Overview

Our annual report summarises our performance, operations, and business highlights for 2024–25. It contains our financial statements, including the opinion of the independent external auditor. It complies with the Financial Accountability Act 2009, Financial and Performance Management Standard 2019, and the detailed requirements set out in the Annual report requirements for Queensland Government agencies. We also recognise our peoples' achievements, and thank our clients and stakeholders for their work with us this year.

Auditor-General’s message

This is my first annual report as the 24th Auditor-General of Queensland, having commenced in the role on 12 August 2024. It is a great honour to lead the Queensland Audit Office (QAO) – an integrity institution that has served the people of Queensland since 1860.

The role of Auditor-General is vital to the strength of Queensland’s integrity system.

Through our work we help maintain trust in our system of government, ensuring public service delivery is transparent and accountable.

This year, QAO has continued to deliver outcomes that support the Queensland Parliament, providing insights and assurance about how well public services are delivered and public money is spent. The effective, efficient, and responsible stewardship of public sector entities, including local governments, is in the interests of all Queenslanders and helps to safeguard the integrity of government.

To support our delivery to Queensland, we invest considerable effort into our relationships, including ensuring that the new parliament was supported with necessary information, and explaining our role and mandate.

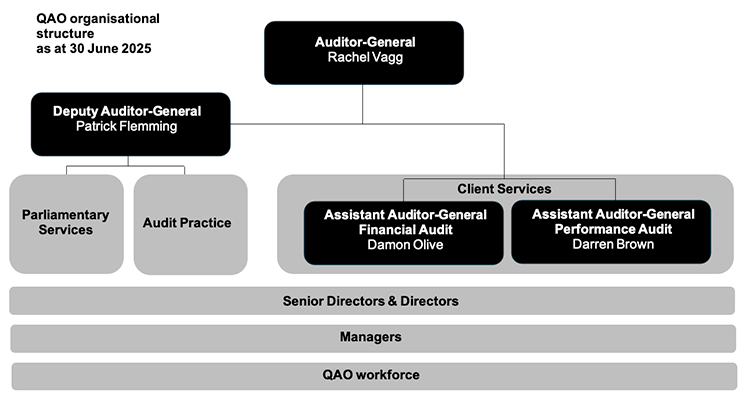

In 2025, we reshaped our operating model to reflect a sharpened strategic focus and to create efficiencies. This included appointing a Deputy Auditor-General and Heads of Performance Audit and Financial Audit in addition to making changes to our governance committees.

These changes reflect the areas of focus we have identified as priorities, including stronger strategic relationships with our clients and enhanced industry expertise to support our future work in areas such as the 2032 Brisbane Olympic and Paralympic Games. Our responses to the 2023 strategic review of QAO are reflected in the changes we have made.

In 2025, I updated my Auditor-General Auditing Standards. The new standards help provide clarity about QAO’s role and the strategic public sector audit objectives that scaffold the work we do. These objectives are at the heart of our role as an audit office and signpost our future direction.

In the coming period, QAO will continue to prioritise our delivery of quality audits that meet our clients’ expectations and regulatory requirements. Guided by our strategic plan, we will continue to foster our relationships and share our insights through genuine and timely engagement. And importantly, we will maintain our focus on meeting the Queensland community’s expectations of probity, accountability, and transparency.

At the same time, we will continue to navigate and anticipate new opportunities and challenges, including new reporting requirements and use of technology and data.

Since our last annual report, we have completed a substantial amount of work on implementing the recommendations from the 2023 strategic review. We will continue to report to the Governance, Energy and Finance Committee, QAO’s Executive Leadership Team, and our Audit and Risk Management Committee on our progress, as we look forward to continuing to realise the benefits.

More than anything, QAO is dependent on ensuring that we retain and develop our high-calibre workforce. We are proud of our people and our culture, and the Executive Leadership Team is committed to ensuring QAO is an attractive place to work. Next year, we will refine the strategic workforce plan to ensure it is reflective of technology and market changes.

I would like to thank and acknowledge the hard-working and dedicated people of the Queensland Audit Office for their efforts over the past financial year.

Rachel Vagg

Auditor-General

1. About QAO

Our role

The Auditor-General is Queensland Parliament’s independent auditor of state and local government public sector entities.

The Queensland Audit Office (QAO) supports the Auditor-General in this work under the Auditor-General Act 2009 (the Act). The Act identifies our responsibilities and provides the legal basis for QAO’s powers, such as access to information.

Our work provides assurance to the Queensland Parliament that there is appropriate stewardship over public sector entities and how they manage public resources. Queensland Parliament provides our office with appropriation to report our insights and recommendations to parliament.

QAO was Queensland’s first integrity office and has been a part of the state’s integrity system since 1860.

Our clients

We provide valued audit services to the parliament and public sector entities to support the delivery of better public services.

The entities we audit include state government departments, government owned corporations, statutory bodies, controlled entities, and Queensland’s 77 councils.

What we do

Our audit findings and insights help entities improve their financial management and service delivery, and help parliament to hold public sector entities accountable.

To achieve this, we:

- audit public sector entities’ financial statements and provide opinions on their accuracy and reliability; and provide insights on their financial performance, risk, and internal controls

- audit the efficiency, effectiveness, and economy of public service delivery through performance audits

- produce reports to parliament that summarise the results of our audits

- promote our work and share our learnings with clients, professional networks, industry, and peers

- conduct investigations into claims of financial waste and mismanagement.

We promote transparency and accountability, and our work helps engender public trust in the system of government by:

- helping entities to improve their performance

- providing assurance to parliament that there is appropriate stewardship over public sector entities

- informing Queenslanders about the public services they receive

- providing scrutiny about how entities are using public money.

Our vision and values

Our vision – Better public services | Our purpose – Independent valued assurance and insights |

Our values

|

|

|

|

Our Strategic plan 2021–25

Our strategic plan outlines our objectives, risks, organisational strategies, and indicators of achievement, aligned to our vision and purpose.

Objectives | Strategic risks | Strategies | Indicators of achievement |

|---|---|---|---|

| We support and inspire our people, which includes our contracted audit service providers, to best serve parliament and our clients. | We do not attract, grow, and retain the right people who uphold our values and ethical and quality standards. | Attract, grow, and retain our people to meet parliament and our clients’ assurance expectations. | Our people are capable, uphold our standards, and feel respected and valued. |

| Those we serve trust and value our independent services and insights. | We do not maintain valued relationships nor adapt our services to meet changing needs. | Build trust in our relationships through listening and tailoring our responses. | Our relationships and independence are valued. |

| We use contemporary auditing practices to deliver independent services that are used to improve accountability and performance. | We do not sufficiently innovate and use our technology to better understand our clients and deliver valued services. | Use data-driven innovation and solutions to enhance our assurance and insights to provide greater value. | Parliament and our clients benefit from our independent assurance services and the insights we provide. |

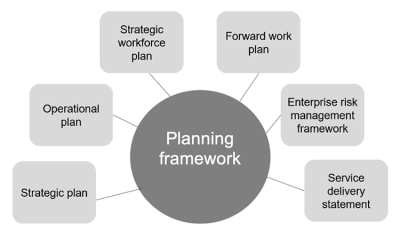

Our strategic planning framework

Our strategic plan is based on a range of intelligence sources and information from across our business. We use our strategic planning framework to identify our aims, risks, and priorities.

2. Our year in review

‘The Auditor-General’s reports to Parliament assist the committee with assessing the integrity, economy, efficiency and effectiveness of government financial management.’ – Report No. 6, 58th Parliament, Governance, Energy and Finance Committee.

