Overview

The Queensland Government is committed to increasing the proportion of renewable energy in Queensland's energy system. This represents a significant change to its energy landscape that will require sustained action and coordination by government and industry.

Tabled 25 November 2021.

Report on a page

In June 2017, the Queensland Government committed to a renewable energy target (the target). To meet the target, 50 per cent of all energy consumed in Queensland must come from renewable sources, such as sunlight, wind, and water, by 2030. The Department of Energy and Public Works (the department) is responsible for managing Queensland’s energy policy. We examined the department’s management of the transition to renewable energy.

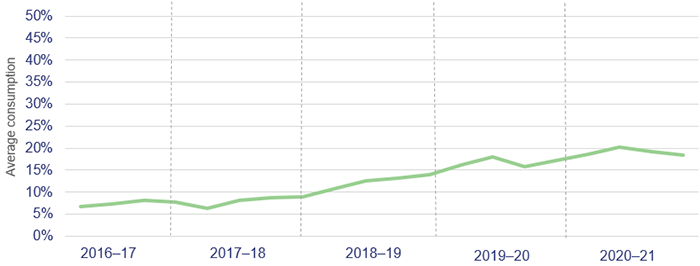

Queensland’s renewable energy was around 19 per cent in 2020–21

Rooftop solar is the greatest renewable generation source in the state, but wind and large-scale solar generation are rapidly increasing. The department reports on the growth in renewables but does not publish a clear definition on how the target is calculated.

In the next four years, a number of new renewable projects are planned to start operating. The department estimates this will see Queensland reach around 35 per cent renewable energy in 2025. Queensland’s progress will then depend on the progression of future projects in early-stage planning. Growth in rooftop solar and green hydrogen production could help achieve the target.

Government is playing a greater role in the transition

Early renewable energy initiatives encouraged the private sector to deliver the transition to renewable energy. The government’s new $2 billion Queensland Renewable Energy and Hydrogen Jobs Fund will increase its direct role in the transition. Under this fund, government owned energy corporations may significantly increase their development and ownership of renewable energy generation. They may also access the fund to support the development of private sector renewable energy projects.

A new ten-year energy plan is in development

Beyond its 50 per cent target, the department has not yet set out its ambitions for the energy system towards 2030. The government has announced the development of a new ten-year energy plan. This would help inform investors, communicate its overall vision for the transition to renewable energy and provide information on its desired end state.

Network infrastructure must support growth and stability

The transmission network may need upgrades to accommodate increasing renewable generation. There have been limited locations within Queensland with sufficient network conditions for new generation projects. Additional renewable generation has also caused network instability in certain regions.

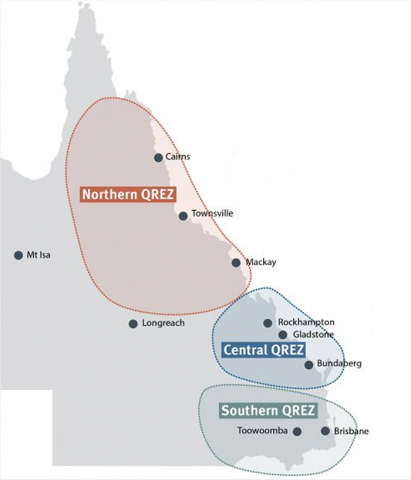

The government’s recently announced Queensland Renewable Energy Zones (in which it plans to invest in infrastructure and encourage new renewable generation projects) will partially address this issue, but further network improvements are likely to be needed to maximise renewable generation.

Drivers for new investment are changing

Increasing renewable generation is contributing to falling average energy prices. While Queensland’s total energy demand is forecast to remain stable this decade, government policy and investor demand for decarbonisation may offset the impact of lower prices. Queensland is also competing with other states for renewable energy investment. The department will need to actively monitor and manage these areas.

We recommend the department communicates its overall vision and objectives for the transition and conducts an interim review by 2025 to formally assess its progress and consider further actions needed to achieve the target. We also recommend the department updates its calculation of progress against the target and improves its public reporting on the transition to renewable energy.

