Overview

With uncertainty around future revenue sources, councils need to manage their costs and measure their performance to be sustainable in the longer term.

This report includes two fact sheets and a better practice tool to support councils. Tabled 25 September 2019.

Report on a page

Local governments (councils) deliver services that affect our daily lives. Many do so without an ability to improve their revenue from their rate payers. They are often a provider of last resort of services to regional communities and have legacy assets to maintain. They do so with limited recurrent financial resources as they may be dependent on government grants. This is particularly true for far western and Indigenous local governments.

We have highlighted the challenges for councils in our previous reports on financial sustainability. This is the third report in our sustainability series, and focuses on managing the costs of services to support long-term sustainability.

We audited five councils for this report on managing financially sustainable services. We have made recommendations to those councils as well as to the whole sector. Each council we audited has some elements necessary to effectively plan and deliver their collective services to support long-term sustainability. But none had all the components working together.

There are opportunities for councils to work together and with the department to share ways to plan services, allocate costs, and measure performance.

Service planning and working together

Planning for services helps councils to identify what level of service to the community they can afford. There are many benefits for councils in developing plans for their services:

- understanding the revenue they need to generate to make services financially sustainable

- understanding and adjusting service levels to manage costs

- managing and maintaining key infrastructure assets

- delivering effective and efficient services and assets that meet community needs.

Understanding the value of services

Understanding the value the community obtains from service delivery allows councils to change the level of services to manage their costs. It also helps guide decisions on new services and when to reduce or remove services.

Understanding the costs of services

Councils should make service-delivery decisions based on an understanding of the full cost of each service. Service costs include direct operating costs and a portion of corporate overhead costs. There are various scalable methodologies and tools available to allocate corporate costs.

Monitoring and reporting on services

Monitoring the financial and operational performance of services will identify ways to improve the efficiency and effectiveness of services. Councils can adjust costs and change service levels where necessary

Introduction

Our series of reports on sustainability highlights the financial challenges faced by local governments in meeting the needs of their community. We have previously produced reports on preparing long‑term forecasts, and the setting of rates and charges. This report focuses on managing the costs of services to support long-term sustainability. Our next report will be on strategic asset management.

Managing costs for financial sustainability

To be sustainable in the longer term, councils need to manage their costs within the amount of revenue they can earn. This is particularly important in an environment where there is uncertainty of future revenue sources, such as a reducing population to pay future rates, and dependence on grant revenue. Grants received by councils are often short term or one-off arrangements, yet they may use them to help finance long-term service commitments.

Councils usually commit to services over the longer term, especially those that use long life infrastructure assets. For example, investing in a swimming pool today will require maintenance and operation for its life of around 60 years. Councils must manage their costs to ensure that they do not spend more on these services over time than they earn from rates, grants, and fees and charges.

Having the right information on their costs allows councils to make informed decisions on how they spend their money. They can decide which services and the level of services to provide to the community within their available revenue. Councils can vary operating hours, assets used, frequency, and the quality of the service to manage their costs. Small savings across many services can improve a council’s financial position.

Council services

Councils deliver four essential services to the local community: roads, water, wastewater/sewerage, and waste collection. They do this directly or through joint ownership of entities. All other council services depend on the needs of the community.

The non-essential services vary across councils. More remote councils often provide services that the private sector delivers in more populous areas.

On average, the five councils provide around 27 services each. Operating hours and regularity of services vary at each council. Examples of the services these councils provide include:

- caravan and tourist parks

- airports

- parks and gardens

- museums, cinemas, and theatres

- swimming pools

- childcare and residential aged care centres and facilities

- quarries and gravel pits

- saleyards

- racecourses.

Appendix B lists the types of services that the councils we audited provide.

Councils do charge fees for some of their services that are operated as a business. This means they are expected to earn sufficient revenue from fees and charges alone to meet all business costs. A saleyard is an example of a service council may run as a business. Services that are not run as a business will sometimes have a fee or charge, but this is not expected to cover the full costs of operating the service, and a portion of the costs are covered from rates, grants or other general revenue.

