Overview

Most public sector entities, including departments, statutory bodies, and government owned corporations and the entities they control, prepare annual financial statements and table these in parliament. This report includes the results for all Queensland state government entities, and evaluates the quality and timeliness of financial reporting for departments. Tabled 27 November 2019.

Report on a page

Results of our audits

This report summarises the results of audits of Queensland state government entities for 2018–19, including the 21 government departments.

The financial statements of all departments and government owned corporations, and most statutory bodies and controlled entities, are reliable and comply with relevant laws and standards.

Most government departments have robust financial reporting processes and systems, allowing them to produce their financial statements in a timely manner. There is room to improve quality assurance processes, with six departments making changes to their final draft financial statements. They should only make changes if they will influence a reader’s understanding.

The state government entities’ controls for financial systems and processes are generally effective, which means management can rely on them when preparing financial statements. We also rely on the controls for our audits.

We raised several matters with entities relating to controls over information systems, financial delegations and conflicts of interest for procurement processes, asset valuations and payroll monitoring.

Departments are prepared for new accounting standards

Departments have prepared well for implementing the new accounting standards for revenue and leases that took effect on 1 July 2019.

Assets and liabilities are both expected to increase by around $2 billion following the introduction of the new lease standard. The Department of Housing and Public Works manages office accommodation for the state and will record most of the changes from the new standard.

Fraud attempts are increasing

There was an increase in fraud attempts this year, mostly relating to requests to change employee and supplier bank account details. Entities must ensure they check all change requests with an independent source. Where frauds occurred, the requests had not been checked effectively.

Strong information systems controls are critical

Information systems continues to be the area in which we identify most issues, particularly in relation to user access to systems and governance over the transfer of information to new systems. For user access we commonly find that:

- employees have been given system access beyond what is required to perform their job, including activities that should be performed by two different people

- there should be more monitoring of an employee’s access and activities within a system, to ensure they are consistent with their job responsibilities and appropriately approved.

Actions for entities

From our analysis of the sector, we identified the following actions for all entities to consider.

Decrease risk of fraud by checking requests to change employee and supplier details

Entities should treat all employee and supplier change requests cautiously, especially requests to change bank account details, as they increase the risk of fraud. When a request is received from a supplier, entities should:

- phone the supplier using a contact number obtained from an independent source, such as the supplier’s website or the White Pages directory

- check the letter that initiated the change for likely errors in details, such as supplier’s name, address, phone number, website, email contact details; financial controller’s or chief financial officer’s name; and remittance email address.

Secure information systems

Entities should secure information systems to prevent unauthorised user access that could result in fraud or error. They should consider:

- assigning employees the minimum access required to perform their job, ensuring that important stages of processes are not performed by the same person

- reviewing user access regularly to ensure it remains appropriate

- monitoring activities performed by employees with privileged access (which is held by users who can access sensitive data and create and configure within the system) to ensure they have been appropriately approved.

Control the transfer of information to new systems

To ensure there are no errors when moving information to a new system, entities must ensure they establish a robust governance process to oversee the project, with:

- an approved governance framework

- a project committee, with enough time and appropriate skills and experience to oversee the project

- a project plan that is supported by detailed risk assessments and task plans and includes assurance processes

- regular reporting to facilitate timely decision-making.

Strengthen procurement processes

Entities should ensure all procurement is appropriately approved and any conflicts of interest are declared and managed. To strengthen procurement practices, entities should:

- regularly review the appropriateness of financial delegations, ensuring controls adequately detect and prevent delegates exceeding their approved delegation limit

- educate employees on the importance of declaring conflicts of interest and how to recognise them, providing an appropriate means to report and record these.

Review payroll reports and reconciliations in a timely manner

Payroll reports and reconciliations should be regularly reviewed to ensure payments made to employees are correct, and any fraud or error is promptly detected.

Improve financial statements

We encourage all entities to bring forward audit committee endorsement and management approval of proformas (early draft financial statements). This will assist in ensuring potential issues are effectively resolved in a timely manner by year end.

We also encourage entities to only alter their draft financial statements if the change will improve a reader’s understanding of their financial operations.

Monitor audit recommendations for implementation by the agreed date

We encourage audit committees to monitor whether management undertakes corrective action in a timely manner to resolve all reported issues and meet agreed milestones.

Use data analysis to prevent and detect fraud in grant programs

We encourage all entities to explore the use of data analysis to:

- better understand the nature of their grant programs and associated risks

- develop expected patterns for grant applications

- identify grant applications that may indicate fraud and warrant further investigation

- continuously learn from confirmed fraudulent applications.

1. Entities in this report

Queensland Audit Office.

The report also evaluates the quality and timeliness of financial reporting for departments. Our assessment of controls over financial systems and processes (internal controls) focuses on departments. We also comment on high-risk issues identified at statutory bodies and controlled entities.

