Overview

Queensland's local governments, also known as councils, are the first line of connection to our communities; providing Queenslanders with a wide range of services such as roads, water and waste, libraries, and parks. To help deliver their corporate objectives and services to the public, some create council-related entities, for example in the pastoral, property services, and arts sectors.

Tabled 22 June 2023.

Report on a page

Financial statements are reliable, but fewer councils prioritised and achieved timely financial reporting

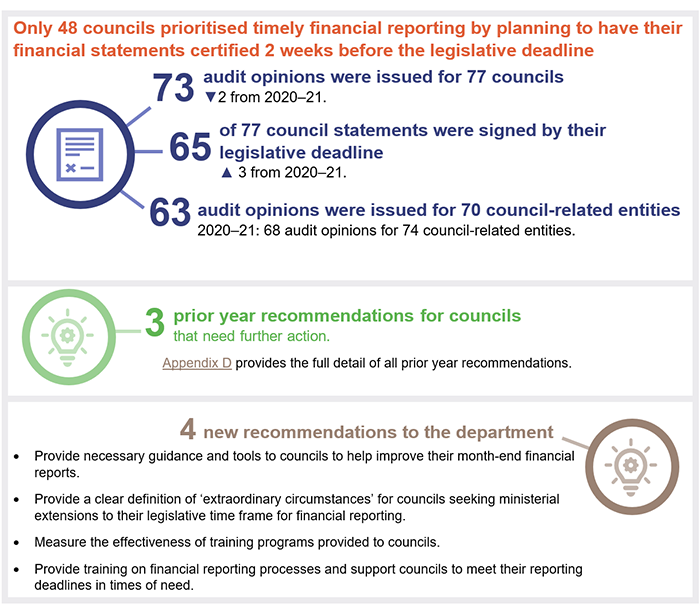

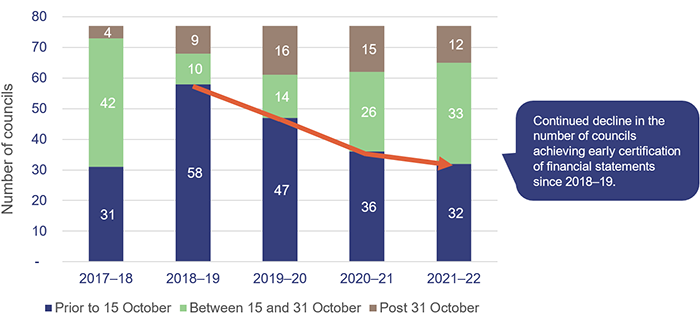

Early financial reporting means current and relevant information is provided to decision-makers and members of the community. In 2021–22, only 32 councils (2020–21: 36 councils) achieved early financial reporting – meaning – having their financial statements certified at least 2 weeks before their 31 October legislative deadline.

In recent years, we have found fewer councils are planning for early completion of their financial statements. This year, only 48 councils planned to certify their financial statements early. In prior years, these numbers were substantially higher (62 councils in 2020–21 and 70 councils in 2019–20).

External factors such as staff shortages and natural disasters have negatively impacted on the sector’s ability to achieve timely financial reporting. However, these issues would be better managed if councils improved the persistent issues we find in their month-end and year-end reporting processes, and their asset management practices.

In this report, we make several recommendations to the Department of State Development, Infrastructure, Local Government and Planning (the department) – as regulator of the sector – to help build capability in the local government sector that will improve timely financial reporting.

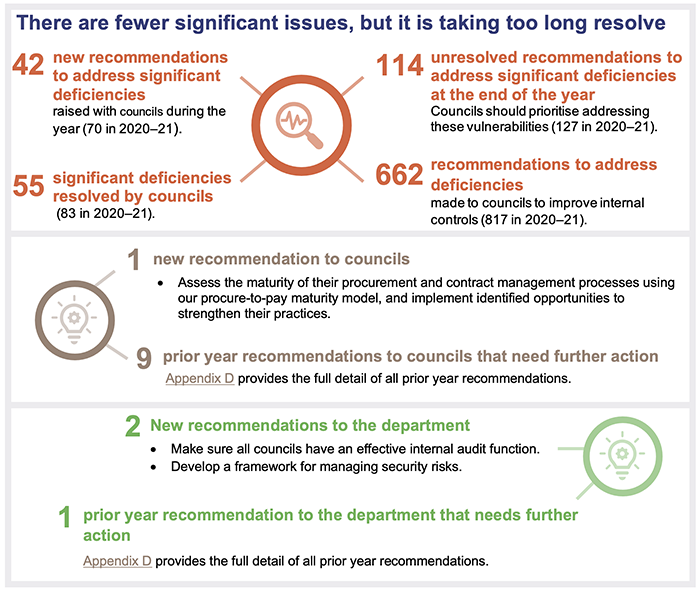

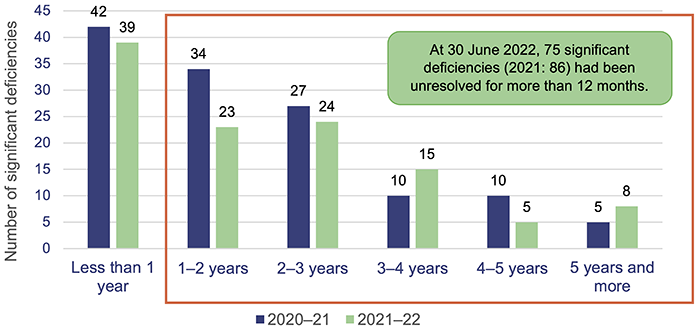

Councils are taking too long to resolve high-risk issues

Significant deficiencies are those that have substantial financial or reputational risk for councils and need to be addressed immediately. Continued efforts by councils have reduced the number of unresolved significant deficiencies to 114 as at 30 June 2022 (2021: 127). However, 65 per cent (2021: 67 per cent) of these significant deficiencies remain unresolved more than 12 months after we identified them.

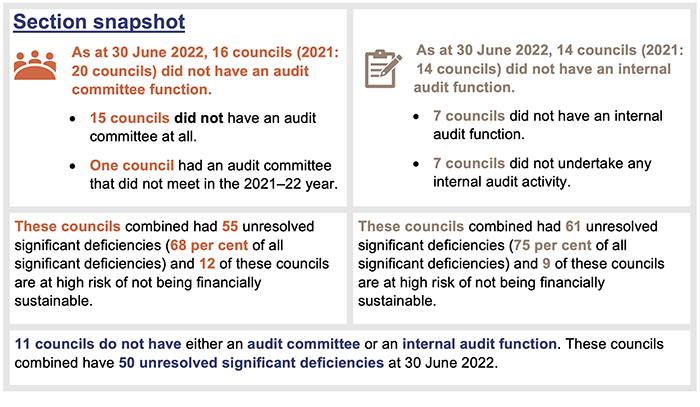

Many councils with significant deficiencies do not have an audit committee (16 councils) or an internal audit function (14 councils – these councils are in breach of the legislation). We have recommended the department make sure all councils establish an effective internal audit function, as required under the legislation.

Almost two thirds of councils still have significant deficiencies in their information systems, at a time when cyber attacks across the public sector keep rising. The department could collaborate with other state government agencies and develop a framework to help councils better manage their information systems security.

