Overview

The entities in Queensland’s transport sector work together to create an integrated transport network, connecting Queensland’s people and businesses.

Tabled 10 December 2021.

Report on a page

This report summarises the audit results of seven entities in Queensland's transport sector: Department of Transport and Main Roads (the department), Queensland Rail, Cross River Rail Delivery Authority, Gladstone Ports, North Queensland Bulk Ports, Port of Townsville, and Ports North.

Financial statements are reliable, but internal controls can be improved

All financial reports in the transport sector are reliable and comply with relevant laws and standards. The systems and processes (internal controls) used to prepare financial statements are generally effective for most entities. Internal controls relating to procurement, payroll processes, and the security of information systems continue to be areas where work is needed.

Governance and oversight needs strengthening at Gladstone Ports

In recent years, Gladstone Ports has had frequent changes to key management personnel and executive positions. These changes have negatively impacted on the governance structure, on reporting, and on the board's ability to enforce the desired decision-making culture.

The changes to executives have also had a high financial impact, including six termination payments totalling $1,530,201 and related legal fees in 2020–21. The lack of policy, guidelines, and board oversight for these termination payments has raised concerns about the propriety of decision‑making.

The impacts of COVID-19 on passenger trips are apparent

The COVID-19 pandemic continues to result in less passenger trips on public transport. Fare revenue collected by the department decreased by 27.6 per cent, while the cost incurred with transport operators increased by 5.2 per cent to $2.8 billion. These trends need to be factored into the planning for the Smart Ticketing project (which is updating the way passengers purchase tickets) and if they continue, might have broader implications on future transport planning, investment, and sustainability for the sector.

Several major projects are underway

The Queensland Transport and Roads Investment Program 2021–22 to 2024–25 plans to spend $27.5 billion on road, rail, and transport infrastructure. This is in addition to the Cross River Rail project.

The contracts the department entered into with transport service providers in 2018 (to enhance the scheduling of bus services and collect data on service provider performance) are proceeding. These are overseen by a multi-tiered governance structure and internal and external reviews.

Major rail and roadworks are both planned and underway, and the department’s Transport Service Contract with Queensland Rail Limited for rail services will be renewed at the end of 2021–22.

Recommendations for entities

Strengthen governance and oversight at Gladstone Ports

We provided a series of recommendations to Gladstone Ports to address deficiencies in governance and oversight. Strong governance underpins a healthy culture, and boards should demonstrate good practice in the boardroom and promote good governance throughout the business. These recommendations are not reproduced in this report.

Prior year recommendations need further action

Entities have taken some corrective action to address recommendations made in our report last year. Despite these improvements, we continue to identify control weaknesses in procurement, payroll processes, and the security of information systems that require further action.

We have included a full list of prior year recommendations and their status in Appendix C.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

1. Overview of entities in this sector

Notes:

- The department has engaged over 50 transport partners to operate public transport services. This is discussed in detail in Chapter 3, in the ‘Delivering Queensland’s public transport’ section.

- There are four port entities—Gladstone Ports Corporation Limited, North Queensland Bulk Ports Limited, Port of Townsville Limited, and Far North Queensland Ports Corporation Limited (Ports North).

- Queensland Rail is a statutory body and includes Queensland Rail Limited.

Compiled by the Queensland Audit Office.

2. Results of our audits

This chapter provides an overview of our audit opinions for the entities in the transport sector. It also evaluates the effectiveness of the systems and processes (internal controls) the entities use to prepare financial statements.