Our performance highlights

| 403 audit opinions on financial statements issued and 15 reports to parliament tabled | |

| 9 parliamentary committee briefings on our reports, services, and performance | Reported on 84 entities’ self-assessed progress on 603 recommendations through the 2024 status of Auditor-General’s recommendations report |

Average time to produce audit reports: Performance – 12.2 months (target 12) Financial – 8.4 months (target 9) | Average cost of audit reports: Performance – $461,000 (target $435,000) Financial – $216,000 (target $165,000) |

95,342 web views of reports to parliament 31,179 views of our resources | Finalised 90 requests for audit |

| Audit client satisfaction: overall – 82 index points (target 80) | Winner of the Australasian Council of Auditors-General (ACAG) Performance Award for our report on Reducing serious youth crime (Report 15: 2023–24) |

Our workforce

| 210.5 full-time equivalent employees | |

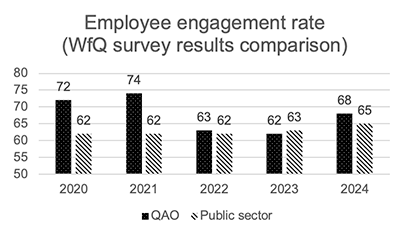

25 per cent culturally or linguistically diverse 53 per cent women | 68 per cent overall engagement from the Working for Queensland survey |

| 84 per cent of audit staff have professional audit qualifications or are studying towards one | 71 training and development hours per auditor 6 staff received CA or CPA qualifications |

‘Working at QAO allows me the opportunity to make a meaningful difference across the state of Queensland, from regional areas to city centres. It is wonderful to know our work can have a positive impact in every corner of our community.’ – Hayden, Audit Manager.

Our finances

| We continue to be financially sustainable by spending less than we earn, in turn, supporting our investment for the future. | |

Total income from continuing operations: $58.922 million | Total expenses from continuing operations: $56.832 million |

3. Our performance

Our performance framework

Our performance framework allows us to monitor and measure what we have delivered. This includes our outputs, how efficiently and effectively we operated, and the outcomes or impact from our services.

Our people and culture are critical to our success, and we value our staff and audit service providers’ contribution to our performance.

We assess our performance against:

- the benchmarked averages of other Australian audit offices, where available, via the Australasian Council of Auditors-General (ACAG)

- our strategic and operational objectives, using a range of measures developed through corporate planning and budgeting processes.

Our performance targets are outlined in our service delivery statement (SDS).

Comparison to our peer audit offices

This year, QAO performed well nationally when compared to our peer audit offices.

We compare our performance results to data available from ACAG.

| QAO performance against peer audit offices |

| We charged a higher percentage of total (whole of office) paid hours to audit work – 51.5 per cent compared to the ACAG average of 44.99 per cent. |

| Our average cost for each hour charged to audits was $191.34 compared to the ACAG average of $211.68. |

| Our average time to produce reports for performance audits was 12.2 months in 2024–25 compared to the ACAG average of 12.1 months. |

| Our average life cycle cost of reports on performance audits was $460,824 in 2024–25 compared to the ACAG average of $447,342. |

We aim to achieve the best possible value by using our resources efficiently and effectively, and ensuring we allocate the right people to the right tasks. This focus was again demonstrated in 2024–25 with QAO achieving the second lowest cost per hour for audit work compared to our peers, while maintaining audit quality and serving parliament.

Cost and timeliness of audits and reports

| Financial audits | |

| Average cost of financial audits – state entities | $108,000 in 2024–25 compared to $97,000 in 2023–24 |

| Average cost of financial audits – local government entities | $102,000 in 2024–25 compared to $93,000 in 2023–24 |

| Average time to produce financial audit reports | 8.4 months in 2024–25 compared to 6.4 months in 2023–24 |

The average cost of our financial audits for state entities was within the target range of $100,000–120,000, while the average cost of financial audits for local government entities was above the target range of $90,000–95,000.

The cost of delivering financial audits was impacted by a number of factors, including increased auditing standard requirements for information systems controls, wage rises from state agreements, and increasing costs associated with travel and technology. During 2024–25, we certified some long outstanding local government financial audits. Costs for these audits were higher due to the complexity of the audits and the duration in finalising them.

We measure the timeliness of our financial audit reports from the end of our clients’ financial year to the tabling date of the report in parliament. This year, the average time to deliver the reports was 8.4 months – slightly shorter than our SDS target of 9 months and longer than last year’s average of 6.4 months.

State general elections impact on timeliness as QAO does not table reports or issue proposed reports for comment during the caretaker period. As a result of the 2024 State general election, the 2024–25 target was increased to 9 months.

| Performance audits | |

| Average life cycle costs of performance audits | $461,000 in 2024–25 compared to $492,000 in 2023–24 |

| Average time to produce performance audit reports | 12.2 months in 2024–25 compared to 13.8 months in 2023–24 |

The average cost of our performance audits, including the reports, was higher than the SDS target of $435,000, but less than last year’s average cost of $492,000. Our cost for these reports was higher than the ACAG average of $413,115.

We measure the timeliness of our performance audit reports from the start of the audit to the tabling date. We delivered our performance audit reports on average in 12.2 months – slightly longer than our SDS target of 12 months, but less than last year’s average of 13.8 months. Our delivery time was slightly longer than the ACAG average time of 12.1 months.

The delay and increase in costs of tabled performance audit reports is due to several reasons, including:

- the complexity of audit topics

- increasing regional travel and engagement of subject matter experts

- the need to socialise audit findings and draft reports with new stakeholders after the change of government

- the increasing cost of service delivery due to wage increases and increases in other operating costs.

Our people and culture

We support and inspire our people, which includes our contracted audit service providers, to best serve parliament and our clients.

This includes by providing training, supporting professional development, and considering the feedback that we receive through our survey mechanisms.

| Key highlights | |

| Improve our Working for Queensland survey score for overall employee engagement | 68 per cent in 2024–25 compared to 62 per cent in 2023–24 |

| Improve independent survey feedback from contracted audit service providers | 95 per cent said we provided value in 2024–25 compared to 88 per cent in 2023–24 |

| Increase on-the-job training and deliver adequate training hours for our people | 71 hours per auditor in 2024–25 compared to 95.1 hours per auditor in 2023–24* *result no longer includes on-the-job training hours |

| Support the achievement of professional audit qualifications | 6 staff received CA or CPA qualifications in 2024–25 compared to 3 staff in 2023–24 |

| Effectively manage workforce capacity risks | 8 graduates hired in 2024–25 compared to 9 graduates in 2023–24 13.2 per cent separation rate in 2024–25 compared to 10.5 per cent in 2023–24 |

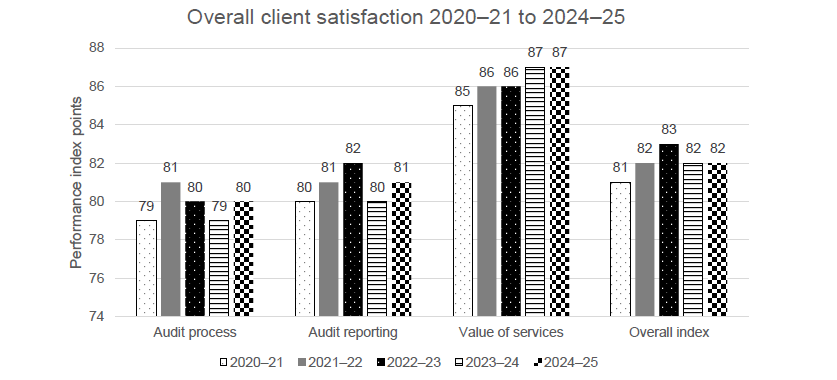

Client satisfaction

We proactively seek to foster client relationships and ensure we are delivering valued, high-quality services.

Our independent client surveys are a key mechanism for monitoring this. We also capture feedback directly and indirectly from our clients when we meet with them or visit their work sites.

Audit clients’ satisfaction with our services

Our client survey program informs our strategic approach and helps us to continuously strengthen our client relationships.

Through our independent research provider, we ask departments, government owned corporations, statutory bodies, and local governments for feedback on our processes, documents and reports, and the value of our services. We use the results to identify trends and address issues.