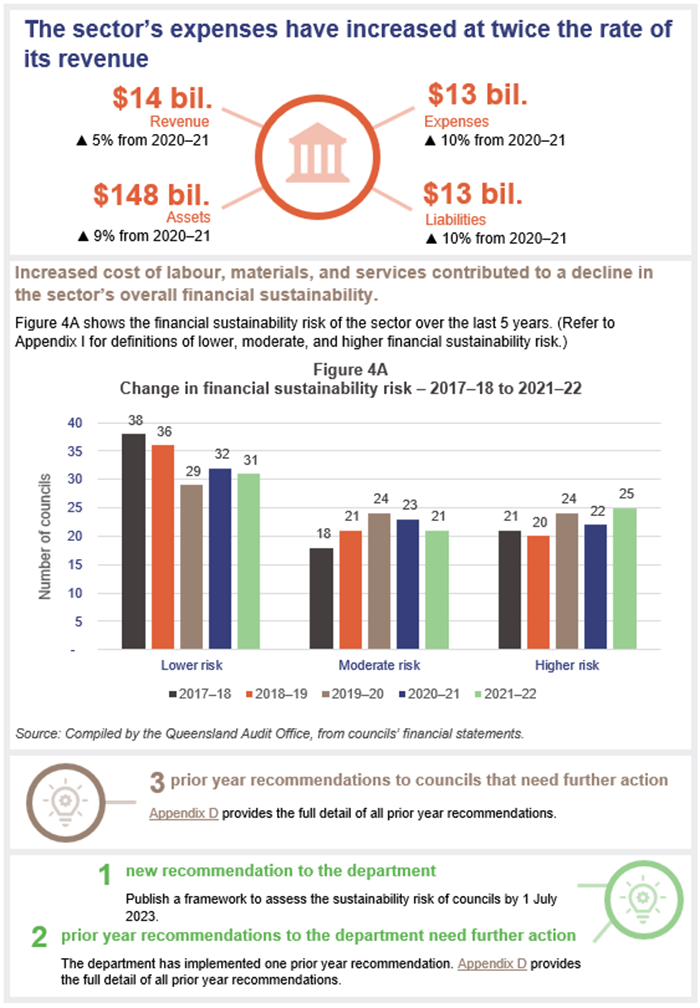

Grant funding received in advance has masked the full extent of the sector’s decline in financial sustainability

This year, 35 councils generated an operating surplus. Although this is consistent with last year, the sector’s operating results were favourably impacted by receiving a large portion of one of its grants in advance. In the absence of this advance grant funding, only 28 councils would have generated an operating surplus in 2021–22. At 30 June 2022, 46 councils (2020–21: 45 councils) are still at either a moderate or a high risk of not being financially sustainable.

Recommendations for councils and the department

Recommendations for councils

This year, we make the following recommendation to councils.

|

Assess the maturity of their procurement and contract management processes using our procure-to-pay maturity model, and implement identified opportunities to strengthen their practices |

|

|

We recommend all councils assess the maturity of their procurement and contract management processes using our procure-to-pay maturity model. Councils should identify their desired level of maturity and compare this to the maturity level that best represents their current practices. This assessment will help them identify and implement practical improvement opportunities for their procurement and contract management processes. |

|

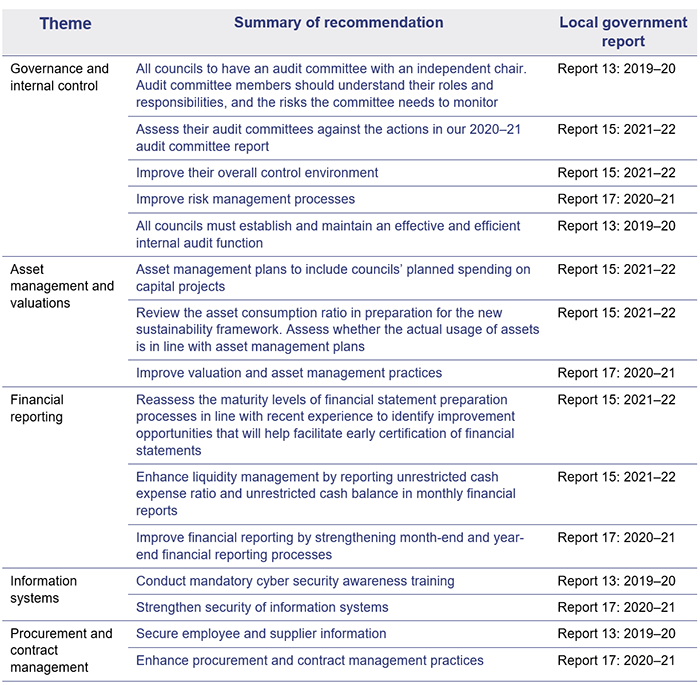

Prior year recommendations need further action by councils

Councils have made some progress to address the recommendations we made in our prior reports. However, further action is still required for 15 recommendations as summarised below.

Implementing our recommendations will help councils strengthen their internal controls for financial reporting and improve their financial sustainability.

We have included a full list of prior year recommendations and their status in Appendix D.

Recommendations for the department

This year, we make the following 7 recommendations to the Department of State Development, Infrastructure, Local Government and Planning (the department).

|

Provide necessary guidance and tools to councils to help improve their month-end financial reports |

|

|

The department should provide guidance and tools such as monthly management reporting pack templates and checklists for the completion of month-end financial reports. These tools should set the minimum standard of information that councillors will need to be provided with to make informed financial decisions. This in turn would help them improve the quality of their month-end financial reports and their month-end processes. |

|

|

Provide a clear definition of ‘extraordinary circumstances’ for councils seeking ministerial extensions to their legislative time frame for financial reporting |

|

|

The department should clearly define what 'extraordinary circumstances' are in the context of extensions to councils' legislated deadlines for certifying financial statements. This will provide consistent criteria for assessing council applications for extensions. |

|

|

Measure the effectiveness of training programs provided to councils |

|

|

The department should measure the effectiveness of the training programs it provides to councils. This would help the department identify remedial actions when desired outcomes are not achieved. |

|

|

Provide training on financial reporting processes and support councils to meet their reporting deadlines in times of need |

|

|

The department should, for councils that do not consistently achieve early financial reporting:

This should be in addition to the tropical financial reporting workshop provided by the department each year

|

|

|

Make sure all councils have an effective internal audit function |

|

|

The department should monitor whether all councils have an internal audit function and that appropriate internal audit activities are undertaken each year. To help councils meet their legislative requirements the department should:

|

|

|

Develop a strategy to uplift capability of the sector on cyber-related matters |

|

|

We recommend the department, in collaboration with the Queensland Government’s Customer and Chief Digital Officer, develops a strategy to increase awareness and improve capability in the sector on cyber-related matters. This will help councils strengthen their information security controls. |

|

|

Publish a framework to assess the sustainability risk of councils by 1 July 2023 |

|

|

The department should publish a framework to assess the financial sustainability risk of councils. This framework should be made available to the sector from 1 July 2023 to align with the effective date of the department’s new financial sustainability guideline. |

|

Prior year recommendations need further action by the department

The department has taken some corrective action to address the 4 recommendations from Local government 2020 (Report 17: 2020–21).

- The department has published its new framework for financial sustainability.

- It continues to work on providing greater certainty for long-term funding to councils and providing more training for financial governance to councillors and senior leadership teams within councils.

- The proposal for the department to require all councils to establish an audit committee has not yet progressed. Parliament’s State Development and Regional Industries Committee, in its report – Report 32: Examination of Auditor-General Reports on the local government sector – confirmed the importance of an audit committee to the sector and recommended to parliament that all local governments should establish an audit committee.

We have included a full list of prior year recommendations and their status in Appendix D.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to all councils and the department. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted.

Any formal responses from councils and the department are included at Appendix A.

1. Overview of entities in this sector

Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions for the local government sector.

Chapter snapshot

We express an unmodified opinion when financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

We issue a qualified opinion when financial statements as a whole comply with relevant accounting standards and legislative requirements, with the exceptions noted in the opinion.

