Overview

In providing services to the state and community, government entities may use debt to fund investment in assets, such as building infrastructure, or invest money to meet obligations, such as those relating to superannuation.

The Queensland Government holds significant investments that it can use to meet the state’s long-term liabilities or to fund future initiatives. One example is the Queensland Future Fund that was established to offset state debt.

Tabled 29 May 2023.

Report on a page

This report examines how the Queensland Government is managing its debt and investments and reports on some recent transactions relating to these. It also discusses risks associated with the debt and investments and how these relate to the work of government entities.

Net debt levels are expected to increase in future years

In 2021–22, positive economic factors meant net debt (financial liabilities minus financial assets) decreased. This contrasted with recent years, when the government borrowed more to stimulate the economy.

The government expects its net debt to increase over the next 4 years, as it uses borrowings to cover the cost of infrastructure and other major initiatives. Significant announcements have also been made about infrastructure to be delivered up to 2035, with funding for these projects to be included in future budgets.

Interest rates have risen, which will affect the associated expenses – particularly for new borrowings. This will have an impact on the government’s fiscal principles relating to debt management, specifically the ratio of net debt to revenue (‘fiscal’ refers to government spending, revenues, and/or debt). Over the coming years, this is expected to become more of an issue, as borrowings are expected to increase and will be at a higher interest rate.

Investments have been volatile in recent years

The government holds investments across several entities, mainly to help fund future obligations it is required to meet. In recent years, the macroeconomic impacts of responses to COVID-19 and other geopolitical events have caused additional volatility across investment portfolios.

Many of the entities holding investments – namely, the insurance entities within government – are facing extra challenges due to an increase in the cost of services they fund. For example, there have been significant increases in the cost of building materials and medical services.

These entities need to ensure they have enough investments to fund their liabilities, as they fall due.

The Debt Retirement Fund has diversified

The Queensland Future Fund – Debt Retirement Fund was established in 2020–21, and it diversified its investments in 2021–22. It did this by investing into different types of assets, in line with the strategy set for its portfolio. It did not pay down any government debt during the year, but it was used to offset state debt and support Queensland’s credit rating. There was a small decrease in its value from $7.742 billion as at 30 June 2021 to $7.718 billion as at 30 June 2022.

The Residential Tenancies Authority’s funding and investment model has changed

Historically, the Residential Tenancies Authority has relied on investment returns to fund its operations, but this has been affected by market volatility for multiple years. At the end of 2021–22, it sold its investments to the government and received the equivalent value in cash in return. Its operations will now be funded through annual grants.

Recommendations for entities

Status of recommendations made in Establishing the Queensland Future Fund (Report 11: 2021–22)

In our report on the establishment of the Queensland Future Fund, we recommended that Queensland Treasury include further detail on the funds established under the Queensland Future Fund Act 2020 (the Act), by amending the Act to require:

- financial statements to be prepared, audited, and made publicly available for each fund created under the Act. These requirements could be based on those included in section 7 of the NSW Generations Funds Act 2018 (NSW)

- additional information to be included within an annual report for the Queensland Future Fund prepared by the Treasurer, including:

- the governance arrangements of the Queensland Future Fund

- the activities and performance of key investments in the fund

- public disclosure of the audited financial information of the fund.

Queensland Treasury responded that the Queensland Future Fund is not an entity of itself, and therefore, does not warrant separate financial statements. We noted in State finances 2021 (Report 13: 2021–22) that we would work with it on how to identify and implement options to enhance financial statement disclosures on the activities of the Queensland Future Fund.

The 2022 audited financial statements for Queensland Treasury included further details on the composition and activities of the Queensland Future Fund. Information is also included in the Queensland Treasury Corporation’s financial statements, as it holds the underlying fund managed by QIC Limited. We will continue to monitor the activities of the fund and the level of disclosure through the reporting currently being provided.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

1. Entities involved in managing debt and investments

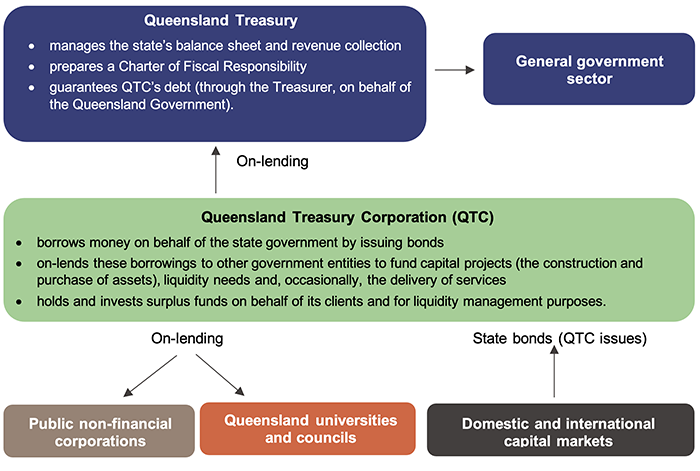

This report examines how the Queensland Government manages its debt and investments, including the associated risks. Three Queensland Government entities are heavily involved in managing the state’s debt and investments:

- Queensland Treasury manages the state's finances. It collects the majority of the state's revenue, sets the fiscal principles the state applies, and manages the state's budget. (‘Fiscal’ refers to government spending, revenues, and/or debt.)

- Queensland Treasury Corporation (QTC) is the central financing authority for the Queensland Government. It provides financial services such as borrowings, cash investments, and foreign exchange.

Queensland Treasury advises QTC how much borrowings the state requires and QTC identifies the most appropriate way to raise these funds in both domestic and international capital markets. Once QTC has raised the necessary funds, QTC on-lends this to public sector entities.

The State Investment Advisory Board (SIAB) is an advisory board of QTC, with independent representatives as well as Queensland Treasury representatives. It determines the investment objectives, strategies, and policies of the QIC funds relating to the state’s long-term assets. - QIC Limited (QIC) is an investment manager and advisor for both public and private sector entities. Entities within the public financial corporations and public non-financial corporations sectors (see Figure 1A) invest with QIC.