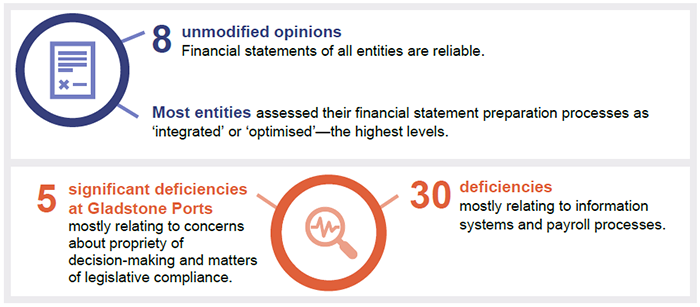

Chapter snapshot

Audit opinion results

We issued unmodified opinions for all transport entities, meaning their financial statements can be relied on. All transport entities met their legislative deadline of 31 August 2021, except Gladstone Ports.

The Gladstone Ports certification was delayed by management due to our request for additional assessments of the remuneration disclosures detailing salary and other benefits to ex-key management personnel. The financial statements were subsequently updated with additional disclosures relating to termination payments and certified on 14 September 2021.

Appendix D lists the audit opinions we issued in 2021.

Most transport entities have self-assessed their financial statement preparation as 'integrated' or 'optimised’—the highest levels in the Queensland Audit Office’s financial statement preparation maturity model. This means they believe their processes for preparing financial statements are efficient and provide high-quality information in a regular, timely manner. The results of our audits support their assessments.

We express an unmodified opinion when financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

Key management personnel are those who have authority and responsibility for planning, directing, and controlling the activities of an entity—directly or indirectly.

Entities not preparing financial statements

Not all Queensland public sector transport entities produce financial statements. Appendix E provides a full list of those who do not, and the reasons why.

Internal controls are generally effective

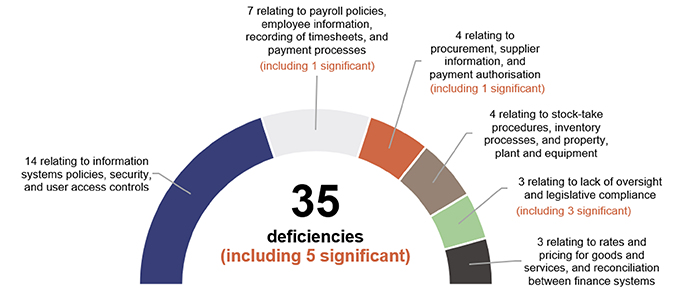

We assess whether the internal controls used by entities to prepare financial statements are reliable, and report any deficiencies in their design or operation to management for action. Those simply rated as deficiencies are of lower risk and can be corrected over time. Those rated as significant deficiencies are of higher risk and require immediate action by management.

Overall, we found the internal controls the transport sector entities have in place to ensure reliable financial reporting are generally effective, but they can be improved.

We assessed the control environment for Gladstone Ports as ineffective due to five significant deficiencies we identified during the audit.

In addition to these, we also reported 30 deficiencies in internal controls across the sector this year. Figure 2A shows the types of deficiencies we identified.

Compiled by the Queensland Audit Office.

We have received responses from each entity on planned corrective action for the internal control issues raised. We are working with them to ensure our recommendations are implemented within agreed time frames.

While most payroll and procurement recommendations from last year were implemented, further action is needed to ensure timesheets are reviewed and officers complete independence declarations before they participate in panels for contract tenders.

Gladstone Ports needs to strengthen its governance and oversight

Queensland public sector entities operate within various legislative and policy requirements that address governance, resource management, and accountability. Effective internal controls (including a strong culture of accountability) are critical in ensuring entities achieve their objectives, comply with the law, and operate with transparency and integrity.

The Port of Gladstone is Queensland’s largest multi-commodity port, (fourth largest coal exporting terminal in the world) and is a major economic hub for central Queensland. As such, it is important for the broader Queensland economy that Gladstone Ports has sound governance and oversight.

We raised matters of concern relating to the propriety of decision-making by the board and senior executives at Gladstone Ports, including non-compliance with legislation. These matters increase the risk of waste of public resources.

