Overview

Each year, the Treasurer prepares consolidated financial statements for the Queensland Government. They reflect the combined results for the 94 individual state entities that are most significant to the financial performance and position of the state government.

Tabled 8 March 2022.

Report on a page

The Queensland Government’s financial statements are reliable

The financial statements for the Queensland Government, the consolidated fund (the government’s central bank account), the report on ministerial expenses, and the report on the office expenses of the leader of the opposition are all reliable and comply with legislative requirements. The audited 2020–21 Queensland Government financial statements were tabled in parliament on 28 October 2021, a month earlier than they were last year.

The state’s financial performance was better than forecast in the budget

COVID-19 and the resulting domestic and global economic downturn substantially affected the state’s main revenue streams in 2019–20, and this was forecast to continue into 2020–21. However, improved revenue performance and stability in expenditure resulted in a substantially lower operating deficit in 2020–21. The state’s financial performance was also significantly better than was estimated in the Queensland Budget 2020–21 (2021 budget).

Improved economic conditions resulted in Queensland receiving an additional $2.7 billion in goods and services tax (GST) funding from the Australian Government this year. This reversed the trend of the 3 previous financial years. Taxation revenue also increased this year, largely through increased activity in the Queensland property market. While revenue from coal royalties declined significantly because of the decrease in coal prices and export volumes, it is expected to increase substantially in 2021–22 due to historically high coal prices in the first half of the year.

Total expenses remained relatively stable in 2020–21 with the Queensland Budget 2021–22 (2022 budget) identifying that the government achieved savings of $750 million under its Savings and Debt Plan. These savings were achieved by reducing departmental appropriations in the 2021 budget, with individual departments required to implement measures to achieve the savings in the 2020–21 financial year.

The 2022 budget forecasts revenue will increase at a greater rate than expenses over the next 4 years. This should see the Queensland general government sector (government departments and other government entities such as hospital and health services) return to a net operating surplus (where revenue exceeds expenses) by the 2024–25 financial year.

The emergence of the Omicron variant of COVID-19 in late 2021 has seen a substantial increase in COVID-19 infections in Queensland and Australia and could negatively impact the Queensland economy in the second half of the 2021–22 financial year.

Debt levels are expected to increase

Additional borrowings were required this year to fund the government’s response to COVID-19 and the infrastructure program. However, the increase in borrowings was not as significant as was forecast in the 2021 budget. The 2022 budget identifies that borrowings will continue increasing over the next 4 years.

In response to the increased debt, the government established the Queensland Future Fund – Debt Retirement Fund in 2020–21. As at 30 June 2021, the fund held $7.7 billion in state investments that can only be used to reduce state debt.

Recommendations

Status of recommendations made in State finances 2020 (Report 15: 2020–21)

In our report last year, we recommended that Queensland Treasury amends the:

- Financial Accountability Act 2009 to include a statutory time frame for certifying and tabling in parliament the consolidated Queensland Government financial statements

- Queensland Future Fund Act 2020 (QFF Act) to include a requirement for financial statements to be prepared, audited, and made publicly available for each fund created under the QFF Act.

While Queensland Treasury did not accept these recommendations, it made a commitment to work towards ensuring the consolidated Queensland Government financial statements are certified by 31 October each year. This year, the audited financial statements were tabled in parliament on 28 October 2021, meaning they were made publicly available a month earlier than last year.

Financial reporting requirements for funds created under the QFF Act were further examined in our audit brief Establishing the Queensland Future Fund (Report 11: 2021–22).

In that report we noted that while there are some disclosures on the Queensland Future Fund in the 113 pages of Queensland Treasury’s financial statements and annual report, the annual report disclosures are not audited.

Based on the transactions that occurred within the Queensland Future Fund structure in 2020–21, and the information publicly available on these transactions, we recommended that the Treasurer and Queensland Treasury reconsider this recommendation.

Provision of further information would provide information on the activities of the Queensland Future Fund and its investments for the public and assist in supporting transparency and accountability. We will continue to work with Queensland Treasury to identify and implement options for enhancing financial statement disclosures on the activities of the Queensland Future Fund.

1. Overview of entities in the Queensland Government

This report analyses the consolidated financial position of the Queensland Government, which is referred to as the total state sector and includes the sectors and corporations shown in Figure 1A. We provide separate reports to analyse the results of our audits for specific industry sectors, including health, energy, water, and transport.

This report also refers to the non-financial public sector, which is a combination of the general government sector and public non-financial corporations.

Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions on the:

- Queensland General Government and Whole of Government Consolidated Financial Statements

- Consolidated Fund Financial Report

- the Public Report of Ministerial Expenses and the Public Report of Office Expenses for the Office of the Leader of the Opposition.

Chapter snapshot

We express an unmodified opinion when the financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

We issue a qualified opinion when the financial statements as a whole comply with relevant accounting standards and legislative requirements, with the exception noted in the opinion.

We include an emphasis of matter paragraph to highlight an issue of which we believe the users of the financial statements need to be aware. The inclusion of an emphasis of matter paragraph does not modify the audit opinion.