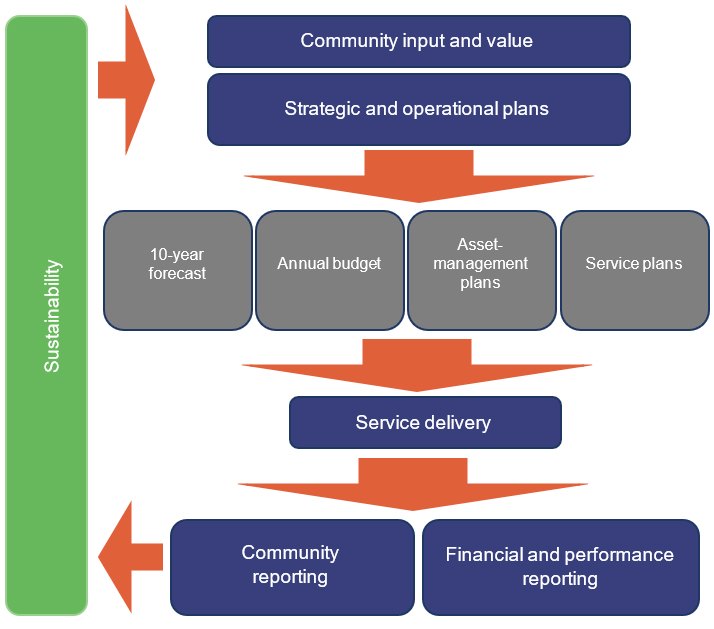

Planning for sustainability

Service planning fits within councils’ operational planning activities. Strategic plans provide the direction for the forecasts and plans—asset management and service—that support the delivery of services. Figure A shows how the different plans and activities that councils undertake support long-term financial sustainability.

Queensland Audit Office.

How we performed the audit

The objective of the audit was to assess whether councils plan and deliver their services to support long-term financial sustainability.

We assessed whether councils:

- develop robust approaches to planning and managing the costs of their services

- monitor and report on the costs and effectiveness of their services.

We conducted field interviews, reviewed key documents and performed data analysis.

We conducted the audit at the following five councils: Bundaberg Regional Council, Longreach Regional Council, Noosa Shire Council, Western Downs Regional Council, and Whitsunday Regional Council. We selected these councils because they have various challenges in delivering services, including varying population growth, economic activity and services.

We included the Department of Local Government, Racing and Multicultural Affairs in our audit, as it provides support and advice to councils. It provides the operating framework through legislation and regulation that aims to improve councils’ accountability, effectiveness, efficiency, and sustainability.

We spoke with Queensland Treasury Corporation because it provides financial services to local government, including financing, surplus cash management, and financial advice.

Queensland Treasury Corporation has developed specific local government forecasting and modelling templates, including a whole-of-life costing tool. Councils can use these templates to understand the long-term sustainability of projects used to deliver council services.

We spoke with the Local Government Association of Queensland (LGAQ) because it is a local government advocacy body, representing the broad objectives of Queensland local governments. LGAQ partners with councils to assist with advancing knowledge and accessing resources.

Appendix H contains further details about the audit objectives and our methods.

Summary of audit findings

How the five councils planned their services

Service planning

Councils decide how to deliver services, what services will cost, and how they will measure and monitor service performance. All five councils had some level of service-planning documents, either in individual service plans, annual operational plans, business unit plans, or asset‑management plans.

Two of the five councils can improve their plans by adding more detail to give council a clear understanding of all their services.

Regular reviews of services to confirm community needs

Consulting with the community on existing services and the cost of services can help councils to provide the right services at affordable levels to support long-term financial sustainability.

None of the five councils we audited reviewed their existing services regularly. They did not consult with the local community about the types or the levels of services needed now or in the future. However, all councils consulted with their communities about new services associated with major construction works or asset acquisitions.

Understanding the costs of services

Councils need complete costing information on individual services so they can be sure that services are affordable. The full cost of services includes direct operating costs and a reasonable allocation of corporate overheads.

All five councils identified the direct operating costs of their services. Two of the five councils knew the full cost of their services as they allocated reasonable corporate overheads to the appropriate services.

Two of the five councils did not have effective approaches to calculating the complete costs before setting their fees and charges for their services. This was because they did not allocate a reasonable proportion of the corporate overheads for all services.

One council has assessed that allocating 56 per cent of corporate overheads to services is sufficient for their decision making. This is lower than the 80 per cent or more allocated by two other councils we consider effective.

New services and changes to existing services

All five councils had approaches in place to consider the whole-of-life costs of new assets to deliver new or amended services.

There is an opportunity for councils to engage with their communities in the early design stage of significant projects. This would ensure that the services and service levels for all new services associated with new or upgraded assets were based on community input.

How the five councils monitored and reported on their services

Reporting on service budgets

One of the five councils reported budget information at the service level. This council and its senior management had clear line-of-sight to revenue and expenses for each of the council's services in the monthly budget reports.

The other four councils monitored and reported on their budgets at the business-unit level. Reports at a business-unit level include the performance of a group of services. The four councils did not have approaches in place to monitor and report on their expenditure and revenue against budgets of individual services except on an ad hoc basis.