Departures of key management personnel and executives

Seven key management personnel and executives have left Gladstone Ports since December 2018.

|

Date |

Position |

|---|---|

|

12 December 2018 |

Chief Executive Officer |

|

14 August 2019 |

Chief Governance Officer |

|

6 March 2020 |

Commercial General Manager |

|

31 May 2021 |

Chief Financial Officer |

|

22 July 2021 |

Interim Chief Executive Officer |

|

31 August 2021 |

Executive General Manager People and Community |

|

31 August 2021 |

General Counsel and Company Secretary |

Compiled by the Queensland Audit Office.

During 2021, the position of chief executive officer was filled by three executives, including one who then left the company within three months of appointment.

The significant turnover has affected the governance structure, reporting, and the board's ability to enforce the desired decision-making culture, with officers needing to act in roles and higher duties for extended periods. There has also been a high financial cost to the company.

The lack of stability of key executives can result in over reliance on professional services consultants. Since 2019, total legal services fees have increased from $5.5 million to $10.2 million in 2020–21, or about two per cent of total expenses. Significant costs relate to the ongoing class action, with advice on employee matters including those related to termination payments also contributing to these costs. While legal services are necessary to manage risk and protect the company’s interest, over reliance on consultants should be closely monitored.

On 1 October, a new Chair of Gladstone Ports was appointed.

Transparency and governance of decisions relating to employee settlement payments

Since 2018, there have been six termination payments totalling $1,530,201 made through deeds of settlement and release (which are legal documents used to formalise agreements between parties involved in disputes).

Two of the payments, which totalled $918,948, occurred after the end of the 2020–21 financial year. These required further consideration by us and were later disclosed in the financial statements as an event occurring after the reporting period.

The board delegates approval of termination payments to the chief financial officer and/or chief executive officer. However, there is no policy, guidance, or board oversight for the use and approval of settlement and release arrangements. Due to concerns over the propriety of decision-making regarding the settlement payments, we reported a significant deficiency to Gladstone Ports.

Matters relating to legislative requirements

The regulatory framework for Gladstone Ports includes the Government Owned Corporations Act 1993 (GOC Act) and the Commonwealth’s Corporations Act 2001. This framework establishes legislative requirements to keep the shareholding ministers informed, maintain appropriate company records, and provide information, explanations, or other assistance during an audit.

During the audit, two matters raised concerns about compliance with these legislative requirements. Gladstone Ports did not:

- initially provide a report to us, as the external auditor, and shareholding ministers about a payment to a former chief executive officer

- appropriately approve and sign all board minutes.

These compliance matters resulted in us reporting three significant deficiencies to Gladstone Ports. We also reported the matters to the shareholding ministers and the Australian Securities and Investments Commission. These matters were considered of such significance that we included a key audit matter (matters that require significant auditor attention) in our audit opinion relating to the risk of management override of controls.

Management override of controls refers to the ability of management and/or those charged with governance to manipulate accounting records and prepare fraudulent financial statements by overriding these controls.

In addition, we reported a significant deficiency relating to the approval of transactions exceeding financial delegation limits. For this matter, management undertook corrective actions to resolve our recommendation during the audit.

The significant deficiencies identified at Gladstone Ports reinforce the need to strengthen governance and ensure the board and management function appropriately to better mitigate risks of uninformed decision‑making and non-compliance with legislative requirements.

To improve governance and oversight, we made several recommendations to Gladstone Ports. We recommended:

- updating policies to provide guidance of payments through deeds of settlement and release

- ensuring appropriate processes are implemented to inform the external auditor and shareholding ministers are informed of substantive matters including litigation, claims and transactions

- ensuring the proceedings and resolutions of directors’ meetings are approved and signed in a reasonable time frame.

Action is required to address ongoing security weaknesses in information systems

Transport entities rely on information technology systems to operate their businesses and prepare financial statements. They must have strong controls over who has access to the systems and the information in them. Weaknesses in information technology controls increase the risk of undetected errors or potential financial loss, including fraud.

In our audits of public sector entities last year, we found that the security of information systems was the most common internal control weakness across the public sector. We made the same recommendation across all our sector reports for entities to strengthen the security of their information systems.