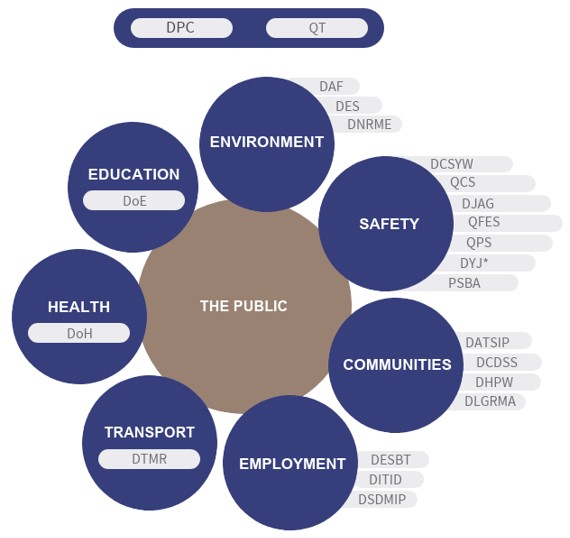

Note: DAF—Department of Agriculture and Fisheries; DES—Department of Environment and Science; DNRME—Department of Natural Resources, Mines and Energy; DCSYW—Department of Child Safety, Youth and Women; QCS—Queensland Corrective Services; DJAG—Department of Justice and Attorney-General; QFES—Queensland Fire and Emergency Services; QPS—Queensland Police Service; DYJ—Department of Youth Justice; PSBA—Public Safety Business Agency; DATSIP—Department of Aboriginal and Torres Strait Islander Partnerships; DCDSS—Department of Communities, Disability Services and Seniors; DHPW—Department of Housing and Public Works; DLGRMA—Department of Local Government, Racing and Multicultural Affairs; DESBT—Department of Employment, Small Business and Training; DITID—Department of Innovation and Tourism Industry Development; DSDMIP—Department of State Development, Manufacturing, Infrastructure and Planning; QT—Queensland Treasury; DPC—Department of the Premier and Cabinet; DTMR—Department of Transport and Main Roads; DoH—Department of Health; DoE—Department of Education.

* DYJ established on 31 May 2019 and has not been assessed in this report.

Queensland Audit Office.

Our assessment of the quality and timeliness of financial reporting and internal controls of government owned corporations, Seqwater, Queensland Rail, and hospital and health services are included in our sector reports on our website at www.qao.qld.gov.au/reports-resources/reports-parliament.

In this report, we also assess some significant initiatives of departments that are designed to deliver on the government’s priorities, including:

- supporting employment through the Back to Work program

- making the transition to the National Disability Insurance Scheme

- transitioning privately operated prisons to the public model

- dispersing the waste disposal levy

- facilitating the National Redress Scheme.

2. Results of our audits

This chapter provides an overview of the audit opinions we issued for each Queensland state government entity. It includes a separate assessment for departments, reporting on the timeliness and quality of their financial reporting and the implementation of their year end processes.

This chapter also highlights our areas of audit focus for 2018–19—the implementation of the new accounting standards, and asset valuations.

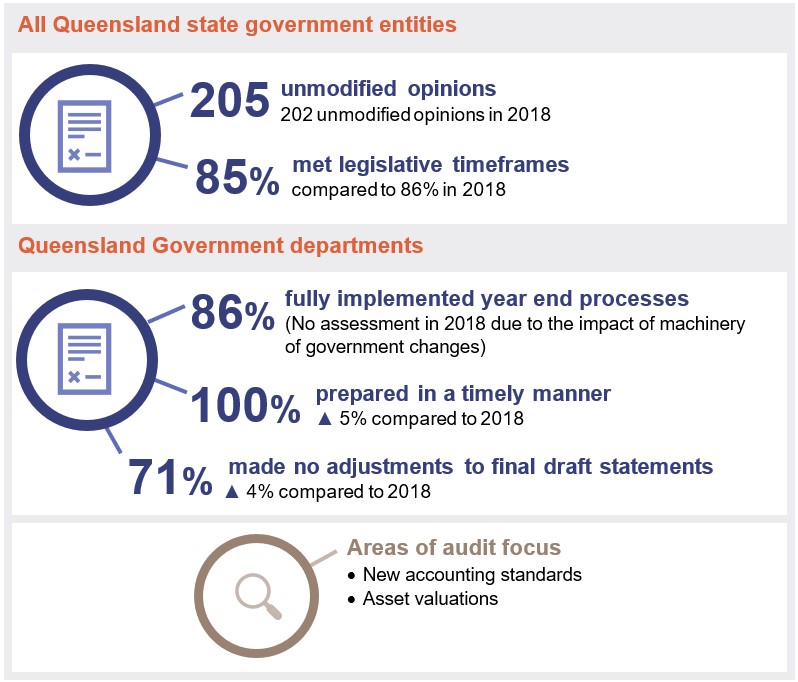

Chapter snapshot

Chapter summary

All departments and government owned corporations, and most statutory bodies and controlled entities, received unmodified audit opinions, meaning their financial statements can be relied on by readers. They provided their draft financial statements to us in a timely manner. This is reflective of the robust financial reporting processes and systems in place across the sector. All departments prepared well for the implementation of new accounting standards this year.

