-based training, including formal, nationally recognised training and on-the-job training.

Queensland Government roles and functions

The Queensland Government aims to minimise skills shortages, focus on training for jobs that are in demand in critical industries, and increase the number of Queenslanders with formal post-school qualifications.

Department of Employment, Small Business and Training

The Queensland Government established the Department of Employment, Small Business and Training (the department) following a machinery of government change in December 2017. The new department has responsibility for employment (from Queensland Treasury), small business (from the Department of Tourism, Major Events, Small Business and the Commonwealth Games), and training (from the Department of Education and Training).

The department’s role is to improve the skills profile of Queensland by delivering a diverse and inclusive vocational education and training investment program aligned to state government priorities and objectives. Its goal is to invest in training based on industry advice to provide Queenslanders with the skills they need to gain meaningful and sustainable employment through the provider of their choice.

The department, as the state training authority, operates the publicly funded, demand-driven training market to deliver priority qualifications that meet industry and community needs. It is responsible for setting policy for the training it subsidises and for monitoring market performance through contract management and compliance arrangements.

The department fulfils its role by:

- providing targeted training to people who need extra assistance to skill or re-skill so they can enter and stay in the workforce

- administering subsidised training programs in Queensland

- supporting public providers in operating effectively and providing high-quality training

- engaging with industry to seek advice on skills needs, workforce planning, and the apprenticeship and traineeship system

- assisting consumers to resolve complaints and navigate the VET system through Queensland’s Training Ombudsman

- regulating apprenticeships and traineeships

- providing incentives to address local, regional, and state skills needs

- monitoring the market to ensure areas of emerging or unmet demand are addressed.

As the owner of most of the state’s training assets (campuses including land and buildings), the department also maintains, manages, and invests in training infrastructure that the public providers need to meet student, community, and industry needs.

Public providers

There are five public providers of VET in Queensland: TAFE Queensland (TAFEQ), Central Queensland University (CQU), Aviation Australia (consolidated into TAFEQ from October 2017), Queensland Agricultural Training Colleges (which will cease to operate after 2019), and the Aboriginal Centre for Performing Arts.

Public providers receive government funding to alleviate some of the cost differentials of being a public provider and to help individual students or communities requiring additional support. They also earn revenue from fee-for-service and by delivering state-subsidised training qualifications.

Public providers offer qualifications in a broad range of subjects, including low-demand qualifications. They also maintain service delivery in remote and regional communities and support displaced students from any private providers that cease operating.

Contestable market

In 2012, governments across Australia entered into the National Partnership Agreement on Skills Reform. Under this agreement, the Australian Government provided incentive payments to states and territories to move towards a more contestable (competitive) VET market.

The agreement sought several outcomes, including a more accessible, equitable, transparent, and efficient VET sector and higher-quality training relevant to individuals, employers, and industry.

The agreement introduced a national entitlement to a government-subsidised training place. Concurrently, Queensland introduced a demand-driven VET system, placing purchasing decisions in the hands of consumers. This reform has led to greater competition between training providers.

The agreement was for five years (2012–13 to 2016–17), and Queensland received $356.9 million for successfully implementing structural reforms and achieving specified training outcomes.

The current Queensland VET market arrangements include:

- having a network of registered training organisations, pre-approved by the department (as pre-qualified suppliers) to deliver eligible training and assessment services

- enabling individuals and employers to select the qualification and the pre-qualified supplier that best meets their needs in terms of delivery strategy, value for money, and potential for securing employment

- publishing subsidy levels for all subsidised qualifications or skill sets—reflecting the level of government contribution toward the cost of training (influenced by priority and relative cost to deliver)

- requiring contribution towards the cost of training by individuals, employers, and/or industry.

VET investment framework

The department, as the state training authority, allocates funding to VET providers through two main mechanisms:

- direct funding to public providers

- contestable funding to both private and public providers.