Not all the transport entities have fully addressed this recommendation. We identified control weaknesses in information system security at four of the seven entities this year. Appendix C provides the full recommendation and status as at 30 June 2021.

Assessment tools for internal controls

We are developing new assessment tools for internal controls relevant to public sector entities. They will provide the entities with greater insight into the strength of their internal control processes.

The tools focus on asset management, change management, culture, governance, grants management, information systems, monitoring, procure-to-pay (the whole procurement process), record keeping, and risk management.

We are currently consulting with our clients on these tools and intend to begin using them in our audits from 2021–22. Our reporting on control deficiencies will not change.

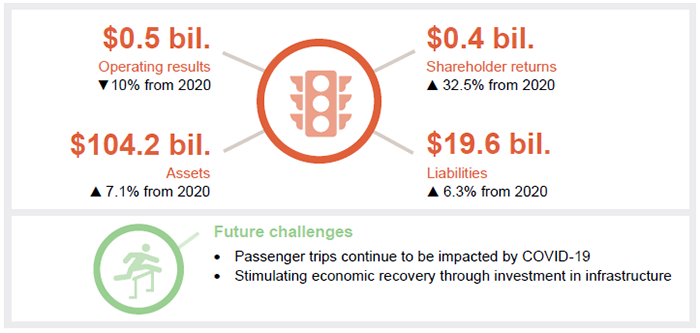

3. Financial results and challenges

This chapter analyses the key financial results and challenges faced by the transport sector.

Chapter snapshot

Operating results and shareholder returns have fluctuated

The transport sector’s operating results decreased by $52 million (10 per cent) in 2020–21. This was mainly driven by the operating result before tax of the Department of Transport and Main Roads (the department) decreasing by $191 million (80.9 per cent) to $45 million in line with the original budget.

Shareholder returns were higher than in the prior year, due to Queensland Rail's increased profit. The increase was primarily driven by higher transport services revenue from its contractual arrangement with the department and lower finance costs and expenditure on consumables than planned.

The sector’s total shareholder returns of $429 million were made up of dividends (a share of profits paid to Queensland Government shareholders) and income tax equivalents (which are paid by commercial operations in government instead of tax).

Service concession arrangements are now on the balance sheet

Accounting standard AASB 1059 Service Concession Arrangements: Grantors became mandatory for the first time during the 2021 financial year. The new accounting standard was developed to improve transparency about the cost of these arrangements and about future obligations between public sector entities and private operators.

A service concession arrangement is an agreement between a public sector entity and private entity to develop, operate, and maintain an infrastructure asset that provides a public service.

For the department, this resulted in an additional $10 billion in assets and $8 billion in liabilities, primarily relating to toll road arrangements such as the Airport Link Tunnel, Gateway Motorway, and Logan Motorway. The department also recognised service concession arrangement revenues of $269 million (2020: $266 million) and expenses of $305 million (2020: $291 million).

Passenger trips continue to be impacted by COVID-19

The COVID-19 pandemic has decreased public transport passenger numbers due to travel restrictions and the adoption of alternative working arrangements (such as working from home). There were 33.5 million (-22 per cent) fewer trips during 2020–21 than in the year before. Consequently, the fare revenue collected decreased by 27.6 per cent to $209.8 million. The department is anticipating public transport patronage will increase by 30 per cent in 2021–22 as vaccination rates increase.

Figure 3A details the change in the number of trips, fare revenue collected, and the costs paid to transport service providers.

|

Bus |

Rail |

Light rail |

Ferries |

Total |

|---|---|---|---|---|

|

Passenger trips |

Passenger trips |

Passenger trips |

Passenger trips |

Passenger trips |

|

Fare revenue |

Fare revenue |

Fare revenue |

Fare revenue |

Fare revenue |

|

Costs |

Costs |

Costs |

Costs |

Costs |

Note: Fare revenue excludes -$0.8 million in go card refund adjustments.