1. Recommendations

|

Achieving the renewable energy target |

|

Transitioning Queensland’s energy system to a minimum of 50 per cent renewable energy by 2030 requires coordinated action and complementary investments by government and industry. To support this, we recommend the Department of Energy and Public Works: 1. publicly communicates its overall vision and objectives for the transition to renewable energy and sets out more information on its desired end state in its ten-year energy plan (Chapter 3) 2. conducts an interim review by 2025 to formally assess its progress towards the target and to consider further actions to support its achievement of the target. These could include additional investment on network infrastructure, increased support for renewable generators or other actions to address external factors (Chapter 3). |

|

Improving public reporting |

|

To improve the transparency and accuracy of public reporting on the transition to renewable energy, we recommend the Department of Energy and Public Works: 3. publishes a detailed public statement of how Queensland’s renewable energy target is defined and measured (Chapter 2) 4. updates its calculations of progress against the target to fully account for all relevant renewable energy, such as small-scale renewable, and non-renewable energy, such as diesel generation (Chapter 2) 5. reports more information on:

|

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to the Department of Energy and Public Works. In reaching our conclusions, we considered its views and represented them to the extent we deemed relevant and warranted. The department's formal response is at Appendix A.

2. Renewable energy in Queensland

The Queensland Government has committed to increasing the proportion of renewable energy in Queensland’s energy system. This change aligns with many other national and international energy policy initiatives.

Renewable energy comes from resources that are naturally replenished, like sunlight, wind, and water. Renewable energy can be captured through technology like photovoltaic cells (solar), wind turbines, electrolysis and hydroelectricity.

The Queensland renewable energy target (the target) requires 50 per cent of all energy consumed in Queensland to be from renewable sources by 2030. The Department of Energy and Public Works (the department) is responsible for managing Queensland’s energy policy, including progress towards the target. Queensland operates in a national electricity market, which is affected by Australian Government policy settings, and the state has advocated for stable and integrated national policies.

This report examines the Queensland Government’s management of progress towards the target.

This chapter outlines:

- how Queensland’s renewable energy target is measured

- recent growth in renewable energy in Queensland

- the changing mix of renewable generation sources in Queensland

- new renewable energy projects being tracked by the department

- additional generation required for Queensland to meet the 2030 goal.

Defining and measuring the target

The Queensland Government’s commitment to the renewable energy target followed a Queensland Renewable Energy Expert Panel report in 2016 that set out pathways to achieving a 50 per cent target by 2030. The report also recommended the renewable energy target be measured as a proportion of energy consumed in Queensland, rather than energy generated.

Generation refers to the total electricity generated in Queensland over a period of time. This is normally measured in megawatt hours (MWh) or gigawatt hours (GWh).

Consumption refers to all electricity used in Queensland. It is normally measured in gigawatt hours. Consumption can be more or less than the sum of all generation as Queensland may import or export electricity.

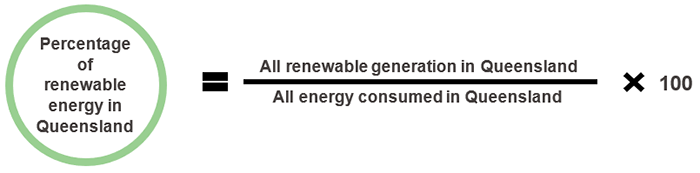

The department uses the calculation in Figure 2A to measure progress towards the renewable energy target.

Queensland Audit Office analysis of Department of Energy and Public Works information.

The department calculates progress using data reported by generators operating in the National Electricity Market (which is the market that connects electricity systems in Queensland, New South Wales, the Australian Capital Territory, Victoria, South Australia, and Tasmania). It also uses estimates of energy that is not included in the national market reporting. The estimates include:

- energy generated by small-scale facilities, such as bioenergy generators that use organic waste material to generate energy

- energy generated for use in the North West Minerals Province. This includes energy generated in the Mount Isa and Cloncurry regions, which are not connected to the national market.

Reported progress in 2020–21 is higher than actual progress

The department’s service delivery statements for the 2020–21 budget show an ‘estimated actual’ of 20 per cent as the percentage of renewable energy in Queensland. However, this calculation:

- does not include all non-renewable energy, for example diesel generation, that is generated outside the national market. Around 1,000 GWh of this type of energy was produced in Queensland in 2020

- does not add the energy generated by small-scale facilities to the total energy consumed

- assumes all bioenergy generators achieve the same performance as the largest bioenergy generator.

We re-calculated performance against the target and found Queensland’s progress was around 19 per cent. This is an important difference as each percentage point change in the level of renewable energy translates into a sizeable change in Queensland’s energy system.