There are still areas for improvement, including refining quality assurance processes to reduce the number of changes to financial statements, and the early involvement of audit committees in the review of financial statements.

While all major public sector entities continued to meet their legislative timeframes for financial reporting, opportunities still exist to prepare their financial statements earlier. We encourage all entities to continue to adopt and refine strategies that enhance their year end financial reporting processes.

Ways of improving year end processes include:

- implementing robust month end processes for internal reporting

- bringing forward key audit milestones

- ensuring timely audit committee review of financial statements

- performing earlier asset valuations and providing prompt feedback to valuers.

These processes will support a more streamlined year end financial statement preparation process and enable relevant and reliable information to be available to the community as soon as possible after 30 June each year.

Audit opinion results for all state entities

We issued unmodified opinions on 96 per cent of the 2018–19 financial statements audited at 31 October 2019. All the major entities of the state received unmodified audit opinions.

We express an unmodified opinion when the financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

We express a modified opinion when financial statements do not comply with the relevant legislative requirements and Australian accounting standards and, as a result, are not accurate and reliable.

| Entity type | Unmodified opinions | Modified opinions | Opinions not yet issued |

|---|---|---|---|

| Departments and entities they control (controlled entities) | 31 | 0 | 2 |

| Government owned corporations and controlled entities | 16 | 0 | 0 |

| Statutory bodies and controlled entities | 116 | 8 | 16 |

| Jointly controlled entities | 3 | 0 | 2 |

| Entities audited by arrangement | 39 | 0 | 2 |

| Total | 205 | 8 | 22 |

Queensland Audit Office.

Appendix C lists Queensland state public sector entities and the opinions we issued on their financial statements.

Modified audit opinions

We issued eight modified opinions in 2018–19, including three disclaimers and five qualified opinions.

The disclaimers relate to three small water boards and highlight the lack of appropriate evidence for the auditor to form an opinion on the financial statements. The three water boards also failed to meet the minimum reporting requirements published by Queensland Treasury.

The five qualified opinions relate to two hospital foundations, two water boards, and a training college. Qualifications relate to:

- property, plant, and equipment balances not being reported in accordance with the Australian Accounting Standards Board (AASB) standard 13 on Fair Value Measurement

- incorrect carrying amounts reported for property, plant, and equipment in accordance with AASB 116 Property, Plant and Equipment

- a lack of control over the receipt of monies limiting our ability to confirm the accuracy and completeness of revenue.

Emphasis of matter

We included an emphasis of matter in our audit reports on 40 financial statements

(2017–18: 47). An emphasis of matter highlights areas we believe users need to be aware of, but it does not modify the audit opinion. We highlighted that:

- only certain accounting standards were used in the preparation of the reports, and the reports were not intended for other users (referred to as ‘special purpose financial statements’)

- uncertainty exists over whether an entity is going to be able to pay its debts as and when they fall due

- the entity has been deregistered, dissolved, or ceased.

The AASB is considering whether to remove the ability to prepare special purpose financial statements. Public sector entities currently preparing them should monitor this and consider the impact of any proposed changes.

Opinions not yet issued

Appendix H lists those entities whose audits are not yet complete. Most of these entities are small and are not consolidated in the Queensland whole-of-government’s financial statements.

Finalisation of overdue financial statements

We also issued seven of the 18 audit opinions for financial statements from prior years that were outstanding as at 31 October 2018. The remaining 11 financial statements continued to be outstanding as at 31 October 2019. The seven audit opinions issued included one qualified opinion on a small water board, relating to the valuation of property, plant, and equipment assets.

Entities exempted from audit by the Auditor-General

A Queensland public sector entity may be exempted from audit by the Auditor‑General for a financial year. This occurs where the Auditor-General deems an entity to be small and of low risk to the Queensland Government as a whole. Exempt entities are still required to engage an appropriately qualified person to audit their financial statements.

This year, 12 Queensland state public sector entities were exempted from audit by the Auditor‑General (2017–18: 23). We have listed them in Appendix D.

Entities not preparing financial statements

Not all Queensland public sector entities produce financial statements. This year, 184 entities were not required, either by legislation or the accounting standards, to prepare financial statements (2017–18: 125). We have identified them in Appendix G.

Machinery of government changes in 2018–19

Transfers of functions between departments are referred to as machinery of government changes. On 20 May 2019, the Department of Youth Justice was established under a machinery of government change. Its core service is to deliver the whole-of-government youth justice strategy.

Core youth justice operations, and supporting assets of $336 million, were transferred to the new department from the Department of Child Safety, Youth and Women on 31 May 2019.

The Department of Youth Justice has an approved extended accounting period of 13 months for 2019–20. As a result, the department did not prepare 2018–19 financial statements.

Legislative timeframes for all entities

All departments, government owned corporations, and large statutory bodies met their legislative timeframes for certification of their financial statements. (We have listed these deadlines in Appendix C.)