Entities within government are involved in providing services to Queenslanders. In doing so, they may use debt to fund investment in physical assets (for example, the construction of infrastructure), and invest money to meet obligations (like those relating to superannuation and insurance) over a longer period. These entities fit within 3 sectors of the Queensland Government, as shown in Figure 1A.

Notes: The orange outlines denote the non-financial public sector, which is a combination of the general government sector and public non-financial corporations sector.

Compiled by the Queensland Audit Office.

In addition, some other public sector entities that are not within the Queensland Government (such as universities and local governments) hold borrowings and investments with QTC and QIC.

2. The Queensland Government’s debt position

This chapter analyses the Queensland Government’s net debt position, including who holds the borrowings, and how net debt is measured and managed.

Most borrowings are monies received from lenders with the agreement that the amounts borrowed will be repaid. Queensland Treasury Corporation (QTC) borrows money on behalf of Queensland public sector entities, so our analysis focuses on these borrowings. Other types of borrowings include leases over physical assets, and contracts to protect against movements in interest rates, electricity prices, and foreign currency exchange rates.

Net debt is calculated as financial liabilities (including deposits held, advances received, borrowings with QTC, leases and other loans, and securities) minus financial assets (including cash and deposits, advances paid, loans paid, and investments).

Why does the Queensland Government borrow money?

Queensland Treasury, as part of its fiscal management role within the state, identifies and manages how ongoing operating expenses, as well as capital expenditure (money spent to purchase or construct new assets or improve the performance of existing assets), should be funded. Entities in the public non‑financial corporations sector typically use borrowings to fund the construction of large infrastructure projects. This maintains the government’s desired capital structure for these entities (the right mix of debt and government investment to finance their operations and growth).

The state also looks to fund its operations and a significant portion of its capital expenditure from the revenue it earns. However, there may be periods when borrowings are required to fund its day-to-day activities. For example, during the COVID-19 pandemic, the state used borrowings to support economic activity.

Who holds debt within the Queensland Government?

Queensland Treasury identifies the borrowing requirements for the state through the budget process. Queensland Treasury Corporation (QTC) facilitates the raising of debt by issuing bonds (a loan for a specific period, with regular interest payments made over the period, and repayment in full at the end) to both the domestic and international capital markets. It then lends this (on-lends) to Treasury or other government entities. Treasury uses the amounts borrowed to fund government programs or projects through appropriations to entities in the general government sector.

QTC also provides these services to public sector entities that are not within the Queensland Government (such as universities and councils) and entities within the public non-financial corporations sector, who identify their own borrowing needs. The roles of Queensland Treasury and QTC are outlined in Figure 2A.

Compiled by the Queensland Audit Office.

What borrowings do entities hold with QTC?

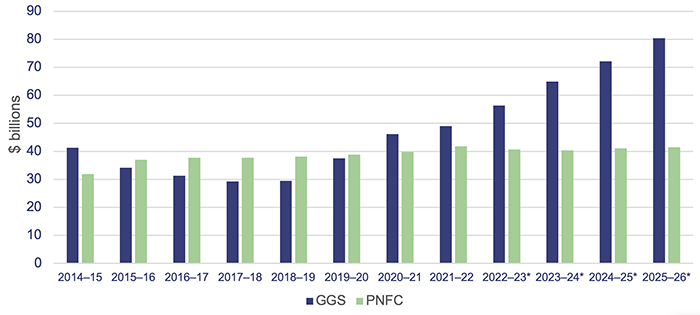

Figure 2B shows the amounts owed to QTC at 30 June each year by the general government sector and public non-financial corporations sector, along with projected borrowings over the forward estimates to 2025–26 for these 2 sectors. As at 30 June 2022, these 2 sectors represent 89 per cent of total debt held with QTC. The remaining 11 per cent predominantly relates to borrowings held by universities and local governments.

Most general government sector entities (departments and statutory bodies) receive most of their revenue from appropriations and grants. Queensland Treasury borrows money from QTC on their behalf, to provide funding for programs or projects in the general government sector. These borrowings with QTC are forecast to increase over the forward estimates as the state invests in its infrastructure program.

Public non-financial corporations sector borrowings are primarily held by entities with income-generating assets. Total borrowings are forecast to remain stable over the forward estimates. These have not changed significantly since the government implemented its Debt Action Plan in 2015–16.

The implementation of the government’s debt action plan reduced borrowings by $7.6 billion in the general government sector. Funds to reduce borrowings came largely from 2 transactions:

- in November 2015, some public non-financial corporations borrowed $2.8 billion to pay special dividends to the general government sector as a capital return

- in June 2016, $3.4 billion of investments previously held aside to meet long service leave liabilities were transferred to the general government sector.

Figure 2B also shows the decrease in general government sector borrowings and increase in public non‑financial corporations sector borrowings at this time.

Note: * Denotes budgeted amounts. GGS – general government sector; PNFC – public non-financial corporations sector.

Compiled by the Queensland Audit Office.

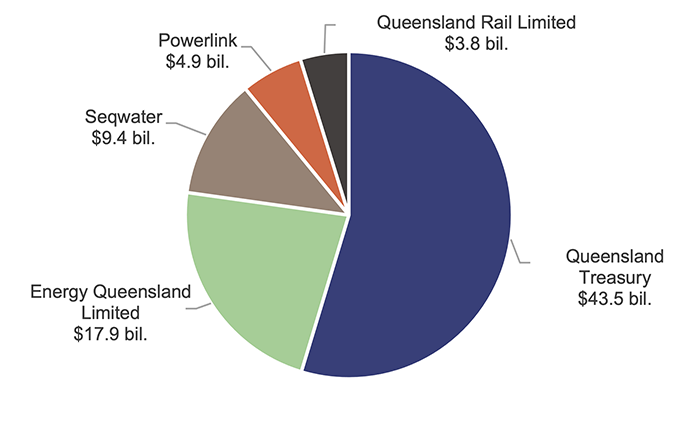

As mentioned, QTC on-lends to Queensland Government entities to fund the delivery of assets and services. Figure 2C shows the top 5 Queensland Government entities with borrowings from QTC, as at 30 June 2022.