We include an emphasis of matter to highlight an issue of which the auditor believes the users of the financial statements need to be aware. The inclusion of an emphasis of matter paragraph does not change the audit opinion.

Audit opinion results

Audits of financial statements of councils

As at the date of this report, we have issued audit opinions for 73 councils (2020–21: 75 councils). Of these:

- 65 councils (2020–21: 62 councils) met their legislative deadline

- 2 councils (2020–21: 10 councils) met the extended time frame granted by the minister (the minister for local government may grant an extension to the legislative time frame where extraordinary circumstances exist)

- 4 councils (2020–21: 3 councils) that received ministerial extensions did not meet their extended time frame

- 2 councils (2020–21: nil) that had their financial statements certified past their legislative deadline did not seek an extension from the minister.

Over the years, some councils have not prioritised financial reporting and their financial statements have not been certified within their legislative deadline. Figure 2A shows councils that have not met their legislative deadline for at least 3 of the last 5 years.

|

Council |

Number of years legislative time frame not met |

|---|---|

|

Palm Island Aboriginal Shire Council |

4 years |

|

Richmond Shire Council |

4 years |

|

Etheridge Shire Council |

3 years |

|

North Burnett Regional Council |

3 years |

Queensland Audit Office.

Financial statements of councils and council-related entities are reliable

The financial statements of councils and council-related entities that we issued opinions for were reliable and complied with relevant laws and standards.

We included an emphasis of matter in our audit report for Richmond Shire Council to highlight that a material change was required to the previous financial statements certified 6 March 2023, and they were replaced by the version we certified 24 April 2023.

Consistent with the last 2 years, we included an emphasis of matter in our audit report for Wujal Wujal Aboriginal Shire Council. This was to highlight uncertainty about its ability to repay its debts as and when they arise.

One controlled entity, Local Buy Trading Trust (controlled by the Local Government Association of Queensland Ltd), received a qualified opinion. This was because it was unable to provide us with enough evidence that the revenue it recorded was complete. This entity received a qualified opinion for the previous financial year for the same reason.

An emphasis of matter was also included in the audit opinion for 11 controlled entities because:

- 6 had decided to wind up their operations

- 2 were reliant on financial support from their parent entities

- 2 had uncertainty about their ability to repay their debts as and when they arise

- one was not able to support a key account balance recorded in its financial statements.

Not all council-related entities need to have their audit performed by the Auditor-General. Appendix F provides a full list of these entities.

Status of unfinished audits from previous years

When we tabled Local government 2021 (Report 15: 2021–22) in May 2022, 2 councils (Richmond Shire Council and Palm Island Aboriginal Shire Council) and 6 council-related entities had not finalised their 2020–21 financial statements. In addition, one controlled entity had not finalised its financial statements for the 2019–20 financial year.

As at the date of this report:

- Richmond Shire Council and 5 council-related entities had their 2020–21 financial statements certified and all received unmodified opinions.

- The Western Queensland Local Government Association had its 2019–20 and 2020–21 financial statements certified. We included an emphasis of matter in our audit opinions for both financial years to highlight that the entity was winding up its operations.

Palm Island Aboriginal Shire Council is yet to have its financial statements certified for the 2020–21 financial year.

Appendix H provides a full list of these entities and the results of their audits.

Fewer councils are achieving early certification of their financial statements

Community and other stakeholders rely on financial statements to understand the financial health of their council. Additionally, financial statements hold elected members accountable for how councils’ money is spent each year.

Queensland councils have 4 months (to 31 October) after their financial year end to have their financial statements certified. Yet, each year, several councils do not meet this time frame, and many more have their financial statements certified close to their legislative deadline – meaning the information is not current and relevant when it is released to the public.

Common issues contributing to councils not achieving timely certification of their financial statements are explained further in this chapter.

For many years, we encouraged councils to have their financial statements certified soon after 30 June – and measured and reported their timeliness using a traffic light model. Under that model, councils that had their financial statements certified at least 2 weeks before their legislative deadline were considered to be timely.

Between the 2017–18 and 2018–19 financial years, councils improved the timeliness of their financial reporting. Although fewer councils achieved early certification in 2019–20, we saw this as a one-off decline in timeliness due to the COVID-19 pandemic.

In recognition of the sector’s progress to improve the timeliness of financial reporting, we stopped measuring timeliness using the traffic light model in 2020–21. We moved to a financial statement maturity model where we asked councils to self-asses their financial reporting maturity levels. It is available on our website at: www.qao.qld.gov.au/reports-resources/better-practice.

However, the change from the traffic light basis of measurement, together with other challenges that councils have faced in recent years, has resulted in a substantial decline in the timeliness of financial statement certification.

This year, only 32 councils (2020–21: 36 councils), which is 40 per cent of the sector (2020–21: 47 per cent), had their financial statements certified 2 weeks before the legislative deadline. Figure 2B shows the time frames for certification of council financial statements over the last 5 years.

Note: 2021–22 (Post 31 October) includes 4 councils that are yet to have their financial statements certified. 2020–21 (Post 31 October) includes one council yet to have its financial statements certified.

Queensland Audit Office.

Early certification of financial statements is always important, but leading into the next local government elections in March 2024 it is even more critical. Elected members will have one last opportunity to demonstrate their council’s financial health to their community when the certified financial statements for the 2022–23 financial year are made publicly available. Acknowledging the importance of this information, going forward, we will compile our local government report as at the statutory reporting date. This will ensure our analysis of the sector’s performance is available to the community early in the subsequent calendar year.

Common issues preventing timely certification of financial statements continue to exist year after year

Ineffective month-end and year-end processes (financial reporting processes)

Ineffective financial reporting processes significantly contribute to councils not having their financial statements certified in a timely manner.

Financial reporting begins with month-end processes that provide elected members and council executives with regular information about the financial performance of council. It finishes with year-end processes that produce the annual financial statements, which are certified and provided to the community and other stakeholders. These processes complement each other.

Councils with good month-end processes generally produce higher quality annual financial statements in less time. This is because they resolve any discrepancies and errors each month.

In the 2020–21 financial year, we asked councils to assess their financial statement preparation processes using our financial statement maturity model, which is available on our website at: www.qao.qld.gov.au/reports-resources/better-practice. As a part of this process, 46 councils self‑assessed that their monthly financial reports were not prepared using accrual accounting processes – recognising revenue and expenses as they are earned or incurred, regardless of when cash has been received or paid.

To understand if these self-assessments were accurate, we reviewed the 30 June 2022 monthly reporting for roughly a third of the sector. Specifically, we compared the operating results (difference between revenue generated and expenditure incurred in the day-to-day operations) reported by these councils in their internal management reports to the results that were reported in their certified year-end financial statements.

If councils adopt an accrual basis of accounting, they would report minimal differences between the annual operating results in their monthly reports and the result in their financial statements. Instead, we found:

- 14 councils (61 per cent of those we reviewed) reported an operating result in their year-end financial statements that was significantly lower than the operating result reported in their monthly financial reports

- for 6 of these 14 councils, they reported an operating surplus (operating revenue higher than operating expenses) in their monthly financial reports at 30 June 2022. But they reported an operating deficit (operating expenses higher than operating revenue) in their certified year-end financial statements.

This means financial reporting processes at these councils are ineffective. Management and councillors at these councils were not provided complete information each month to make informed decisions. They also did not have reliable financial information to help prepare the next year’s budget.

This year, we provided councils with guidance about accrual accounting and how this should be reported in monthly financial reports. This included items reported in the financial reports such as depreciation (allocating the value of an asset over its life) and grant revenue (timing of recognition).

As part of our 2022–23 financial year audits, we are reviewing whether councils implemented our guidance for accrual accounting. We will report on these outcomes in our Local government 2023 report.