Results are shown as index points, which is the average of the aggregate indices for each area of surveyed performance. Our overall combined result this year was 82 index points, exceeding our overall target of 80.

Our clients noted our professionalism and conduct of audits as a key strength. Our ongoing commitment to consulting early on our audit planning, results, and reports to parliament will further help us to build on these results. Clients also noted areas of improvement, including better knowledge sharing in auditor transitions and improved responsiveness in relation to technical queries.

In 2024–25, we also surveyed our clients’ audit committee chairs. These surveys occur every 2 years. Our overall satisfaction result of 85 index points trended higher than in the last survey (2022–23: 84 index points) and exceeded our overall target of 80.

Financial audit specific results

This year’s results saw improvements across all survey categories.

| Key highlights – financial audit | |

| Our overall result of 83 index points was higher than last year (82) and exceeded our overall target of 80 | We received: 81 for our audit process (2023–24: 79) 81 for reporting (2023–24: 80) 88 for the value of our services (2023–24: 87) |

Feedback from a surveyed financial audit client:

‘The working relationship between the new audit team in FY 2024 and the department’s management and staff was very effective, supportive and amicable. Issues were able to be raised, discussed and resolved by working together throughout the financial year and during the financial audit.’– ORIMA survey, September 2024.

Performance audit specific results

There were lower scores this year from our performance audit clients. Contributing factors include changes to the survey questions and the sensitivity of the audit topics in this financial year.

| Key highlights – performance audit | |

| Our overall result of 72 index points was significantly lower than last year (82) and below our overall target of 80 | We received: 70 for our audit process (2023–24: 80) 75 for reporting (2023–24: 84) 71 for the value of our services (2023–24: 83) |

Feedback from a surveyed performance audit client:

‘The senior executive audit staff were excellent to work with and we appreciated that towards the end of the process the care, time and consideration of the feedback we provided was actioned.’ – ORIMA survey, March 2025.

Parliamentary stakeholder engagement

We aim to help parliament understand public sector entities’ financial management and performance, to support their accountability role.

Following the State general election in October 2024 and change of government, the structure and membership of Queensland’s parliamentary committees changed.

We wrote to the 7 newly established portfolio committees to provide an overview of our recent and upcoming work related to the entities they oversee. This included previous committee inquiries into our reports, which had lapsed with the dissolution of the 57th parliament.

We engage directly with ministers about our recent and upcoming audits. This includes offering to meet with the ministers whose entities are involved in an audit to ensure they understand our aims and to promote our recommendations.

This year, the Auditor-General, QAO, and 23 of our reports were referenced on 87 occasions by members of parliament during parliamentary discussions and estimates hearings.

We engage proactively with parliamentary committee chairs, deputy chairs, and secretariat staff to help us better understand committee needs in relation to our reports and to obtain advice on how and when to engage with members.

| Key highlights – parliamentary engagement |

| An information session for committee secretaries in September 2024 to help them understand annual reports and financial statements. |

| An overview of QAO sent to all members of parliament (MPs) and committees, and briefing notes to new ministers. Meetings between the Auditor-General and new ministers, and a presentation at the MP induction. |

| A QAO office site visit in May 2025 for new members of 3 committees, coordinated via the Governance, Energy and Finance Committee. |

Briefings on our reports to parliament

This year, 20 reports were referred to committees, including 16 tabled in 2024–25 and 4 from previous years. This total includes 4 reports that were self-referred by 4 new committees of the 58th parliament.

| QAO briefings to parliamentary committees |

| We gave 9 briefings to 6 parliamentary committees covering the findings and recommendations in 14 of our reports to parliament. This is an increase on the 4 briefings we gave to 4 committees on 5 reports in 2023–24. |

| We expect to provide briefings on the remaining reports we tabled in this financial year, later in 2025. |

| Committees finalised 26 inquiries, including 20 reports referred in previous years; 3 referred in 2024–25; and our Annual report 2022–23, Annual report 2023–24, and 2023 strategic review of the Queensland Audit Office. |

4. Our services

Delivery of audit services

We design our audit work to respond to the risks the public sector and our clients face. We report on matters of significance to our clients and to parliament.

Our work is delivered by experienced leaders and public sector auditors who are supported through our professional development programs. We use public sector-specific methodologies for financial statement audits and performance audits, and we are developing a new sustainability reporting methodology.

Underpinning our performance is our focused quality program, which reports publicly through our annual transparency report.

This year, we reshaped our financial audit and performance audit programs, with renewed executive leadership positions for each function.

Financial audit

Each year, we deliver contemporary, high-quality audits that provide parliament and our audit clients with trusted, independent assurance and advice. We provide more than 400 audit opinions for our state and local government clients across Queensland. We prioritise our client relationships and our teams travel to all corners of the state to provide services on the ground. We also work closely with our contracted audit service providers (ASPs) who support the delivery of our audit program each year. Our ASPs are a critical part of our workforce and in 2024–25, they delivered 44 per cent of our audits.

We now deliver our financial audit program under industry-based leadership, meaning we are investing in focused knowledge of our audit clients and their diverse industries such as health, education, energy, and financial services.

Among the highlights this year was the uplift in our client and ASP satisfaction scores.

| Expanded focus on information systems risks |

| This year, risks associated with information security and controls were significant and we provided greater insights about them to our clients and in our reports to parliament. |

| We will continue this focus in 2025–26, with a new report to parliament on information systems risks planned. |

Attracting, developing, and retaining our people is an important investment for QAO. We continue to embed our community-based resourcing model and prioritise the growth and training of our staff.

Our data and analytics program supports our cost-effective products, ensuring we embrace innovation and use refined tools. This year we introduced:

- new data solutions for larger audit clients to support efficient and consistent risk assessment processes

- a streamlined dashboard for our local government reports.

Throughout the year, we also continued to work with our first tranche of clients to prepare for sustainability assurance with climate reporting commencing in 2026.

Performance audit

We provide independent assurance to parliament and public sector entities through our performance audits. This year, we tabled 6 performance audit reports to parliament. These reports examined matters of significant interest to parliament and the public, including the Brisbane 2032 Olympic and Paralympic Games and protecting students from bullying.

In 2024–25, the performance audit function continued to attract high-quality and well-credentialled staff. We have focused on improving our tailored professional development program for performance audit and renewed the way we engage with our clients to strengthen our relationships.

In addition to reports to parliament, the team contributed to the development of our:

- Forward work plan 2025–28

- 2024 status of Auditor-General’s recommendations (Report 1: 2024–25)

- revised performance audit methodology, incorporating new objectives of ethics, probity, sustainability, and equity to existing efficiency, effectiveness, and economy objectives.

Our team’s achievements were rewarded at the annual Australasian Council of Auditors-General IMPACT Awards. Report to parliament nominations come from all Australian and New Zealand jurisdictions, and QAO has taken out an award in each of the last 4 years, demonstrating our consistently high standard of audits and reporting.

In 2025, our Reducing serious youth crime (Report 15: 2023–24) report to parliament won the Excellence award, recognising the report’s quality, impact, and high standards of evidence and audit methods.

| Impact of our work – Reducing serious youth crime (Report 15: 2023–24) |

This audit topic’s breadth and complexity required a carefully considered scope and high-quality evidence to support the report findings. Robust data analysis and our approach to collecting and collating information provided a high level of assurance on our findings, helping the entity to identify meaningful opportunities to improve its performance. |

Entities acted quickly on our findings, with outcomes driven by regular engagement about the need to ensure the 12 recommendations added value and would be implemented effectively. Following the report’s tabling, the Department of Youth Justice released a new youth justice strategy – A Safer Queensland 2024–2028 Youth Justice Strategy. |

Interest in this report has been significant and it is QAO’s most accessed report to parliament. In May 2025, we were also invited to present to more than 100 staff on the Audit Board of the Republic of Indonesia on this report. |

Sustainability assurance reporting

Mandated climate-related financial disclosures come into effect for the Queensland public sector’s larger government companies in 2025–26.