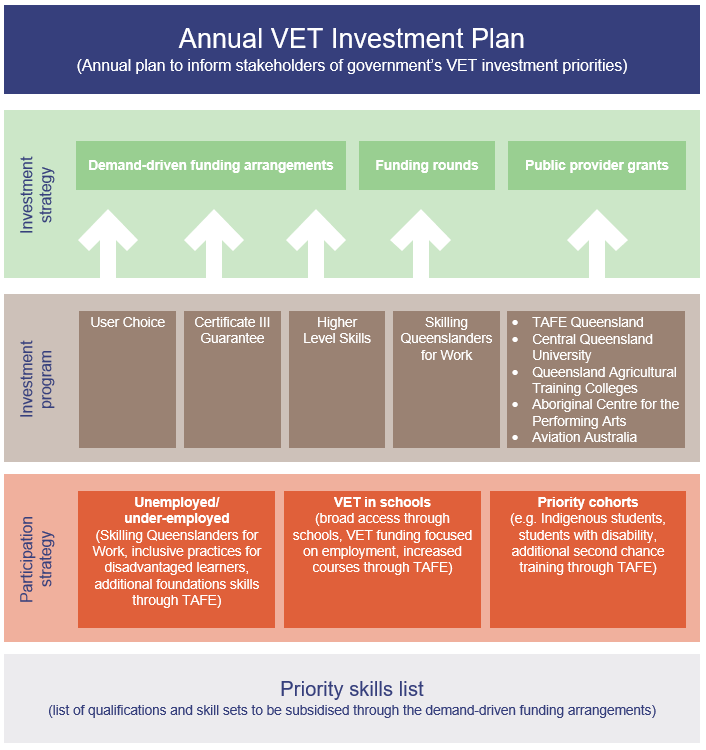

Each year, annual VET investment plans outline the Queensland Government's planned investment in vocational education and training.

The plans are underpinned by a VET investment framework that supports demand-driven funding arrangements across several program areas and provides support for disadvantaged learners and other priority student cohorts. It also makes a significant contribution to public providers to enable them to operate in a competitive VET market and provide training services to remote and regional areas.

Figure 1B shows the 2018–19 VET investment framework.

The Department of Employment, Small Business and Training’s 2018–19 Annual VET Investment Plan.

The different VET investment programs collectively focus on supplying skills for jobs and supporting priority groups.

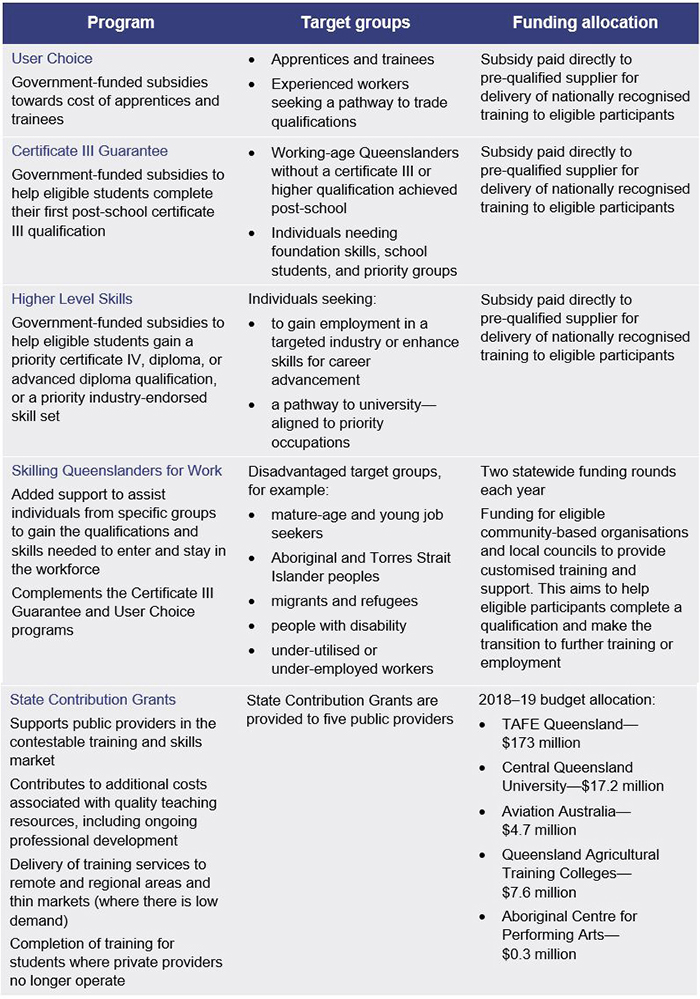

Figure 1C describes each VET investment program, the target groups, and how Queensland distributes the funding.

2018–19 Annual VET Investment Plan.

VET data standard and reporting

Training providers must supply compliant and timely VET activity data for all accredited training, irrespective of funding arrangements. They must comply with the Australian Vocational Education and Training Management Information Statistical Standard, which is the national data standard for collecting and distributing information on training activity.

VET activity data is used both nationally and by the state to measure and report student and employment outputs and outcomes. In Queensland, pre-qualified suppliers submit data monthly to the department so it can make subsidy payments under pre-qualified supplier arrangements. The department reports this VET activity data to the National Centre for Vocational Education Research (NCVER) on a quarterly basis. The data is used for research, analysis, and statistical purposes and contributes to the continued improvement of national VET policy and practices.