Compiled by the Queensland Audit Office from Department of Transport and Main Roads passenger reports.

The department and its transport service providers continue to deliver services despite the downturn in passenger trips and fare revenue. The costs incurred by the department for these services have increased by 5.2 per cent from last year to $2.782 billion in 2020–21.

If these trends sustain over the medium term, greater consideration of usage may need to be incorporated in transport planning, investment, and sustainability for the sector.

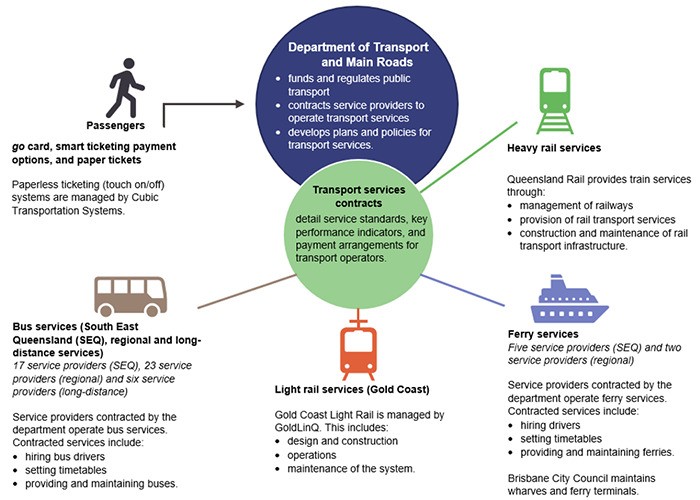

Delivering Queensland's public transport

The department contracts service providers such as local councils and private enterprises to operate public transport services.

The contracts outline key elements such as public transport services to be provided and remuneration to be paid to the providers. They include service area locations, timetables of services, maintenance and safety of facilities, and key performance indicators for timeliness of services.

There are over 50 service providers for bus and ferry services with different requirements that must be managed by the department. The payments to operators are largely driven by a base payment and contract variables, including driver wages, fuel usage, and maintenance costs.

Individual contracts can contain different service requirements and payment models, such as including performance incentives in the operator’s remuneration. The performance data used for payments is often complex, and it is gathered in different ways, including self-submission by operators (on the kilometres travelled and hours of operation) and estimation by the department.

Figure 3B details the public transport service providers across rail, bus, and ferry, and the services they provide.

Compiled by the Queensland Audit Office.

Transport service contracts for bus services

In 2018, most South East Queensland bus operators moved to new transport service contracts with the department. This is the fourth time the contracts have been refreshed, so they are referred to as fourth generation (4G) contracts. The new contracts aim to increase the reliability and efficiency of services by introducing performance measures and financial incentives for operators. They also introduce technology systems for scheduling services and collect data on operator performance.

A multi-level governance structure has been introduced to oversee the implementation of 4G bus contracts. This includes project teams, a program steering group, a leadership team governance board, and executive leadership team oversight. Each level has varying responsibilities in terms of project delivery, assessment, decision-making, and risk escalation. Monthly reporting of high and critical risks is conducted with the leadership team governance board, allowing the program to gain executive leadership team support if required.

The department has undertaken several internal and external reviews to provide assurance on the completion of 4G contract delivery, contract management, and data reliability, to support the oversight of the implementation of the 4G contracts.

New and improved data collection methods continue to be implemented—such as GPS tracking—to more accurately monitor actual hours and kilometres travelled. This will allow better monitoring of on-time running, streamline payments, and reduce reliance on self-submission by operators and estimations. The department will undertake ongoing assurance activities to provide confidence in the accuracy of the data.

A new rail transport service contract will be negotiated

The Rail Transport Service Contract (TSC) with Queensland Rail details the service delivery requirements for passenger rail services for South East Queensland, travel and tourism, and infrastructure services for the South East Queensland and regional rail network.