Reporting on service performance

All councils used performance measures to monitor and report on their annual operational plans. However, none of the five councils had effective processes and systems in place to monitor and report on the effectiveness and efficiency of their services—internally to management and externally to the community.

Two councils had linked the performance measures in the annual operational plans directly to their services. This gave management measures on each service. However, many of the measures focused on tactical activities of business units rather than on strategic achievements or efficiency.

The other councils had designed their measures to monitor and report on the strategies in their annual operational plans or business plans but did not link them to their services. It was not possible for them to determine if they were managing and delivering individual services effectively and efficiently.

Audit conclusions

Each council had some elements necessary to effectively plan and deliver financially sustainable services. None of the five councils had all the elements working together. This affects their ability to effectively plan and deliver their services to support long-term sustainability.

Councils can work together to share ways to plan, deliver, and monitor their services.

Conclusions per council

Planning and managing the costs of services

Bundaberg Regional Council, Whitsunday Regional Council, and Noosa Shire Council had effective approaches in place to plan for their services for long‑term sustainability.

All five councils had some level of service planning either in their annual operational plans, business unit plans, service plans, or asset plans. Bundaberg Regional Council, Noosa Shire Council, and Whitsunday Regional Council had detailed information on their services, including services’ direct operating costs.

Whitsunday Regional Council and Noosa Shire Council allocated a reasonable proportion of their corporate overheads to services. Bundaberg Regional Council considers that allocating 56 per cent of corporate overheads to services is sufficient for decision making. However, this does not represent a reasonable proportion and increases the risk of incomplete service costs being used for decision making. Longreach Regional Council and Western Downs Regional Council are not effectively planning for their services as they do not understand their services’ full costs and do not allocate a reasonable proportion of their corporate overheads to services.

None of the councils had effective approaches in place to regularly review their services. They do not know whether their services meet the current or future needs of their communities.

Monitoring and reporting the costs and effectiveness of services

Longreach Regional Council effectively monitored operating costs at the service level. The other four councils monitored the budgets of business units, which represent multiple services. This could lead to missed opportunities to analyse the financial performance of services and make changes as necessary.

All five councils effectively monitored and reported on aspects of the effectiveness of some of their services. None of the councils effectively monitored or reported on the effectiveness and efficiency of all their services

Recommendations

Based on the findings from the audited councils, we developed some recommendations that all councils can consider.

All councils

We recommend all councils, especially those with a focus on improving sustainability consider whether:

1. they include sufficient details about their services within their existing planning documents or consider developing individual service plans (Chapter 2)

Details about services should be scaled to the size and complexity of council and include:

- how the service aligns to council’s strategy

- the service level (for example, operating hours)

- the assets used to deliver the service

- operational risks for the service

- operating costs and overhead costs.

2. all existing services meet their community's current and future service needs and they deliver them at affordable levels by developing and undertaking regular reviews of existing services (Chapter 1)

3. budget owners develop consistent individual business unit and service budgets by providing documented budget guidelines, templates, and training (Chapter 1)

4. they benchmark their corporate overheads and allocate a reasonable proportion to services by developing and approving a corporate overhead methodology appropriate to the size and complexity of council (Chapter 1)

5. they make decisions to deliver new services or amend existing services (associated with new major capital projects) with an understanding of the whole-of-life costs and any impact on corporate overheads

Councils could develop their own or adopt an existing project decision framework that includes community engagement on the need for and level of new services. They could use the Queensland Treasury Corporation project decision framework and whole-of-life costing tool to develop their own framework or work together to share existing frameworks and tools (Chapter 1).

6. they collect reliable and accurate information on the effectiveness and efficiency of their services.

Councils could develop a performance monitoring and reporting framework to support both internal management reporting to council and external reports to their communities (Chapter 2).

Department of Local Government, Racing and Multicultural Affairs

We recommend that the Department of Local Government, Racing and Multicultural Affairs supports councils to develop:

7. models, benchmarks, and tools that are scalable for differently sized councils to allocate their corporate overheads to their services (Chapter 1)

The department could, where appropriate, provide examples (templates), access to technical expertise and facilitate the development of tools for groups of councils.

8. a set of measures of effectiveness and efficiency to help councils monitor the performance of their services (Chapter 2).

The department could develop a set of standard measures of councils’ common services for reference. It could also facilitate groups of similar councils to share existing resources or coordinate the development of new resources in partnership with existing council networks.

Guidance

We developed a range of materials for councils to support them to implement our recommendations.

Appendix C—Prioritising service delivery

Appendix E—Measuring service performance

Appendix F—Allocating corporate overhead costs to services.