There are also major industrial facilities, such as liquified natural gas plants, which generate non‑renewable energy to use in their operations. We have not included these facilities in our calculations.

|

Recommendation 4 We recommend the Department of Energy and Public Works updates its calculations of progress against the target to fully account for all relevant renewable energy, such as small-scale renewable, and non-renewable energy, such as diesel generation. |

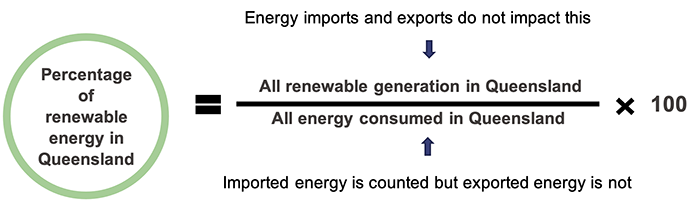

Energy imports and exports are counted differently

The department measures progress against the target by comparing renewable energy generated in Queensland to the total energy consumed within Queensland. This approach is based on the department’s interpretation of the Queensland Renewable Energy Expert Panel report.

The department’s measurement approach includes energy imported into Queensland from other parts of the National Electricity Market but excludes energy that is exported from Queensland. For example, over the past five years, Queensland exported an average of nearly eight per cent of all energy generated in the state. It imported an average of less than 0.5 per cent. Because the exported energy was not consumed in Queensland, it was not reflected in the renewable energy calculation.

Figure 2B outlines how imports and exports are factored into the renewable energy calculation.

Queensland Audit Office analysis of Department of Energy and Public Works information.

The current approach to measuring progress against the target:

- treats the calculation of renewable energy differently to the calculation of other energy

- results in a higher proportion of renewable energy when Queensland is exporting energy.

If progress against the target was measured as either the proportion of energy consumed from renewable sources, or the proportion of energy generated from renewable sources, then Queensland’s performance in 2020–21 would be around one percentage point lower.

Some states in the National Electricity Market with a renewable energy target measure their progress by considering energy generation only.

There is limited information on how the target is measured

The department sets out the renewable energy target and its estimated performance in its annual service delivery statements. But these do not describe how the department treats various elements of this calculation. For example, they do not define how the department includes energy imports or exports, or energy from domestic solar and other small-scale renewable generators in the renewable energy calculations.

|

Recommendation 3 We recommend the Department of Energy and Public Works publishes a detailed public statement of how Queensland’s renewable energy target is defined and measured. |

Queensland’s current energy mix

Renewable energy in Queensland has grown

In 2017, Queensland’s renewable energy consumption was around seven per cent of total energy consumed. Figure 2C shows Queensland’s consumption of renewable energy since then. The increase has been driven by multiple factors, including market forces and government incentives.

Queensland Audit Office analysis of OpenNEM data, Australian Energy Statistics data, and Department of Energy and Public Works data.

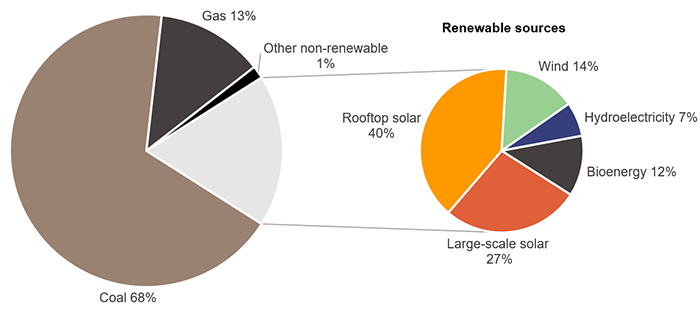

Most of Queensland’s energy is generated from thermal sources, like coal and gas. Figure 2D shows the primary renewable and non-renewable energy sources and their contribution to total energy generation in Queensland.

Note: Around 18 per cent of all energy generated in Queensland in 2020–21 was from renewable sources. This is lower than Queensland’s consumption of renewable energy in this period because of the treatment of energy imports and exports, as outlined in this chapter.

Queensland Audit Office analysis of OpenNEM data, Australian Energy Statistics data, and Department of Energy and Public Works data.

Most of Queensland’s renewable generation is from solar

Rooftop solar is the single largest source of renewable energy generation in Queensland. When combined with large-scale solar generation (or solar farms), it represents around 67 per cent of all renewable generation in Queensland.

Solar energy is only generated when the sun is shining, resulting in high levels of solar generation in the peak of the day. This does not align with when demand for energy is highest, which is typically in the morning and evening when people are at home. A diverse mix of renewable energy sources and storage, such as large-scale batteries or pumped hydroelectricity (which uses water reservoirs to store energy), is needed to supply renewable energy when solar is unavailable.