Compiled by the Queensland Audit Office from QTC financial information.

As at 30 June 2022, Queensland Treasury had $43.5 billion of borrowings from QTC. It uses these borrowings to support government departments and other government entities (such as hospital and health services). Most of it is for the state infrastructure program and economic development and, in recent times, for response to the COVID-19 pandemic.

Each of the other 4 entities has significant infrastructure portfolios to deliver services. They use debt financing as a source of funds to support investments in renewing and increasing this infrastructure, and to maintain a desired capital structure (the right mix of debt and government investment to finance their operations and growth). They use their revenue to pay these debts.

How does the Queensland Government measure its performance in managing debt?

The state budget is focused on the general government sector. As part of the budget-setting process, the government outlines its fiscal objectives and the fiscal principles that support them. The state budget is developed in line with these principles each year.

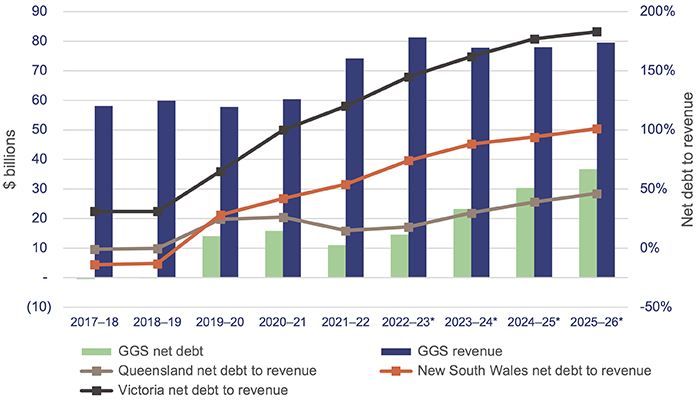

The government assesses the sustainability of government debt by comparing the level of net debt (financial liabilities minus financial assets) to the revenue it earns each year, referred to as the ‘net debt to revenue ratio’. The budget includes a fiscal principle aimed at ensuring the general government sector net debt to revenue ratio is maintained at sustainable levels in the medium term (usually between 4 to 10 years) and targeting reductions in the net debt to revenue ratio in the long term.

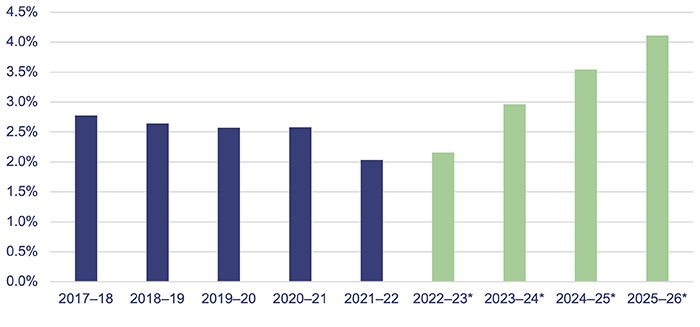

Figure 2D shows the trend of the net debt to revenue ratio for the general government sector. It also shows that the ratios are expected to worsen over the next 4 years as the state continues to invest in its economic recovery and capital infrastructure programs. For comparison, the chart also includes comparative net debt to revenue ratios for the New South Wales and Victorian governments. This shows that while the ratios increase in line with the growth in borrowings, they do so at a lower rate than 2 other state governments.

Note * Denotes budgeted amounts. GGS – general government sector.

Compiled by the Queensland Audit Office, from Queensland Treasury; NSW Treasury; and Department of Treasury and Finance, State of Victoria information.

If the government identifies that changes are needed to manage debt levels, it can take action that includes:

- managing its operating expenditure to ensure there are sufficient funds available to pay down existing debt and to reduce the need to fund new projects through borrowings. The government’s fiscal principles include ensuring that the general government sector’s average annual growth in expenditure is less than the average annual growth in its revenue. The principles also include targeting continual improvements in net operating surpluses (how much the general government sector receives from its operations) to ensure that capital expenditure is funded primarily through cash received from its day‑to-day operations

- introducing new initiatives to help provide funding for the debt or to provide more assets to support the debt position. This was done in 2015–16, through the Debt Action Plan as explained earlier. It was also done in 2020–21, when the Queensland Future Fund – Debt Retirement Fund was established. We explained this in Establishing the Queensland Future Fund (Report 11: 2021–22). We have provided an update on the activities of the fund in Chapter 4 of this report

- increasing revenues (for example, by introducing new or changed levies and taxes) to reduce future borrowing requirements. However, as we identified in State entities 2022 (Report 11: 2022–23), revenues can be sensitive to market conditions outside the control of the government, such as fluctuations in the price of coal or other resources.

What has caused movements in the net debt position in recent years?

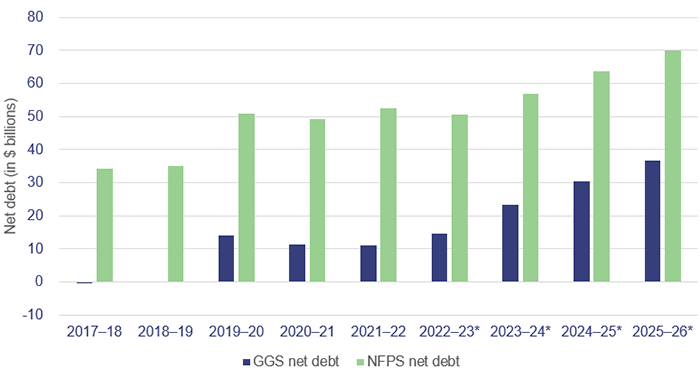

Figure 2E shows the net debt for the general government sector and the non-financial public sector since the 2017–18 financial year, alongside projected net debt.

Note: Years marked with an * are projected figures, from the 2022–23 Budget Update. GGS – general government sector; NFPS – non-financial public sector, which includes the general government sector and the public non-financial corporations sector.

Compiled by the Queensland Audit Office.