The 30 entities that did not meet their legislative timeframes were small statutory bodies, controlled entities, and entities audited by arrangement.

| Entity type | Met the timeframe | Missed the timeframe | No legislative timeframes | Not yet due |

|---|---|---|---|---|

| Departments and controlled entities | 29 | 1 | 2 | 1 |

| Government owned corporations and controlled entities | 13 | 1 | 2 | 0 |

| Statutory bodies and controlled entities | 112 | 28 | 0 | 0 |

| Jointly controlled entities | 0 | 0 | 5 | 0 |

| Entities audited by arrangement | 15 | 0 | 25 | 1 |

| Total | 169 | 30 | 34 | 2 |

Queensland Audit Office.

Effectiveness of departments’ financial statement preparation

All departments implemented year end processes that resulted in the timely delivery of draft financial statements.

The quality of financial statements improved this year. Last year, machinery of government changes affected financial statement processes and the timeliness and quality of draft financial statements. We continue to discuss areas for improvement with departments.

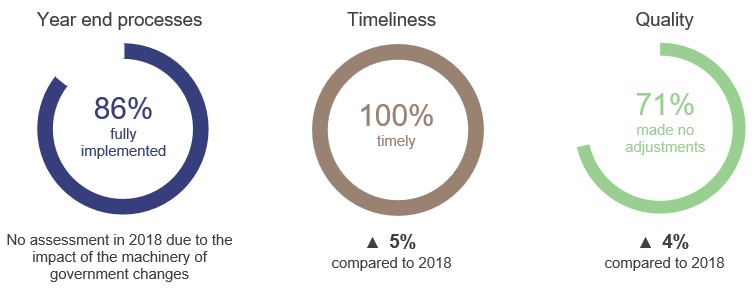

Figure 2C summarises our assessment of the financial statement preparation processes for Queensland Government departments.

Queensland Audit Office.

Our assessment of year end processes, timeliness, and quality for departments is outlined in Appendix E.

Most departments fully implemented year end processes by the target date. Three departments experienced delays in finalising their asset valuations and resolving accounting issues.

All departments prepared draft financial statements in a timely manner, achieving timeframes set by management and delivering the first complete draft of the financial statements to auditors by the agreed date.

One department required a significant adjustment to tax balances in their final draft financial statements (2017–18: no significant adjustments).

We encourage departments not to amend their financial statements for immaterial adjustments. This year, departments made changes to various aspects of their financial statements that had no impact on a reader’s understanding of the statements. Making unnecessary changes may impact on the overall timeliness and cost of the financial statement finalisation process and increase the risk of preparation errors.

Action for all entities

We encourage all entities to bring forward audit committee endorsement and management approval of proforma (early draft financial statements). This will assist in ensuring potential issues are effectively resolved in a timely manner by year end.

We also encourage entities to only alter their draft financial statements if the change will improve a reader's understanding of their financial operations.

Financial statement preparation maturity model

We have developed a new model for assessing the maturity of financial statement preparation, which we will introduce from 2019–20 (see Appendix F). The financial statement preparation maturity model will replace our traffic light method of assessing the effectiveness of financial statement preparation processes, and reviewing year end processes and the timeliness and quality of financial statements. The new model focuses on four components:

- quality month end processes and reporting

- early financial statement close processes

- skilled financial statement preparation processes and use of appropriate technology

- timely identification and resolution of financial reporting matters.

The model assesses components by assigning a level of maturity, which ranges from ‘developing’ to ‘optimised’. We will encourage entities to use the model to evaluate their expected level of maturity and benchmark their actual level of maturity. The model will highlight improvement opportunities for entities.

Areas of audit focus

Our audits focus on areas that present a higher risk of fraud or error in the financial statements. The risk of fraud or error increases with increased complexity or subjectivity in decisions, or when the sector experiences significant changes. In departments, we focused on the implementation of new revenue and lease accounting standards and on the valuation of assets.

New revenue accounting standards

Overall, departments have taken appropriate action to understand the new accounting requirements and analyse their revenue sources to determine their impact.

The AASB 15 Revenue from Contracts with Customers and AASB 1058 Income of Not-for-Profit Entities standards take effect from 1 July 2019 for not-for-profit entities. These standards will apply to departments preparing financial statements for 2019–20. Queensland Treasury’s policy does not allow for early adoption of these standards.

The new standards are more complex than the previous equivalent standards. Their main impact is to change the timing of when revenue is recognised to when services are delivered. Certain complex criteria must be met to allow revenue to be deferred, and entities must review all their revenue contracts and arrangements to determine if the requirements have been met.

Revenue sources for departments mainly include appropriations (allocated by government), grants and contributions (received for specific purposes), user charges, royalties, and licence fees.

Most departments have assessed that the new standards will not significantly change the timing of their revenue recognition.