2. Investing in vocational education and training

This chapter assesses whether the Department of Employment, Small Business and Training is effectively managing the Queensland Government’s investment in vocational education and training and is achieving the desired outcomes.

Introduction

The Department of Employment, Small Business and Training (the department) works with industry and other stakeholders to identify vocational education and training (VET) priorities. The priorities are intended to meet the skills needs of industry and to help a range of individuals including:

- people entering the labour market for the first time

- people up-skilling for a higher-level job

- people re-skilling for a different job

- school students

- priority cohorts, such as disadvantaged jobseekers.

By setting training priorities and subsidising what it costs public and private providers to deliver the training, the department directs funding towards the skills and qualifications needed in the labour market. Government subsidies encourage training providers to deliver priority training and help make this training affordable and attractive, so that more students enrol.

This chapter assesses whether the department is effectively managing government investment in VET and achieving the desired VET outcomes by:

- prioritising investment in the skills that Queensland employers require in order to reduce skills shortages

- providing trainees with the skills they need to become employed, improve their employment, or engage in further study

- providing disadvantaged Queenslanders with the opportunity to gain the skills they need to find work

- strategically planning for Queensland’s VET infrastructure needs.

Prioritising VET investment

The department does not have a VET strategy, but it is currently developing a strategy that will outline priorities for Queensland’s VET sector.

In November 2018, the Queensland Government convened the Future of Work—Skills and Industry Summit with participants from across industry, small business, universities, the training sector, unions, and government agencies. The government intends to use input received at the summit to inform its strategic policy agenda, including a Skills Strategy.

In the absence of a strategy, the department uses an annual VET investment plan to publish VET priorities and initiatives. The investment plan:

- supports demand-driven funding arrangements across three programs (User Choice, Certificate III Guarantee, and Higher Level Skills)

- provides support for disadvantaged learners and other priority student cohorts

- provides a significant contribution to public providers to help them operate in the competitive VET market.

The investment plan provides clear information on priority skills and on the funding arrangements for courses and qualifications most likely to lead to employment for graduates. High-priority training receives a higher government contribution, which means that student fees for priority courses are likely to be lower.

We found the investment plan clearly outlines the Queensland Government’s short- to medium‑term investments, priorities, and initiatives. However, it does not cover Queensland’s longer-term strategies for developing and sustaining the VET sector and the long-term purpose, roles, and responsibilities of Queensland’s public providers. The department should also include its Service Delivery Statement target employment and student outcomes for Queensland and any program-specific targets in the Skills Strategy or annual VET investment plan.

The department obtains and analyses key information inputs to develop the annual investment plan. For example, the plan is informed and influenced by:

- the government’s commitments, such as Skilling Queenslanders for Work

- input from industry advisors on current and future skill needs

- student and training activity data (to identify demand trends)

- forecasts of likely take-up of government-funded training, and expenditure associated with that training

- compliance, quality, or performance issues relating to a specific industry area or qualification.

However, it is not always obvious how the department uses these inputs to develop the investment plan, because decision-making is not clearly documented. There is a risk that it depends on key personnel with critical information and knowledge, without having clear documentation of the planning process as a back-up.

Industry consultation

The department consults extensively with industry, training providers, and community organisations to identify the skills that Queensland needs. It uses industry advice to inform its decisions about training priorities and to improve and expand on opportunities for employment for disadvantaged groups.

The department’s engagement division undertakes annual consultation with 10 contracted groups (called VET industry advisory organisations). These groups represent a diverse range of important industry areas in Queensland, and the department provides funding for them to give advice on training and investment for specific industries and occupations.

The department also engages with other industry contacts to inform its investment decisions and receive feedback on skills needs, training priorities, and subsidies. Engagement takes many forms including:

- informal relationships between departmental staff and a broad range of industry and employment stakeholders, as well as within the department and across government

- regional staff who engage with regional VET stakeholders through training reference group meetings and other relevant stakeholder forums to share best practice, policy, and procedural information

- regional advisory committees, local reference groups, and project officers

- public and private pre-qualified suppliers and community-based organisations that engage with local industry and employers on relevant training and potential employment for participants.

Government subsidies

The department’s approach to prioritising subsidies is informed by industry consultation on skills demand and workforce planning. Having identified the skills that Queensland needs, the department subsidises the relevant training, thereby encouraging VET providers to deliver it. This is a key feature of the demand-driven funding arrangements.