Net debt for the general government sector was forecast to increase by $8.2 billion in 2019–20. This was due to additional borrowings to fund capital projects (for example, transport infrastructure including Cross River Rail) and the recognition of lease liabilities (for example, leases over office accommodation on implementation of a new accounting standard). Net debt was higher than forecast mainly due to the COVID-19 pandemic, with macroeconomic factors and the government response impacting revenues, expenses, and investment values. Prior to this, the focus of the government had been on reduction of debt, particularly for the general government sector.

In recent years, the government has focused on measures to manage net debt, in light of the unexpected additional borrowings it needed. This included creating the Queensland Future Fund – Debt Retirement Fund to provide for future debt reduction and offset state debt to support Queensland’s credit rating. In QTC’s 2022 annual report, it reported that the credit rating agencies had reaffirmed the state’s and QTC’s credit ratings.

In addition, the savings and debt plan was announced in 2020. This plan targeted savings of $3 billion over 4 years to 2023–24. The Queensland Budget 2022–23 identified this target has been met. These savings represented amounts by which departments’ appropriations were reduced in budgets from 2020–21 and over the forward estimates.

In 2021–22, favourable economic conditions (with higher revenue from coal royalties) have also assisted in managing the debt balance. The improved conditions have meant the government borrowed less than budgeted in 2021–22, as there were more operating cash flows to fund planned capital expenditure.

The 2022–23 Budget Update forecasts a continued increase in borrowings over the forward estimates to 2025–26, although less of an increase than was forecast in the 2021–22 budget. More borrowings are currently expected, based on the need to fund capital investments beyond maintenance and replacement.

The capital program across government is projected to be $64.8 billion between 2022–23 and 2025–26, a significant increase of $12.6 billion on the 4-year capital program outlined in the Queensland Budget 2021–22.

This includes an additional $4 billion over the next 4 years as part of the new $62 billion Queensland Energy and Jobs Plan, which the Queensland Government released in September 2022. This investment was partially funded through higher revenue from coal royalties in 2021–22. The full plan will be delivered through a mix of private and public sector investment, with the energy system to remain majority owned by the people of Queensland.

The capital program and budget do not yet include all future projects for the Brisbane 2032 Olympic and Paralympic Games. As the detailed planning for energy projects and the games progresses and as information on funding sources, costs, and timing become available, this will be reflected in future budgets.

How is interest on the debt managed?

The majority of general government sector debt (borrowed by QTC and on-lent to Queensland Treasury) is held under fixed (rather than variable) interest rates. Higher inflation has brought forward the timing and number of expected cash rate increases in 2022 and 2023 by the Reserve Bank of Australia. These interest rate increases were anticipated in the 2022–23 Budget Update.

The impact of interest rate variations in the short term is not expected to be significant, but as new borrowing arrangements are entered into at current rates, the interest expense is expected to increase. The 2022–23 Budget Update estimates interest expenses to be $1.8 billion in 2022–23, an increase of $245 million (16.2 per cent) on 2021–22. Comparing interest expenses to operating revenue provides information on the share of revenue that must be devoted to servicing debt costs.

Figure 2F shows that this ratio is projected to increase over the forward estimates. In 2021–22, 2 per cent of the general government sector’s operating revenue was needed to service the cost of debt, with the lower percentage also associated with higher revenue in that year. This is estimated to increase to over 4 per cent by 2025–26.

QTC and Queensland Treasury continue to manage the risks around interest expense through several strategies. These include having a mixture of loan durations and types, as well as holding assets to back the debt (and manage credit risk).

Queensland Treasury also provides input into managing the risk of variation in interest rates through:

- the policies it sets

- by providing the framework for approval of borrowings by entities within the general government sector.

3. The Queensland Government’s investments

This chapter analyses the Queensland Government’s investments, including how they are managed, the entities involved with the investments, and why these investments are held.

How are government investments managed?

The Queensland Government holds investments across several entities. It does this to:

- fund long-term obligations

- manage risk associated with future expected payments

- manage the state’s debt.

Many of these investments are held through managed funds. The distinction between managed funds and other funds announced by government is explained in Figure 3A.

| What is a fund? |

|

The government will often refer to the creation of a fund, or the contribution of money to a fund, when making announcements about various initiatives. These are usually allocations of resources or monies within budgets, and they are different to managed funds. DEFINITION In 2021, an amount of approximately $2 billion was contributed to the consolidated fund (the Queensland Government’s central bank account). This represented proceeds from 25 per cent of the shares in Queensland Titles Registry Pty Ltd being transferred into long-term investments held by QTC. This was used to support long‑term government priorities through the establishment of a Housing Investment Fund, Path to Treaty Fund, and Carbon Reduction Investment Fund (key initiatives announced as part of the state budget process). Another example is the Queensland Renewable Energy and Hydrogen Jobs Fund. It is not backed by a separate managed fund but is instead an allocation of funding from the government within the budget. |

Compiled by the Queensland Audit Office.

The state’s portfolio of investments is held by various government entities.

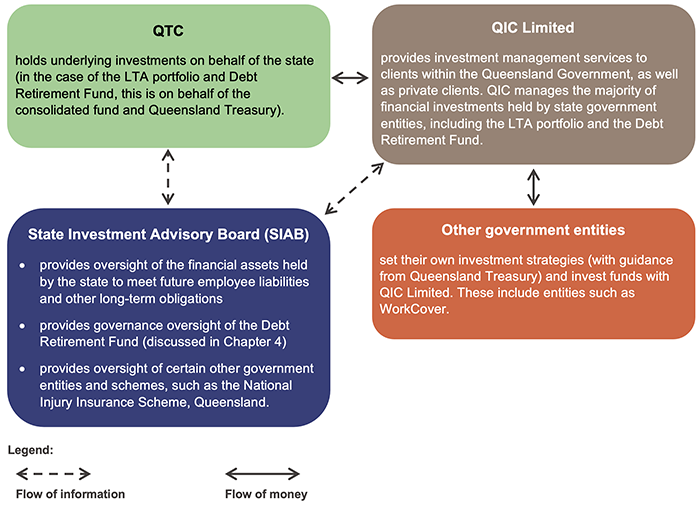

While QIC Limited is the investment manager of the state’s long-term investments (and therefore undertakes the day-to-day management of investments), the State Investment Advisory Board (SIAB) provides oversight for many of the investment strategies for the government.