In addition to adopting accrual accounting for monthly reporting, we continue to recommend councils improve their month-end and year-end processes as detailed in Appendix D.

The department can play a key role in helping councils improve their month-end processes, and in turn, their year-end processes, to achieve early financial reporting. This can come in the form of guidance and templates such as monthly financial reports and checklists for completing month-end processes.

|

Recommendation for the department Provide necessary guidance and tools to councils to help improve their month-end financial reports (REC 2) |

|

The department should provide guidance and tools such as monthly management reporting pack templates and checklists for the completion of month-end financial reports. These tools should set the minimum standard of information that councillors will need to be provided with to make informed financial decisions. This in turn would help them improve the quality of their month-end financial reports and their month-end processes. |

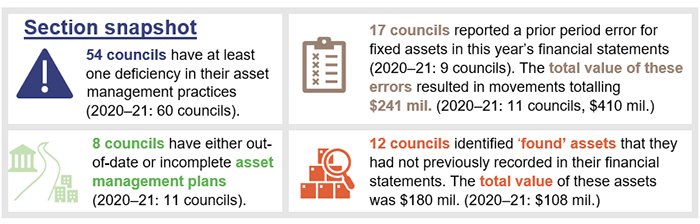

Asset management (including maintenance of asset data) and asset valuations continue to challenge the sector

Queensland councils combined manage approximately $114 billion of infrastructure assets. The large and diverse asset base means that maintaining good asset data, accounting for assets, and determining asset values often presents challenges. We discuss below the common issues we find at councils.

Asset management and asset data – Some councils do not have up-to-date asset management plans or good asset data to help them maintain and optimise the performance of their assets. This is because they have poor systems for managing assets, lack of resources or expertise, or have outdated/incorrect information.

When councils have accurate asset data, it is a good starting point to build a good asset management plan. For this, councils should regularly inspect their assets and make sure information in their financial systems and geographical information systems – which are used to capture, store, and manage detailed components of assets, including their geographical location – agree to each other.

When councils do not have good asset data, the information presented in their financial statements may be incorrect. This year, 12 councils reported values for assets for the first time in their financial statements, although these councils always owned these assets. This is known as ‘prior period errors’. This is not the first time councils have reported prior period errors in their financial statements. These errors arise because some councils do not have good processes to account for assets as and when they acquire them.

Asset valuations processes – Determining the fair value of council assets is complex and highly subjective. Councils often rely on the expertise of external valuers to help value their assets. The common issues we find with councils’ valuation processes are:

- councils not engaging early enough with external valuers, causing valuations to not be undertaken in a timely manner

- lack of or inadequate review of the valuer’s work that results in errors being identified during our audits – councils are the owners of these assets and know their assets well. They need to make sure the assumptions and judgements the valuer uses are reasonable and appropriate to their circumstances.

Councils should also consider the timing of their programs to value assets. Some councils complete comprehensive valuations (which need condition assessments, physical inspections, and a review of unit costs) on all types of assets in the same financial year. This is an extensive amount of work. These councils may benefit from a rolling program where a single type of asset is valued each year (for example roads, buildings, and water and sewerage assets could be comprehensively revalued in separate years). This helps spread the work required across multiple years and makes engaging an external valuer easier in times when limited valuers are available.

These issues also impact the completion and certification of financial statements, and often these delays result in councils not meeting their legislative deadline. Councils still need to take further action to address our prior year recommendation to improve their asset management and valuation practices as detailed in Appendix D.

Asset management is also critical to the long-term sustainability of councils, as discussed in Chapter 4.

We are finalising our performance audit on improving asset management in local government. This report will include recommendations for how councils can effectively manage their assets while minimising the total cost of owning them. We encourage councils and the department to review this report when it is tabled (expected in mid-2023) and implement any recommendations relevant to them.

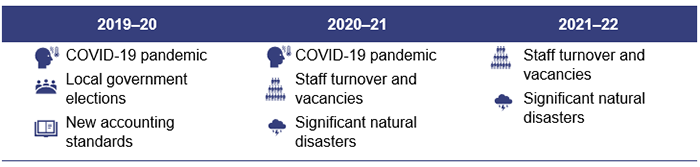

Other factors that have impacted timely reporting

Ineffective month-end and year-end processes and asset management issues have long been the reasons councils do not achieve timely certification of their financial statements. If councils had these practices imbedded and operating effectively, they would be better equipped to manage external disruptions. However, because they do not, external factors (as summarised in Figure 2C) have also contributed to untimely financial reporting in recent years.

Compiled by Queensland Audit Office.

In Local government 2020 we explained the challenges councils faced being impacted by and responding to COVID–19, local government elections, and new accounting standards, and how these delayed the certification of their financial statements. In this section, we explore the other factors that contributed to a decline in the timeliness of financial reporting by councils in subsequent financial years.

Staff turnover and vacancies

Since 2021, Australia (and the rest of the world) has been impacted by what has been called the ‘great resignation’, where workers left organisations at scale and pace. The local government sector was not immune to this phenomenon.

For councils outside of South East Queensland, attracting and retaining experienced staff has historically been a challenge, and this has become even harder in the last 2 years. Many councils face the choice between filling vacant roles with less experienced and qualified staff or engaging external consultants at a significantly higher cost.

The loss of knowledge when staff leave an organisation, and the disruption from frequent turnover of staff, prevents councils from maturing their financial and business systems, processes, and strategy.

Individual councils are unlikely to overcome these challenges alone. Some councils come together as a group through platforms such as ‘alliances’ or ‘regional organisations of councils’ – groups of councils from similar geographic locations form an association to achieve common goals. These councils can benefit from sharing resources and expertise, as well as through combined purchasing power.

We have seen councils successfully work together during the COVID-19 pandemic to implement directives from government, such as border closures and cleaning public amenities. Councils need to leverage such collaboration and work together to create more depth and resilience in back-office functions such as financial management, human resource management, and information management and security. Their ability to do this is aided by the fact that currently 90 per cent of councils use one of 4 accounting systems.

Natural disasters

Natural disasters cause significant disruption to councils – diverting attention from their usual operations to focus on disaster response. Accounting for natural disasters (for example the change in the value of a council’s assets because of damage caused by a flood) is also complex and time-consuming. This adds further pressure to councils’ finance teams – especially in small and regional councils that are already experiencing staff shortages.

When a natural disaster strikes, it generally impacts more than one council in a region. We have seen disaster management groups at impacted councils come together and serve their communities in such difficult times to help with recovery processes.

Councils could again use this experience of working together to develop comprehensive documentation of the assumptions and judgements they use to determine the fair value of their assets (which is the amount for which the assets could be sold in a fair transaction).

Planning for the financial reporting process is weak

Councils are not aiming for early certification of their financial statements

At the start of each years’ audit process, councils provide us dates they plan to have their financial statements certified. Since we moved away from measuring their timeliness using a traffic light system (explained earlier in this chapter), fewer councils are striving for early certification.

Figure 2D shows, for the last 3 years, how many councils planned to have their financial statements certified early – that is, 2 weeks before their legislative deadline of 31 October.

Queensland Audit Office.

In the 2019–20 financial year, 91 per cent of the sector planned to have their financial statements certified 2 weeks before the legislative time frame. This declined to 80 per cent in 2020–21 and declined even more in 2021–22 to only 62 per cent of the sector.

If councils do not plan to have their financial statements certified early, they are unlikely to improve the timeliness of their financial reporting.

Ministerial extensions are sought very late

When a council does not expect to have its financial statements certified within the legislated deadline, it can seek an extension of time from the minister for local government.

Under the legislation, the minister may grant an extension when ‘extraordinary circumstances’ prevent the council from having its financial statements certified within the legislative deadline.