Each year, the department reviews the qualifications on the priority skills lists for relevancy and considers any issues raised by industry or identified by the Australian Skills Quality Authority (which accredits courses and registered training organisations to ensure nationally approved quality standards are met). While the priority skills lists can remain relatively consistent from one year to the next, changes do occur, including:

- new qualifications replacing old ones (changes to nationally approved training packages)

- qualifications or skill sets being removed due to no activity for two years or the results of market performance reviews

- qualifications or skill sets being added due to industry submissions or government priorities.

We found that while the department records the changes, it does not sufficiently document the reasons for the changes.

Market performance review

In 2018, the Queensland Training Ombudsman undertook a market performance review of qualifications the department identified as high-risk based on industry and regulator feedback, market trends, and pre-qualified supplier compliance history. Market trends that contribute to the department’s assessment of a high-risk qualification include short course duration, low student-contribution fees, and high complaint levels (from industry, employers, or students).

The purpose of the review was to assess whether the identified qualifications meet the needs of industry. The Queensland Training Ombudsman assisted the department with stakeholder consultation, providing an independent avenue for all stakeholders to submit written submissions. The review led to changes in the priority skills list. Two qualifications—the Certificate III in Surface Extraction Operations and the Certificate IV in Building and Construction—were removed.

Industry submissions

When an industry group identifies a need for a new subsidised qualification, it submits a business case to the department. The business case must demonstrate that the proposed qualification will meet industry needs not currently covered by a qualification on the existing subsidy list. In 2017–18, the department approved 44 of the 50 new qualifications industry requested.

Timing of priority skills list updates

The department finalises and approves changes to the list in early- to mid-June. Approval is needed before the lists are published, usually at the end of June, with the changes taking effect from 1 July. Because of the short time frame between the publishing of the list and it taking effect, pre-qualified suppliers are not certain that their qualifications will be subsidised. This can negatively impact on their ability to plan.

Assessing outcomes from VET investment

VET is seen as an important strategy for contributing to equitable, inclusive, and sustainable economies and societies. Measuring outcomes and public value from VET investment is complex, due to its multiple relevant dimensions, including economic growth, social equity, sustainability, and multiple stakeholders who derive benefits (such as individuals, industry organisations, employers, governments, and the broader community).

The department uses nationally agreed VET outcome and output measures to track the performance of the VET system in Queensland. The measures cover student outcomes resulting from their participation in a demand-driven training program.

Annual VET investment

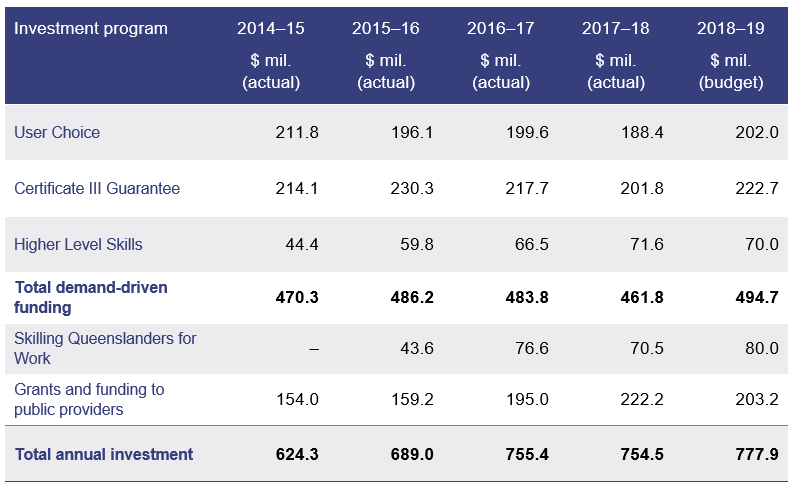

From 2014–15 to 2017–18 Queensland increased VET investment by $130.2 million (21 per cent), but the number of Queensland students participating in VET and completing qualifications did not increase. In that period, an additional $68.2 million has gone to supporting public providers in a contestable market and $70.5 million was allocated to the re-introduction of Skilling Queenslanders for Work (which provides support to assist disadvantaged cohorts to participate in training).

In 2017–18, of the Queensland Government’s total annual VET investment of $754.5 million, it allocated $222.2 million (29 per cent) to public VET providers to maintain a level of quality and service in the contestable market (called State Contribution Grants). Of this, TAFE Queensland (TAFEQ) received $197.5 million. In Chapter 4, we assess the investment in, and the outcomes of, public VET providers, and the challenges of meeting the government’s service expectations while competing for funding and students.

Figure 2A shows the actual investment in VET programs from 2014–15 to 2017–18, and the budget allocation for 2018–19, as published in the 2018–19 Annual VET Investment Plan.

Note: Contestability began in July 2014.

Annual VET investment plans 2014–15 to 2018–19.