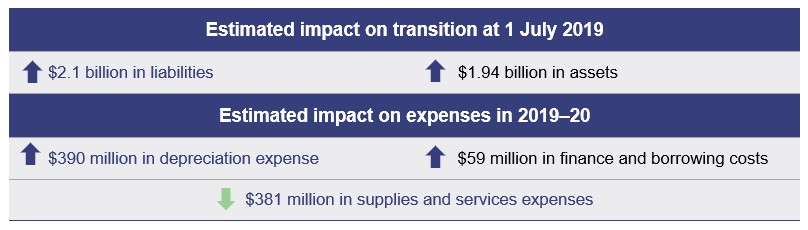

New lease accounting standard

All leased assets and liabilities will be reported on the balance sheet following the introduction of this new standard.

From 1 July 2019, the new accounting standard AASB 16 Leases requires all leases to be recognised on the balance sheet as right-of-use assets and lease liabilities. This changes the timing for recognising the expenses for the leased assets, and they are expected to be higher at the start of the lease period, reducing over time.

Queensland Government departments obtain access to office accommodation through the Department of Housing and Public Works (DHPW), which has the right to relocate entities at any time (if there is a whole-of-government benefit). As a result, it will recognise these leases in its financial statements on behalf of the other state government entities. This will have a significant impact on its financial position and result from 2019–20 onwards, as shown in Figure 2D.

Queensland Audit Office.

Valuation of assets

For most entities, land, buildings and infrastructure are the largest asset classes on the balance sheet and are reported at fair value in compliance with AASB 13 Fair Value Measurement.

Complex valuation methodologies are applied to government assets, including infrastructure assets, and some asset classes are difficult to value due to their nature, for example, land under roads. The inputs to valuation models are subjective and are reliant on significant estimates and management judgements. As a result, the risk of error in the calculations or estimates is higher.

We focus our audit attention on these transactions, assessing valuation methodology (including key assumptions), the number of years an entity expects to use an asset, and the cost to replace it.

This year, we did not identify any significant (high-risk) issues. However, we did identify deficiencies relating to asset valuations, including incorrect and incomplete data in asset registers, no monitoring of the useful lives of assets, and a lack of formal approval prior to starting a valuation.

3. Internal controls

Internal controls are the people, systems, and processes that ensure an entity can achieve its objectives, prepare reliable financial reports, and comply with applicable laws. Features of an effective internal control environment include:

- secure information systems that maintain data integrity

- a strong governance framework that promotes accountability and supports strategic and operational objectives

- robust policies and procedures, including appropriate financial delegations

- regular management monitoring and internal audit reviews.

This chapter reports on the effectiveness of internal controls, primarily focusing on departments. We also comment on high-risk issues identified at statutory bodies and controlled entities. We provide areas of focus for entities to improve their internal controls.

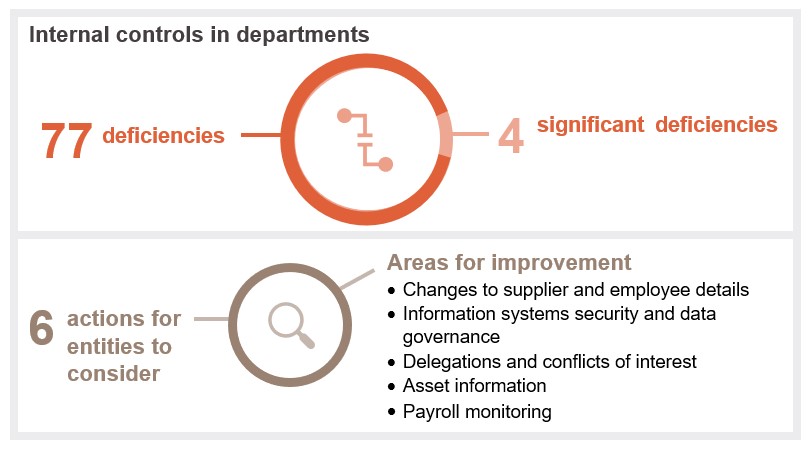

Chapter snapshot

Chapter summary

Internal controls in departments are generally effective and support reliable financial reporting. However, we identified the following issues where entities need to strengthen internal controls:

- a lack of independent checking of changes to supplier and employee details

- weaknesses in user access controls, data integrity, and data governance

- instances where financial delegations were exceeded and conflicts of interest were not declared

- inaccurate or incomplete asset valuations

- a lack of review of payroll monitoring reports.

Entities have accepted our recommendations and have either resolved or are currently addressing any deficiencies identified.

Areas of focus for improvement of internal controls

Checking requests to change supplier and employee details

There was an increase in fraud attempts this year. To help prevent fraud, agencies must ensure they check requests to change supplier and employee bank account details.

We identified significant deficiencies in checking changes to supplier information at Trade and Investment Queensland (TIQ), Screen Queensland Pty Ltd, and TAFE Queensland, with a further four deficiencies identified across all departments.