Queensland Government financial statements

The Financial Accountability Act 2009 requires the Treasurer to prepare annual consolidated financial statements for the Queensland Government. The Auditor-General issued an unmodified audit opinion on the Queensland Government’s 2020–21 consolidated financial statements on 25 October 2021, meaning we consider the financial statements can be relied upon.

The audited financial statements were tabled in parliament by the Treasurer and Minister for Trade and Investment on 28 October 2021. This meant the statements were made publicly available a month earlier than in the previous year, and 3 months earlier than in the 2018–19 financial year. This timing is consistent with a commitment made by the former Under Treasurer in response to our recommendation in last year’s report.

Consolidation of financial reports of significant state entities

The consolidated financial statements for the Queensland Government reflect the combined financial results for 94 individual state entities. These entities are the most significant to the financial performance and position of the Queensland Government.

We issued unmodified opinions on the financial statements for 93 of these entities.

The 2020–21 financial statements for the Queensland Rural and Industry Development Authority (QRIDA) received a qualified audit opinion. We were satisfied that this issue did not affect the consolidated Queensland Government financial statements. We will explain this qualification in further detail in our report State entities 2021.

The financial report on the consolidated fund

The consolidated fund is the Queensland Government’s central bank account. Revenue and other money received by the government, including from taxes, royalties, Australian Government grants, fines, and vehicle registration fees, are paid into the consolidated fund. Dividends paid by government owned corporations (to the government, as their owners) are also paid into the consolidated fund.

Each year, government departments receive funding from the consolidated fund through appropriations. The amounts appropriated to departments are approved by parliament as part of the annual state budget process.

The Financial Accountability Act 2009 requires the Treasurer to keep a ledger recording the amounts received into and paid out of the consolidated fund. The Consolidated Fund Financial Report acquits these amounts each year. It also compares amounts provided to departments against the amounts approved by parliament.

This year, an additional amount of approximately $2 billion was paid into the consolidated fund, representing proceeds from 25 per cent of the shares in the Queensland Titles Registry Pty Ltd being transferred into the long-term investments held by Queensland Treasury Corporation (QTC). This investment will be used to support several long-term government priorities through the establishment of:

- the Housing Investment Fund, with its returns used to drive new supply to support current and future housing needs

- the Path to Treaty Fund, with its returns used to support path to treaty actions with First Nations Queenslanders

- the Carbon Reduction Investment Fund, with its returns supporting the existing Land Restoration Fund in leveraging private finance and investment and supporting financially sustainable carbon markets.

As these funds were only established in June 2021, they did not operate during the financial year. We will continue to monitor action taken to establish operational aspects of the funds and report on these in future reports.

Results of our audit

The Auditor-General issued an unmodified audit opinion on the Consolidated Fund Financial Report on 27 August 2021, before the legislative deadline of 30 September 2021. We included an emphasis of matter paragraph to draw attention to the fact that the report was prepared on a cash basis.

The Treasurer tabled the financial report in parliament on 27 August 2021. However, the tabled report only included a draft version of the independent auditor’s report, as the final had not been issued by the Auditor-General at that time. The independent auditor’s report signed by the Auditor-General was subsequently tabled in parliament by the Treasurer later the same day as an erratum (an acknowledged and corrected error).

Public reports of ministerial expenses

Ministers and assistant ministers have staff and resources to assist them in their duties. The Department of the Premier and Cabinet administers expenditure for ministerial offices and for the Office of the Leader of the Opposition.

The Financial Accountability Act 2009 requires the Department of the Premier and Cabinet to prepare an annual public report of ministerial expenses. The Opposition Handbook also requires the Leader of the Opposition to prepare, and have audited, an annual report of expenses.

A separate statement of expenses is prepared for each office that existed during the financial year. As a result of changes to ministers and ministerial portfolios following the state election in October 2020, the number of statements for ministerial offices and the Office of the Leader of the Opposition increased to 51 (2019–20: 31).

In 2020–21, total expenses increased by $2.34 million (5 per cent) to $49.2 million, reflecting increases in:

- employee expenses

- domestic travel, and travel to and from electorates

- charter costs required for travel by the Premier and Leader of the Opposition during the state election

- rental increases for building services.

These increases were partly offset by the fact that no overseas travel occurred in the 2020–21 financial year due to COVID-19 restrictions.

Results of our audits

The Auditor-General issued unmodified audit opinions on the Public Report of Ministerial Expenses and the Public Report of Office Expenses for the Office of the Leader of the Opposition on 20 August 2021. We included emphasis of matter paragraphs to draw attention to the fact that these reports are prepared for specific purposes – to fulfil responsibilities under the Financial Accountability Act 2009 and the Opposition Handbook.

3. Financial performance of the Queensland Government

This chapter analyses the financial performance, position, and sustainability of the Queensland Government. We assess the main transactions and economic events for the year as well as relevant emerging issues.

Chapter snapshot

The financial performance of the Queensland Government was better than forecast

The ‘net operating balance’ is a key measure of financial performance. It compares the revenue earned by the Queensland Government to the expenses it incurred on day-to-day operations. When there are more expenses than revenue, the net operating balance is in deficit.