Entities within scope will be required to prepare a sustainability report that complies with Australian Sustainability Reporting Standards issued by the Australian Accounting Standards Board. They will also be required to obtain independent assurance of their climate-related financial disclosures.

QAO has been preparing to audit the new disclosures and reports by developing a specific sustainability methodology and training our staff. We have also worked with our in-scope clients to prepare for the first reports and audit process.

We will undertake quality reviews over sustainability audits as we provide assurance work, to support our continuous improvement.

Data and analytics

Data and analytics solutions support the efficient and cost‑effective delivery of our audit services.

We continue to seize opportunities to develop innovative solutions that integrate with our audit methodologies and support deeper insights from our work. Our tools are designed to increase our efficiency by reducing the time our audit teams spend on manual data analysis and administrative tasks.

We also continue to focus on attracting talent to support our work in data and analytics, including targeting graduate recruitment.

Our focus on innovation contributes to an analysis-driven culture that challenges our people to seek ways to better serve our clients. Future priorities include exploring how AI-based functionality can add value to our business outcomes, clients, and our people.

| How data and analytics solutions support our audits |

| This year, we delivered several new audit-driven analytics solutions that are continuing to reduce the hours our people spend on manual audit calculations and analysis. These included a risk assessment solution and a risk response (finance and payroll) solution, delivering streamlined data and diagnostics, and collectively saving up to 10 hours per client. |

| We used data analysis to help us better understand the volume of cyber bullying incidents occurring during our audit Protecting students from bullying (Report 6: 2024–25). To do this, we worked with the client to analyse free text description fields using a rules-based scoring system. Using this analysis, we gained insights that informed the audit and provided evidence-based support for recommendations on improving incident reporting. |

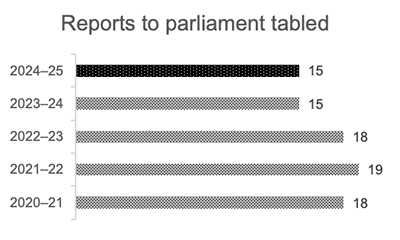

Reporting the results of our work to parliament

We tabled 15 reports to parliament on the results of our audits, our insights, key facts, and recommendations for performance improvement – the same number as in 2023–24.

We tabled 6 performance audit reports and 8 financial audit reports to parliament, along with the 2024 status of Auditor-General’s recommendation report. Our reports included recommendations to public sector entities about how they can improve their performance and service delivery. We discontinued the Queensland regions report in this financial year, instead ensuring that our forward work plan includes a sufficient focus on regional service delivery through our range of planned audit topics.

We aim to table reports promptly to ensure timely assurance for parliament and so entities can act on our recommendations quickly. We meet this challenge by reviewing our internal processes and structures to identify how we can improve our efficiency and reduce the costs of our audits, without compromising on quality.

This year, we have continued to implement our strategic review recommendations, particularly focused on increasing engagement and leveraging the expertise of subject matter experts.

| We are focused on delivering high-quality, timely reports |

| We balance the need for plain language reports with providing sufficient context to interpret our findings and recommendations. We continually seek feedback to improve our reports and work with communication experts and editors. |

| The complex or sensitive nature of specific topics requires more engagement and time for clients to respond to draft reports, affecting our timeliness. |

| We did not table reports or issue proposed reports for comment during the caretaker period leading up to the State general election in October 2024, in accordance with the tabling protocols outlined in the Auditor-General Auditing Standards. |

Monitoring the implementation of our recommendations

Each year, we monitor the progress entities are making on implementing our recommendations. We do this by asking them to self-assess their progress and we report to parliament on these results.

Our status of Auditor-General’s recommendations reports provide insights about shared challenges and opportunities for entities and are a useful departmental engagement tool for parliamentary committees. They highlight the most common types of recommendations we make and those that entities are slower to implement. Responses from entities also help inform the detailed ‘follow-up’ audits we undertake each year as set out in our forward work plan.

We tabled our report 2024 status of Auditor-General’s recommendations (Report 1: 2024–25) in parliament on 20 September 2024, which included gathering information from 84 entities’ self-assessment of their progress in implementing 603 recommendations from 40 reports to parliament.

This included 9 new reports (8 reports tabled in 2022–23 and our Conserving threatened species report tabled in 2018–19) and 31 reports from earlier years that had outstanding recommendations.

| 2024 status of Auditor-General’s recommendations (Report 1: 2024–25) | |

| 27 entities reported fully implementing 52 per cent of the total outstanding recommendations. | 30 of the 40 reports to parliament have outstanding recommendations. |

| Entities reported fully implementing 45 per cent of the 223 outstanding recommendations from the 2023 report. | 10 of the 84 entities reported fully implementing our recommendations. |

Our forward work plan

Each year, we publish a 3-year plan that covers our performance audit topics and focus areas for financial audits.

Our plan supports our delivery of insightful and timely reports to parliament and helps ensure we are auditing the right matters at the right time. It provides transparency to parliament, our clients, and the public, and gives our clients visibility so they can anticipate and prepare for our audits. We enhanced this visibility in 2024–25 by including a list of potential and reserve topics for the first time.

We improved the format of the plan, with a greater focus on the executive summary information to make it easier for readers to navigate. Our updated focus areas also reflected changes in priorities.

This year, we published our Forward work plan 2025–28 on 30 June 2025. A summary is available at Appendix B.

We engaged proactively with our stakeholders, including government owned corporations, in developing our plan and regularly seek input or feedback from parliamentary committees, entity leadership, peak and integrity bodies, and others. This year, we significantly uplifted this consultation prior to finalising our plan to help inform focus areas, topics, and priorities.

Over the next 3 years, we will include new or updated audits that respond to emerging risks, and any changes to government priorities and strategies.

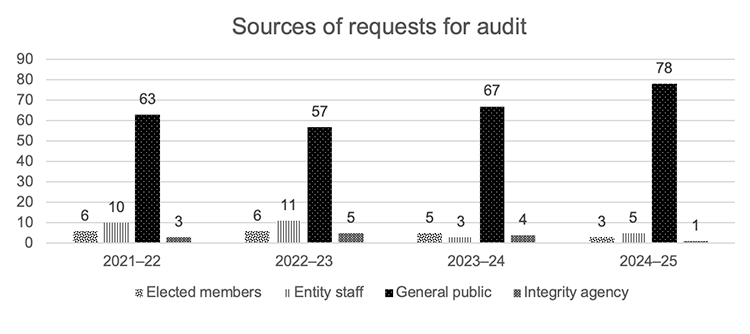

Managing requests for audit

QAO welcomes information on public sector performance and requests for audits from members of the public, elected representatives, public sector and local government employees, and other integrity bodies.

To be transparent, we publish requests from members of state parliament and local government councillors on our website.

The most common topics or themes this year related to project management, contract management, procurement, conflicts of interest, and waste in public expenditure.

| Requests for audit |

We received 87 new requests for audit this year, compared to 79 last year. 3 requests were received from elected members. 4 requests were assessed as high priority, meaning the topic may have a significant impact, reflect a widespread issue across public sector service delivery, or relate to significant financial waste and mismanagement. |

Our completed investigations resulted in recommendations to entities to strengthen their internal controls and informed forward work planning topics. Some of our reports to parliament incorporate matters raised in requests for audits, such as:

- grants to the Quandamooka Yoolooburrabee Aboriginal Corporation in the report Managing Minjerribah Futures funding (Report 14: 2024–25)

- ex-gratia payments in the report State entities 2024 (Report 11: 2024–25).

Stakeholder engagement

In 2024–25, we increased our strategic focus on stakeholder relationships to better understand the risks public sector entities are facing and where our audits can add the most value.

With a state general election and local government elections falling in 2024, we have invested more time engaging with new leadership to discuss their areas of focus, the work we do, and emerging risks. Client relationships are a central focus of our strategic plan, and we embed close oversight in our organisational structure and operating model to mitigate risk.