TIQ did not maintain a record of supplier details for its overseas offices or have processes in place to independently verify requests to change these details. As a result, unauthorised changes were made to supplier details, resulting in a loss of $350,000. It continues to be under investigation. Since this incident, TIQ has introduced processes to ensure that all change requests are independently validated with the supplier, and a record of supplier details is maintained.

A fraud of $51,480 occurred at Screen Queensland Pty Ltd (SQ) as a fraudulent request to change a new supplier’s bank account details was not independently verified with the supplier. Following this incident SQ implemented additional processes to verify bank account details for all suppliers to prevent future frauds. SQ also commissioned an independent investigation into the incident and a review into the organisation’s accounts payable processes.

Action for all entities

Entities should treat all employee and supplier change requests cautiously, especially requests to change bank account details, as they increase the risk of fraud. When a request is received for suppliers, entities should:

- phone the supplier using a contact number obtained from an independent source, such as the supplier’s website or the White Pages directory

- check the letter that initiated the change for likely errors in details, such as supplier’s name, address, phone number, website, email contact details; financial controller’s or chief financial officer’s name; and remittance email address.

Strengthening information systems security and data governance

With increasing reliance on technology, entities must secure their information systems to protect against external cyber attacks, or the inadvertent or malicious actions of employees. This protects the quality and integrity of information, providing for complete and accurate management reporting. Reference can be made to my recent report number 3 for 2019–20 on managing cyber security risks to assist in this information security space.

Information systems security and data governance can be improved in several departments, and in the following paragraphs, we have identified areas in which all entities should assess their internal controls.

Limiting employee access to systems

The ability to access all functions within the system should only be assigned to employees when appropriate for their position. In addition, employees should not have more than one active user account, because this could allow them to perform different stages of a process that should be performed by two independent people in the system. We identified two significant deficiencies at the Department of Justice and Attorney-General and one at TAFE Queensland in relation to user access. Both entities advised that action has been taken to address the matters reported.

Monitoring system access

Activities performed by employees with privileged access (which is held by users who can access sensitive data and create and configure within the system) must be monitored. User access security reports should be reviewed on a consistent and timely basis to ensure data has not been corrupted and unauthorised transactions have not been processed.

Ensuring effective data governance

Governance processes for moving information to new systems must be strong to ensure data is accurate and complete and the resulting financial reporting is reliable.

We identified one significant deficiency at the Department of Employment, Small Business and Training in relation to the lack of effective governance processes over the migration of financial records from three existing finance systems to a new finance system. This resulted in delays in the accurate and complete transfer of the financial records. The department has reconciled the information for the financial statements.

Action for all entities

Entities should secure information systems to prevent unauthorised access that could result in fraud or error. They should consider:

- assigning employees the minimum access required to perform their job, ensuring that important stages of processes are not performed by the same person

- reviewing user access regularly to ensure it remains appropriate

- monitoring activities performed by employees with privileged access (which is held by users who can access sensitive data and create and configure within the system) to ensure they have been appropriately approved.

To ensure there are no errors when moving information to a new system, entities must ensure they establish a robust governance process to oversee the project, with:

- an approved governance framework

- a project committee, with enough time and appropriate skills and experience to oversee the project

- a project plan that is supported by detailed risk assessments and task plans and includes assurance processes

- regular reporting to facilitate timely decision-making.

Managing financial delegations and conflicts of interest

Entities should ensure that financial delegations are set at appropriate levels, clearly documented and used appropriately. This is critical to ensuring that decisions and approvals are made by appropriate officers. Entities need to make sure all procurement decisions are fully justified and appropriately documented, and that all conflicts of interest have been declared.

Appropriate use of delegations

Levels of financial delegation assigned to officers should be appropriate for their position and functional role. Delegations are critical for ensuring that only appropriately skilled officers are authorised to make decisions or approve transactions. Entities should have processes in place to monitor the use of financial delegations.

A significant deficiency was identified at the Department of Child Safety, Youth and Women, as an employee approved contracts above their financial delegation. The department has since implemented new review processes to prevent this from occurring again.

Management of conflicts of interest

Entities should implement policies and procedures that require employees to assess and report any conflicts of interest that might influence their decision-making. Procurement decisions should be fully defensible and appropriately documented, taking into consideration any identified conflicts.

We identified one significant deficiency at the Gasfields Commission Queensland in relation to a related party transaction that was not initially declared. The interest has since been declared, and the commission is reviewing its procurement practices.

We identified deficiencies across departments where staff had not complied with departmental procurement policies. This included a failure to complete a conflict of interest declaration or to declare an identified conflict. There was no evidence of related party transactions or undue influence in the procurement decision process in these instances.

Procurement practices in a decentralised environment

Trade and Investment Queensland (TIQ) operates a global decentralised model, which includes multiple offices located within Queensland and overseas. It had not established a procurement policy and processes for its overseas branches, which could result in inconsistent procurement practices. TIQ advised that it has since introduced an international procurement process including policies, procedures and training for all staff.