The SIAB is an advisory board set up under QTC, with independent representatives as well as Queensland Treasury representatives. It determines the investment objectives, strategies, and policies of the QIC funds relating to significant state investments.

Figure 3B outlines the roles and responsibilities of key parties involved in managing the state’s investments.

Compiled by the Queensland Audit Office.

Which government entities hold investments?

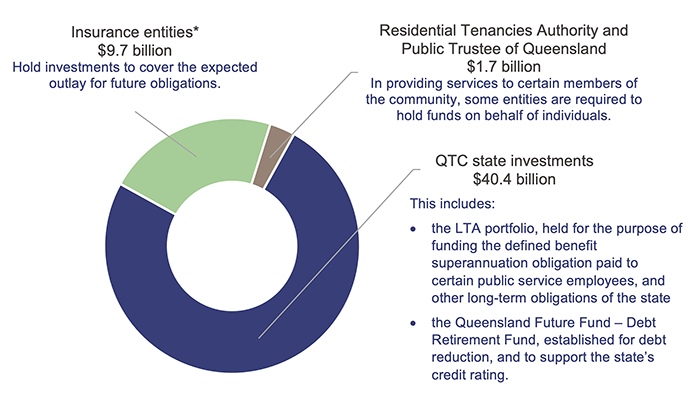

Figure 3C shows some of the significant holders of government investments (where the investments are held in QIC funds), as at 30 June 2022.

Note: *Insurance entities include Motor Accident Insurance Commission; Nominal Defendant; Queensland Building and Construction Commission; The National Injury Insurance Agency, Queensland; and WorkCover Queensland.

Compiled by the Queensland Audit Office.

How have the investments performed?

The entities in Figure 3C each have different asset allocations (the mix of different types of investments in a portfolio), aligned to their risks and objectives. The considerations behind asset allocations can include:

- the time frames over which obligations may need to be covered, namely whether they need to be paid out in a short time frame or in the longer term. Some Queensland Government entities cover obligations that can extend beyond 50 years (such as providing long-term treatment, care, and support to individuals injured in motor vehicle accidents)

- the expected costs of fulfilling the obligations, including any specific economic factors that could impact on them in future

- wider economic factors, such as inflation and the discount rate (which calculates the future value of an asset or liability in today’s dollars)

- expectations of stakeholders, which have recently expanded to include environmental, social, and governance considerations.

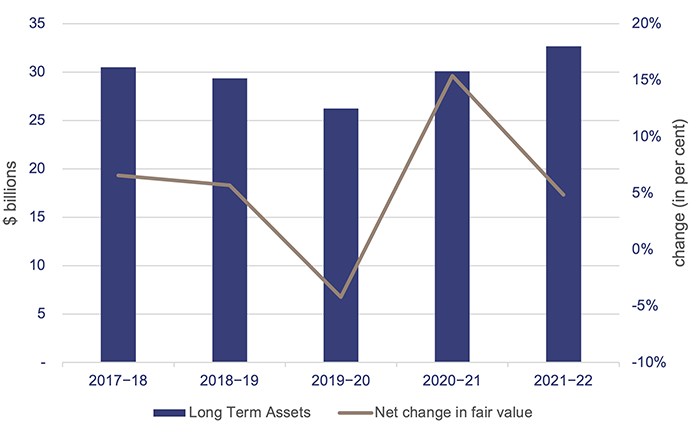

The LTA portfolio is the largest single asset pool held within the state, and it has a diversified asset mix. Figure 3D shows total long-term assets for the state in recent years, compared to the net change in fair value of these assets. (Fair value is the price at which the investments could be bought or sold.)

Note: Net change in fair value represents only the change in the fair value of financial assets, which in this case are the investments. It does not include deposits or withdrawals made during the year.

Compiled by the Queensland Audit Office.

After 4 years of steady returns, the change in fair value of the investments significantly decreased in 2019–20, due to the macroeconomic impact of COVID-19 on financial markets. This was followed by a significant increase in 2020–21, due to an upturn in general economic activity and the recovery of financial markets. In 2021–22, there were lower returns, due to the ongoing macroeconomic impacts of COVID-19 and other geopolitical factors; however, these did not result in the decrease in value experienced in 2019–20.

The LTA portfolio invests across many different categories of investments, which has helped minimise the impacts of these external factors.

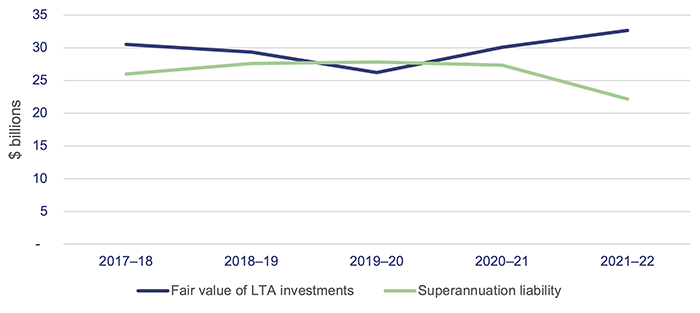

The LTA portfolio is held for the purpose of funding long-term obligations of the state. The largest liability the LTA portfolio backs is the defined benefit superannuation scheme. The Queensland Government holds the superannuation defined benefit obligation for the State Public Sector Superannuation Scheme and Judges’ Scheme. This scheme provides for post-retirement benefits to certain public service employees and has been closed to new members since November 2008. Various factors, such as salary growth and employee turnover/retirement, are considered when valuing the future obligations of the scheme.

The scheme is recorded in the whole-of-government financial statements, in accordance with the Australian Accounting Standards Board’s (AASB’s) accounting standard AASB 119 Employee Benefits. This calculation is complex; is performed by the State Actuary; and uses assumptions about future salary growth, interest rates, and inflation when estimating the value to be paid.