Supporting reporting outcomes

We value our relationship with Queensland Treasury and work closely on whole-of-government accounting and financial reporting matters.

In February 2025, Treasury presented at our client technical update event for public sector finance officers on a range of topics, including sustainability assurance reporting. We also engaged closely with the chief finance officers of departments, including through a tailored forum on 26 March 2025.

The Deputy Auditor-General presented at the 2024 Interdepartmental Accounting Group’s annual conference on 27 November 2024 on a range of topics, including our upcoming work, machinery of government changes, cyber and information systems, and sustainability assurance.

Supporting audit committees

An audit committee supports accountable officers, chief executives, and boards by providing oversight and insights into financial reporting and internal controls. They also play a key role in monitoring entities’ progress in implementing our recommendations.

This year, we liaised with our clients’ audit committees regularly as part of our audits and via dedicated briefings. Our attendance at audit committee meetings enabled us to share learnings and insights, and ensured committees had visibility of emerging risks.

We continued to share learnings in our briefing papers for audit committees for all our audit clients, and at a range of QAO-hosted and external event presentations. This year, we also produced some specific guidance for committees through our Insights on audit committees in local government (Report 10: 2024–25) report to parliament. Appendix D of the report provides a list of actions to help improve audit committees in local government.

Our engagement activities included 2 dedicated briefings to audit committee chairs in December 2024 and May 2025. We shared key information, learnings, and insights with chairs about our work, priorities, and recent reports to parliament in these sessions. Surveyed attendees said the events were ‘professional and informative’, ‘excellent’, and offered ‘great presentations’.

Supporting local government

Queensland's local governments, also known as councils, are the first line of connection to our communities.

We aim to maintain and strengthen our relationships with the many stakeholders who support councils, including the Local Government Association of Queensland, the Local Government Finance Professionals (LGFP), and accounting and auditing standards boards.

This year, we supported councils on a range of matters, including through:

- our Local government 2024 (Report 13: 2024–25) report to parliament, which included an interactive data dashboard that allows readers to search by their address or local government area to see financial performance and demographic information

- better practice guides to support local government service delivery

- joint presentations at LGFP webinars and events

- tropical workshops in collaboration with the Department of Local Government, Water and Volunteers aimed at helping local governments to prepare for financial reporting, and support timeliness and quality.

Collaboration

We invest in our professional relationships with peers through the exchange of information and insights.

Australasian Council of Auditors-General (ACAG)

The Auditor-General is a member of ACAG, alongside other offices in Australia, New Zealand, Papua New Guinea, and Fiji. ACAG’s objective is to strengthen public sector auditing in Australasia through leadership, collaboration, and advocacy. We work closely with it through committee meetings, discussion papers, and by contributing to standard-setting boards.

In April 2025, QAO representatives attended ACAG’s IMPACT conference in Perth, Western Australia, which is a biennial event for public sector performance audit professionals. QAO representatives also attended ACAG committee meetings in October 2024 and April 2025.

We also support the Papua New Guinea Institutional Partnerships Program, funded by the Department of Foreign Affairs and Trade and coordinated by the Australian National Audit Office.

Integrity bodies

We engage with other Queensland integrity bodies, as permissible under legislation, and have regular discussions on public sector risks.

This year, the Auditor-General met with the accountable officers from the Crime and Corruption Commission, Office of the Queensland Integrity Commissioner, Office of the Information Commissioner Queensland, and Queensland Ombudsman.

Professional bodies

We contribute to work programs or sit on project advisory boards for the Australian Accounting Standards Board and Auditing and Assurance Standards Board. We focus our liaison on public sector financial reporting-specific matters and applicability to help guide standard setting as well as our own application of the existing standards.

We are actively involved in the work of professional accounting bodies, Certified Practising Accountant (CPA) Australia and Chartered Accountants Australia and New Zealand.

Our audit staff obtain professional qualifications and attend or present at events hosted by these bodies. In 2024–25, this included:

- the CPA Australia International Women’s Day Breakfast panel on 18 March 2025

- the CPA Australia Queensland Public Sector Committee forum on 11 September 2024.

| Celebrating a long connection with professional bodies |

Paul Christensen, Senior Director was recognised for his 30-year CPA membership. David Hardidge, Technical Director was recognised for his 40-year CPA membership and is the current Queensland Divisional Council Deputy President. Sumi Kusumo, Senior Director was admitted to the Australian Institute of Company Directors. |

Communication and engagement

Our strategic program of communication activities aims to promote accountability and transparency across the public sector and support the parliament’s work in strengthening public sector accountability.

Many of the learnings in our reports are relevant to entities beyond those we make recommendations to. We share insights and learnings broadly to enhance the visibility of our work so they can benefit entities in useful ways, ultimately supporting the delivery of better public services. The resources we deliver are mapped to the audit areas of focus in our forward work plan and designed to engage and add value.

Promoting our reports to parliament

We aim to produce reports that are clear and easy to read and understand to help the public sector improve. Readership of our reports and resources shows us whether we are increasing exposure to our insights and having an impact where it matters.

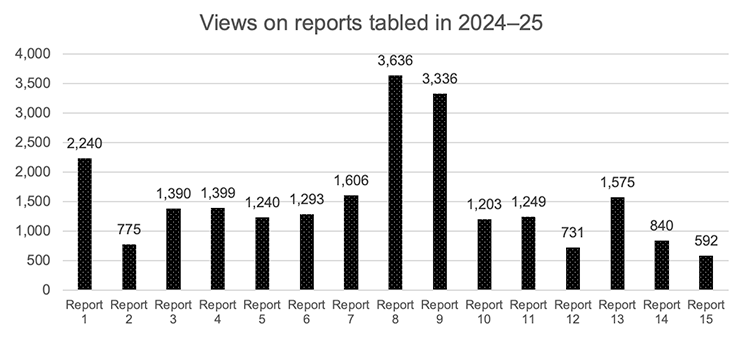

This year, our reports were viewed 95,342 times (compared to 72,767 times in 2023–24). The 3 highest-viewed reports tabled in this financial year were:

- Health 2024 (Report 8: 2024–25)

- Major projects 2024 (Report 9: 2024–25)

- 2024 status of Auditor-General’s recommendations (Report 1: 2024–25).

Maturity models and other self-assessment tools

For some reports, we develop accompanying maturity models, guides, or tools. This year, we added a new asset management maturity model to help entities self-assess their level of maturity for each of the major elements of asset management.

Our most-downloaded guides this year were the Risk management maturity model and Fraud and corruption self-assessment tool.

Interactive data dashboards

We bring some of our insights to life via our interactive data dashboards. Our dashboards reflect the results of our financial audit reports and incorporate demographic information to help users understand financial performance results for entities.

One of our most popular dashboards supports our status of Auditor-General’s recommendations reports, allowing readers to search based on their interests or role. Another key dashboard is QAO Queensland, which highlights key insights and data from across all of our dashboards. Collectively, our dashboards were viewed 7,877 times this year.

Blog articles

QAO’s blog is a key channel to promote our insights and share the expertise of our people.

In 2024–25, we published 21 blogs, attracting a total of 7,083 views. Our 3 most-read blogs were:

- Lessening the year-end rush: embracing a hard close audit

- Implementing machinery of government changes

- Our update on Queensland Treasury’s reporting requirements for 2024.

Some of our blogs form part of an ongoing series, reflecting topical issues or areas of focus. This year, we commenced a new blog series on the topic of sustainability assurance.

Fact sheets

We also produce fact sheets that explain our role, services, processes, and specific topics in more depth. Some of our fact sheets also help explain or support some of our better practice guides, for example on internal control assessments.

Our most-viewed fact sheets this year were on internal control assessments, our forward work plan, and preparing position papers for accounting matters and evaluation.