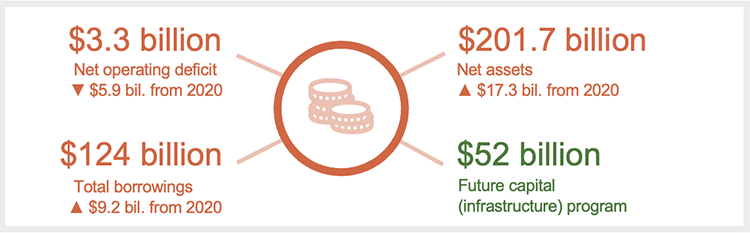

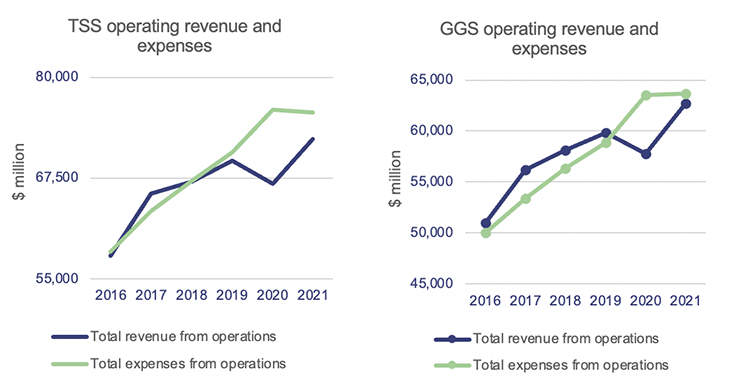

This year, the Queensland Government reported a net operating deficit of almost $3.3 billion for the total state sector (TSS – all government-related entities and corporations, including the general government sector), which was an improvement of $5.9 billion on the prior year.

The net operating deficit for the general government sector (GGS – government departments and other non-trading entities, for example, the hospital and health services) was $937 million, compared with a deficit of over $5.7 billion in 2019–20. This is also significantly less than the forecast deficit of over $8.6 billion included in the Queensland Budget 2020–21 (2021 budget).

In our report last year, State finances 2020 (Report 15: 2020–21), we noted the financial performance of the Queensland Government had reduced over the previous 3 financial years, with expenses increasing at a greater rate than revenue. This trend reversed this year, with TSS revenue increasing by $5.5 billion (8.3 per cent) and total expenses remaining stable. The increase in revenue was largely due to an upturn in general economic activity through increased household expenditure and investment in residential property markets in 2020–21.

Queensland Audit Office.

The Financial Accountability Act 2009 (FA Act) requires the government to have a charter of fiscal responsibility giving details of the fiscal objectives and the fiscal principles that support them. (‘Fiscal’ refers to government spending, revenues and/or debt.) These principles inform the strategy on which the state budget is developed each year.

This year, the government developed a new Charter of Fiscal Responsibility when developing the Queensland Budget 2021–22 (2022 budget). The charter and the fiscal principles were revised to better reflect current economic conditions and government priorities following COVID-19.

The revised charter includes a new fiscal principle aimed at ensuring average annual growth in general government sector expenditure in the medium term is below the average annual growth in general government sector revenue.

Risks to Queensland’s future financial performance

The state’s financial performance in 2020–21 reflects a general improvement in economic conditions since it began its recovery from the impacts of COVID-19 felt in 2019–20. The continued improvement in Queensland’s financial performance is, however, highly dependent on several factors.

The 2022 budget identifies that the Queensland economy continues to face challenges including:

- ongoing risks associated with the COVID-19 pandemic both domestically and internationally

- geopolitical and trade tensions between nations, including Australia’s trade relations with China, and their potential impact on Queensland exports

- risks to coal export volumes in the medium to longer term because countries are moving away from coal consumption as they aim to achieve zero carbon emissions by 2050.

In developing forecasts in the 2022 budget, the government adopted the following key assumptions about the continuing impact of COVID-19:

- Queensland and Australia will continue to be successful in containing any community outbreaks of COVID-19 and there will be no prolonged or widespread lockdowns

- the Queensland border will remain mostly open

- the international border will remain closed to most travellers through to mid-2022, with more travel bubbles gradually being established from 2022 onwards.

In line with key budget assumptions, Queensland reached its target COVID-19 vaccination rate for those aged 16 and over on 8 December 2021. However, the emergence of the Omicron variant in late 2021 has resulted in a substantial increase in COVID-19 cases in Australia and internationally. In Queensland, cases peaked from late-January into February 2022.

The update to the 2022 budget, released by the government in December 2021, identifies that the emergence of this, and potentially other severe and/or transmissible variants, could negatively impact consumer and business confidence and pose a significant risk to local and global economies. Following the increase in COVID-19 cases, heightened levels of staff absenteeism from illness, or meeting isolation requirements, were reported. The increase in staff absenteeism in some industries, including transport and freight, has caused disruption to the supply of goods and services to the public. It is not possible at this stage to determine the impact the increase in COVID-19 cases will have on the local or global economies.

