The new standard AASB 1058 Income of Not‑for-Profit Entities

AASB 1058 Income of Not‑for-Profit Entities will require you to reassess the way you currently account for grants and government funding, as well as other contributions, compared to current AASB 1004 Contributions. These new requirements may result in revenue or income being recognised on a different basis with a corresponding impact on your profit or operating result.

For not-for‑profit (NFP) entities, both AASB 1058 and AASB 15 will commence from financial years beginning on or after 1 January 2019. We illustrate the transition dates in a separate article.

A critical issue in accounting for funding arrangements will be whether the arrangement is accounted for under AASB 15 or AASB 1058. Guidance is included in both standards to assist in determining which to apply.

AASB 15 was drafted for the for-profit private sector, and the AASB has included specific guidance in applying the standard to not-for-profit entities. This guidance includes how to apply the private sector terminology and concepts.

We consider the application of these standards in the following sections.

Change in reasoning

There has been a significant change in the requirements for recognising revenue and income from AASB 1004 to AASB 15 and AASB 1058.

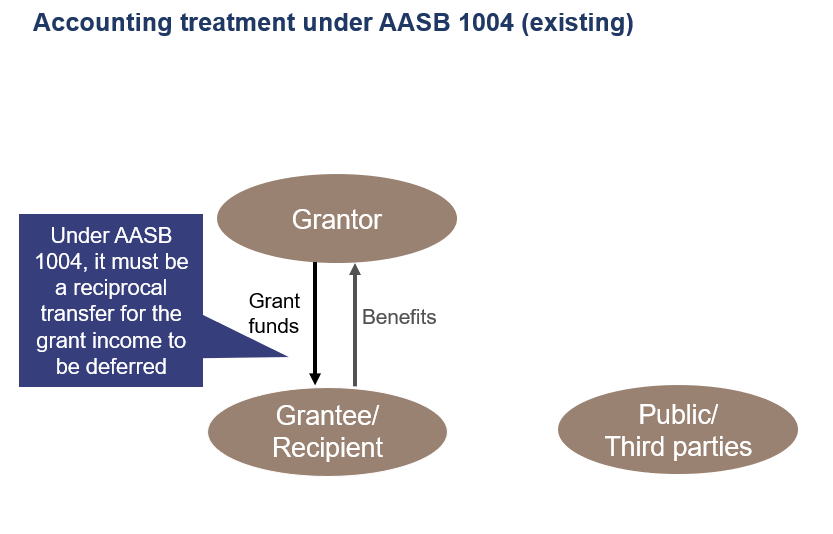

Under AASB 1004 the accounting treatment depended on whether the funding was considered a reciprocal or non‑reciprocal transfer. For a transaction to be reciprocal and accounted for as a services arrangement (that is, allowing recognition of the revenue to be deferred), the entity providing the funds had to receive benefits of approximately equal value to the asset/cash transferred. If, for example, the state government provided funds to an entity, but the benefits went to the public at large, this was not considered to be reciprocal. Consequently, up-front income recognition was required.

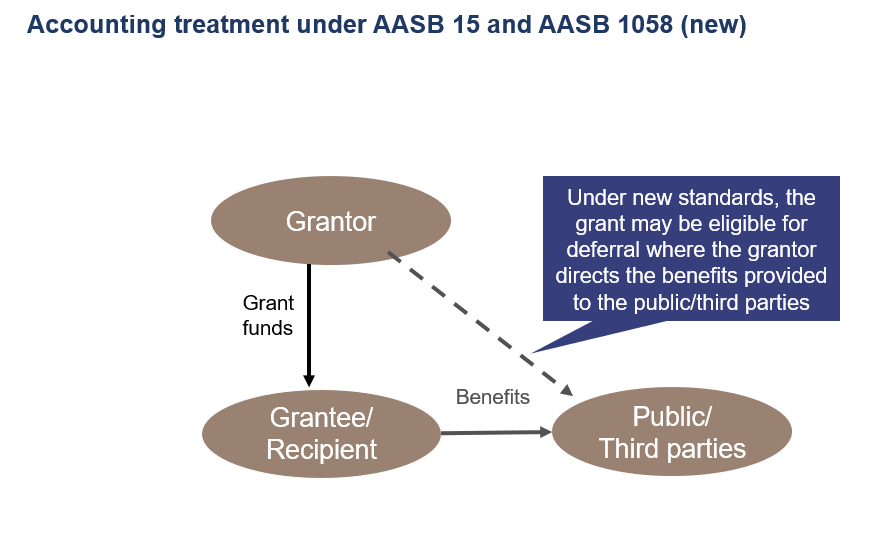

Under the new standards, however, if the entity providing the funds can direct where those benefits go, then the entity making the directions is potentially considered the customer in an arrangement accounted for under AASB 15.