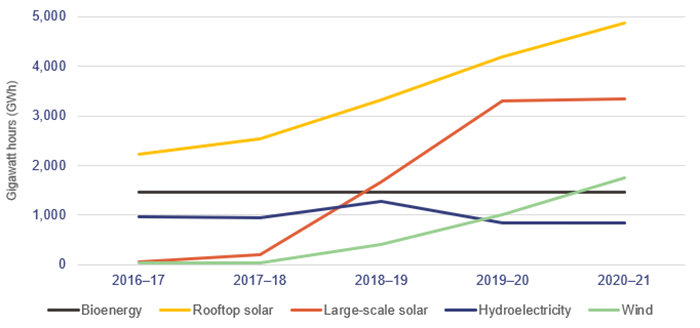

The renewable generation mix is changing

While rooftop solar has been the greatest contributor to renewable energy in Queensland since 2017, wind and large-scale solar energy have increased rapidly in recent years.

Figure 2E shows the changing mix of different renewable sources in Queensland since 2017.

Queensland Audit Office analysis of OpenNEM data and Department of Energy and Public Works data.

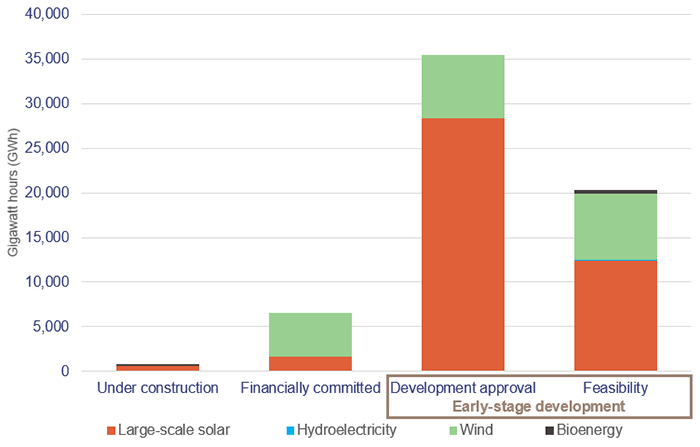

Queensland’s future renewable projects

The department tracks potential renewable projects

The department maintains a list of planned renewable energy projects in Queensland, across three broad categories:

- Early-stage development—these projects have been announced but have not yet secured financial investment. They are separated into two sub-categories: development approval and feasibility.

- Financially committed—these projects have secured financial investment, but construction has not yet commenced.

- Under construction—construction has begun on these projects, but they are not yet operational.

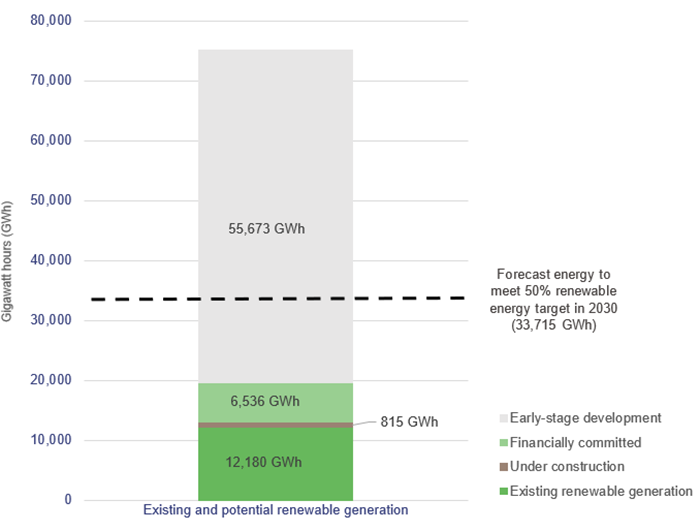

Figure 2F shows the total proposed generation from each of the department’s project categories. We have not validated the department’s list of future projects.

Note: Data does not include energy storage projects such as pumped hydroelectricity and battery storage.

Department of Energy and Public Works project tracking data as at March 2021.

There is a long list of potential renewable projects

The department expects that by 2025 around 35 per cent of all energy consumed in Queensland will be from renewable sources. This is based on the department’s project construction forecast and assumes most renewable projects that are under construction or financially committed will become operational.

As shown in Figure 2G, based on the current demand forecast for 2030, Queensland would then need around one-quarter of all generation from current early-stage development projects to go ahead to reach the 50 per cent renewable energy target in 2030.

The list of early-stage development projects may not be exhaustive, and additional projects may be announced in coming years. The required generation to hit the target could also be impacted by other factors, such as increased rooftop solar generation or increased energy consumption in Queensland. For example, the Queensland Hydrogen Industry Strategy 2019-2024 aims to increase the use of renewable energy in the production of green hydrogen.

Queensland Audit Office analysis of OpenNEM data, Australian Energy Market Operator data, and Department of Energy and Public Works project tracking data as at March 2021.