Action for all entities

Entities should ensure all procurement is appropriately approved and any conflicts of interest are declared and managed. To strengthen procurement practices, entities should:

- regularly review the appropriateness of financial delegations, ensuring controls adequately detect and prevent delegates exceeding their approved delegation limit

- educate employees on the importance of declaring conflicts of interest and how to recognise them, providing an appropriate means to report and record these.

Regular monitoring of payroll expenses

Payroll reports and reconciliations (between the finance and payroll system) should be consistently reviewed to ensure payments made to employees are correct, and any fraud or error is promptly detected. All departments should work to improve current practices and ensure payroll reports are reviewed in a timely manner.

Action for all entities

Payroll reports and reconciliations should be consistently reviewed to ensure payments made to employees are correct, and any fraud or error is promptly detected.

Improving asset information

Entities must ensure they acquire, maintain, and replace their physical assets to meet community needs. To do this, they need to keep complete and accurate asset records, understand the nature and condition of their assets, and adopt an appropriate valuation approach. We identified several departments that can improve their processes so that:

- their valuation methodology is approved prior to the valuation being performed

- asset information is complete and accurate

- asset condition is regularly assessed and used to inform the expected period they will use the asset.

Status of reported internal control deficiencies

Management and those charged with governance are responsible for the efficient and effective operation of internal controls. An audit committee may be established to assist them to obtain assurance over internal control systems.

An audit committee is responsible for considering audit findings, management responses to those findings, and the status of audit recommendations.

We analysed the appropriateness and timeliness of remedial action undertaken by departments to resolve any internal control deficiencies we identified. All departments have resolved or are currently addressing these deficiencies. Figure 3A outlines the status, as at the time of issuing this report, of control issues we reported over the last three years.

Queensland Audit Office.

Across the departments, there are 46 deficiencies on which management is continuing to undertake corrective action. They include some deficiencies that were reported to management in 2016–17 and 2017–18.

Proactive and timely resolution of reported deficiencies indicates a strong control environment. Significant control deficiencies and high-risk financial reporting issues should be addressed as a matter of priority.

Action for all entities

We encourage audit committees to monitor whether management undertakes corrective action in a timely manner to resolve all reported issues and meet agreed milestones.

4. Initiatives of Queensland Government entities

Chapter snapshot

Queensland Audit Office.

Chapter summary

The Queensland Government identified critical priorities within its budget for 2018–19 and outlined initiatives to advance the state. Priorities relate to areas of health, energy, water, education, employment and business, environment, transport and infrastructure, and community safety.

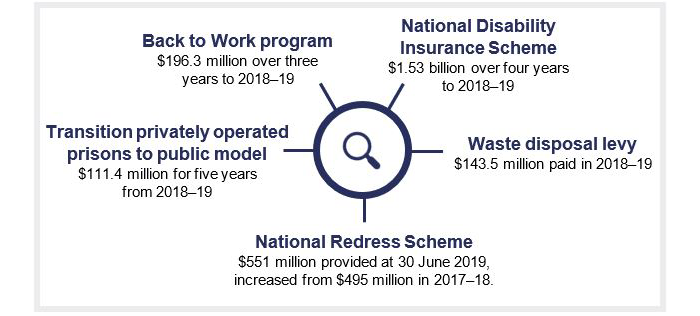

We have examined most initiatives in our separate sector reports and have reported on them to parliament. In this report, we summarise five significant transactions not captured within our other reports. These include:

- supporting employment through the Back to Work program

- making the transition to the National Disability Insurance Scheme

- transitioning privately operated prisons to the public model

- dispersing the waste disposal levy

- facilitating the National Redress Scheme.

Supporting employment through the Back to Work program

The Back to Work program, managed by the Department of Employment, Small Business and Training, aims to assist unemployed jobseekers to join the workforce, and to support the growth of Queensland businesses. The program commenced in 2016 and has currently been extended to 30 June 2020.

Over the three years to 30 June 2019, the department provided $196.3 million in grants to 9,427 employers. Employers can claim between $10,000 and $20,000 per employee, depending on the employee’s age and length of unemployment. Payments are made to employers in three instalments over a year, as eligible employees complete minimum periods of continuous paid employment.

The program is currently available throughout regional Queensland and selected local government areas in South East Queensland (Ipswich, Lockyer Valley, Logan, Moreton Bay, Scenic Rim, and Somerset). The program targets areas experiencing higher unemployment.

The department continues to tighten its controls over the program to manage the risk of fraudulent applications. This includes strengthening documentation requirements from employers and validating information against external sources. It is also investing in data analysis, with all applications checked for unusual characteristics and exceptions investigated prior to approval and payment.

Action for all entities

We encourage all entities to explore the use of data analysis to:

- better understand the nature of their grant programs and associated risks

- develop expected patterns for grant applications

- identify grant applications that may indicate fraud and warrant further investigation

- continuously learn from confirmed fraudulent applications.