In January 2022, extreme rainfall associated with ex-tropical cyclone Seth resulted in severe flooding in the Wide Bay Burnett area. In response to the damage caused by these events, the government has made available additional disaster funding and financial assistance to those impacted by the floods.

The Australian Government provides funding to states and territories through national non-infrastructure partnership agreements. These agreements support the delivery of specific projects or agreed government services – for example, responses to COVID-19 and to domestic and family violence. The 2022 budget identified that there are 17 agreements (out of 77 active agreements) due to expire on 30 June 2022 for which the Australian Government had not allocated any funding beyond 2022. These agreements provided over $100 million in funding in 2020–21.

The main agreement due to expire in 2021–22 is the agreement on Universal access to early childhood education. This agreement is expected to provide $60 million in grant revenue in 2021–22. The 2022 Australian Government budget provides $1.6 billion nationally over 4 years from 2021–22 and then $589 million per year (indexed) to make an ongoing funding contribution to preschools. Negotiations on the new funding agreement are still to be finalised.

After the 2022 budget, the Queensland and Australian governments entered into 3 new agreements to replace existing agreements, which are expected to provide $23.3 million in grant revenue in 2021–22. Any decision by the Australian Government to not renew or replace the remaining funding agreements may affect the Queensland Government’s capacity to meet ongoing community service needs.

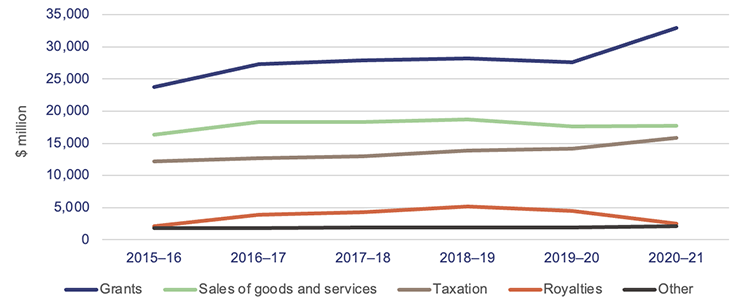

Total revenue increased this year

Revenue earned by the state in 2020–21 was $72.3 billion, an increase of almost $5.5 billion (8 per cent) from the prior year. This largely related to increases in Australian Government grants and taxation revenue earned by the state. These increases were partially offset by a decrease in royalties.

Figure 3B shows the movement in major revenue sources for the total state sector this year.

Queensland Audit Office.

The 2022 budget anticipates that general government sector revenue will grow by an average of 3.9 per cent each year over the 4 years to 2024–25.

Australian Government grant funding increased

Each year, the Queensland Government receives GST funding from the Australian Government as a grant. Between the 2017–18 and 2019–20 financial years, the amount of GST funding Queensland received decreased by $2.4 billion. The decrease was due to:

- the Australian Government collecting less GST

- Queensland’s allocated share of the GST pool decreasing.

However, this year, GST funding increased by $2.7 billion to $15.4 billion, despite the 2021 budget forecasting GST revenue to decline further. The increase was due to the Australian Government collecting more GST revenue as the national economy recovered from the initial impact of COVID-19.

The 2022 budget forecasts GST revenue grants to continue increasing over the next 4 years, to $18 billion in 2024–25. The increase in the national GST pool along with an increase in Queensland’s allocated share of the GST pool are the key drivers of this forecasted increase.

Other grant revenue from the Australian Government also increased this year by approximately $2.7 billion. This included amounts provided to support responses to COVID-19 and to fund infrastructure projects.

The 2022 budget forecasts other Australian Government grants to increase over the next 4 years, to $15.2 billion in 2024–25. This is subject to the renewal or replacement of national partnership agreements due to expire on 30 June 2022.

Royalties continued to decrease

The Queensland Government earns royalties from the extraction of coal, metals, petroleum and gas, and other minerals. Royalties decreased by almost $2 billion in 2020–21, largely because of decreases in the volume and price of coal exports, with COVID-19 driving weaker global demand for coal. This was the second consecutive year in which royalty revenue decreased.

The 2022 budget forecasts royalties and land rents to increase in 2021–22, reflecting the expected improvement in global economic conditions. The 2022 budget update released in December 2021 identifies that since the budget, coal prices reached historic highs due to global supply issues. Coal prices are expected to return to more normal levels in the second half of the year. As a result, royalty revenue in 2021–22 is expected to be almost $3 billion higher than the 2022 budget estimate.

The 2022 budget update identifies that the government intends to invest $2.5 billion from the additional royalty revenue collected in the long-term investments held by Queensland Treasury Corporation on behalf of the state. This is to offset potential reductions to Queensland’s future GST grant revenue allocation under equalisation principles developed by the Commonwealth Grants Commission.

Taxation revenue is increasing

Taxation revenue increased by over $1.6 billion in 2020–21. This was mainly driven by increases in:

- transfer duty (a tax on the transfer of Queensland land or business assets), due to increased activity in the residential property market

- gaming taxes and levies, because many venues were closed in the previous year due to COVID-19.