The total generation from all proposed renewable generation is around four times the existing level. If all these projects go ahead, it will significantly reshape Queensland’s energy generation profile.

Many early-stage projects may not be operational by 2030

While projects that are under construction or financially committed have a high likelihood of reaching completion, it is unlikely that all early-stage development projects will become operational by 2030. Many do not yet have finance or development approval and are exposed to a variety of market risks.

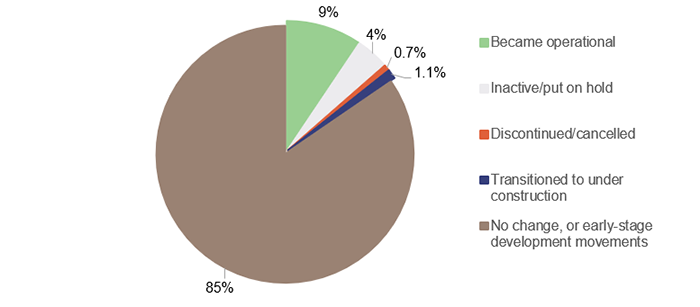

The department does not report on the status of proposed projects or how these change over time. Using its project tracking data, we found that projects representing nine per cent of potential renewable energy generation became operational between June 2017 and March 2021. Meanwhile, projects representing 85 per cent of potential renewable energy generation had no significant change in status. A further six per cent either transitioned to construction, were put on hold, or were discontinued. This is shown in Figure 2H.

Note: Percentages represent the potential energy generation of the 158 projects tracked by the department. Percentages do not equal 100 per cent due to rounding.

Queensland Audit Office analysis of Department of Energy and Public Works project tracking data as at March 2021.

The department does not assess the likelihood of individual early-stage projects becoming operational, nor does it estimate how many early-stage projects will reach completion by 2030. Without this information, it cannot be certain the current pipeline of early-stage projects is sufficient.

The conversion rate outlined in Figure 2H reflects historic market conditions and past government actions. If projects continue to become operational at this historic rate, there may not be enough renewable generation in Queensland by 2030 to meet the target. However, the average size of renewable projects reaching financial close has been increasing. Converting larger projects will bring Queensland closer to the target. Other factors, such as growth in rooftop solar and green hydrogen generation, could also assist Queensland to achieve the target.

The department advised its current renewable energy initiatives are targeted at improving investment conditions to support renewable generation projects in Queensland. We discuss this in Chapter 3.

3. Managing the transition

In 2020–21, around 19 per cent of all energy consumed in Queensland was from renewable sources. The Queensland Government’s target of 50 per cent renewable energy by 2030 represents a significant change to Queensland’s energy landscape.

The transition will require sustained action and coordination by government and industry. The Queensland Government has committed over $3 billion since 2017 to achieve the target. The Department of Energy and Public Works (the department) is steering the shift, working with infrastructure providers and energy generators.

We would expect a program of this significance and duration to be carefully managed to achieve the best results.

This chapter examines how the Queensland Government is managing the transition to renewables, including:

- key renewable energy initiatives, and how these have changed over time

- how the department communicates its overall approach and key objectives

- how the department monitors progress to keep the transition on track

- risks and challenges to a successful transition.

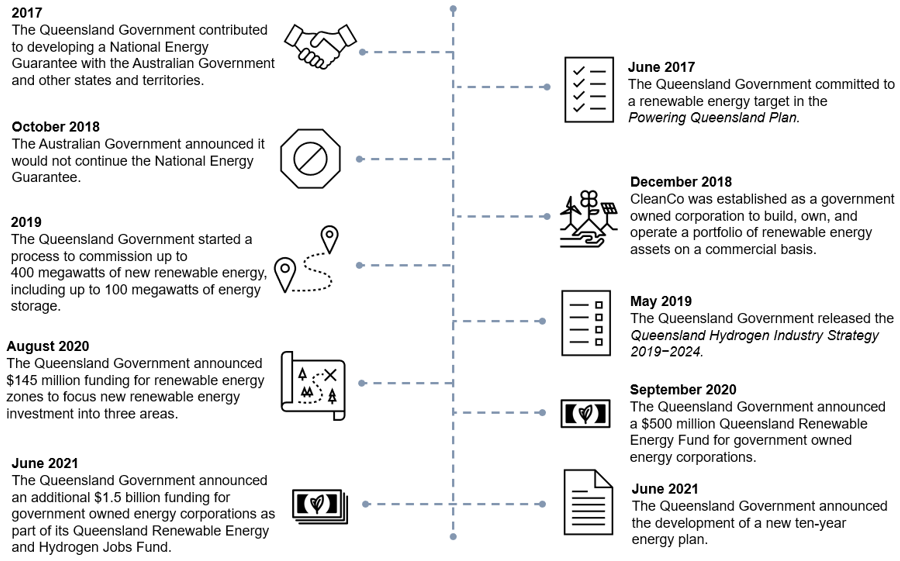

Key renewable energy events since 2017

The Queensland Government formalised its commitment to the target in June 2017. This report focuses on significant government actions since then. Queensland is also part of a changing national energy policy landscape. We outline some of these national policies below for context.