Figure 3E shows the value of the LTA portfolio and defined benefit liabilities (not including the contributions made by members), as reported in the whole-of-government financial statements as at 30 June each year.

Compiled by the Queensland Audit Office.

The improvement in the above position reflects:

- stronger investment returns, which increased the value of the investments

- a decrease in the superannuation liability, reflecting higher interest rates (based on Commonwealth government bonds) used in discounting estimated payments of future superannuation benefits.

The government has a fiscal principle that targets for the defined benefit obligation to be fully backed by investments, in line with advice from the State Actuary. When the State Actuary assesses if the liability is fully funded under actuarial standards, it uses different criteria to calculate the liability to those required by the applicable accounting standards. For example, while AASB 119 requires the liability to be calculated using a discount rate based on Commonwealth government bonds, the State Actuary applies a rate based on expected investment returns. This can result in a significant difference in the surplus/deficit calculated under accounting and actuarial standards.

The Superannuation (State Public Sector) Act 1990 was amended in 2020 to include a requirement consistent with this fiscal principle, and it has been achieved consistently since then.

What are the risks associated with the state’s insurance obligations?

Many of the investments held within the state are used to pay for obligations of the state, in particular, providing care and insurance for certain people and events. To meet these obligations, the government needs to carefully plan and manage the investments held by the relevant entities.

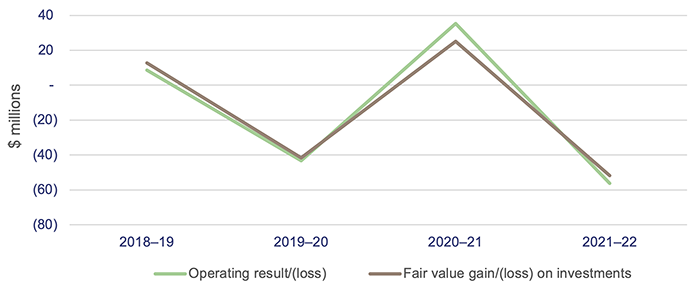

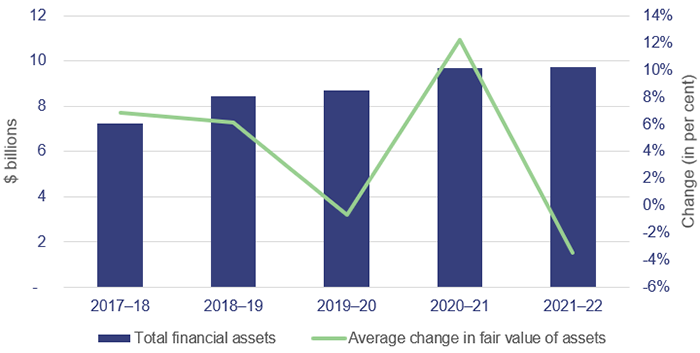

Figure 3F shows the changing value of total financial assets held by the insurance entities, compared to the average gain or loss on fair value of these assets.

Compiled by the Queensland Audit Office.

Movements in the net gain or loss on the fair value of the assets held by the insurance entities follows a similar trend to that of the LTA portfolio. However, insurance entities saw a greater decline in fair value movement in 2022 due to the different investment types and strategies they used.

Having significant and ongoing fluctuations in investments may pose a risk in terms of entities’ investments sufficiently covering their liabilities. This is particularly important when considering the rising costs of claims currently seen across the insurance entities. These investments are managed, in conjunction with other strategies, to meet these obligations over the medium to long term.

Some of the specific risks the state manages through invested funds include:

The National Injury Insurance Agency, Queensland (NIIAQ) – NIIAQ recognises a liability for lifetime treatment, care, and support expenses for eligible individuals injured in motor accidents. The liability has steadily increased over the last 5 years, in line with initial expectations for the scheme.

The agency needs to consider very long time frames for its liability and also the rapidly increasing costs of providing care and support. The service providers it engages often also provide services for NDIS participants, and this industry has seen significant increases in the cost of attendant care (with pricing limits for 2022–23 increasing by 9 per cent).

These factors have been considered in the setting of the NIIAQ’s investment strategy, which is overseen by SIAB. The investments include a portion designed to achieve higher returns (‘growth’ portfolio) and a portion designed to manage risks relating to the scheme being longer term, and therefore exposed to different risks (‘defensive’ portfolio).

WorkCover – The gross cost of claims incurred increased by 5.8 per cent from 2020–21 to 2021–22. The number of claims decreased, but there was an overall increase in the average cost per individual claim. This was mainly due to an increase in mental health-related claims, which tend to be higher in cost. Also, individuals with mental health-related issues tend to take longer before they can return to work. WorkCover anticipates that mental health-related claims will continue to increase in 2022–23.

Queensland Building and Construction Commission (QBCC) – 2022 saw an increase in builder insolvencies in Queensland. This was largely due to factors affecting the construction industry, such as labour shortages, supply chain disruptions, and significant increases in the cost of building materials.

QBCC covers the cost of rectification of works, as well as of completion of contracts, if a builder becomes insolvent. Events such as builder insolvencies can affect the timing and amount of payments needing to be made, and can mean previous assumptions need to be reassessed.

Queensland Government Insurance Fund (QGIF) – QGIF covers several obligations for the government, such as property (including cyber risk insurance), general liability, and indemnity claims. In recent years, historical abuse claims have grown significantly. QGIF is not a separate entity and is reported as part of the whole-of-government financial statements. The assets held to back its obligations form part of the LTA portfolio.

4. The Queensland Government’s significant transactions in 2021–22

In managing its debt and its investment strategy, the Queensland Government occasionally takes significant steps. In 2021–22, these related to diversifying the Queensland Future Fund – Debt Retirement Fund, managing the performance of the Debt Retirement Fund, and restructuring the investments of the Residential Tenancies Authority.