Transition to the National Disability Insurance Scheme (NDIS)

The National Disability Insurance Scheme (NDIS) is a major national reform, governed and funded under agreements between the federal, state, and territory governments. The NDIS intends to provide greater choice, control, and economic and social participation for people with disability. The scheme is administered by the National Disability Insurance Agency (NDIA), a separate agency established by the Australian Government.

Queensland’s Department of Communities, Disability Services and Seniors (DCDSS) is the lead agency coordinating the whole-of-government transition to NDIS for the state. The Bilateral Agreement between the Commonwealth and Queensland: Transition to the National Disability Insurance Scheme sets out the roles and responsibilities for the transition and includes the transition schedules and funding contributions.

Queensland’s transition to the scheme began in 2015–16 and has progressively rolled out, with a plan to reach full transition by June 2019. The NDIS is now available across Queensland. However, due to slower than anticipated rates of access by new participants, the transition has been extended to allow the federal government more time to support more Queenslanders to enter the scheme.

As eligible clients transitioned, DCDSS gradually ceased funding to existing specialist disability services providers. Under the transition bi-lateral agreement, the state government continues to make contributions to the NDIS. Total payments from the department to the NDIA between 2015–16 and 2018–19 were approximately $1.46 billion.

DCDSS has experienced a reduction in its workforce as a result of the transition. To 30 June 2019, 664 employees took voluntary redundancy (at a cost of $44.738 million). In addition, 122 employees transferred to the NDIA under the first offer of an employment arrangement covered by the NDIS Incentive Scheme (at a total cost of $2.576 million).

Transitioning privately operated prisons to the public model

Taskforce Flaxton was announced by the Crime and Corruption Commission (CCC) on 22 March 2018. In December 2018, following a nine-month inquiry, the CCC released its report on corruption risks and corruption in Queensland prisons. The report made 33 recommendations to reform the Queensland Corrective Services’ anti-corruption framework, improve external oversight mechanisms and safety for staff and prisoners, increase accountability and transparency, and raise performance standards.

In July 2018, the government announced it had suspended the tender processes for the two privately operated prisons, pending its consideration of the Taskforce Flaxton’s final report and citing concerns over the number of assaults on staff occurring in privately operated prisons.

Following the outcomes of the Taskforce Flaxton report, the Queensland Government announced Operation Certitude on 29 March 2019. This involved the transition of Queensland’s two remaining privately operated correctional centres—Arthur Gorrie and Southern Queensland—to public operation. Arthur Gorrie will transition from the GEO Group Australia Pty Ltd on 1 July 2020, and Southern Queensland will transition from Serco Group Pty Limited on 1 July 2021.

Under the public operating model, more prison staff will be allocated to these two correctional facilities. The department will receive $111.4 million in funding over five years from 2018–19.

Waste disposal levy

As part of the state’s overall waste management strategy, a waste disposal levy was introduced from 1 July 2019 to encourage business and industry to reduce, reuse, recycle, and only send waste to landfill if it cannot be recovered. The total revenue the state government budgeted from the Queensland Waste Levy in 2019–20 was $432.6 million.

All waste going to landfill in Queensland will incur the relevant levy unless the waste is both generated and disposed of in a non-levy zone. There are exemptions for some specific types of waste, such as waste that results from a declared disaster.

The levy zone includes 39 of the 77 local government areas. This covers around 90 per cent of Queensland’s population and is where most waste is generated and disposed of.

To ensure the waste levy has no direct impact on households, the Queensland Government will fund councils that dispose of household waste in the levy zone. Councils will also be provided with a payment to offset the cost of the levy for households with a commercial waste collection service not covered by this arrangement. These include caravan parks, manufactured home parks, retirement villages, boarding houses, gated communities, and rural residents with commercial bulk-waste arrangements.

Councils received an advance payment ($143.5 million) in June 2019 to assist them in implementing the waste levy in 2019–20. A total of 43 councils received this advance payment—39 located inside the levy zone and four (Cook, Wujal Wujal, Yarrabah, and Palm Island councils) located outside of the levy zone, but which dispose of their waste in the levy zone.

The annual payment for 2020–21 and subsequent years will be made to councils in quarterly instalments.

National Redress Scheme

The Australian Government established the National Redress Scheme for Survivors of Institutional Child Sexual Abuse (the National Redress Scheme) in response to the recommendation of the Royal Commission into Institutional Responses to Child Sexual Abuse. The Scheme is intended to support people who experienced institutional child sexual abuse before 1 July 2018.

It began on 1 July 2018 and will run for 10 years. It will support eligible applicants through a monetary payment, access to counselling and psychological care, and the option to receive a direct personal response from the institution responsible.

The Queensland Department of Child Safety, Youth and Women is the lead agency coordinating the Queensland Government’s participation in the National Redress Scheme.

In 2017–18, the department recognised a liability of $495 million for the introduction of the National Redress Scheme. The liability recorded by the department increased to $551 million in 2018–19 as a result of additional information. Scheme payments will be based on the number and timing of claims.

At 30 June 2019, approximately $3 million of the $551 million was due and payable, following notification from the Australian Government of the offers that had been accepted by claimants.