The timeline in Figure 3A outlines key renewable energy events in Queensland.

Queensland Audit Office.

Early actions focused on market delivery and national coordination

In 2016, the Queensland Renewable Energy Expert Panel said the Queensland Government should encourage the market to deliver renewable energy to the ‘fullest extent possible’. The department accepted this recommendation and approached the transition as a market-led policy.

Early government actions encouraged commercial investment in renewable energy, through approaches such as:

- reverse auctions, where suppliers bid their lowest price to deliver renewable energy

- financial support for four large-scale solar energy generators

- improving the facilitation of large-scale renewable projects.

In 2018, the Queensland Government established CleanCo Limited (CleanCo) to build, own, and operate a portfolio of renewable energy assets on a commercial basis. Queensland’s other government owned corporations, CS Energy and Stanwell Corporation, are also involved in renewable energy generation.

The government designed these initiatives to develop the renewable energy market and increase its overall capability to deliver Queensland’s transition to 50 per cent renewable energy.

The government committed to advocate for integrated national energy policies through this period. Most notable was the National Energy Guarantee led by the Australian Government, which sought to lower energy prices and emissions. The National Energy Guarantee was discontinued in 2018.

The government adjusted course in 2020

In early 2020, the department identified that private sector investment in new renewable energy may significantly reduce. It noted the number of financially committed projects (projects with financial investment but not under construction) had reduced from 17 in 2017 to only two in 2019.

The department attributed this to declining private investment conditions. These included:

- the closure of the Australian Government’s Large-scale Renewable Energy Target

- lower wholesale energy prices (the prices retailers pay for energy to supply to their customers) during times when solar-generated energy output is high

- more stringent requirements for energy projects to connect to the national energy grid.

Around the same time, the COVID-19 pandemic impacted Queensland’s business and industries. This led to a series of actions and investments in the 2020–21 and 2021–22 state budgets. These investments focused on economic recovery and creating jobs for Queenslanders.

In response to changing market conditions and government priorities, the Queensland Government now intends to directly invest significant funds through its government owned energy generators. This is a shift from its prior market-led approach.

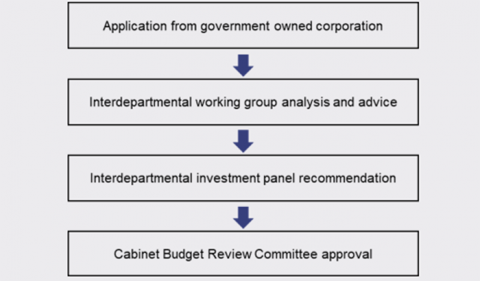

Figures 3B and 3C detail two current renewable energy initiatives in Queensland.

|

Queensland Renewable Energy Zones |

|

The Queensland Government has committed $145 million to establish three Queensland Renewable Energy Zones (QREZ)—the Northern, Central, and Southern QREZ. In these areas, the government intends to:

The government aims to coordinate investment in transmission and generation infrastructure to support Queensland industries and benefit local communities. The Northern, Central and Southern zones shown below cover areas identified by the Australian Energy Market Operator as having good quality renewable resources and other characteristics suitable for renewable energy development. |

Department of Energy and Public Works.

|

Queensland Renewable Energy and Hydrogen Jobs Fund |

|

The Queensland Government announced a $2 billion Queensland Renewable Energy and Hydrogen Jobs Fund as part of the 2021–22 budget. This includes $1 billion over the four years to 2024–25, expanding on the previous $500 million Queensland Renewable Energy Fund to prioritise hydrogen and increase jobs in the renewable sector. The new fund supports government owned corporations to increase their ownership of commercial renewable energy and hydrogen projects, including supporting infrastructure. Government owned energy corporations can present investment and funding proposals for consideration and approval through the fund. Investment proposals will be considered based on the key objectives set by government, including renewable energy and hydrogen, commercial viability, and employment and jobs. Investment proposals can be made in partnership with the private sector. Funding is approved by the Cabinet Budget Review Committee on the advice of an interdepartmental investment panel that includes the department, Queensland Treasury, and the Department of the Premier and Cabinet. Queensland Renewable Energy and Hydrogen Jobs Fund approval process |

Queensland Audit Office analysis of Department of Energy and Public Works and Queensland Treasury information.