However, when councils, and many times the same councils, keep seeking an extension from the minister year after year, it cannot be deemed ‘extraordinary circumstances’. In Figure 2E, we show the number of councils that applied for an extension and the number of councils that met their extended time frames over the last 5 years.

Note: * For 2021–22, 4 councils that applied for extension are yet to finalise their statements.

Queensland Audit Office.

Of the 10 councils that received an extension of time to have their financial statements certified for the 2021–22 financial year:

- 7 did not apply for an extension until late in October 2022

- 6 applied for more than one extension this year

- 6 also applied for an extension last year.

This confirms that some councils do not have good processes to have their financial statements certified in a timely manner.

In Results of audits: Local government entities 2011–12 (Report 10: 2012–13), we recommended the department determine and publish criteria for granting ministerial extensions to reporting deadlines in ‘extraordinary circumstances’. At the time, the department acknowledged the merit of our recommendation; but it has not yet taken any action to provide clarity on what extraordinary circumstances are.

|

Recommendation for the department Provide a clear definition of ‘extraordinary circumstances’ for councils seeking ministerial extensions to their legislative time frame for financial reporting (REC 3) |

|

The department should clearly define what ‘extraordinary circumstances’ are in the context of extensions to councils’ legislated deadlines for certifying financial statements. This will provide consistent criteria for assessing council applications for extensions. |

Department’s role to address skills shortages and improve timely financial reporting

Although staff shortages have contributed to untimely financial reporting, this issue has existed in the sector for several years, especially in regional and remote councils. The fundamental reason councils in regional and remote areas struggle to achieve timely financial reporting is the lack of appropriately qualified and skilled staff.

In 2020 we collected information from more than half the sector to understand the extent of qualified and skilled staff in their engineering and finance teams. At the time we gathered this information, we noted that:

- 16 per cent of these councils did not have appropriately qualified engineers that were responsible for managing their infrastructure assets

- 27 per cent of these councils did not have an accountant with a post-tertiary qualification that was responsible for managing their finances.

We plan to survey the sector for our next local government report to understand if this situation has worsened, given the recent impact of the great resignation explained earlier in this chapter.

Councils who regularly fail to meet the legislative deadline for financial reporting generally do not have the necessary skills to improve their financial reporting. These councils would benefit from greater support by the department to help develop strategies to improve their financial reporting processes.

In Local government 2020, we recommended the department provide training to councillors and senior leadership teams for councils that have limitations raising revenue due to remoteness and small populations (that is, councils that are highly reliant on grant funding). Our recommendation aimed to improve councillors’ and senior leaders’ understanding of governance and accountability to allow them to drive change within their councils.

Some of these councils were already prioritising financial reporting and had established good governance processes, such as an effective audit committee and internal audit function. However, most were not.

This year, 25 per cent of the councils (7 councils) we recommended receive additional training did not meet their legislative deadline. At 30 June 2022, these councils also had 31 unresolved significant deficiencies (breakdowns in internal control that we identified with substantial financial or reputational risk for councils that need to be addressed immediately). This is 27 per cent of the unresolved significant deficiencies for the sector. In addition, 5 of these councils do not have an audit committee or an internal audit function.

This indicates that the training provided by the department may not be achieving the desired outcomes.

|

Recommendation for the department Measure the effectiveness of training programs provided to councils (REC 4) |

|

The department should measure the effectiveness of the training programs it provides to councils. This would help the department identify remedial actions when desired outcomes are not achieved. |

The department, as the regulator of the local government sector, also has a responsibility to make sure councils comply with the financial reporting obligations required under the Local Government Act 2009 and the Local Government Regulation 2012.

In addition to continuing to deliver and improve the training for councillors and senior executives, the department should develop targeted training for finance staff. This should be aimed at councils that consistently fail to have their financial statements signed in a timely manner and do not have adequate skills around financial accounting and reporting processes. The department currently provides example financial statements and conducts certain workshops for councils. However, the untimely financial reporting by councils confirms these are not addressing the skills shortage for financial reporting in the sector.

One option would be for the department to establish a group of qualified, experienced professionals who could help councils in need from time to time. This approach would be similar to that now used by the Public Sector Commission to help state government departments dealing with significant government restructures. Should the department adopt such a model, it would need to be clear about when councils could use this service.

|

Recommendation for the department Provide training on financial reporting processes and support councils to meet their reporting deadlines in times of need (REC 5) |

|

The department should, for councils that do not consistently achieve early financial reporting:

This should be in addition to the tropical financial reporting workshop provided by the department each year

|

3. Internal controls

Internal controls are the people, systems, and processes that ensure an entity can achieve its objectives, prepare reliable financial reports, and comply with applicable laws. Features of an effective internal control framework include:

- strong governance that promotes accountability and supports strategic and operational objectives

- secure information systems that maintain data integrity

- robust policies and procedures, including appropriate financial delegations

- regular monitoring and internal audit reviews.

This chapter reports on the effectiveness of councils’ internal controls and provides areas of focus for them to improve. When we identify weaknesses in the controls, we categorise them as either ‘deficiencies’, which need to be addressed over time, or ‘significant deficiencies’, which are high risk and need to be addressed immediately.

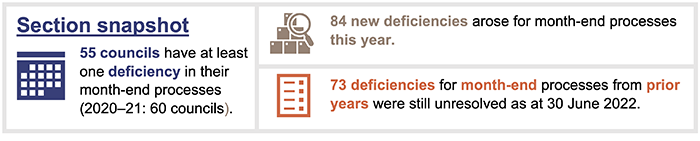

Chapter snapshot

Internal controls are improving, but more than half the sector still has unresolved significant deficiencies

Councils have continued to reduce the number of unresolved significant deficiencies in their internal controls. But, as at 30 June 2022, 42 councils (2021: 47 councils) have at least one significant deficiency they need to address. Figure 3A shows the total number of significant deficiencies we have identified in the sector over the last 5 years, along with those that remained unresolved at 30 June each year.

Queensland Audit Office.

Although councils have reduced the number of significant deficiencies, many are still unresolved for more than 12 months as shown in Figure 3B.

Queensland Audit Office.

Significant deficiencies are those that may result in substantial financial or reputational loss to councils – which in turn may impact their financial sustainability. When these significant deficiencies are unresolved for a long time, the risk of financial and reputational loss to councils increases.

In Appendix J, for each council, we list the number of significant deficiencies that remain unresolved for more than 12 months. As at 30 June 2022, 35 councils (2021: 35 councils) had one or more significant deficiencies that remained unresolved more than 12 months after we identified them.

Entities that do not resolve significant deficiencies in a timely manner generally do not have good governance and monitoring processes in place. When an entity strengthens its internal controls and implements good governance structures – such as by establishing an effective audit committee and internal audit function – it can also improve its financial performance.

Audit committees and internal audit functions

Audit committees

Audit committees play a key role in providing management with an independent and objective source of advice on various matters. This includes financial reporting, internal controls, risk management, and internal and external audit functions.

While management retains ultimate accountability for councils’ internal controls, audit committees help improve councils’ internal controls by overseeing proactive and timely resolution of outstanding issues.

After several years of recommending to councils that they should establish an audit committee function, in Local government 2020 we recommended the department should mandate all councils to establish an audit committee. The State Development and Regional Industries Committee (a committee of parliament) in its report – Report 32: Examination of Auditor-General Reports on the local government sector – recommended to the parliament that all councils should establish an audit and risk committee.

In the 2023–24 financial year, we plan to undertake an audit on the effectiveness of local government audit committees. This report will follow on from Effectiveness of audit committees in state government entities (Report 2: 2020–21) and provide insights into the effectiveness of audit committees at councils.