In 2021, TSC payments to Queensland Rail were $1.912 billion. This is budgeted to increase to $2.074 billion in 2022 due to cost escalations (including increasing services and employee wages, and so on) and the need for operational readiness to support the Cross River Rail project. The current TSC will expire at the end of June 2022, with the department to guide the government’s consideration of the renewal.

The Rail Transport Service Contract Renewal Project is currently underway, with the department considering options for structuring the new TSC. The project is evaluating how the contract could be structured to align with strategic transport plans and ensure value‑for‑money outcomes. These considerations include key performance measures, how the contract will manage timetable changes for new services—including for the Cross River Rail—and responsibilities for the New Generation Rollingstock (new, individually-propelled train carriages).

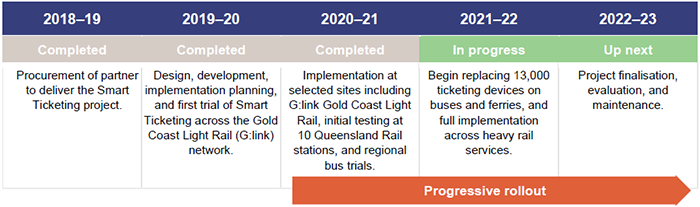

The Smart Ticketing project is being implemented

The department is leading a project to deliver a new ticketing system for Queensland's public transport. The main contractor is CUBIC Transportation Systems, which also delivered the go card system.

The $371 million Smart Ticketing project will allow travellers to pay for trips using contactless credit or debit cards, smartphones, and smartwatches. It will involve upgrading existing ticketing equipment and developing new digital products to enable patrons to self-manage their travel through websites and mobile apps.

Currently, go card payment facilities are only available in South East Queensland. Smart ticketing will reach across 19 regional areas, such as Townsville, Rockhampton, and Toowoomba.

As at 30 June 2021, $211 million had been spent on the project, and approximately 225,933 transactions and $567,000 in revenue had been collected on the Gold Coast Light Rail and other test sites. While this only represents approximately 0.3 per cent of all fare revenue, the uptake is expected to increase as the progressive rollout reaches more regions and modes of transport.

The project has been implemented with several small-scale hardware trials and user feedback programs.

Compiled by the Queensland Audit Office

A project delivery board and a separate strategic board provide oversight and governance of the project. The project team provides regular progress reports to the boards and the department’s Information and Systems Committee.

The project has governance arrangements that are well designed and understood by the department, including project health checks at critical gateways, internal audit reviews, and a project team and supplier with experience with public transport ticketing solutions.

Although COVID-19 has impacted on the project’s resourcing, progress delays experienced to date have been minor and are not expected to affect the overall delivery date of 2022–23.

The Smart Ticketing project is currently on track to be delivered within budget. However, scope and milestone changes are needed for new projects like the Brisbane Metro (high-frequency bus system being delivered by Brisbane City Council), and Cross River Rail, which were not factored into the original project. The targets and expected benefits of the project should be revisited in light of these scope changes and the COVID-19 impacts on passenger trends.

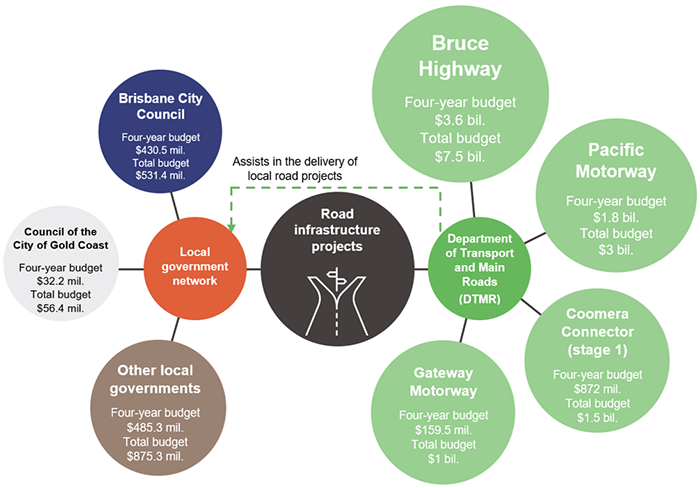

Planned investment in transport infrastructure

The Queensland Transport and Roads Investment Program 2021–22 to 2024–25 (QTRIP) outlines current and planned investment in road and transport infrastructure in Queensland.