The 2022 budget has forecast average growth of 3.6 per cent per annum in taxation revenue across the next 4 years. This is primarily driven by continued strength in transfer duty and a rebound in payroll tax as employment and business conditions improve.

Other state revenue remained steady

Revenue from the sale of goods and services provided by the Queensland Government increased marginally by $75 million in 2020–21. However, it received less revenue from the sale of electricity due to lower electricity prices in 2020–21. Further analysis of electricity prices is available in our report, Energy 2021 (Report 7: 2021–22).

The lower revenue from electricity sales also resulted in the state’s government owned corporations paying $600 million less in dividends and income tax equivalents to the state this financial year.

Constraining government expenditure

Total expenses remained relatively stable in 2020–21, decreasing by $400 million to $75.6 billion. While employee expenses increased by $842 million, other operating expenses (for example, costs of supplies and services and expenses arising from legal action and other compensation claims against the government) decreased by $1.1 billion.

The decrease in other operating expenses largely reflects amounts provided for in 2019–20 arising from historical physical and sexual child abuse claims and other litigation costs.

The increase in employee expenses is significantly lower than that experienced in recent years. It primarily reflects a marginal increase in workforce requirements to meet the ongoing demand for frontline health services and to cater for school enrolment growth, as outlined in the 2022 budget. In 2020–21, the government deferred scheduled increases in general government sector wages into the 2021–22 and 2022–23 financial years. The deferral of these wage increases is expected to see employee expenses increase by 4.5 per cent in 2021–22 and 4.1 per cent in 2022–23.

As identified in our Forward work plan 2021–24, we will conduct an audit on managing workforce agility across state government departments in 2022. This audit will examine the effectiveness of the Queensland public sector’s workforce planning to support an agile and flexible workforce that can meet changing needs and government priorities.

Savings and Debt Plan

In July 2020, the Queensland Government announced a Savings and Debt Plan with targeted savings of $3 billion over 4 years to 2023–24. Workstreams (which focused on specific areas) were established to progress measures to identify savings opportunities and help agencies to achieve savings through to 2023–24. These workstreams targeted savings in accommodation, advertising and marketing, data and information communication and technology (ICT) contract costs, workforce, corporate support services, grants administration, and procurement.

In the Auditor-General’s foreword to last year’s report, the Auditor-General noted that the government would need to manage its expenditure and ensure debt levels are sustainable. He also identified that in doing so it would be important for the government to monitor, assess and report on action taken in implementing its Savings and Debt Plan and the extent to which targeted savings are being achieved.

The 2022 budget identified that $750 million in savings were achieved across government agencies in 2020–21 under the plan. The 2022 budget includes a table identifying savings of $721 million achieved by departments and a further $29 million in savings at a whole-of-government level. These savings included the departments of health ($177.5 million), education ($110.5 million), and transport and main roads ($80.9 million). However, it is our understanding that these savings represent amounts by which the departments’ appropriations were reduced in the 2021 budget to reflect targeted savings to be achieved by agencies during the 2020–21 financial year.

Individual departments were responsible for identifying and implementing measures to achieve these targeted savings. The 2022 budget identifies some general examples of savings made in 2020–21.

As identified in our Forward work plan 2021–24, we intend to conduct a future audit on state government financial forecasts and performance measures. This audit will examine how the framework for preparing the state budget supports the government’s identified fiscal principles and seeks to achieve the objectives and measures identified in key economic plans such as the Savings and Debt Plan.

Achievement of the new fiscal principle on constraining expenditure growth

In 2021–22, general government sector expenses are forecast to increase by $3.5 billion and are expected to grow at an average annual rate of 2.3 per cent over the 4 years to 2024–25. The forecast growth in expenses, however, is lower than the forecast growth in revenue over the same period. This is consistent with the new fiscal principle identified in the 2022 budget (to ensure average growth in general government sector expenses remains below the average growth in general government sector revenue). If these rates are attained, there should be an operating surplus in 2024–25.

While the 2022 budget forecasts total expenses to grow by just 2.3 per cent, employee expenses are forecast to increase by an average of 3.9 per cent each year over the 4 years to 2024–25. This means the government will need to achieve savings in other expenses over this period if it is to achieve its forecast expense targets in line with the new fiscal principle.

The new principle replaced a previous principle aimed at ensuring growth in full-time equivalent employees (the number of employees measured in terms of full-time employment) did not exceed population growth over the budget period.

As identified in our Forward work plan 2021–24, we are currently conducting an audit examining government administrative spending and highlighting patterns and trends in spending that may represent opportunities for savings. We anticipate reporting on the results of this audit in mid-2022.