The government intends to publish a ten-year energy plan

The Queensland Government’s new fund can only be accessed by government owned corporations, either solely or in partnership with the private sector. This may increase government’s ownership of renewable energy generation or supporting infrastructure in the next four years.

While this approach allows government to direct renewable investment into priority areas and renewable technologies, the implications of this change have not yet been communicated to stakeholders or industry. For example, the government has not set out:

- the reasons for its new course

- its ambitions for the direct delivery of renewable energy by government owned generators

- what the new approach may mean for CleanCo

- the implications for private sector renewable energy providers and investors.

In June 2021, the Premier and Minister for the Olympics announced the development of a new ten-year energy plan that sets out the government’s intentions for Queensland’s energy system.

|

Recommendation 1 We recommend the Department of Energy and Public Works publicly communicates its overall vision and objectives for the transition to renewable energy and sets out more information on its desired end state in its ten-year plan. |

Monitoring the transition

The department monitors progress against the renewable energy target, working with other government departments, the renewable energy industry, and government owned corporations to:

- collect data on the transition, including the amount of generation from renewable sources and information on proposed renewable energy projects

- assess the risk of not achieving the target and develop strategies to increase the likelihood of a successful transition

- report on current progress, new initiatives, and expected developments in renewable energy.

The department provides limited information in its public reporting

The department’s public reporting includes an annual target for the consumption of renewables. This is its estimate of renewable generation in the following year, based on known projects.

Its targets and actual results are outlined in Figure 3D.

|

Service standard |

2019–20 |

2019–20 |

2020–21 |

2020–21 |

2021–22 |

|---|---|---|---|---|---|

|

Renewable energy as a percentage of total energy consumed in Queensland |

9.9% |

17.9% |

20% |

20% |

22% |

Department of Energy and Public Works service delivery statements.

The department’s reporting could be expanded to better inform energy stakeholders and provide more transparency about the transition to renewable energy. For example, it could report on:

- how much energy has been generated from solar, wind, and other sources

- how it has calculated the actual energy generated

- what assumptions it makes to set future targets. For example, it could set out which projects are expected to finish construction and start to generate energy in the next 12 months.

|

Recommendation 5 We recommend the Department of Energy and Public Works reports more information on:

|

Risks that may impact on achieving the target

The department’s energy division considered the risk of not achieving the renewable energy target to be its highest energy-related risk in 2020. We expect a risk of this significance to be actively managed, with a documented risk assessment and management strategy. However, the department’s corporate risk management register includes only one renewable energy risk. The entry is titled ‘Deliverable depends on inputs, which change unexpectedly’ and was initially recorded in November 2018. The register does not record any management control, action, or other response to address this risk.

Figure 3E sets out the key risks we identified during this audit.

Coordinating industry and government is challengingRenewable projects take time to plan and build. With only nine years remaining, effective program management is needed to sustain industry momentum. |

|

Network infrastructure must continue to adaptThere are limited locations with sufficient network conditions for new generation projects across Queensland. Increasing renewable generation is causing network instability in some areas. |

|

Drivers for new investment are changingWholesale energy prices are trending lower. Further price falls could discourage new investment and negatively affect Queensland’s progress towards the target. |

|

Other external factors could affect progressThe economic and supply chain impacts of COVID-19 may cause some renewable energy projects to slow down or become unviable as they compete for skilled staff or physical resources. Renewable energy policy developments in other states could also divert investment from Queensland. |

Queensland Audit Office analysis.

Coordinating industry and government over a long time is challenging

The renewable energy target is a long commitment, requiring sustained action by industry and government over 13 years. A transition over this length of time is difficult, as it requires:

- coordinating many public and private sector entities in a rapidly changing sector

- maintaining consistent policy and objectives to support long-term investments and major infrastructure projects—for example, the time required to start hydroelectric energy generation in a new location can be 10 years or longer

- adapting to future changes in critical areas such as overall policy, market conditions, or renewable energy technologies, while delivering diverse and stable energy generation for Queensland.

These challenges are made more complex as the path to the renewable energy target may not be linear but could involve an acceleration of renewable energy generation in the early, middle, or end stages of the decade.

Beyond its 50 per cent target, the Queensland Government has not yet set out its ambitions for the energy system in 2030 or its expectations for progress this decade. For example, it has not set out its desired combination of generation from wind, solar or hydroelectricity sources; nor has it set out in detail its preferred locations for renewable development. As a result, it is difficult to know whether the transition to renewables is on track or whether the department should adjust its objectives or processes.