Client events

We host and support a range of client engagement events throughout the year, with topical agendas presented by members of our expert QAO team. Our events are tailored to meet the needs of client groups and to provide opportunities for discussion and relationship building.

In 2024–25, our events covered key topics ranging from technical and standards updates, insights from our audits and reports, and our upcoming work. Key events included:

- our annual client technical update for our state and local government finance managers, which attracted 525 attendees

- briefings to audit committee chairs in December 2024 and May 2025, attracting 167 attendees

- a new forum for public sector department chief finance officers in March, with 13 attendees

- forums and workshops for our audit service providers to share knowledge, examine risks facing specific industries, and discuss audit approaches, with 341 attendees

- a forum for our energy, ports, and transport clients, with 91 attendees.

| Engagement with tools and channels in 2024–25 | |

| Most viewed report: Health 2024 (Report 8: 2024–25) | 21 blogs published, attracting 7,083 readers |

| Most read blog: Lessening the year-end rush: embracing a hard close audit | Most accessed better practice guide: Risk management maturity model |

| Views on all published dashboards: 7,877 | 9 events, with more than 1,500 attendees |

5. Our corporate governance

Leadership

Our structure promotes strategic and accountable oversight of our operations. The Executive Leadership Team (ELT) supports the Auditor-General in meeting QAO’s responsibilities under the Auditor-General Act 2009 (the Act) and governs QAO’s strategic direction.

ELT membership and activities

The ELT is led by the Auditor-General and has shared responsibility for audit excellence, innovation, and operational performance. The Deputy Auditor-General and each of the Assistant Auditors-General are also members of the ELT.

QAO acknowledges the contribution of Assistant Auditor-General, Karen Johnson who retired in 2025, following a distinguished career, which included 13 years in a range of leadership roles at QAO.

The ELT determines QAO’s strategy and budget; leads us in achieving our objectives; and helps to optimise, monitor, and report on our performance and risks. The group meets twice per month, with QAO’s Chief Financial Officer also attending relevant sections of the meetings.

A new division, Specialist Audit, will be introduced in the coming financial year. It will focus on specialist audit, including information systems audit, data and analytics, and sustainability reporting, and will be headed by a new Assistant Auditor-General role.

Governance framework

Our governance arrangements promote effective and accountable management.

Our governance committees challenge and monitor our risks and our actions. We rationalised our committees in November 2024, with the Audit Quality Sub-Committee, People Committee, and Finance Management Group activities incorporated into other activities.

Audit and Risk Management Committee

The Audit and Risk Management Committee (ARMC) is an advisory committee to the Auditor-General. It is comprised of 3 independent members who bring expertise from other industry environments.

The ARMC provides oversight of QAO’s risk, control, and fiscal responsibilities underpinning our corporate governance. It met 5 times in 2024–25. Details of committee membership are included in Appendix C. Our charter details the committee’s responsibilities and appropriateness of the members’ skills and includes that the committee must assess and report to the Auditor-General on its performance.

QAO Initiatives Program Board

The QAO Initiatives Program Board monitors and oversees QAO’s initiatives in response to the risks and opportunities the business faces.

During 2024–25, this included overseeing the:

- data and analytics program

- sustainability reporting project

- learning and development refresh

- finance system replacement project.

The board reports to the ELT and provides recommendations on project governance. As at 30 June 2025, its membership consists of the Deputy Auditor-General, Assistant Auditor-General – Financial Audit (Chair), and a Senior Director. It met 6 times during the financial year.

Sub-committees to the ELT

Sub-committees of the ELT monitor and make recommendations about QAO’s primary risks.

| Business activity | |

| Information and Cyber Governance Committee |

|

| Workplace Health and Safety Committee |

|

| Audit quality and performance | |

| Quality Management Committee |

|

| Technical Issues and Major Transactions Committee |

|

2023 strategic review of our office

In 2023, a strategic review of QAO was conducted by an independent reviewer, appointed by the Governor-in-Council, with the final report tabled in parliament on 15 February 2024.

Overall, the report concluded that:

- the preceding 5 years have been a tumultuous period, domestically and internationally, and that QAO has navigated these challenges and served the state well

- Queensland gets good value from its investment in QAO

- QAO performs its functions economically, effectively, and efficiently.

This review provided insights into how well we are operating and fulfilling our mandate. The 2023 strategic review report and QAO’s response is available on our website.

In September 2024, the former parliamentary Cost of Living and Economics Committee published the report on its inquiry into the strategic review, Inquiry into the Report on the 2023 Strategic Review of the Queensland Audit Office (Report No. 15).

Key aspects of the committee’s report included:

- consideration of stakeholder submissions, evidence given by the reviewers, the former Auditor-General, and QAO staff at public hearings in 2023–24, and evidence given by the current Auditor-General in August 2024

- support for the strategic reviewers’ recommendations

- a recommendation that the legislative assembly note its report.

We provided an update on the status of the recommendations to the parliamentary Governance, Energy and Finance Committee in April 2025.

Our progress on implementing the 2023 recommendations

We closed 14 recommendations in 2024–25, with 28 in progress as at 30 June 2025 and 2 not started. Internal audit confirmed that we appropriately addressed the recommendations we closed.

We are reporting our implementation progress to QAO’s ELT and ARMC, and the Governance, Energy and Finance Committee. We are also keeping staff informed of our actions and updating our clients and stakeholders at events and meetings, as relevant.

As part of implementing the strategic review recommendations, QAO also reviewed its performance measures. This resulted in the inclusion of additional measures in the performance statement (pages 55–58).

Overview of QAO’s implementation of 2023 strategic review recommendations

| Recommendation type | In progress | Not started | Closed | Total |

| Made to QAO | 28 | 2 | 17 | 47 |

| Made to external parties |

| 8 | 1 | 9 |

| No further follow-up required |

|

| 2 | 2 |

| Subtotal | 28 | 10 | 20 | 58 |

External audit of QAO

QAO’s financial statements are independently audited. Our new external auditors were appointed by the Governor-in-Council on 15 May 2025 for a 3-year term on the recommendation of Department of the Premier and Cabinet.

Our external auditors provide assurance that the information in our financial statements can be relied upon, and that the statements are free from material misstatement and comply with relevant legislation.

Legislative environment

Public Sector Ethics Act 1994

QAO is an integrity body and ethics are a deeply ingrained focus in all that we do. Our internal policies, procedures, and practices align with our ethical principles and values. Our auditors also apply the Code of Ethics for Professional Accountants, as issued by the Accounting Professional and Ethical Standards Board.

QAO also adheres to the whole-of-government public service Code of Conduct, established under the Public Sector Ethics Act 1994.

Human Rights Act 2019

Under the Human Rights Act 2019, we fully support the rights of people to be treated with dignity and respect. We reflect this in our values and assess staff on this as part of their performance reviews.

We adhere to all requirements of the Human Rights Act 2019 and have received no complaints.

Integrity and Other Legislation Amendment Act 2024 and Auditor-General Act 2009

Changes have been made to our enabling legislation, with the main amendments changing the budget approval process for QAO.

From 1 January 2025, the Auditor-General must submit proposals for additional funding to the parliamentary Governance, Energy and Finance Committee. Additional funding includes requests to fund large one-off projects, such as system replacements, or requests to fund an increase in the services provided by QAO, such as an increase in the number of our performance audits.

We are working closely with the committee and Queensland Treasury to establish appropriate protocols and processes for applying these new requirements.

We did not make any requests for additional funding or for an increase to our charge out rates in developing our budget for 2025–26.

Preparation for new information privacy requirements

Significant privacy reforms announced in 2024–25 came into effect from 1 July 2025.

Throughout the year, we prepared for the new requirements, which include the mandatory notification of data breach scheme. This involved aligning our security incident, event, and data breach management plan to the 5 incident response stages – identify, contain, evaluate, notify, and mitigate. Within these response stages, we have set key performance indicators to help us meet the new time frames.