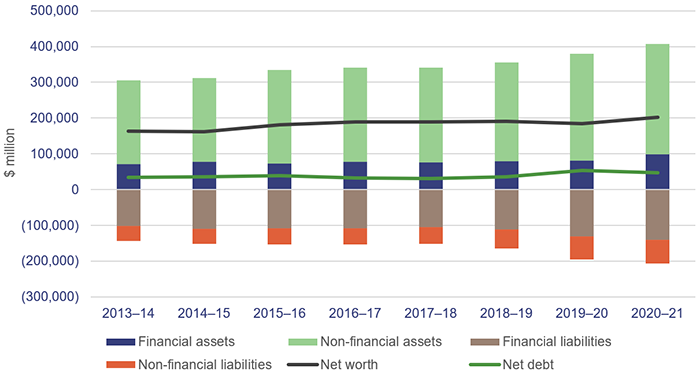

The state’s net worth has improved, but borrowings will continue to increase over the next 4 years

The Queensland Government’s response to COVID-19 adversely affected the state’s balance sheet in 2019–20 and was estimated to do so for several years. However, in 2020–21, the state’s net worth (the difference between total assets and total liabilities) increased by $17.3 billion (9.4 per cent).

Figure 3C shows the net worth for the total state sector for the past 8 years. Despite increasing debt levels, the net asset position of the state remains strong. Between 30 June 2018 and 30 June 2020, the state’s net debt (financial liabilities less financial assets) increased by $21.5 billion. This year, however, net debt decreased by $5.8 billion (11 per cent). However, the difference between total financial liabilities and financial assets is expected to increase over the next 4 years.

Queensland Audit Office.

The improvement in the state’s net worth was largely driven by increases in investments held in the Queensland Future Fund, cash deposits held with the Queensland Treasury Corporation, and increases in the value of assets. These were partly offset by increases in borrowings and amounts provided for under several insurance and compensation schemes.

In 2019–20, the Queensland Government provided for a potential liability arising from a class action relating to the 2011 South East Queensland floods brought against Seqwater, Sunwater, and the Queensland Government through the Supreme Court of New South Wales (the court).

In February 2021, Sunwater and the Queensland Government agreed to pay $440 million in relation to the class action. Seqwater successfully appealed against the court judgement, which means it is no longer liable to pay damages. That decision does not impact on the settlement being paid by Sunwater and the Queensland Government. Further information on this is available in our report, Water 2021 (Report 3: 2021–22).

Additional borrowings to fund the state’s economic recovery

In 2020–21, total state sector borrowings increased by $9.2 billion to $124.2 billion. These represent all amounts borrowed by Queensland Treasury Corporation on behalf of the state and include amounts then loaned to non-Queensland Government entities (for example, local governments and universities) and amounts borrowed in advance of current requirements and invested by Queensland Treasury Corporation.

Of the $124.2 billion, $39.8 billion relates to amounts borrowed by government entities that operate on a commercial or ‘for-profit’ basis, for example, government owned corporations. Given the commercial nature of these entities, they are normally better positioned to generate sufficient revenue to repay their borrowings.

The Queensland Government’s borrowings will continue to increase

The 2022 budget forecasts that borrowings will significantly increase over the next 4 years. The increased borrowings will predominately be used to continue funding the state’s economic recovery and its investment of $52.2 billion in capital projects over this period.

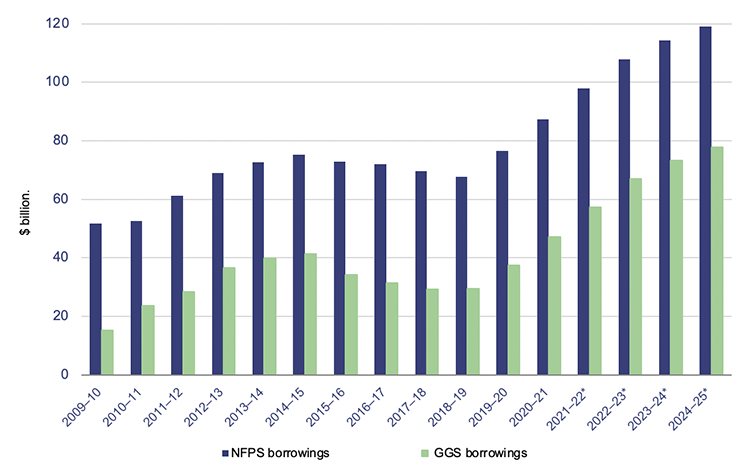

Figure 3D shows the increase in borrowings, which is largely attributable to the general government sector, which is a subset of the non-financial public sector (NFPS – for example government departments, government owned corporations, and large statutory bodies). The borrowings reported in the graph in Figure 3D represent amounts borrowed by Queensland Treasury Corporation and loaned to other Queensland Government entities. They exclude amounts borrowed by Queensland Treasury Corporation and loaned to non-Queensland Government entities (for example, local governments and universities) and amounts borrowed in advance of current requirements.