Diversifying the Debt Retirement Fund

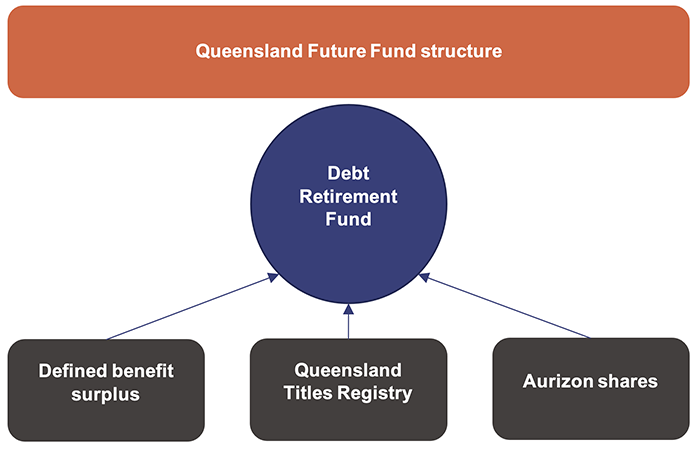

When established in 2021, the Queensland Future Fund – Debt Retirement Fund was funded through 3 initial investments, as shown in Figure 4A.

Note: The defined benefit surplus represented investments previously held in excess of the needs to meet the government’s future defined benefit superannuation obligations. The government held shares in Aurizon Limited (previously Queensland Rail freight operations) after its privatisation.

Compiled by the Queensland Audit Office.

These investments are held through a trust managed by QIC Limited, known as the Debt Retirement Trust.

As we outlined in Establishing the Queensland Future Fund (Report 11: 2021–22), a diversification program was undertaken soon after these assets were contributed. This was to minimise the risk to the fund through concentration (that is, holding most of its funds in a small number of assets) and to provide liquidity.

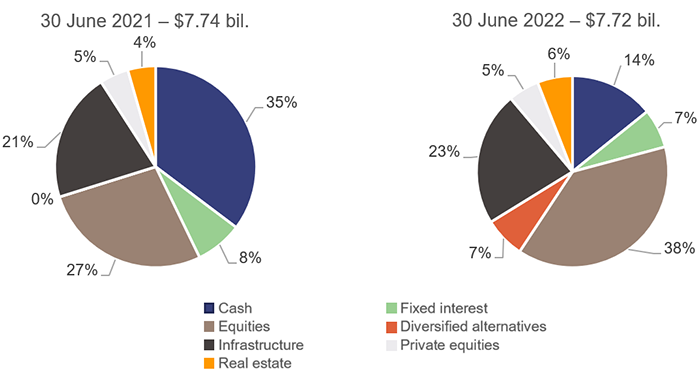

The fund continued to diversify its investments across the 2021–22 period, as shown in Figure 4B.

Notes: The ‘Infrastructure’ class includes a 22 per cent investment in the Queensland Titles Registry business.

Equities: investments in Australian and overseas shares.

Diversified alternatives: investment in varied pools of investments across alternative asset classes, such as private equities, infrastructure, and properties.

Private equities: investments in private companies (those that are not listed on a stock exchange).

Compiled by the Queensland Audit Office.

The main reasons for these changes included:

- A further $67 million of investments in the QIC Registry Trust (the trust that holds the Queensland Titles Registry business) were transferred from the Debt Retirement Fund to 2 government agencies. These were the Motor Accident Insurance Commission and the Nominal Defendant (which is responsible for compensating people injured in a motor vehicle accident, where the other driver was uninsured or unidentified). This was in exchange for other QIC investments.

- QIC Registry Trust distributed $845 million to unitholders (those who hold shares known as ‘units’ in an investment trust) – including the Debt Retirement Fund that holds 22 per cent of units in the trust – across the year. The Debt Retirement Fund reinvested its share in other funds. This distribution came from raising of borrowings and from operating returns. In its first financial statements for the period ended 30 June 2022, QIC Registry Trust reported an increase in the value of the Queensland Titles Registry business of $975 million, and distributions received from that business of $457 million.

The Debt Retirement Fund purchased units in additional QIC investment funds to meet its investment objectives across 2022.

Financial performance of the Debt Retirement Fund

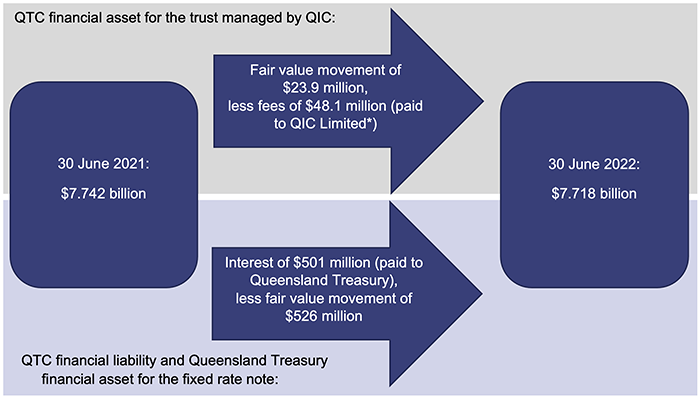

2021–22 was the first full year of operations for the Debt Retirement Fund. The results of the fund are reported in the annual reports of Queensland Treasury Corporation (QTC) and Queensland Treasury. QTC reports on the financial assets in the Debt Retirement Fund held with QIC, and the financial liability for the fixed rate note held between QTC and Queensland Treasury. Queensland Treasury reports a financial asset for the fixed rate note.

A fixed rate note is a debt instrument that pays a fixed amount of interest per annum. It is used to recognise the benefit of an investment for one party (Queensland Treasury), even though the investments themselves are held by another party. In the case of the Debt Retirement Fund, Queensland Treasury recognises the benefit of the fund, while QTC holds the underlying trust investment. The same arrangement is used to account for the state’s Long Term Asset portfolio.

Under the requirements of the Debt Retirement Fund trust deed, QIC prepares separate financial statements for the managed fund; however, these are not publicly available, as there is no requirement for them to be published.

Figure 4C provides a summary of the Debt Retirement Fund’s financial performance.

Notes: Fair value is the price at which the investments could be bought or sold. The movement reflects the change in fair value over the financial year.

*QIC returns a portion of the fees received to Queensland Treasury as part of the Competitive Neutrality Fee Regime. Competitive neutrality fees are a requirement for public sector entities to pay taxes to remove the benefits (and costs) as a result of their public ownership when competing with the private sector.