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to all 77 councils and the Department of Local Government, Racing and Multicultural Affairs. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from these entities are at Appendix A.

1. Service planning

Introduction

Councils can control or reduce their costs through understanding and actively managing their services. Managing the costs of each service, and adjusting the level of service provided as needed, will help to support financial sustainability.

Councils can incorporate service planning into existing planning documents or stand-alone service plans. Service planning involves identifying the services council provides, the users of the services, assets used to deliver the service, costs to operate, and performance measures.

Effective planning for services requires councils to understand the full costs of their services. The full cost of a service includes operating costs (which relate clearly and exclusively to a specific service) and corporate overhead costs (such as finance and information technology, which are shared between many services).

We examined how well the councils were planning for their services. This included how well they had:

- reviewed their services to understand if they were meeting their community's current and future needs

- identified all the costs (operational and corporate overheads) of delivering the services at the desired level and quality

- set their fees at a level that balanced the community benefit with the funding available from rates

- assessed all new services to identify benefits and risks and consider the whole-of-life costs of any assets needed.

Councils engage in both formal and informal consultations with their communities via correspondence, social media and surveys. Councillors also play an important role, engaging with the community on local and regional issues.

Service planning

We found that three of the five councils had effectively developed detailed plans for how they intended to use their resources to deliver services for their communities. These plans included information such as:

- why they were delivering the services

- who used their services

- when customers could access the service

- how much the services cost to operate

- where services were based, or the locations covered

- how they would monitor the contribution of the service to their corporate strategies and community outcomes.

In the three councils with detailed plans, the links were not always clear between their corporate and operational plans and the services the councils delivered.

The other two councils had some high-level information about their services in their asset‑management plans. For example, the asset‑management plans included a listing of the services delivered from each building asset. But the councils did not have enough detail about the costs of delivering their services at the expected service levels.

One council had clearly aligned all its services with its operational plan. This gave management the ability to focus on managing its services and the assets needed to deliver them.

If councils do not have detailed plans for their services, they may not be able to effectively manage them. They may not know if their services are supporting their vision for their communities.

Recommendation

We recommend all councils consider if they include sufficient details about their services within their existing planning documents or consider developing individual service plans.

Details about services should be scaled to the size and complexity of council and include:

- how the service aligns to council’s strategy

- the service level (for example, operating hours)

- the assets used to deliver the service

- operational risks for the service

- operating costs and overhead costs.

We have provided an example service plan in Appendix D.

Regular service reviews of community needs

We found none of the councils were regularly reviewing their existing services. They did not formally consult with their communities about the range of services they want now or in the future, or about the level of service the community is prepared to pay for. For example, councils did not formally consult with the community about how many days per week the library should open, even though a significant proportion of library-operation costs are for staff salaries and longer opening hours increase the service cost. Community consultation about the costs of each option and the impact of costs on either fees or rates could help councils to provide the right services at affordable levels.

We found examples of all five councils consulting with their communities about decisions to invest in new or amended assets and services. Four of the five councils had approved, current community engagement strategies or policies. None of the five councils had effective processes to consult with their community on the need for their existing services or the levels at which they should deliver their existing services.

There is a risk that existing services may not be meeting community needs, or that the service levels are wrong (too high or too low). Councils may miss opportunities to achieve cost savings they could redirect to improving or expanding frontline delivery, constraining rate increases, and enhancing overall sustainability.

All the councils had approaches to engage and consult with their community on emerging issues, new or amended services, and/or projects. For major projects that would deliver new or significantly amended services, councils considered whether community input was either required by legislation or necessary to inform council decisions.

Case study 1 shows how Noosa Shire Council engaged with the community to get input on a significant redevelopment project. The Park Road boardwalk project involved the replacement of approximately 400 metres of boardwalk from Little Cove beach access to Noosa National Park. The upgrade was to bring the boardwalk up to a standard that could provide for future growth in demand while having minimal disturbance on the adjacent natural area.

| Community engagement on the Park Road boardwalk |

|---|

|

Background Noosa Shire Council engaged in extensive community consultation on the Park Road boardwalk upgrade. Council wanted to fully understand the community’s needs and the impact of the new infrastructure. It also wanted to demonstrate environmental excellence and innovative construction solutions. The council engaged with Kabi Kabi/Gubbi Gubbi representatives, local environmental groups, and the surfing community, seeking input into how it could incorporate cultural heritage into the design of the upgrade. Consultation In October 2017, council approved a community engagement plan that incorporated:

Council completed the design work in March 2018 and construction in November 2018. Results As part of the design phase, council considered the various materials and long-term sustainability of the service by analysing the whole-of-life costs of various options. The extensive community consultation resulted in high-level community satisfaction. Conclusion By engaging with the community on the early design of the project, council was able to design the project to meet the community’s expectations. It was also able to use materials that will reduce maintenance costs across the life of the asset and reduce the need to increase rates. |

Queensland Audit Office, based on documents from Noosa Shire Council.