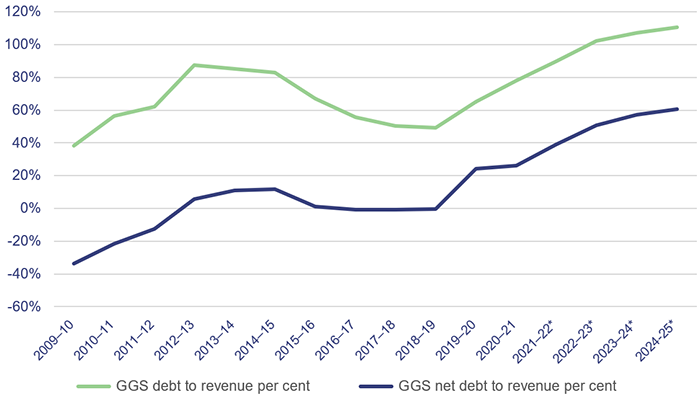

To ensure debt levels are sustainable, the Queensland Government has updated its fiscal principles in relation to government debt. The government assesses the sustainability of government debt by comparing the level of net debt (financial liabilities less financial assets) to the revenue it earns each year (referred to as the ‘net debt to revenue ratio’).

The intent of the principle is to stabilise the general government sector net debt to revenue ratio in the medium term, and target reductions in the net debt to revenue ratio in the long term. In previous years, the government assessed sustainability of debt by using a debt to revenue ratio that did not take into account the amount of financial assets held by the state.

Figure 3E shows the impact on both the net debt to revenue and debt to revenue ratios for the general government sector. It also shows that the ratios will continue to worsen over the next 4 years as the state continues to invest in its economic recovery and capital infrastructure program.

The Queensland Government plans to use the borrowings to fund its investment in major infrastructure projects. Given the high value of these infrastructure projects, the failure to appropriately manage the cost of these projects through unexpected delays or price movements could also increase the government’s future borrowing requirements.

We are currently conducting an audit examining how effectively public sector entities are managing the contracts for the delivery of major new infrastructure. We are also preparing a report on the status of the government’s major infrastructure projects. We anticipate reporting on the results of these audits in 2022.

Over the long term, the state must be able to fund its operations and a significant portion of its capital program from the revenue it earns. This is to ensure a burden of debt is not unduly placed on future generations without the benefit of supporting assets and services.

However, there may be temporary periods when borrowings are required to fund the state’s day-to-day activities (for example, when the state was required to provide stimulus to support economic activity in 2019–20).

In 2020–21, cash received by the general government sector from its day-to-day activities (for example, taxes, Australian Government grants, and sales of goods and services) exceeded the cash it paid to conduct those activities (for example, wages, supplies and services, and grants and subsidies) by $219 million (2019–20: cash payments exceeded cash receipts by $152 million). This meant, this year, the state funded its operations from the revenue it earned instead of using borrowings.

The 2022 budget forecasts net cash from the government’s day-to-day activities to remain in surplus over the next 4 years as revenues continue to improve.

The Queensland Future Fund will be used to manage the state’s future debt levels

In August 2020, parliament passed the Queensland Future Fund Act 2020, under which it established the Queensland Future Fund – Debt Retirement Fund (the fund). The fund will hold state investments for future growth to be used to offset state debt when assessing Queensland’s credit rating. The Act requires that all amounts withdrawn from the fund be used only for reducing debt.

During 2020–21, the government seeded the fund with initial investments of $7.7 billion. Further information on the establishment of the fund is included in our report Establishing the Queensland Future Fund (Report 11: 2021–22).

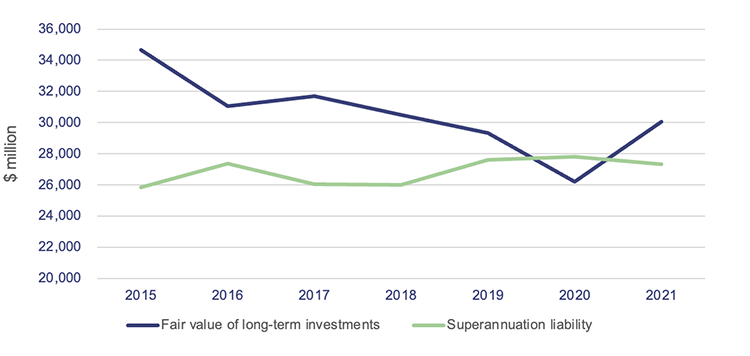

The value of the investments held to fund the state’s superannuation increased

The Queensland Government is responsible for meeting the financial obligations of the defined benefits (specified payments/pensions) for the State Public Sector Superannuation Scheme (QSuper) and Judges’ Scheme. As at 30 June 2021, the value of investments held to meet future superannuation obligations exceeded the Queensland Government’s superannuation liability by $2.8 billion.

This is a significant improvement on the position as at 30 June 2020, where the value of the superannuation liability exceeded the value of the investments held by $1.5 billion. The improved position was due to an increase in the value of the investments held, and a decrease in the government’s superannuation liability. This is shown in Figure 3F.

Note: Fair value – the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties, in an arm’s length transaction.

Queensland Audit Office.

As at 30 June 2021, the Queensland Government’s superannuation liability was $27.3 billion, a decrease of $478 million from the prior year. The value of this liability is calculated by the State Actuary applying the requirements of the Australian Accounting Standards Board's (AASB) accounting standard AASB 119 Employee Benefits. The underlying model used to value the liability is complex and involves expert judgement and estimation in selecting long-term assumptions, including salary growth, interest rates, and inflation. The valuation is highly sensitive to changes in these assumptions.