Compiled by the Queensland Audit Office.

The Debt Retirement Fund is reported on in multiple sets of financial statements. These include:

- the Debt Retirement Trust, which is managed by QIC. These are special purpose financial statements and are not available publicly. The underlying trust had a return of less than one per cent for 2021–22

- the investment in the trust, which is held by QTC. This is reported as a financial asset by QTC and reflects the return of less than one per cent excluding fees paid

- a fixed rate note between QTC and Queensland Treasury, which reflects the value of the trust at the start and end of each year.

The difference between the reporting in the QTC and Queensland Treasury financial statements relates to the fair value movements, interest expenses, and management fees. The fixed rate note has a fixed interest rate of 6.5 per cent per annum, whereas the returns in the QTC financial statements vary, depending on the performance of the underlying trust managed by QIC.

The 6.5 per cent rate was established based on the expected average return of the investments in the Debt Retirement Fund. The return may vary each year, but as this is a longer-term investment, the return should be viewed across the period of investment. The Debt Retirement Fund portfolio investment return objective is to achieve CPI plus 4.5 per cent (before fees) over a rolling 10-year horizon.

The note is a financial liability for QTC (that is, it owes interest on this each year) and a financial asset for Queensland Treasury. The fair value of the note is adjusted to equal the same as the value of the QIC trust at year end.

Figure 4D summarises some of the main ongoing objectives of the Queensland Future Fund, as outlined in the Queensland Budget 2020–21.

|

Budget objective |

Progress assessment |

|---|---|

|

Provide for debt reduction |

As at 30 June 2022, no debt had been paid down from the Queensland Future Fund, consistent with 30 June 2021. |

|

Hold state investments for future growth |

The assets in the fund were further diversified across 2022. This included the further transfer of $67 million of investment in the Queensland Titles Registry to other government entities (in exchange for units in other QIC funds). The fund also purchased additional units in other QIC investments. These purchases diversified the fund to help manage liquidity, and to meet the asset allocation set for the fund. |

|

Offset state debt to support Queensland’s credit rating |

In QTC’s 2022 annual report, it reported that the credit rating agencies had reaffirmed the state’s and QTC’s credit ratings. |

|

Play a material role in the state’s management of its debt |

This cannot be assessed in the early stages of the Queensland Future Fund. Progress on this will be measured in future years. |

Note: One objective relating to the establishment of the fund has been excluded from Figure 4D, as it was fully achieved in 2020–21.

Compiled by the Queensland Audit Office.

Restructuring investments of the Residential Tenancies Authority

Some government authorities are partially or fully reliant on investment returns to fund their operations. In positive economic environments, this can be sustainable. But in times of economic uncertainty and fluctuations in returns (as seen in Australia and globally in recent years), the uncertainty around returns can constrain the entities’ ability to plan and fund their operations.

The Residential Tenancies Authority (RTA) is one such entity. It holds tenancy bonds (the bonds people pay up front before moving into rental properties), which it invests. It has not charged fees for this service, and it has historically relied on the returns from its investments to fund its operations, which included 200 full-time equivalent staff as at 30 June 2022.

For the year ended 30 June 2022, the investments held by the RTA made a loss of $52 million, which contributed to a $56 million operating loss for the year. The RTA also faced risks relating to cash flows, as the investment volatility was not matched by movement in its liabilities. All tenancy bonds in the liability were at a fixed amount and could be called for payment on demand, which placed further strain on its funding model. This contributed to instability for the RTA in managing operations, with the operating result fluctuating significantly over the last 4 years, as shown in Figure 4E.

To help provide certainty in the funding for RTA, the government announced in March 2022 that it would change its funding model, through an amendment to the Residential Tenancies and Rooming Accommodation Act 2008.

The amendment moved the tenancy bonds from within QIC investments held directly by RTA, to an RTA bank account (with no exposure to investment markets). This was facilitated through the Queensland Long Term Asset portfolio purchasing the QIC investments from RTA and providing the equivalent cash value in return. Following this change, the RTA will now be funded through annual grants from the government, as opposed to investment returns.

The transfer of the investments occurred in 2 stages, with the first on 1 July 2022 (based on the 30 June 2022 value of the investments). A further transfer occurred on 30 September 2022, based on any differences between the preliminary and final valuations of the investments at year end.

The government will also make an equity contribution (a cash contribution that adds to the equity balance of an entity and is not required to be paid back, unlike a loan) – estimated to be $55 million – to RTA during 2022–23. This is to top up the RTA’s assets so they fully cover the tenancy bond liabilities (which was not the case at 30 June 2022, due to the investment returns experienced).

Investing Queensland’s resources windfall

The increase in coal prices in recent years has seen the value of Queensland’s coal exports increase significantly (subsequently increasing related revenues and profits made by the state’s coal mining companies). This has had a flow-on impact in the amount of royalty revenue collected by the state.

The Queensland Budget 2022–23 also introduced 3 new coal royalty tiers from 1 July 2022, which the 2022–23 Budget Update estimated would generate additional royalty revenue of approximately $3 billion in 2022–23.

The additional revenue raised from coal royalties is expected to fund a range of investments, including:

- a $3 billion long-term asset held by the Consolidated Fund for future infrastructure in regional Queensland

- $1 billion in equity for investment in government owned corporations, to support regional infrastructure projects.

General government sector borrowings are forecast to increase by $31 billion to 2025–26. The expected increase in revenue means these borrowings are less than originally estimated in the 2021–22 budget.

Housing Investment Fund

In October 2022, the state government announced an additional $1 billion investment in the Housing Investment Fund. This is in addition to the original $1 billion allocated to the fund when it was established as part of the Queensland Budget 2021–22. The returns from this fund are to be used to support the ongoing delivery of social housing across the state.

In March 2023, the Queensland Government announced money from the Housing Investment Fund would be used to secure housing in Townsville and across South East Queensland through a partnership with a community housing provider. We will assess the operation of the fund in our 2022–23 report on debt and investments.