Meeting the scope of AASB 15 for deferral of revenue

The essential criteria for inclusion in the scope of AASB 15, and possible deferral of revenue recognition, are that the rights and obligations created under the funding agreement are enforceable and sufficiently specific. Guidance on these terms is included in the standard.

Enforceable is an easier concept to apply in the for-profit sector, and usually means whether the contract can be enforced in court. Many not-for-profit agreements do not have similar provisions. They often rely on the promises of the not-for-profit entity receiving the funds, or implied threats of withdrawal of future funding for non-compliance. Such approaches are not likely to meet the requirements for being within the scope of AASB 15. To be enforceable means that you have an obligation to perform under the arrangement to provide goods and services.

Sufficiently specific broadly means that the terms are specific enough for you to know what goods you will be providing, or services you will perform, and to what extent you have completed those promises. AASB 15 calls those promises ‘performance obligations’. You must determine how far along you are in meeting those performance obligations to determine how much revenue to recognise or defer (to be matched to expenses in the future).

Applying both terms will require significant judgement. Sufficiently specific will require particular attention as the term needs to be applied in accordance with the standards and related guidance, and not the dictionary definition.

If both criteria are not met, then the arrangement will likely be accounted for under AASB 1058 as up-front revenue.

Refund obligation

Many people are going to be disappointed that having a refund obligation in an arrangement will not require revenue to be deferred until the funds are spent. The AASB does not consider a refund obligation to be a liability or performance obligation. This is because the entity has the discretion to avoid breaching the agreement, which would require the return of the funds.

Capital grants

While the new standards do not use the term capital grants, there are specific provisions for ‘transactions where the consideration to acquire an asset is significantly less than fair value principally to enable the entity to further its objectives’ and where the transfer is ‘to enable an entity to acquire or construct a recognisable non-financial asset to be controlled by the entity’.

It is common for grants agreements to construct assets (such as buildings) to have a condition that the building must be used for the purposes specified, otherwise the asset must be returned or the money returned.

These type of contract provisions are not considered sufficient to meet the requirements of AASB 15/AASB 1058 for deferral of revenue over the life of the asset. The AASB does not consider that the asset is being transferred, and therefore there is no transfer of goods and/or services to be accounted for under AASB 15.

The accounting in AASB 1058 is to recognise revenue over the construction period, like that which AASB 15 requires. Therefore, revenue may be deferred slightly over the construction period, instead of being recognised up-front. However, the underlying mismatch between revenue and expenses remains, with depreciation being recognised over a longer period.

Another difference from AASB 1004, is that the provisions for income recognition for contribution of assets applies to assets where the consideration is ‘significantly less than fair value’. Previously, requirements to fair value contributed assets were for assets received free of charge, or for nominal consideration. This may mean more contributions having to be fair valued on recognition.

Portions of AASB 1004 retained

Some portions of AASB 1004 have been retained. These relate mainly to parliamentary appropriations, restructure of administrative arrangements, and contributions by owners.

Transitional provisions

We discuss the different transition methods under AASB 15 and AASB 1058 in a separate article.

Disclosures

The disclosure requirements have been expanded. Although these need to be applied using focused financial reporting concepts, we expect that most entities will need to include more, relevant detail.

If you are a department and need to make administered items disclosures, you will need to apply the new standard to those disclosures.

Implementation Plans

The previous requirements under AASB 1004 often resulted in up-front revenue recognition. Many people complained that this resulted in a mismatch of revenue and expenses. The new standards, AASB 15 and AASB 1058, may require deferral of revenue, although possibly not in as many instances as people desired. Determining the appropriate accounting will be more complex under the new standards. Accounting under AASB 15 or AASB 1058 is not an accounting policy choice by the entity. The nature of the arrangement, and its terms and conditions, will determine which standard is applicable.

We urge public sector entities that have not yet started their implementation plans to start as soon as possible. You may have a very large number of arrangements to analyse.