The decrease in 2020–21 reflects movements in the key assumptions applied in the actuary’s model, including the impact of higher interest rates in discounting estimated payments of future superannuation benefits. This year, the discount rate applied was 1.5 per cent, representing an increase in the rate applied in 2019–20 (0.9 per cent). The liability is forecast to continue declining over the next 4 years as bond rates continue to recover, and as members of the defined benefit fund retire. (The fund has been closed to new entrants since 2008.)

The Queensland Government maintains a fiscal principle of targeting full funding of long-term liabilities, including superannuation, based on advice from the State Actuary. To achieve this, the Queensland Treasury Corporation, on behalf of the Queensland Government, holds long-term investments to meet future superannuation obligations. These investments may also be required to meet other long-term liabilities, for example, obligations under the Queensland Government Insurance Fund.

The long-term investments are managed by QIC Limited. In 2020–21, the value of these investments increased by $3.9 billion to $30.1 billion at 30 June 2021. This was despite $1.5 billion in long-term investments being transferred to the Queensland Future Fund.

On 20 August 2020, the Superannuation (State Public Sector) Act 1990 was amended to require the state to hold assets that are at least equal in value to the accrued liability of the state in relation to defined benefits – measured at least once every 3 years. The value of the accrued liability for the purpose of this Act is the value determined by an actuarial investigation performed in accordance with the Superannuation (State Public Sector) Deed 1990 (the deed).

Each year, the State Actuary provides a report to the QSuper board on the status of the defined benefit fund and makes recommendations on the required funding arrangements. In accordance with the deed, the QSuper board considers this report and determines the state’s required contributions to the fund to meet benefit payments.

When the State Actuary assesses if the liability is fully funded, it uses different criteria to calculate the liability to those required by the applicable accounting standards. For example, while AASB 119 requires the liability to be calculated using a discount rate based on government bonds, the State Actuary applies a rate based on expected investment returns. The use of these rates can result in a significant difference in the surplus/deficit calculated.

The State Actuary’s actuarial investigation of QSuper as at 30 June 2021 reported a fund surplus of $6.65 billion (30 June 2020: $3.57 billion), which is substantially higher than the difference between the value of the investments held and the liability calculated on an accounting basis. The surplus calculated by the actuary was substantially higher this year due to the strong investment return earned during 2020–21. The State Actuary’s report is available on the QSuper website.

On 28 October 2021, the Superannuation (State Public Sector) (Scheme Amendment) Act 2021 was assented to, supporting the merger of QSuper and Sunsuper. The merged entity (Australian Retirement Trust) will be one of Australia’s largest superannuation funds and will manage over $200 billion in assets on behalf of its members. The merger of these entities is not expected to impact on the state’s defined benefit liability in respect of Queensland public sector employees.

New accounting standard for service concession arrangements

The 2020–21 financial year saw the introduction of new accounting standard AASB 1059 Service Concession Arrangements – Grantors. Service concession arrangements are agreements under which an operator (private sector) is contracted to provide or operate an asset on behalf of the grantor (public sector) of the arrangement. The new standard requires the public sector grantor to recognise both an asset and a matching liability for each service concession agreement.

The standard was required to be adopted retrospectively, meaning balances reported in last year’s financial statements were adjusted in the current year financial statements to recognise amounts that would have been disclosed if the standard had been adopted in prior years.

In adopting the standard this year, the state was required to retrospectively recognise approximately $9.8 billion in assets and $8.1 billion in liabilities as at 1 July 2019. The difference of $1.7 billion was adjusted against the accumulated surplus at 1 July 2019 as it represented the net revenue that would have been earned from the service concession agreements prior to 1 July 2019.

Assets now recognised on the state’s balance sheet as service concession agreements include the Airport Link, Gateway Motorway, Logan Motorway, Brisbane Airport Rail Link, Port Drive, Noosa Hospital, and the Princess Alexandra Hospital car park.

Emerging future risks and challenges

Native title compensation claims against the government could significantly increase liabilities

In March 2019, the High Court of Australia handed down its decision in the Griffiths v Northern Territory appeal case (known as the Timber Creek case), establishing a precedent for quantifying native title compensation claims. Several native title claims that affect the Queensland Government have been filed with the National Native Title Tribunal under the Native Title Act 1993 (Commonwealth).

These claims could result in a significant liability for the Queensland Government. The Timber Creek decision provides guidance for calculating native title compensation. As at 30 June 2021, 146 native title determinations had been made in Queensland and there were a further 50 registered claimant applications. These determinations or applications may lead to native title compensation claims. The government is presently unable to quantify the possible compensation payable.

2032 Olympic and Paralympic Games

On 21 July 2021, the International Olympic Committee announced Brisbane as the host city for the 2032 Summer Olympic and Paralympic Games. There are likely to be significant financial implications for the state for the delivery of the games, including required infrastructure. These have yet to be determined.

This announcement occurred after the 2022 budget was prepared. In anticipation of a favourable announcement, the budget provided $29.3 million over 2 years for the Department of Tourism, Innovation and Sport as an initial allocation of funding for preparations for the Olympic and Paralympic Games.