We supported our audit service providers to ensure they are also preparing for the new requirements. We also worked on reconfirming our data sharing arrangements with audit clients to ensure we are clear about what information we need to conduct our audits.

To ensure our people are ready for the changes, we focused on delivering training and development activities aimed at ensuring staff understand the requirements and the implications of non-compliance.

Recordkeeping

New recordkeeping legislation came into effect in December 2024 and will be implemented over the next 2 years. In 2024–25, we commenced planning for the new recordkeeping standards, which are expected to be released in 2026.

Our key risks and responses

QAO’s integrated risk management approach encompasses our culture, processes, and structures for identifying, responding to, and controlling existing and emerging risks.

Our risk management framework informs our strategic and business planning, and we apply it to our operations, projects, and business decisions.

We record our key risks in our risk register, which we report on quarterly to the ELT and ARMC. We also review our risk framework and operational risks regularly to ensure we are focusing on the right things at the right times. In 2025, the ELT undertook a full review of our risk framework and strategic and operational risks. Changes will be discussed with the ARMC early in the 2025–26 financial year. Ongoing monitoring and reporting on our risks and controls are key priorities.

Our risk focus areas include our mandate, the quality of our audit services, security, people, finance, and technology.

Audit quality

Audit quality is a key priority for QAO. We aim to perform our audits consistently and to a high degree of excellence to meet the expectations and regulatory requirements of our clients.

We have well-established controls, processes, and governance in place to ensure we meet these responsibilities, including:

- risk-based audit methodologies that meet the current requirements issued by the Australian Auditing and Assurance Standards Board

- an annual quality assurance plan targeting higher risk audit jobs

- engagement quality officers who review our audit work and reports to parliament

- reviews of our audit service providers’ performance and their systems of quality management

- effective resource allocation, ensuring the right mix and skills of people for our clients’ needs

- an integrated learning and development program to grow our capability and share learnings

- a focus on ensuring our work is supported by sufficient and appropriate audit evidence.

The Auditor-General Auditing Standards describe how we perform our audits and underpin our quality focus. The standards provide insights into public sector-specific auditing objectives, and adopt the standards issued by the Auditing and Assurance Standards Board where relevant.

We publish a transparency report on our website to demonstrate our commitment to audit quality. This report:

- highlights whether our system of quality management is effective

- explains our quality program and results

- outlines how we seek to improve our audit practices

- describes our systems of quality management.

We published our Transparency report 2023–24 on our website on 18 October 2024.

Complaints management

This year, QAO received 4 complaints, compared to 7 last year. These complaints mostly related to our processes for delivering financial audit services. We take all complaints seriously and manage them in line with our policies and best practice, which includes the Queensland Ombudsman’s complaints management guidance.

In 2024–25, we updated our complaints policy and procedures to create further efficiencies. We actively monitor our client relationships and any action plans that are in place to ensure that identified improvements are addressed.

Cyber and information security

Cyber security remains a key risk for all organisations. At QAO, we are continuing to evolve our training, tactics, and controls to ensure our security posture is robust and to foster a high level of awareness.

Our policies, standards, procedures, and planned activities help ensure the security of our information and protect the integrity, confidentiality, and availability of our information assets.

This year, we continued to refine our security controls, undertaking a physical breach exercise and performing internal audits on our information security management system and information technology (IT) controls. Our controls help us to monitor and act on risks before they become issues and to ensure we can respond to, and recover from, an incident.

We continued to update and improve our information security management system in accordance with ISO 27001 – the leading international standard for information security. We also remain committed to implementing the Australian Signals Directorate’s ‘essential eight’ maturity model for mitigating cyber risk. We have successfully reached our target maturity level in 5 of the essential eight strategies. This progress reflects our dedication to achieving a strategic balance between robust security controls and business continuity.

We increased our training activities this year to ensure our workforce and audit service providers are aware of their obligations under the Auditor-General Act 2009 and adhere to recordkeeping protocols, report any breaches, and ensure protected information is not divulged or made public.

Workforce capacity and capability

The skills profile within the audit profession is transforming, as advancements drive demand for professionals with skills in data analytics, cyber security, and sustainability assurance.

Our strategic workforce planning responds to emerging challenges such as this, and our actions are aimed at identifying and bridging any gaps between our current and future workforce needs. This helps us to attract and retain the right people. Next year, we will further refresh and refine the current strategic workforce plan.

This year, we completed our learning and development refresh project, including contemporary training material. Supported by high-quality training products, we continue to exceed our mandatory training requirements for professional qualifications and public sector knowledge.

| We are focused on developing and caring for our workforce |

In 2024–25, we continued to embed our team-led model of delivery called communities, and our staff tell us that they feel supported through a closer connection to their team. This year, we have focused our communities on sectors and industry-specific activities to ensure our staff can develop suitable skills to identify and respond to industry risks. |

| The connection our staff have with QAO and its purpose is strong. The results of the 2024 Working for Queensland survey showed improvement in how staff are feeling about workload pressure and how their workload affects their health. |

| Our systems and processes help us to deliver our audits in a consistent way that supports our client experience. This includes a resource management system, robust performance management system, and training and development opportunities. |

Internal audit

Internal audit conducts independent and risk-based assurance activities aimed at improving QAO’s operations.

Internal audit works in line with a strategic and annual audit plan, and its charter aligns with the Institute of Internal Auditors’ International Professional Practice Framework, including the Global Internal Audit Standards and other professional standards. The internal audit function also validates the actions we have taken to address strategic review recommendations before we close them.

QAO engaged Bellchambers Barrett to deliver its internal audit program.

The results and recommendations of the internal audits and QAO’s subsequent actions are tracked and followed up by the Head of Internal Audit and reported to the Auditor-General, ELT, and ARMC.

| Internal audit assessments in 2024–25 included: | |

| Fraud risk management |

|

| HR functions – policy |

|

| Audit quality – independence declarations and secondary employment |

|

| Performance management |

|

| Information Security Management System (ISMS) |

|

6. Our people

Our diverse workforce

We aspire to be a supportive and connected workplace, with an exemplary approach to building our people and culture.

We value our people as unique individuals who work together to give us a broad range of valued skills, supported by transparent and accessible leadership.

Our workforce demographics

| 210.5 full-time equivalent employees. | 176 of our staff have a professional qualification or are studying towards one. |

| The average age of our multi-generational workforce is 37.81 years. | 25 per cent of our staff are culturally and linguistically diverse, exceeding the public sector CALD benchmark of 12 per cent. |

| 53.12 per cent of our staff are women and in 2024, the first female Auditor-General was appointed. | 4.46 per cent of our people identify as having a disability. |

QAO’s performance is exceeding benchmarks in cultural and linguistic diversity, and ongoing efforts to achieve gender parity, close the gender pay gap, and improve representation, demonstrates our leadership and aligns with government values and community expectations.

Building our workplace culture

Our culture is underpinned by our 4 core values, which inform how we work with our clients and each other.

Our shared objectives, values, behaviours, and practices ensure our employees feel respected, empowered, and motivated to do their best work.

Our people care about the work they do and understand how it contributes to better services for Queenslanders. Through a continued focus on work-life balance, workload management, and our wellbeing framework, we will continue to scaffold and support our workforce. This includes efforts to integrate diversity, equity, and inclusion into our staff forums, communication, and project teams, to foster a more inclusive and respectful culture.

Every year, we recognise employees who demonstrate our values and approach, and in 2024–25, there were 2 recipients of the QAO Award.

Our Audit Support team of Alison Wright, Allison Pontaks, Christine Zappala, and Janine Amies was acknowledged for their consistently high standard of administrative support to the business. This team plays a key role in helping audit teams operate smoothly and ensuring audits are delivered efficiently.

Senior Director David Toma was recognised for his continual engagement and passion, inspiring others by going above and beyond. His calm resilience under pressure and ability to find solutions to business problems is highly respected by all and aligns with QAO’s aspirations as an innovative and learning-oriented organisation.