QTRIP outlines a total of $27.5 billion in infrastructure investment, of which $16.8 billion is contributed by the Queensland Government and $10.7 billion by the Australian Government. Figure 3D outlines the key investment areas. The Department of Transport and Main Roads works together with local governments to deliver the projects.

|

Roads |

Rail |

Bus |

Other* |

Total |

|---|---|---|---|---|

|

$20.8 billion |

$5.9 billion |

$326 million |

$479 million |

$27.5 billion |

|

▲2.1% |

▲3.6% |

▼4.7% |

▼4.8% |

▲2.2% |

Notes:

- *Includes cycleways, maritime, and other transport infrastructure.

- Rail investment includes the $600 million Rollingstock Expansion Project, which will be replaced by the recently announced $7.1 billion Queensland Train Manufacturing Program.

- Movement percentages are calculated by comparing QTRIP for 2020–21 to 2023–24 against 2021–22 to 2024–25.

Compiled by the Queensland Audit Office from the Queensland Transport and Roads Investment Program 2021–22 to 2024–25.

Road infrastructure

Key projects for investment in roads include upgrading the Bruce Highway, Pacific Highway, and Gateway Motorway, and constructing the Coomera Connector (stage 1) project. Priority areas for the highway and motorway upgrades include improving safety, flood immunity, and capacity by duplicating sections.

Note: The total budget includes the 2021–22 to 2024–25 budget and the indicative budget for ongoing projects after that period.

Compiled by the Queensland Audit Office.

Upgrades to the Bruce Highway involve a 15-year program of works, which began in 2013 and are funded by the Australian and state governments. The proportion of funding varies by project. At 30 June 2021, 382 projects have been delivered, 121 projects are in the design or construction phase, and 37 projects are in the planning phase.

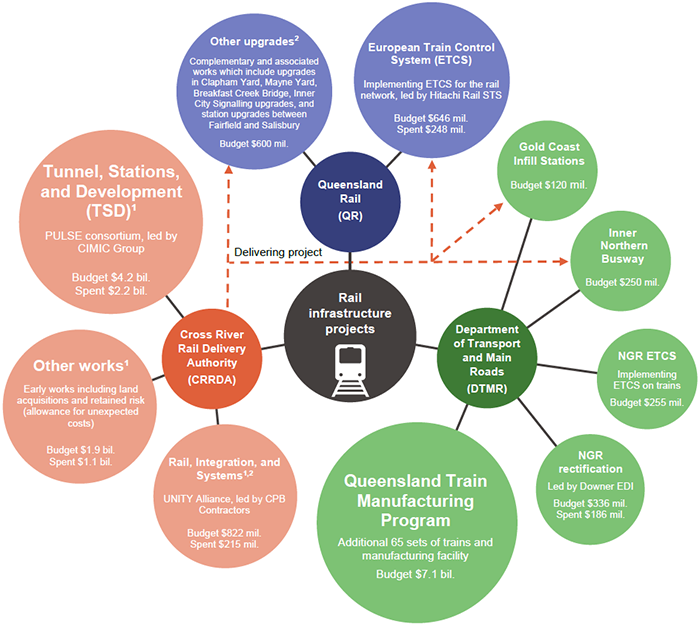

Rail infrastructure

Figure 3F shows the major rail projects currently underway or being planned.

Notes:

- 1 The Cross River Rail Delivery Authority capital budget for the Cross River Rail project (including private finance) is $6.888 billion.