Recommendation

We recommend all councils consider if all existing services meet their community's current and future service needs and they deliver them at affordable levels by developing and undertaking regular reviews of existing services.

We have provided an example of a prioritisation tool in Appendix C.

Budgeting operating costs and overheads

We found all councils effectively identified and included direct operating costs in service budgets. However, three of the five councils did not know the full cost of delivering their services as they did not effectively allocate a reasonable proportion of their corporate overhead costs to their services. One of the three councils assessed that allocating 56 per cent of corporate overhead costs provides sufficient information for decision making. This is lower than the 80 per cent or more allocated by two other councils we consider effective.

Direct operating costs

We found all five councils effectively identified the direct costs of operating their services. They ensured that budgets included employee costs, operating expenses, and depreciation. Four of the five councils had documented budget guidelines or policies for staff on how to develop budgets. This helped those councils to develop their budgets consistently across all the different business units. It also ensured staff treated council-wide costs, such as depreciation and staff on-costs, consistently.

Noosa Shire Council expects staff to build budgets from a zero base (zero-base budgeting). Staff create a new budget each year and support budget lines with evidence of the anticipated expenses and revenue. Zero-base budgeting forces managers to explain how each budget item links to the service and removes funding for items no longer needed. This approach identifies waste and operations that no longer need funding. We do note, however, that this approach is time intensive and may not suit all councils.

At the other councils, staff built their budgets by reviewing the revenue and expenses from previous years and adjusting the figures using a percentage increase or decrease based on a council-wide analysis. We also observed individual services at Whitsunday Regional Council analysing forecast volumes on the impact of service budgets.

Recommendation

We recommend all councils consider whether budget owners develop consistent individual business unit and service budgets by providing documented budget guidelines, templates, and training.

Corporate overheads

We found two councils allocated 80 per cent or more of their corporate overhead costs to their services. This provides a reasonable allocation of corporate overheads and effective costing information.

One council allocated 56 per cent of their corporate overhead costs to their services. They have assessed that this provides materially accurate costing information. However, this does not represent a reasonable allocation of corporate overheads and is lower than the 80 per cent or more allocated by the two councils we consider effective.

Two councils did not allocate sufficient corporate overheads to their services (four to 22 per cent).

Figure 1A shows the allocation of corporate overheads to services by council. Whitsunday Regional Council and Noosa Shire Council allocated the greatest proportion of their corporate overheads at 95 per cent and 80 per cent respectively.

Not allocating a reasonable proportion of corporate overheads reduces councils' understanding of the full cost of their services. This reduces their capacity to meaningfully compare the costs of their services with other councils and the private sector. It also affects the accuracy of information when councils make decisions to:

- expand or reduce existing services

- outsource services to the private sector

- discontinue unaffordable services that no longer deliver value.

Assembled by Queensland Audit Office from council budget reports.

Two councils excluded governance costs from the corporate overhead costs allocated to services. They considered that the costs of operating the council and the cost of complying with various legislative requirements did not reflect the true cost of delivering its services to the community. The types of governance costs they did not allocate included:

- council management

- salary costs for the mayor, councillors, and the chief executive officer

- the costs of supporting councillors

- preparing financial statements.

We acknowledge there are some governance costs that would exist for council whether they delivered the services themselves or outsourced all services.

We observed two different approaches to allocating corporate overhead costs.

Some councils allocated corporate overhead costs based on an estimate of how much time corporate staff spent supporting council services. For example, if the finance branch estimated they spent 30 per cent of their time supporting the saleyards, 30 per cent of the finance budget was allocated to the saleyards.

Some councils identified other ways to allocate the corporate overhead costs. A common way to allocate the cost of information technology (IT) overheads was the number of devices used to deliver a service. The more devices (computers, printers, iPads, and servers) needed for a service, the more support the service would need from the IT branch. For example, if the library had five per cent of all IT devices across council, the council allocated five per cent of the cost of the IT overhead to the library.

We have developed guidance for councils on different methodologies for allocating corporate overheads. Councils should adopt an approach that is scalable to their business. We have provided examples of cost allocation methodologies in Appendix F.

Recommendation

We recommend all councils consider whether they benchmark their corporate overheads and allocate a reasonable proportion to services by developing and approving a corporate overhead methodology appropriate to the size and complexity of council.