Equity and diversity

We reinforced our commitment to a respectful and representative workplace this year by advancing a range of diversity, equity, and inclusion (DEI) initiatives.

Under QAO’s Diversity, Equity, and Inclusion Action Plan 2024–2026, we appointed diversity champions to lead initiatives and foster a culture of inclusion. Our champions met monthly to share knowledge and collaborate across different areas of the business. We will continue to explore ways to maintain visibility and engagement of the DEI initiatives, including through integration in QAO’s staff forums.

We also joined Diversity Council Australia, to help ensure our efforts aligned with national best practice and to obtain access to expert insights to further enrich our work.

Cultural awareness was also an area of focus this year, with the ELT establishing a First Nations Awareness Project Team to help drive and foster greater awareness and inclusion.

Developing and supporting our people

We are a learning-oriented organisation that values and invests in its people. We ensure that there is connection, collaboration, and a focus on maintaining our culture.

To be at our best, we need an engaged workforce with the right skills and qualifications, who have opportunities to progress in their careers and feel fulfilled. To support this, we have continued to focus on building a learning culture that prioritises communication, professional development, and collaboration.

We continued to refresh our learning and development framework to better align employee competencies, role requirements, and training delivery. A key element of this was ensuring our people were at the centre of the framework and were both empowered and supported to drive their development. Employees welcomed the shift from traditional classroom-based training to training that can be accessed anytime and anywhere.

Enhanced professional development and investment in continuous learning opportunities also help employees adapt to evolving industry requirements. We will continue to develop transparent career pathways for our people, to improve employee satisfaction, and support retention.

| Key learning and development outcomes this year include: |

|

We continued our focus on work-life balance, with hybrid work arrangements and initiatives that support an inclusive and supportive work environment. Opportunities, like our 5 all-staff meetings, to come together to connect, collaborate, and build our culture, is a central element of our employee engagement approach.

We supported our staff to attend key industry conferences, such as those hosted by Chartered Accountants Australia and New Zealand, Certified Practising Accountant (CPA) Australia, and the Committee for Economic Development of Australia. These opportunities help our staff to maintain a contemporary view of the sectors and environments our clients operate in.

We continued to integrate our audit service providers (ASPs) into QAO’s training program, to support a consistent level of service delivery. Our program covered a range of relevant topics and provided opportunities for feedback and collaboration. This year, our ASPs were also offered a plain language workshop to further enhance service delivery.

In addition to ensuring the right level of staffing at each level to meet the scope of our work, we continue to consider our current and future workforce needs, including by:

- examining how we source and increase the consistency of shorter-term contractors and specialist capability to efficiently support higher-tempo periods during the year

- engaging and collaborating with our peers and industry specialists to help source the skills we need for sustainability assurance.

During 2024–25, we also put in place a range of organisational and process changes aimed at improving our performance. These included new Heads of Performance and Financial Audit roles with direct reporting lines and fewer levels of review, clearer accountabilities, and a focus on industry expertise.

Our graduate program

Our graduate program helps us to meet industry-wide recruitment and retention challenges linked to high market demand. A particular priority for QAO is to develop a talent pipeline for the emerging growth areas of information systems audit and sustainability assurance.

We increased our efforts on attracting candidates to our graduate program this year through an optimised digital recruitment platform driven by a strategic communication campaign. This platform specialises in connecting students and graduates with internships and graduate roles with top employers. The new approach delivered strong results, with the number of graduate and undergraduate applications increasing by 43 and 25 per cent respectively.

In 2024–25, we ranked in the top 10 for prospective graduates across a range of areas following surveys by the digital recruitment platform. The below rankings included all accounting organisations. QAO:

- ranked first for work-life balance

- ranked second for career prospects and diversity

- ranked fourth for culture and as best overall employer.

We support our graduates through structured learning and development, on-the-job coaching, and clear pathways to support their career progression.

Graduates who complete the program go on to join our Auditor Forums, which are designed to streamline the transition from graduate auditor to auditor and provide peer support as knowledge and skills are developed. In turn, this helps build their core skills, prepare them for the next level of their career, and foster connections across the office.

| ‘QAO cares about your career progression and enhancing your auditing skills, and the graduate program provides the tailored training and mentoring you need to succeed.’ – Alannah, 2024 graduate |

Professional qualifications

Professional audit qualifications are a requirement for our audit staff as they progress their careers. QAO funds staff to obtain their Chartered Accountant or CPA designations, and this year 6 employees achieved these qualifications. QAO also funds staff to obtain their Certified Information Systems Auditor and Certified Information Systems Security Professional designations for information systems audit staff and information technology (IT) staff. We also reimburse the cost of professional memberships for our staff, including Chartered Accountants Australia and New Zealand and CPA Australia memberships for audit staff.

International experiences for our people

Our relationships with audit offices overseas are opportunities to grow our people, as well as share audit expertise, techniques, and methodologies. This year, our people participated in international secondments at the Office of the Auditor-General British Columbia and Audit New Zealand.

In September 2024, 2 staff travelled to New Zealand for a 4-week secondment and in April 2025, 2 staff travelled to British Columbia for a 6-week placement. These are reciprocal arrangements and this year QAO also hosted 4 staff from New Zealand and 2 staff from British Columbia.

| ‘The secondment was a great opportunity to experience a warm and supportive team environment, gain hands-on training, and share insights on improving team communication and feedback.’ – Don, Audit Senior, QAO |

| ‘The secondment in Canada has provided a unique opportunity to gain international experience while developing both technical and soft skills in a new business environment. Working with different regulatory and financial systems has offered valuable exposure to various accounting standards, enhancing my technical versatility. Additionally, the experience has strengthened my professional network and broadened my global perspective.’ – Tina, Assistant Manager, QAO |

| ‘A secondment with the QAO is a fantastic opportunity for professional growth and personal enrichment. It fosters the exchange of expertise and best practices between Audit New Zealand and QAO, benefitting both organisations.’ – April, Assistant Manager, Audit New Zealand |

Feedback from our employees

Working for Queensland survey

We participate in the annual Queensland Government Working for Queensland (WfQ) survey, which gives us information on how engaged our people feel, how they view our leadership group, and how satisfied they are with their jobs.

We assess our results against benchmark data, comparing our results to those of smaller public service offices (less than 500 staff).

In the 2024 survey, 94 per cent of our employees responded compared to 86 per cent in 2023. Our overall employee engagement result was 68 per cent, a 6-point increase on last year’s result. The score for employee engagement for smaller Queensland government organisations was 65 per cent.

These improvements in performance are the result of our action plan delivered across the year. Actions included:

- an embedded community structure and operating rhythm, providing consistency for teams and clients, and greater engagement with managers and clients

- streamlined performance review processes providing clear, standardised objectives

- transparent communication about the promotion process, including time frames, number of roles available, and updates

- fostering connection through a weekly email from leadership, in-person staff seminars, and team-building activities.

| Areas where we are performing well |

| 90 per cent of our people enjoy working flexibly. |

| 88 per cent of our people understand what is expected to do their job well and how their work contributes to QAO’s objectives. |

| 83 per cent of our people believe performance is assessed fairly and 79 per cent believe our recruitment strategies are fair and transparent. |

| Areas where we need to improve, where our results have declined, or we are lower than the public service |

| 24 per cent of our people reported experiencing the need to work long hours. |

| 18 per cent of our people reported being overloaded with work always or often. |

| 31 per cent of our people discuss ways to promote wellbeing within their team. |

We will continue to develop activities aimed at addressing areas for improvement and share progress with our people and governance committees. These include:

- embedding our models of delivery

- engaging additional support where required

- implementing a lateral hire support framework to ensure newly hired employees transition into their roles with the required level of support through on-the-job coaching and training

- managing leave effectively to balance organisational resourcing with employee wellbeing

- implementing the wellbeing framework to support employees.

Pulse survey

Our anonymous pulse surveys help us to understand employee sentiment and receive feedback.