AASB 15 applies to both for-profit and not-for-profit entities. For-profit entities must apply AASB 15 for financial years beginning on, or after, 1 January 2018. Not‑for-profit entities have another year to get ready, and must apply AASB 15 for financial years beginning on, or after, 1 January 2019.

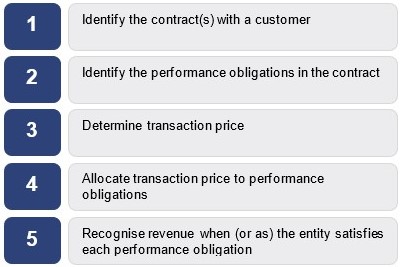

AASB 15 introduces a 5-step model for recognising revenue:

Because the standard includes requirements and guidance on many implementation issues, it is more complex than it initially seems. These requirements and guidance include a variety of issues for public sector entities, such as grants and fees for service.

For not-for-profit entities to be able to ‘match’ revenue and expenses more closely, they need to be within the scope of AASB 15. While AASB 15 was written for the for-profit sector, the AASB has included not-for-profit guidance. However, applying AASB 15 is likely to be challenging.

Two fundamental issues for not-for-profit entities to be within the scope of AASB 15 are:

- whether the agreement is enforceable

- whether the agreement is sufficiently specific.

Enforceable is an easier concept to apply in the for-profit sector, and usually means whether the contract can be enforced in court. Many not-for-profit agreements do not have similar provisions. They often rely on the promises of the not-for-profit entity receiving the funds, or implied threats of withdrawal of future funding for non-compliance. Such approaches are not likely to meet the requirements for being within the scope of AASB 15.

Sufficiently specific requires being able to determine how far along you are in meeting the agreement’s promises. AASB 15 calls these promises performance obligations. You must determine how far along you are in meeting those performance obligations to determine how much revenue to recognise or defer (to be matched to expenses in the future).

Time is running out to be ready. You should familiarise yourself with the new standard and understand how it will affect you now.