We recommend that the Department of Local Government, Racing and Multicultural Affairs supports councils to develop models, benchmarks, and tools that are scalable for differently sized councils to allocate their corporate overheads to their services.

The department could, where appropriate, provide examples (templates), access to technical expertise and facilitate the development of tools for groups of councils.

We have provided examples of cost allocation methodologies in Appendix F.

Fees and charges

Councils can fund services from a combination of rates, grants, and fees and charges. Councils set fees and charges based on several factors such as customers’ ability to pay, changes in costs, and pricing of similar services. Cost is one element in setting fees and charges. Using the full cost of the service will help inform councils’ decisions on fees and charges. Councils can then also understand the effect on the contribution from rates revenue.

We found that three of the five councils did not effectively consider the full cost of their services before setting their fees and charges. This was because they had not allocated a reasonable proportion of corporate overheads for all services.

New services and changes to existing services

We found that all five councils had approaches in place to consider the whole-of-life costs of new assets to deliver new or amended services. Three of the five had formal, documented project decision frameworks to ensure consistency of information on the benefits, risks, and full operating costs of proposed new assets.

Councils with formal project decision frameworks consistently assess proposals for new or renewed assets. Considering the whole-of-life cost of owning the asset and operating the service gives council a full understanding of what it will cost before they decide to build or remodel.

The frameworks we observed included:

- clear governance roles and responsibilities for decision making on the sustainability of council assets and affordability of associated services

- a project management office that provides centralised leadership and coordination of the framework and reporting

- tools and templates for project proposals, transparent reporting, cost management, and performance reporting of projects and programs

- consistent methodologies for the delivery of projects.

We observed that the frameworks did not align with the councils' community consultation frameworks and policies. There is an opportunity for councils to engage with their communities in the early design stage of projects. This would ensure that services and service levels are based on actual community needs, not on historical levels or instinct.

We observed one example where a council analysed service variations to an existing service. Previously, the council owned but did not operate the Dalby and Chinchilla cinemas. Case study 2 shows how the council considered the costs of the service in its decisions to operate the service.

| Dalby and Chinchilla cinemas |

|---|

|

Western Downs Regional Council owns cinemas in Dalby and Chinchilla. The cinemas contribute to council’s strategic priorities of strong economic growth, active vibrant communities and great liveability. Council decided to manage and operate its cinemas in-house from 1 August 2018, rather than continue with private sector operation. Council did this because they identified from community feedback, declining patronage and a poor range of offerings that the service was not meeting the community’s needs. There was a risk that people were leaving the local community to watch movies and spending their time and money away from Western Downs. The cinemas contribute to the local economy by encouraging residents to support local businesses while attending the movies. Having a local service also encourages a sense of community and liveability. Decision to change the service To make this service decision, council undertook a service options analysis to examine the following scenarios:

Council analysed the pros and cons of each scenario, including its financial impact to the community. It decided that although the service was not breaking even, the service had significant benefits to the community. Council brought the operation back in-house to understand the full costs of operating the cinemas. This will give council an opportunity to analyse the operating costs and benefits of the service. It will be able use this information to inform any future decisions to consider outsourcing of the service to a private operator. Council took over operation of the theatres on 2 August 2018. Council states that revenue for 2018–19 has increased by 12.3 per cent on 2017–18. Considerations Council could also consider, where appropriate the:

|

Queensland Audit Office from council documents.

Recommendation

We recommend all councils consider whether they make decisions to deliver new services or amend existing services (associated with new major capital projects) with an understanding of the whole-of-life costs and any impact on corporate overheads. Councils could develop their own or adopt an existing project decision framework that links with their community engagement policy.

Councils could develop their own or adopt an existing project decision framework that includes community engagement on the need for and level of new services. They could use the Queensland Treasury Corporation project decision framework and whole-of-life costing tool to develop their own framework and tools or work together to share existing frameworks and tools.

2. Service monitoring and reporting

Introduction

Measuring performance enables councils to monitor if performance is stable, declining, or increasing. Importantly, this allows councils to take corrective action, prioritise resources to services that are effective and efficient, and consider alternatives for inefficient or ineffective services that are not delivering value to the community or are risking their long-term sustainability.

Measuring performance also gives councils the information they need to prompt a review of costs. Efficiency measures have a strong link to cost management and will tell councils the cost of delivering a unit of the service. Councils can benchmark cost with other councils or operators to understand if the council is spending too much or too little on the service.

Reporting on financial performance

We found that four of the five councils monitored and reported on their budgets at the business unit level. They did not have effective approaches in place to monitor and report on budgets of individual services.