VET outcomes

Nationally agreed VET outcome and output measures cover student participation and completion of qualifications, student employment outcomes, and employer and student satisfaction with the quality and relevance of training delivered. The department also reports on the average cost of completed competencies.

The department uses these measures to track the performance of the VET system in Queensland and reports them in its service delivery statements and annual reports. The National Centre for Vocational Education Research (NCVER) also reports on VET student outcomes, providing a comparison between Queensland and national results.

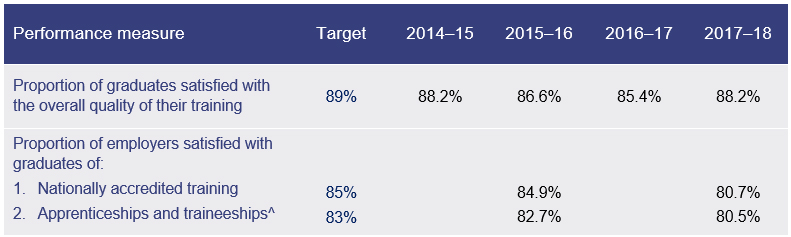

While competency and qualification completion rates have remained relatively static, employment outcomes and employer satisfaction have decreased slightly over the last four years. The employer satisfaction decrease in Queensland has been consistent with a drop in the national average. Student satisfaction with the quality and outcomes of VET in Queensland is in line with the national average of 87.3 per cent in 2018.

The department does not currently measure the public value derived from the government’s investment in public providers through State Contribution Grants. In 2017–18, the government invested 29 per cent of total VET budget in these grants, but it cannot measure how effectively the funding achieved intended results. Measuring public value is important, as it provides governments and funders with analytical information on the system’s performance and provides further justification for VET expenditure.

Student participation and completion

Equity and effectiveness of access are measured by the number of students participating in the VET system. Since the introduction of the contestable market in 2014, the number of students enrolled in VET and completing qualifications has remained static.

Figure 2B shows student enrolments and qualifications completed from 2012–13 to 2016–17.

Department of Employment, Small Business and Training VET Activity Data.

Queensland has seen a gradual increase in participation by Indigenous students aged between 15 and 64, from 10 per cent in 2013 to 12.1 per cent in 2017. This reflects the success of programs such as Skilling Queenslanders for Work. However, Queensland is still tracking behind the 2017 national average for Indigenous participation of 17.6 per cent.

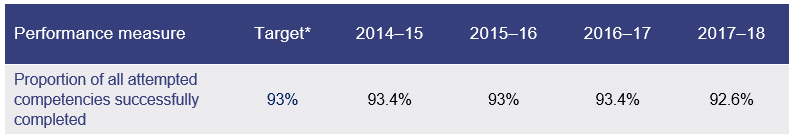

VET qualifications are made up of individual units of competency. Figure 2C shows the proportion of all attempted competencies that students successfully completed.

Note: * Target for proportion of all attempted competencies successfully completed was 90 per cent for 2014–15 and 2015–16.

Department of Education and Training Annual Reports 2014–15 to 2016–17; and Department of Employment, Small Business and Training Annual Report 2017–18.

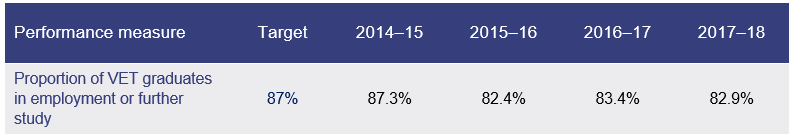

While a student’s successful completion of a qualification is an indicator of the training’s effectiveness, many students leave before completing if they obtain employment. Therefore, employment outcomes are better indicators of effectiveness.

Employment outcomes

An employment outcome is where a student: 1) who was not employed before training becomes employed after training, 2) becomes employed at a higher skill level after training, or 3) receives a job-related benefit.

Figure 2D shows the proportion of VET graduates in Queensland who obtained employment or went into further study for 2014–15 to 2017–18.

Department of Education and Training Annual Reports 2014–15 to 2016–17; and Department of Employment, Small Business and Training Annual Report 2017–18.