Internal audit

An internal audit function is a key building block for good financial reporting and governance practices. It provides an independent view on whether a council’s internal control framework is effective and helps promote a strong risk management and compliance culture.

Every council in Queensland is required under the Local Government Act 2009 to establish an effective internal audit function. An effective internal audit function is one where a council must, in each year, have an internal audit plan (a list of audits that it plans to undertake) and deliver on that plan.

Figure 3C shows councils that did not have an internal audit function established as at 30 June 2022 and those that had established a function but did not undertake any internal audit activity.

|

Councils with no internal audit function |

Councils that had no internal audit activity |

|---|---|

|

Cherbourg Aboriginal Shire Council* |

Bulloo Shire Council |

|

North Burnett Regional Council |

Carpentaria Shire Council |

|

Palm Island Aboriginal Shire Council |

Croydon Shire Council |

|

Paroo Shire Council |

Etheridge Shire Council |

|

Richmond Shire Council* |

McKinlay Shire Council |

|

Woorabinda Aboriginal Shire Council* |

Mornington Shire Council |

|

Wujal Wujal Aboriginal Shire Council* |

Northern Peninsula Area Regional Council |

Note: * These councils have not had an internal audit function for 3 or more years as at 30 June 2022.

Queensland Audit Office.

Nearly 60 per cent of the councils in Figure 3C failed to meet the legislative deadline in 2021–22:

- Four of these councils are yet to have their financial statements certified.

- Four of these councils missed the deadline but subsequently had their audit opinions issued. Of these, 2 councils have not met their legislative deadline for 3 or more years in a row.

The department, as the regulator for the local government sector, needs to make sure that councils comply with their legislative requirements to establish an effective internal audit function. The department also has a role to educate councils on the benefits of an internal audit function and make sure appropriate resources – such as guidelines and templates – are available to councils.

|

Recommendation for the department Make sure all councils have an effective internal audit function (REC 6) |

|

The department should monitor whether all councils have an internal audit function and that appropriate internal audit activities are undertaken each year. To help councils meet their legislative requirements the department should:

|

Common internal control weaknesses in the sector

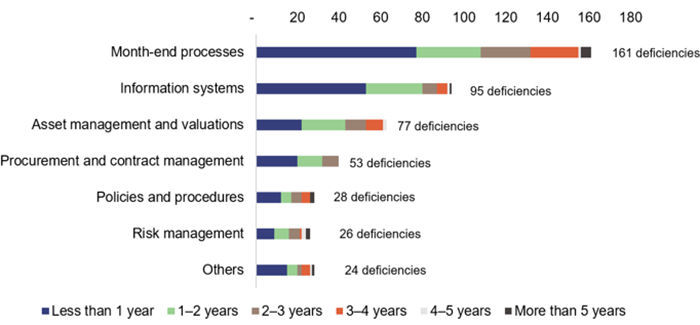

The common internal control weaknesses we discuss in this chapter are those that have persisted for several years. Figure 3D summarises these weaknesses by the number of years they have been unresolved, as at 30 June 2022.

Queensland Audit Office.

The number of weaknesses in information system controls continues to rise in the sector

Councils hold large volumes of financial, operational, and personal data about their suppliers, customers, and employees in their information technology systems.

Recent cyber attacks on the information systems of Australian and international entities, including some high-profile Queensland public sector entities, have disrupted their operations and caused loss of sensitive data.

As recently as April 2023, one regional council in central Queensland became a victim of a cyber attack. The council is assessing the impact of this attack and has involved cyber security experts to help it manage the recovery process. This is on the back of other councils in Victoria and New South Wales that were also impacted by cyber attacks within the last 18 months.

The frequency and number of attacks in the last 2 years highlights that it is no longer if, but when a successful attack will occur.

It is critical that councils implement strong security controls to protect their data from cyber attacks, undetected errors, and potential financial loss, including through fraud. Our Forward work plan 2023–26 includes an audit topic on Responding to and recovering from cyber attacks that will provide insights and lessons learned on entities’ preparedness.

This year, because of changes to the Australian auditing standards, we undertook in-depth reviews of information system controls across all public sector entities in Queensland. From these, we identified additional deficiencies in councils’ information systems.

The changes to Australian auditing standards require auditors to assess the effectiveness of information systems controls that are critical to generate financial information. It is important to note that these changes do not focus on controls that protect systems against cyber attacks and do not provide assurance that council’s cyber security measures are strong enough. However, the findings from our audits inform councils of the vulnerabilities in their systems and provide them opportunities to strengthen their internal controls.

The most common internal control deficiencies identified include:

- inappropriate access levels being assigned to council staff. This means staff can process transactions when they are not authorised to do so. This may expose councils to financial loss, unauthorised access to their data, and the risk of loss of data

- lack of good controls to implement and monitor strong passwords. Weak passwords are easier to guess, and they expose information technology systems to potential cyber attacks

- lack of good policies to govern the security of information systems. These policies should define obligations that staff need to comply with when using councils’ information technology systems.

Implementing effective controls to mitigate the risk of cyber attacks should be performed on a cost–benefit basis. Accordingly, in Managing cyber security risks (Report 3: 2019–20) we recommended all entities in the Queensland public sector firstly assess whether they:

- have a framework for managing cyber security risks

- know what information assets they have

- know to what extent those information assets are exposed to cyber security risks.

Based on the results of these activities, entities should implement cyber security risk mitigation strategies.

Since October 2018, the Queensland Government’s Customer and Chief Digital Officer (QGCCDO) has required state departments to implement an information security management system (ISMS) – a systematic approach to identify and manage information security risks – in accordance with the ISO 27001 Information Security Standard. Currently, no such standards are mandated for the local government sector.

There is an opportunity for the department to collaborate with the QGCCDO to improve the information technology security practices of the sector, using the principles of an ISMS. This would provide the department information about councils that have weaker information security controls.

|

Recommendation to the department Develop a strategy to uplift capability of the sector on cyber-related matters (REC 7) |

|

We recommend the department, in collaboration with the Queensland Government’s Customer and Chief Digital Officer, develops a strategy to increase awareness and improve capability in the sector on cyber-related matters. This will help councils strengthen their information security controls. |

Appendix D provides our full recommendation from previous years, which still requires further action by councils.

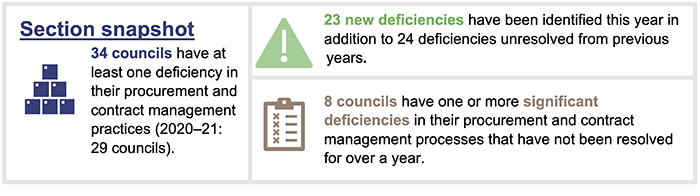

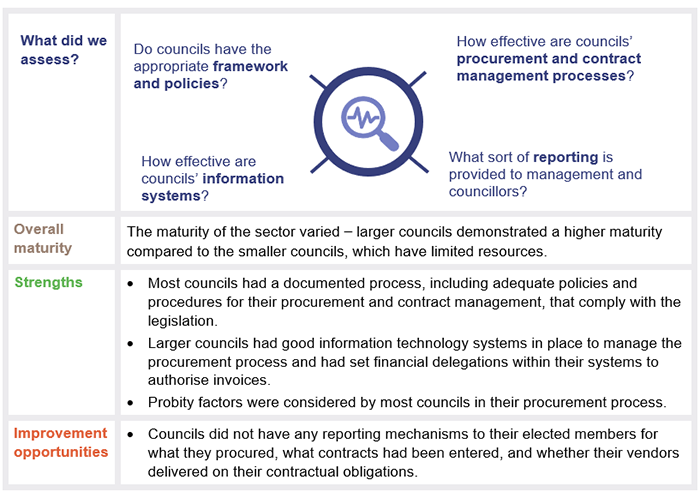

Procurement and contract management practices are not

fit-for-purpose

Councils collectively spend approximately $8 billion each year to obtain goods and services from varied suppliers. When such large amounts of monies are spent – which are funded by tax payers in the form of grants or other sources such as rates and fees – there is a need for strong controls and processes. This is important so councils can uphold their communities’ confidence that their monies are spent wisely.