- The Rail, Integration, and Systems total package value is now commercially available. (We did not disclose this in the Transport 2020 (Report 10: 2020–21) report due to commercial sensitivities.)

- 2 Budget for Rail, Integration and Systems package is $1.4 billion, which comprises of $822 million as part of the $6.888 billion Cross River Rail capital budget and $600 million of ‘Other upgrades’ relating to Complementary and Associated (C&A) Works funded by Queensland Rail.

- An infill station is one that’s built on a rail line to address demand in a location between existing stations.

- The European Train Control System offers signalling and control improvements.

Compiled by the Queensland Audit Office.

On 20 October 2021, the Queensland Government announced the $7.1 billion Queensland Train Manufacturing Program to deliver 65 new six-car passenger trains at a purpose-built manufacturing facility. The program will replace QTRIP’s $600 million Rollingstock Expansion Project which initially provided for 20 new six-car passenger trains. Three manufacturers have been identified to bid on the new program, with a preferred supplier expected to be announced in the second half of 2022.

In addition, work continues on the rectification and upgrades for 75 New Generation Rollingstock (NGR) trains, to make them more accessible to passengers with disabilities. Downer EDI is delivering the $335.7 million project.

The department had spent $185.6 million as at 30 June 2021, mostly for planning and design phases prior to beginning works on the first train. Subsequent payments will be made on a train-by-train basis as the upgraded trains return to service. Three upgraded trains were delivered in 2020–21, with a further 25 planned to return to service in 2021–22. All trains are expected to be in service by 2024.

The Cross River Rail is progressing

Major construction on the Cross River Rail project began in 2019. The $6.888 billion project is funded through $5.409 billion of state contributions and $1.479 billion in private finance contributions. The capital budget includes funding for the Tunnel, Stations and Development (TSD) and Rail, Integration, and Systems work packages and for other works such as station upgrades and land acquisitions, and for delivering the European Train Control System (ETCS) for the rail network, which is funded by Queensland Rail. The department will lead the $255 million project to fit the required ETCS technology to the trains.

Figure 3F shows the transport agencies funding the major rail infrastructure projects.

The TSD is the largest work package. Delivered via a public–private partnership, it is funded through a combination of state contributions ($2.7 billion) and private finance contributions ($1.479 billion). The private finance contributions are now fully committed, and the Queensland Government started capital contributions in June 2021. The service payments covering the interest and private finance contributions will be made over the five-year construction period and 25 years of maintenance.

Public–private partnerships are cooperative agreements generally entered into with private sector entities for the delivery of government services.

The TSD is currently in the design and construction phase, which is expected to be completed in 2024. It is expected to be operational in 2025, after testing and commissioning. We have not identified any significant financial reporting issues in our audit of the financial statements.

As indicated in our Forward work plan 2021–24, we will be producing a report on major projects early in 2022. This will assess preliminary procurement activities and progress against budget and milestones on the Cross River Rail project. The report will also cover procurement, planning, coordination, and delivery of other major infrastructure projects across Queensland.

Early stages of the Inland Rail Project

Inland Rail is an Australian Government infrastructure project designed to connect Melbourne to Brisbane via regional Victoria, New South Wales, and Queensland. The estimated 1,700 kilometre project is being delivered through the Australian Rail Track Corporation (ARTC), in partnership with the private sector.

On 29 November 2019, the Australian and Queensland governments signed a bilateral agreement for Inland Rail, outlining details of the proposed project, and in December 2020, the Australian Government announced an additional $5.5 billion investment for the project, bringing the total budget to $14.5 billion.

The Department of Transport and Main Roads is the lead agency engaging with ARTC on behalf of the state. The department and ARTC are negotiating agreements for the project, including the Queensland Development Agreement, which sets out the terms and conditions for the delivery in Queensland, including the construction and operating lease agreements.

The department is not required to make capital contributions to the project and is compensated from ARTC for involvement in project planning, land resumptions, and other project-related costs.

Construction across all Queensland sections is currently expected to start by 2023.