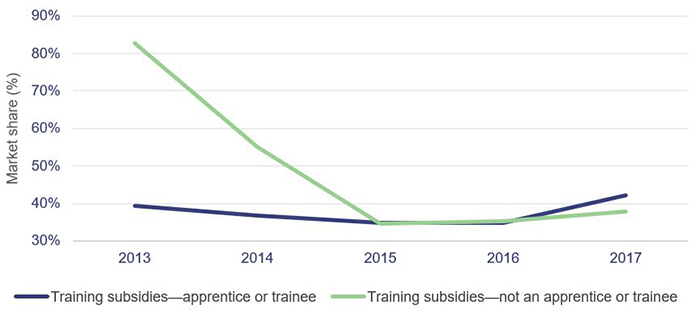

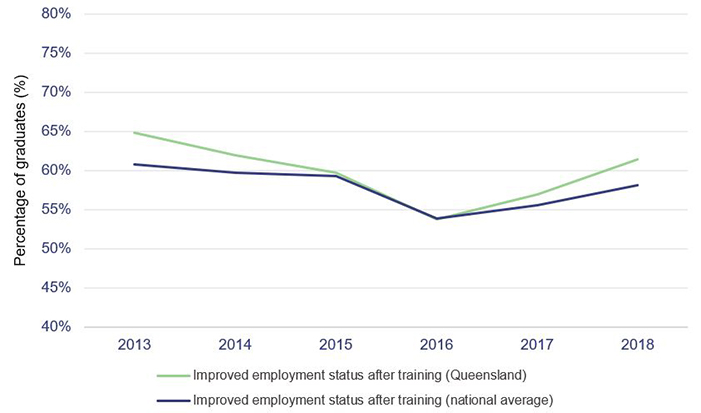

Compared with the average of the other states, Queensland is consistently in line with or slightly above the average for employment outcomes. Figure 2E shows the proportion of government‑funded VET graduates in Queensland with improved employment after training between 2013 and 2018 (excludes students going on to further study).

Note: We have excluded NCVER results from Tasmania, the Northern Territory, and the Australian Capital Territory because their low populations make their employment outcomes after training less comparable to Queensland and the other states.

National Centre for Vocational Education Research (NCVER) VET Student Outcomes Survey 2018.

Student and employer satisfaction

Student satisfaction with the quality and outcomes of VET in Queensland is consistently high and in line with the national average. In 2018, satisfaction was 88.2 per cent in Queensland compared to the national average of 87.3 per cent.

Employer satisfaction with VET has decreased since the introduction of the fully contestable market in July 2014. Employer satisfaction with nationally accredited training is marginally below the 2017 national average of 82.2 per cent. But employer satisfaction with apprenticeships and traineeships is above the national average of 77.5 per cent. The decrease for Queensland from 2015 to 2017 is consistent with a drop in the national average.

Figure 2F shows the VET student and employer satisfaction from 2014–15 to 2017–18.

Note: ^ Employer satisfaction estimates are obtained from the biennial national survey Employers' Use and Views of the VET System, conducted by NCVER in 2013, 2015, and 2017.

Department of Education and Training Annual Reports 2014–15 to 2016–17; and Department of Employment, Small Business and Training Annual Report 2017–18.

Cost efficiency

The department measures cost efficiency by dividing the total budget for its training and skills service area by the total number of successfully completed individual study units (competencies) in a given financial year. This does not include additional costs that public and private providers incur to deliver those competencies. Therefore, this measure helps the department to monitor whether its investment to support delivery of those competencies is becoming more efficient.

Based on this calculation method, the department has decreased the cost of unit completions from $701 in 2009–10 to $614 in 2018–19 (based on its estimate as part of the state budget process for 2019–20). Figure 2G shows the average cost per competency successfully completed from 2009–10 to 2018–19.

Department of Education and Training Annual Reports 2009–10 to 2016–17; and Department of Employment, Small Business and Training Annual Report 2017–18 and Service Delivery Statement 2018–19.

Based on recent analysis of NCVER data and the efficiency of the investment in VET programs (excluding public provider grants), Queensland’s training system from 2014 to 2017 was more efficient than other jurisdictions. This is a relative assessment only and does not preclude that further efficiencies may be possible.

Supporting disadvantaged people in obtaining skills for the workforce

Skilling Queenslanders for Work is an initiative consisting of seven programs helping disadvantaged people to access and complete vocational education and training and find employment.

The program is on track to meet its target of investing $420 million to support 54,000 Queenslanders in finding work over six years (2015–16 to 2020–21). It is currently meeting the overall target employment outcomes for participants across the state.

The department uses this investment to fund community-based organisations to provide 'wrap‑around' individual support and services in a community-based environment. Eligible community-based organisations assist disadvantaged people facing complex barriers to learning by providing personal and learning-support services with pathways into VET and employment.

Allocating funding

Funding under Skilling Queenslanders for Work is fully contestable. The department has implemented a competitive application process with funding rounds held twice-yearly on a statewide regional basis.