Despite this, we identify more weaknesses each year in councils’ procurement and contract management processes and practices.

To gain a comprehensive understanding of the extent of the efficiency and effectiveness of councils’ procurement and contract management processes, we implemented our procure-to-pay maturity model at 5 councils this year.

We selected a range of councils from large councils in South East Queensland to a small remote Indigenous council to assess the maturity of their procurement and contract management processes.

Figure 3E summarises the scope of the maturity model, together with the strengths and improvement opportunities we identified.

compiled by Queensland Audit Office.

|

Recommendation for all councils Assess the maturity of their procurement and contract management processes using our procure-to-pay maturity model, and implement identified opportunities to strengthen their practices (REC 1) |

|

We recommend all councils assess the maturity of their procurement and contract management processes using our procure-to-pay maturity model. Councils should identify their desired level of maturity and compare this to the maturity level that best represents their current practices. This assessment will help them identify and implement practical improvement opportunities for their procurement and contract management processes. |

We also identified as a part of our audits common internal control weaknesses in councils’ procurement and contract management processes and practices – that we have reported for several years. These are:

- value for money – Councils have not maintained good documentation on the appropriate number of tenders/quotes obtained for the purchase of goods and services. This means they were not able to demonstrate they were getting the best price for the goods and services they procured

- risk of procuring incorrect goods or goods at incorrect prices – Councils have procured goods and services before entering an agreement with suppliers. This means they exposed themselves to risks of disagreement with suppliers over the terms of purchases (such as quantity and price of goods procured)

- poor contract management practices – We find councils either do not maintain contract registers or their registers lack key information such as start and end dates and values of contracts. When contract registers are well maintained, they help councils better plan their financial commitments, track their obligations, and reduce the risk of paying more than they agreed with suppliers.

In Contract management for new infrastructure (Report 16: 2021–22), we made recommendations for how entities can improve their frameworks for managing contracts. Councils may benefit from implementing the recommendations made in this report to improve their contract management processes.

Appendix D provides our full recommendations from previous years, which still require further action by councils.

Stronger risk management is needed in uncertain times

Queensland councils faced considerable risks in recent years, including the challenges of the COVID-19 pandemic, natural disasters, rising cyber crime and fraud, and an uncertain economic outlook.

These risks have reinforced the need for good risk management practices to make sure councils deliver desired outcomes to their communities.

Common areas councils can improve their risk management practices include having:

- a well-documented and up-to-date business continuity and disaster recovery plan that is tested periodically. This will help councils continue to deliver services and infrastructure to the community and minimise the impacts of any disruptions in the event of a disaster

- an up-to-date and complete risk management framework and risk register. This will help councils identify and address the risks facing their business, and in doing so, increase the likelihood of successfully achieving their objectives.

Appendix D provides our full recommendations from previous years, which still require further action by councils.

Councils need to establish good policies and procedures

Over the last few years, we have noticed an increase in the number of councils that do not have good policies and procedures. Policies and procedures provide guidance, ensure consistency, assign accountability, and establish clarity to council staff and elected members on how the council operates.

At 30 June 2022, 13 councils either did not have policies and procedures in place for some of their day‑to-day operations, or these policies and procedures were outdated. These councils may have increased financial and reputational risks, because council staff and elected members may not manage the operations in line with the council’s expectations.

Good policies and procedures are critical for those that are new to the organisation – whether it be council staff or an elected member.

Over the years, councils in Queensland have experienced significant change in their elected members as a part of local government elections (which occur every 4 years). Following these elections, we also see changes in the staff who hold key positions across councils.

With the next local government elections being held in March 2024, councils should make sure they establish good policies and procedures to help smoothly transition any newly elected members and new executive staff.

4. Financial performance

In this chapter, we analyse the financial performance of councils, with emphasis on their financial sustainability that is measured under the Financial Management (Sustainability) Guideline 2013, issued by the department.

Chapter snapshot

Financial sustainability measures are changing for the sector, but a framework to measure the associated risk is needed

In Local government 2020 and Local government 2021, we explained the challenges councils face to demonstrate their ability to achieve financial sustainability, particularly those in remote areas. These include:

- lower population and fewer employment opportunities, resulting in lower revenue-generating ability

- higher costs of maintaining a large asset base spread over a large geographic area

- the current financial sustainability guideline, which expects all councils to achieve the same financial benchmarks (refer to Appendix I for details of the financial measures and benchmarks).

The department recognised these challenges and has developed a new financial sustainability guideline. Under this new guideline, councils are grouped into similar categories (known as tiers) to better reflect the varied drivers and challenges across the sector.

The new guideline introduces additional ratios and benchmarks (that vary across the tiers) that councils will report against in their financial statements from 2023–24 onwards.

The department is currently developing a framework (risk framework) to measure sustainability risk under the new guideline. Given the new guideline will be implemented from 1 July 2023 (for the 2023–24 financial year), it is important that the risk framework is also made available to the sector from this date.

|

Recommendation for the department Publish a framework to assess the sustainability risk of councils by 1 July 2023 (REC 8) |

|

The department should publish a framework to assess the financial sustainability risk of councils. This framework should be made available to the sector from 1 July 2023 to align with the effective date of the department’s new financial sustainability guideline. |

Role of grant funding in local government

Snapshot of grants received by councils (based on a 5-year average)

Queensland councils receive grants from the Australian and Queensland governments for their day-to-day operations (operating grants) and to construct and maintain their assets (capital grants). Without these grants, some councils in Queensland would not be able to provide services to their communities and maintain their assets.

Financial assistance grants

One operating grant received by every council in Australia is the ‘Financial Assistance Grant’ (FA grant) from the Australian Government. The FA grants play an important role in supplementing the operating revenues of councils – so much so that they represent approximately 51 per cent of operating grants for the sector in Queensland.

The FA grants are made up of 2 components – a general purpose grant and an identified road grant. Both components are untied, meaning they can be used for any purpose. These grants are provided by the Australian Government and are distributed through the department with the assistance of the Queensland Local Government Grants Commission (the Commission) – an independent body appointed by the governor in council (which is the Governor acting on advice of the Executive Council to approve the decisions of Cabinet. All Cabinet ministers are members of the Executive Council, with at least 2 ministers and the Governor needed for a meeting).

The Commission allocates these grants based on the requirements of a Commonwealth Act (the Local Government (Financial Assistance) Act 1995) and the national principles established by the Australian Government. The FA grants are distributed using the following principles:

- The identified road grant is allocated based on the expected cost for councils to maintain roads in their local government area.

- The general purpose grant is allocated

- 30 per cent based on the population of the council. This component is entirely at the discretion of the Australian Government and all councils in Australia receive this component of the general purpose grant

- 70 per cent based on the council’s relative need (amount of grants required by a council to provide effective and efficient services to its community). This portion also considers a council’s ability to generate revenue and the expenditure it incurs on services. This component is determined by the Commission and is not distributed to councils that have a population of 80,000 or more.

In 2020–21, the Commission changed its grant allocation methodology, recognising that remote councils with small populations have limited means to raise sufficient revenue to meet the cost of providing services to their community.

As a part of this change in methodology, the Commission also decreased the threshold for the relative need grant from 80,000 to 50,000 residents, to align with other jurisdictions in Australia. This means that 5 fewer Queensland councils will receive the 70 per cent component of the FA grant in 2022–23.