An interim review could serve as a useful checkpoint to ensure the transition is on track. For example, it could provide a formal trigger for the government to intervene further in the market if the transition to renewable energy slows and the department no longer expects to achieve the target. Similarly, a review could show that continued direct government support is no longer required.

The transmission network must support increasing renewables

Queensland’s energy transmission and distribution network was not designed to accommodate increasing renewable energy. Renewable generators are smaller and more geographically dispersed than traditional thermal generators (such as coal and gas), requiring more transmission infrastructure to connect them to the grid.

Renewable generation can also affect the energy network’s stability. Renewable energy generators like wind and solar have variable energy outputs that can cause imbalances in areas of the network. Similarly, rooftop solar generation sends energy into the network from households and businesses, reversing the direction of traditional energy flows. At high levels, this can weaken the network’s stability or overall performance.

The department has recognised that it needs to overcome limitations in the energy network to achieve the renewable energy target. It has:

- commissioned Powerlink (the Queensland electricity network operator) to examine the expansion of renewable energy in Queensland and recommend appropriate actions to maintain the network’s performance

- established three Queensland Renewable Energy Zones, which are designed to coordinate investment in infrastructure for transmission and generation. This initiative includes $40 million to upgrade transmission lines between Cairns and Townsville

- supported developments to ease network pressure, including changes to energy storage infrastructure, such as its recent commitment to invest $22 million to investigate the potential for pumped hydroelectricity at Borumba Dam.

Network infrastructure challenges will require ongoing management as they evolve. It is likely that further investments will be needed as renewable generation increases.

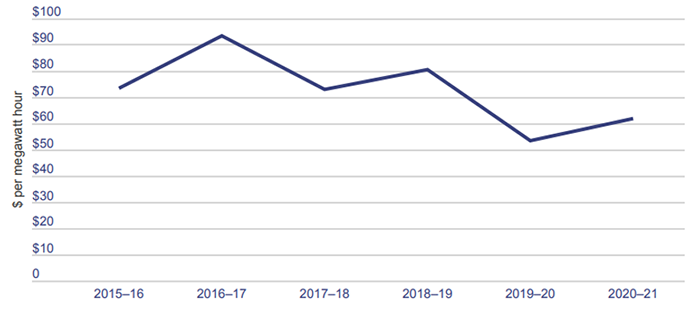

Drivers for new investment are changing

The Australian Energy Market Operator (AEMO) forecasts demand for energy in Queensland to remain stable throughout the 2020s. AEMO notes that improvements in energy efficiency and the adoption of rooftop solar are likely to offset demand growth driven by population changes.

Because Queensland's demand outlook is currently flat, additional renewable generation is likely to put downward pressure on wholesale energy prices, unless demand for energy grows. Figure 3F shows the average wholesale price for energy in Queensland over the past five years.

Queensland Audit Office analysis of Australian Energy Market Operator data.

A decrease in wholesale energy prices may reduce the profitability of existing generators. Our report Energy 2020 (Report 11: 2020–21) sets out implications of lower prices on electricity generators, including a lower asset value of over $1.1 billion in 2019–20.

Lower prices are particularly relevant for thermal generators, which often have higher operating costs and less production flexibility than renewable generators.

Falling prices may also discourage new renewable generators from entering the market. However, investor preferences and government policies that promote lower carbon emissions may offset the impact of price falls.

Other external factors could affect progress

The success of Queensland’s transition to renewables depends on many factors. For example, the economic and supply chain impacts of COVID-19 may impact on the viability and timelines of renewable projects. Additionally, the availability of suitable land, materials, and skills could present barriers to new projects.

Policy developments regarding renewable energy in other jurisdictions could also divert investment from Queensland. For example, New South Wales' Electricity Infrastructure Roadmap expects to attract $32 billion in energy investment by 2030.

The Queensland Renewable Energy Zones and Queensland Renewable Energy and Hydrogen Jobs Fund may partially overcome external market factors. However, the department currently has no formal assessment that demonstrates how these initiatives will sufficiently address external challenges.

The Queensland Government committed to advocate for stable and integrated national energy policies in the Powering Queensland Plan. We note that national policy settings impact the transition to renewables.

|

Recommendation 2 We recommend the Department of Energy and Public Works conducts an interim review by 2025 to formally assess its progress towards the target and to consider further actions to support its achievement of the target. These could include additional investment on network infrastructure, increased support for renewable generators or other actions to address external factors. |