The department distributes grant funds to seven different Skilling Queenslanders for Work programs, based on past results and feedback on employer engagement strategies, skills development, and job creation opportunities. It then allocates regional funding based on unemployment rates, youth data, and the capacity of the communities to deliver the services.

The department has designed and implemented robust and well-controlled processes for distributing and monitoring Skilling Queenslanders for Work funding to community-based organisations, based on government and good-practice grants-administration guidelines. The processes include:

- assessing applications against published weighted criteria

- evaluating eligible applications using independent Regional Priority Jobs committees (made up of employee and employer representatives, a local government representative, and a community representative, and chaired by a department regional director)

- approving applications recommended by the committees.

The time frame between opening the funding round and announcing the successful applicants is lengthy, taking five months on average. The department cannot inform successful applicants or issue contracts until the announcement is made.

While the department needs to undertake due diligence and governance processes, the time frame often makes planning difficult for the community-based organisations, especially if they rely on the funding for extending staff contracts and have waitlists of potential participants.

The standard Skilling Queenslanders for Work service agreement is for one year. This can impact on the ability of some community-based organisations to attract and retain appropriate staff and to assist disadvantaged groups in the medium to long term.

While the department uses one-year contracts to help manage delivery risk and allow more flexibility to respond to emerging or urgent needs, it introduced longer-term contracts in 2018. The department extends the standard agreement by up to two years (maximum three years), dependent on a satisfactory annual performance review of the previous year’s project delivery.

At each funding round, a small number of long-term contracts may be offered based on recommendations by the Regional Priority Jobs committees. The offer is made by the department at the time when funding approval is notified.

Offering long-term contracts is not a widespread practice. So far, the committees have approved 11 long-term contracts. The department sees these contracts as ideal for markets where specialised services have a limited number of suitable providers. The department limits the number of long-term contracts to safeguard budget availability for future funding rounds and ensure it can respond to statewide and local emergent needs or government priorities.

For six of the seven Skilling Queenslanders for Work programs, a community-based organisation’s proposal for funding must include accredited training funded under the Certificate III Guarantee or User Choice programs.

Community-based organisations are responsible for engaging an appropriate pre-qualified supplier to deliver the training. Their selected pre-qualified supplier must have suitable education and support services and learning resources for disadvantaged learners.

The department's funding guidelines strongly recommend that community-based organisations consult with their selected pre-qualified supplier before submitting their funding application. However, it does not require that they provide evidence of this consultation in their application.

We found that some community organisations had not effectively engaged with accredited training providers prior to starting their project. We found examples where a community-based organisation had either not adequately consulted the pre-qualified supplier, or the pre-qualified supplier had not delivered what was verbally discussed. This potentially reduces program effectiveness and limits its ability to achieve positive outcomes.

Program outcomes

As at 31 May 2019, the government has invested $296.56 million under Skilling Queenslanders for Work and the number of people assisted through the program is 41,568. If this trend continues, the program will support 64,000 Queenslanders over its six years of funding (2015–16 to 2020–21).

Of the 41,568 people assisted to date:

- 36,857 have undertaken training and exited (91 per cent)

- 26,946 have had a positive outcome (73 per cent)

- 23,757 have obtained a job (64 per cent).

In 2016, the Queensland Government Statistician’s Office surveyed Skilling Queenslanders for Work participants 12 months after they exited the program to find out how many were employed, engaged in further study, or both.

Figure 2H summarises the key results.

Queensland Government Statistician’s Office.

Overall, 73.1 per cent of surveyed Queenslanders reported a positive outcome (they were employed, engaged in further study, or both). This is above the positive outcome targets set for the individual programs within the Skilling Queenslanders for Work initiative, which range from 55 per cent to 70 per cent of participants gaining employment or engaging in further study. However, as noted above, the survey response rate was only 34 per cent of participants.

In addition to the employment and economic outcomes, the Skilling Queenslanders for Work initiative plays a role in developing human and social capital. It provides broader significant social benefits for the Queensland community, such as health and wellbeing, social and support networks, community participation, and engagement. Although often difficult to quantify, these broader impacts are nevertheless of value. They complement the labour-market outcomes achieved by the program and demonstrate that its value extends beyond conventional economic measures.

Managing VET infrastructure

The department currently owns and maintains VET training sites and facilities primarily used by TAFEQ. TAFEQ delivers VET in 42 state-owned facilities and also leases facilities in a further 15 locations across Queensland. As a public provider, its facilities are a major competitive advantage in attracting student enrolments and an important part of Queensland’s economic infrastructure. In general, private registered training organisations do not have the scale, finance, or commercial incentive to invest in comparable facilities.