These changes will result in 54 councils receiving more funding in 2022–23 than in previous years.

Impact of grants on the sustainability of councils

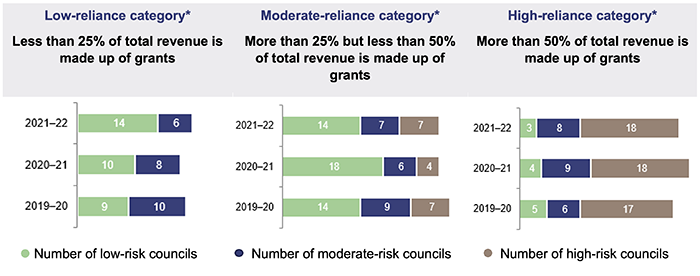

Given the importance grant funding plays in the sector, we analysed the financial sustainability of councils based on their reliance on grants (including both operating and capital grants), as shown in Figure 4B.

Note: * Grant reliance is calculated using 5-year average of grant funding as a percentage of total revenue.

Compiled by the Queensland Audit Office, from councils’ financial statements.

In the 2019–20 and 2020–21 financial years, the local government sector received higher than usual grant funding to help it recover from the financial impacts experienced during the COVID–19 pandemic response.

In 2021–22, grant funding to councils declined, as economies started to recover from the financial impacts of the pandemic response. With the decline in grant funding, the reliance on grants has also reduced. Accordingly, more councils this year (14 councils) have a lower financial sustainability risk in the low reliance category than last year (10 councils).

Generally, as a council’s reliance on grants increases, its risk of not being financially sustainable also increases. However, at 30 June 2022, 3 councils that had a high reliance on grants had a low risk of being financially unsustainable.

These 3 councils are in one of the most remote locations in Queensland and have significant limitations on generating their own revenue. Yet, with strong governance structures and internal controls, and sound budget monitoring processes, they have managed their spending and consistently generated operating surpluses.

Early receipt of grant funding has masked the operating deficits some councils would have otherwise incurred

This year, 35 councils generated operating surpluses. This is consistent with last year (2020–21: 35 councils) and the results before the pandemic. However, this year, the sector as a whole received a large portion of its FA grants in advance.

Usually, in June each year, councils receive approximately half of the next year’s FA grant in advance. This year, the Australian Government decided to pay approximately 75 per cent of the 2022–23 financial year FA grant in advance. This advance payment was based on the new ‘relative need’ funding model discussed earlier in the report.

Because these grants are untied and councils do not have any specific obligations to meet, under accounting principles, councils reported these amounts as revenue in 2021–22. This meant that some councils that would have reported an operating deficit this year, instead reported an operating surplus.

Receiving a large portion of the FA grant in advance may seem advantageous for some councils. However, these funds need to be set aside to fund operations throughout 2022–23.

In Figure 4C, we show the number of councils that generated operating surpluses for 2017–18 to 2021–22. We also show what the sector’s operating performance would have been for 2021–22 if councils had not received this advance funding.

Any entity may occasionally incur an operating deficit. But when operating deficits are a regular occurrence, it is a sign the entity has weak budgeting and monitoring processes, and in some instances a habit of overspending or undercharging their community for services provided. This year, 42 councils incurred operating deficits. Of these, 27 have incurred operating deficits each year for the last 5 years.

Australia (as with the rest of the world) is facing significant increases in costs to employ staff and procure goods and services. In 2021–22, councils in Queensland experienced an increase in employee costs and material and services costs of 5 per cent and 10 per cent respectively.

Increased costs and rising interest rates can significantly impact fiscal policy (government's use of taxation and spending to influence the economy). This may mean tighter budgets and possible reductions to funding for councils in future years. But councils still need to provide essential services (roads, water, waste, and sewerage) to their communities, regardless of the level of grant funding they receive.

This is an ideal time for councils to revisit their costs and assess whether, at a minimum, the costs of providing these services are recovered through the fees they charge to their community. This includes reconsidering the need for some non-essential services they provide. Some of these non-essential services cost councils more than the fees they can charge, and in some instances, they do not generate any revenue from these non-essential services.

In Managing the sustainability of local government services (Report 2: 2019–20), we undertook an in‑depth review of processes at 5 councils for planning and delivery of services to support long-term sustainability. As a part of this report, we also published a service prioritisation tool to help councils prioritise how money is distributed for spending on their non-essential services. The tool is available on our website at: www.qao.qld.gov.au/reports-resources/better-practice.

Based on the findings at the 5 councils, we made recommendations to all councils. We strongly encourage all councils to review the progress they have made implementing these recommendations.

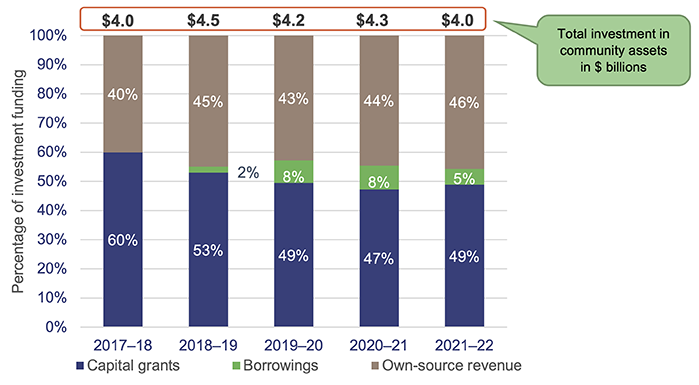

Investment in assets is not enough to meet community needs

The total investment in community assets in 2021–22 was $4.0 billion (2020–21: $4.3 billion). As in prior years, funding for this investment came from capital grants, borrowings, and own-source revenue (revenue earned by councils from their day-to-day business), as shown in Figure 4D.

Compiled by the Queensland Audit Office, from councils’ financial statements.

Councils’ reliance on borrowings to build and maintain community assets has remained low. The total debt of the sector at 30 June 2022 was $6.4 billion (2021: $6.2 billion). This is only 4.3 per cent of the value of community assets (2021: 5 per cent).

While it is encouraging to see councils continuing to invest in their assets, this level of investment is not enough to meet the needs of their communities. This is because it is not keeping up with what it would cost to replace the assets.

In Local government 2021, we highlighted the importance of the asset consumption ratio. This ratio measures the current value of a council’s assets relative to what it would cost to build new assets with the same benefit to the community. In our 2021 report, we recommended councils review their asset consumption ratio and act to make sure their assets continue to meet the needs of their community.

The department has introduced this ratio in its new sustainability guideline (effective from 1 July 2023) and set a benchmark of greater than 60 per cent for all councils.

We calculated the asset consumption ratio for all councils as at 30 June 2022 and identified that:

- 7 councils (2021: 6 councils) risk the possibility of their assets not being maintained to a standard to meet community expectations (these councils do not meet the benchmark for the ratio of 60 per cent)

- 9 councils (2021: 10 councils) risk their assets not being maintained to a standard that meets community expectations in the next few years (these councils have an asset consumption ratio that is between 61 per cent and 65 per cent).

When compared to the prior year, we found that only 7 councils improved their asset consumption ratio this year, while 44 councils show a declining ratio.

We continue to recommend councils review their asset consumption ratio and take the necessary steps to improve it. This is so their assets are maintained at a level that meets the future needs of their community.

Appendix D provides our full prior year recommendation, which still requires further action by councils to address these issues.

Local government dashboard 2022

Our interactive map of Queensland allows you to search and compare councils to view their financial performance and sustainability indicators. This tool includes information on revenue, expenses, operating costs, assets, liabilities and sustainability indicators.