One council had structured its annual operational plan and budget on its services. This council and its senior management had a clear line-of-sight to revenue and expenditure for each council service in the monthly budget reports.

The other councils reported on the budgets of individual business units each month. Council business units may be responsible for delivering multiple services to the community. Monthly reporting on business unit budgets allows councils to hold the managers accountable for any budget variances. However, councils may not see variations in the operating costs of individual services, as under-spends in one service may cancel out over-spends in another.

The risks of not reporting on budgets at the service level are that councils:

- focus on the financial position of the business unit as a group of services

- miss an opportunity to analyse the financial performance of services provided to the community and make changes as necessary

- do not identify underperforming or unaffordable services.

If it is not practical for councils to monitor budgets at the service level every month, then periodic analysis of individual service budgets would help to mitigate risks.

Reporting on effectiveness and efficiency

We found that the five councils did not have effective processes and systems in place to monitor and report on the effectiveness and efficiency of business units and services. Councils reported internally to management and externally to the community on some measures of effectiveness and efficiency of their services. However, there were gaps in the information as they did not report at least one measure of effectiveness and efficiency for each service.

Many of the measures in council reports focused on the tactical activities of business units rather than on outcomes for the community, supported by effectiveness and efficiency assessments. The community and council require a balance of effectiveness and efficiency measures to adequately assess the performance of services.

When councils use a mix of measures to monitor both the effectiveness and efficiency, they are more able to demonstrate they are using public resources well. This allows senior management and council to intervene and implement corrective action where a service is ineffective or inefficient.

Figure 2A shows our assessment of the performance measures councils use to monitor their services. We reviewed how many measures councils report in the planning documents including operational plans and service catalogues. We found many measures focused on day‑to‑day activities (input measures, for example the number of meetings held) and did not provide insights into the effectiveness and efficiency of the service delivery to the community.

| Council | Number of activity measures | Number of effectiveness measures | Number of efficiency measures | Number of measures with no data | Number of measures |

|---|---|---|---|---|---|

| Bundaberg Regional Council | 32 | 60 | 0 | 2 | 94 |

| Longreach Regional Council | 238 | 114 | 2 | 0 | 354 |

| Noosa Shire Council | 12 | 49 | 29 | 0 | 90 |

| Western Downs Regional Council | 57 | 60 | 3 | 0 | 120 |

| Whitsunday Regional Council | 72 | 27 | 0 | 1 | 100 |

Note: Councils may report efficiency measures in other documents such as directorate reports; however, they were not aligned with their operational plans or council services.

Queensland Audit Office.

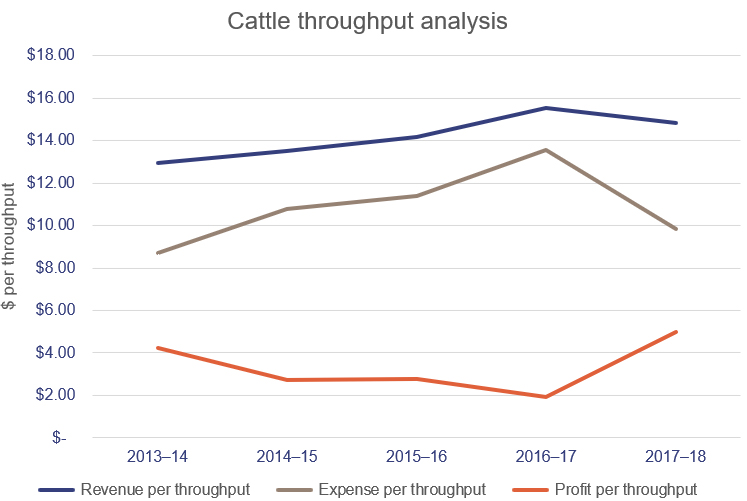

Western Downs Regional Council owns and operates the Dalby regional cattle saleyard. The service has been running for over 75 years and is one of Australia’s largest saleyards, with average annual sales of more than 200,000 cattle. Case study 3 shows the value of analysing performance for decision making about services.

| Monitoring the efficient performance of Western Downs Regional Council’s saleyard |

|---|

|

Western Downs Regional Council operates the saleyard as a commercial business. It expects to meet its costs from revenue from customers and make a profit. To determine the prices it charges to its customers, council has developed a 10-year pricing model, which is reviewed annually. The pricing model aims to provide an appropriate level of profit or returns over a long period. Council monitors the service through bi-monthly Saleyard Advisory Committee meetings. The committee reports to council on the performance of the service as well as any operational issues. The committee monitors and reports on the monthly cattle throughput and profitability. But there are no service operational targets, effectiveness measures, or efficiency measures to help inform service decision making. By measuring appropriate efficiency measures, council can make more informed cost decisions and demonstrate the value of its service to the community. Council could also consider other benefits of a service that brings business into the community when making any future decisions about the value of the service. Our analysis of the efficiency measures for the service The key activity to be measured for saleyard efficiency is cattle throughput. Council could report on the efficiency of the saleyard service by reporting on revenue/expense/profit per throughput. This will show areas most affected by throughput changes and can highlight areas of focus for council. We identified five key financial measures and the average annual movement over the past five years:

Total expenses on average per annum are increasing in-line with annual average revenue increases over the past five years. The average increase to net profit per annum is 31 per cent. This increase to net profit is primarily due to a 26 per cent increase in throughput levels in the 2018–19 financial year compared with 2017–18. |

Queensland Audit Office.

Guidance on measuring performance

Each council has its own approach to measuring performance. None of the councils had frameworks or policies to guide staff on how to develop measures of effectiveness or efficiency.

Taking different approaches to measuring the effectiveness and efficiency of council services reduces councils’ ability to compare their services. There is an opportunity for councils to work together and share the workload of developing and testing rigorous measures. A consistent approach could also help all councils to improve the efficiency and effectiveness of their services.

We recognise that the varying size and nature of councils across our vast state means that comparing performance may not always be appropriate. However, councils of similar size and circumstances or within similar geographic regions may find comparisons helpful.

We have developed guidance for councils on how to measure the effectiveness and efficiency of their services. Appendix E outlines the key principles to consider in developing measures of service performance and includes some examples.

Recommendation

We recommend all councils consider whether they collect reliable and accurate information on the effectiveness and efficiency of their services.

Councils could develop a performance monitoring and reporting framework to support both internal management reporting to council and external reports to their communities.

We recommend that the Department of Local Government, Racing and Multicultural Affairs supports councils to develop a set of measures of effectiveness and efficiency to help them monitor the performance of their services.

The department could develop a set of standard measures of councils’ common services for reference. It could also facilitate groups of similar councils to share existing resources or coordinate the development of new resources in partnership with existing council networks.

We have provided guidance for developing measures in Appendix E.

2018 local government dashboard

Our interactive map of Queensland allows you to search and compare councils to view their financial performance and sustainability indicators.

Glossary

| Term | Definition |

|---|---|

| Annual operational plan | The annual operational plan for a local government specifies how it will implement its five-year corporate plan during the period of the annual operational plan. The plan must be consistent with its annual budget, and state how it will manage operational risks. |

| Asset-management plan | The asset-management plan defines the assets that council uses to deliver its services. This is a comprehensive overview of the long-term forecasting of estimated capital expenditure and provides strategic direction for achieving the long-term corporate plan. |

| Corporate overheads | Corporate overheads are the back-office costs associated with the operations of the council. This encompasses costs relating to human resources, finance, asset management, information technology, fleet and so on. The overheads relate to providing both internal and external council services. When a business allocates overheads to its services, they can accurately understand all the costs of delivering the service. Businesses generally allocate overheads using cost drivers in a corporate overhead model. |

| Corporate plan | The corporate plan defines the strategic direction and vision of the council for a minimum period of five years. It specifies key performance indicators to measure the council’s achievements. This document provides accountability of the council to the local community. |

| Project decision framework | A framework that guides the governance arrangements (who makes the decisions) and methodology requirements (the information they need) that councils use to make decisions on project concept development, options analysis, feasibility, risks, and benefits. The frameworks typically define the role of a project board and provide tools and templates to ensure consistent analysis of proposed projects. Queensland Treasury Corporation has a project decision framework and tools for councils to adapt and adopt. |

| Service | A service is a group of actions or effort performed to satisfy a public need or fulfil a public demand. A service aims to provide value to the community. A service can comprise a series of activities and be delivered from an individual or group of assets and resources. |

| Service plan | A service plan outlines the activities used by council to deliver a service to its community. The service plan includes information on defining service objectives, level of service, department/branch the service is categorised under, cost centres, future demand analysis, risk management, performance metrics, and life cycle management (assets involved in providing the service). The service plan can be a separate document or form part of other council planning documents (such as the annual operational plan or asset-management plans). There is no legislative requirement for councils to develop service plans. |

| Sustainability | Sustainability is the view of long-term viability. Councils need to be able to sustain a positive financial position for future generations. Council should have appropriate funds to deliver services that provide economic, environmental, and social benefit to the community. Sustainability is integral as councils have finite resources and need sufficient funds to continue essential operations if financial risks materialise in the event of adverse financial conditions. |