Machinery of government changes and government policy decisions in the last six years have led to several changes in ownership and management of the state’s VET assets. Changes include:

- 2012–13: Queensland’s training assets were owned and managed by TAFE’s six registered training organisations, which were part of the Department of Education, Training and Employment

- June 2014: the Queensland Government created QTAMA to own and manage state training assets for VET on a commercial basis with no obligation to prioritise TAFEQ’s access over other training providers

- July 2014: Central Queensland University merged with Central Queensland Institute of TAFE. The Department of Education and Training transferred ownership of Central Queensland Institute of TAFE’s training assets to Central Queensland University

- July 2015: the new Queensland Government passed the QTAMA repeal bill, returning ownership of the state’s training assets to the Department of Education and Training and prioritising TAFEQ’s access to training assets over other providers

- December 2017: the Queensland Government created the Department of Employment, Small Business and Training, which took ownership of the state’s training assets from the Department of Education.

The government expects TAFEQ to work collaboratively with the department to deliver training infrastructure that maximises skills outcomes for Queensland. While TAFEQ does not control the government’s investment decisions on the sites it occupies, it is part of the main decision‑making body—the six-member Training Infrastructure Investment Committee. The committee is the governing body for ensuring that the infrastructure investment program meets the department’s strategic and operational requirements, including delivering fit-for-purpose and future-focused infrastructure.

The frequently changing ownership of training assets (such as buildings and campuses) over the last six years has led to a lack of strategic direction. It has also led to an inconsistent approach to asset management and under-investment in asset maintenance, resulting in a maintenance backlog.

The department works collaboratively with TAFEQ on infrastructure planning to ensure future investment decisions meet training requirements. The department has recently assessed its training assets to develop regional infrastructure plans, which will help inform more comprehensive regional master plans for the state’s training infrastructure portfolio.

Managing and maintaining training assets

In 2015, the former Department of Education and Training engaged an independent group to provide asset life cycle assessments for every site, including a condition rating for assets, and a 10-year repairs and maintenance forecast.

The estimate for total backlog maintenance on training assets was $31.7 million. This may be a significant understatement of the total needed to restore all of Queensland’s training assets to a reasonable condition, because the assessment only covered buildings considered necessary to meet future training needs. After the department addresses the assessed maintenance backlog, significant parts of Queensland’s training asset portfolio will still be in poor or unusable condition.

The department and TAFEQ have been working on a memorandum of understanding to define who does what in managing and maintaining training assets. In April 2018, the department released to TAFEQ a first draft memorandum of understanding for building maintenance at Queensland’s VET buildings. In July 2019, they endorsed and finalised the memorandum.

When agencies don’t have a clear delineation of responsibilities for training assets, risk increases, not just for the assets themselves, but also for issues such as occupational health and safety.

Strategic infrastructure planning and investment

In 2018, the department’s infrastructure team, in consultation with TAFEQ, began regional infrastructure planning for the entire state. The plans incorporate the government’s investment and disposal decisions, and outlines strategies for the 14 regions’ training assets based on:

- indicative capital and maintenance costs by training site

- economic and demographic indicators of future training demand

- assessment of existing building efficiency.

The department will use the regional infrastructure plans to develop more comprehensive regional master plans for the state’s training infrastructure portfolio. These plans include considerations of demand, accessibility, asset condition, and flexibility.

The department is already delivering investment at some sites and developing master plans for others.

In the 2017 Advancing Our Training Infrastructure election commitment, the Queensland Government committed to investing $85 million in VET infrastructure. The six master plans being developed are linked to delivering that election commitment. The department anticipates it will develop master plans for all its VET training infrastructure within three years.

The six master plans are:

- Gold Coast region ($15 million)

- Pimlico (Townsville) TAFE Campus ($26 million)

- Mt Gravatt TAFE campus ($15 million)

- Toowoomba TAFE campus ($4 million)

- Redlands region ($10 million)

- Cairns TAFE campus ($15 million).

3. Managing risks in a contestable market

This chapter assesses how the Department of Employment, Small Business and Training manages the risks of funding private and public registered training organisations in a contestable market.

Introduction

As the administrator of the Queensland Government’s vocational education and training (VET) subsidies, the Department of Employment, Small Business and Training (the department) is responsible for maintaining the integrity of the subsidised training market. It does this through a range of activities, including approving pre-qualified suppliers to receive subsidies and monitoring their compliance with contractual obligations.

To be eligible to apply for pre-qualified supplier status, the applicant must be registered with the Australian Skills Quality Authority (ASQA) as a registered training organisation. Registered training organisations must comply with the Vocational Education and Training Quality Framework regulated by ASQA, including the Standards for Registered Training Organisations 2015.