Overview

Our annual report summarises our performance, operations and business highlights for 2019‒20. It contains our financial statements, including the opinion of the independent external auditor. It complies with the Financial Accountability Act 2009, Financial and Performance Management Standard 2019, and the detailed requirements set out in the Annual report requirements for Queensland Government agencies. We also share information about our people and our future.

Auditor-General's foreword

It has been a year marked by change. The Queensland Audit Office and wider state and local government entities tackled the challenges of delivering their services during a period of new or emerging risk. They faced more complex community service needs, and continued pressure on the efficient use of resources.

The next few years will see Queensland work through the implications of COVID-19 on public spending and service delivery. The exact impact for government is difficult to know at this stage but the Queensland Audit Office (QAO) will need to share the insights we find from our audit work to effectively support the state’s recovery.

Throughout 2019–20, the oversight provided by independent offices was more essential than ever. Our role of providing trusted and valued assurance did not change, but the way we did our work evolved. We ensured our client relationships remained a priority as we engaged a little differently and strove to understand the challenges entities were facing. We gave our clients specific COVID-related advice during our audits, within our reports, and through our blog. Throughout this annual report, I provide information on how we supported our people, parliament, and clients during the pandemic.

We delivered 16 reports to parliament, in which overall we made 79 recommendations. We also made over 800 recommendations directly to clients during our audits. Fewer reports compared to last year reflects the agility we took to our audit program, where we delayed some reports in response to the COVID-19 pressures our clients were facing.

At the heart of our work is driving positive change in the way public services are delivered to help improve the lives of Queenslanders. We are always looking to maximise the impact we have. Parliament improves legislation and frameworks; but performance and process improvements come from entities themselves. We remained committed to building our clients’ trust in us, so they are more likely to hear and accept our advice, and act on our recommendations.

We have been working on how we can best engage with parliament. We developed new types of reports to parliament that range in depth but provide our insights more quickly, the first of which will table in 2020֪–21. We also engaged 500-plus councillors following the March 2020 election, offering information on how we can support them. We plan to do the same with members of parliament after the state election in October 2020.

Our performance is not possible without the expertise, passion, and commitment of our workforce. To my people and our audit service providers—thank you for your hard work. You faced trying times with tenacity and I am proud of what you achieved.

When our workforce operates as one team, we can offer richer, more consistent, and efficient services. Implementing our new operating model meant we got better at integrating our services, providing more strategic oversight of our work, and giving our staff more opportunities to develop.

We prioritised audit quality and continued to strive for the highest professional standards. Expectations of quality in today’s audit environment is indeed increasing, and our revised approaches harness the positive developments in audit practice.

Our ability to mobilise our workforce via secure systems during COVID-19 was a great achievement. Throughout the year, I continued to hold over 100 meetings with clients across Queensland. These relationships are important to us. We now need to get back to working at our clients’ sites in-person.

On 27 September 2020, we celebrate 160 years of service to Queensland. Over the years, QAO has supported entities through a range of difficult times and resultant recovery periods. I anticipate a demanding year ahead for Queenslanders; but QAO and I will be there to support you.

Brendan Worrall,

Auditor-General

About the Queensland Audit Office

We are Queensland’s independent auditor of state and local government public sector entities, as established under the Auditor-General Act 2009.

The Auditor-General is fully independent, appointed by the Queensland Governor in Council for a seven-year term. The parliamentary Economics and Governance Committee provides oversight of the Auditor-General and the office.

Our vision is for better public services. To achieve this, we:

- provide professional audit services, which include our audit opinions on the accuracy and reliability of the financial statements of public sector entities and local governments

- provide entities with insights on their financial performance, risk, and internal controls; and on the efficiency, effectiveness, or economy of public service delivery

- produce reports to parliament on the results of our audit work, our insights and advice, and recommendations for improvement

- conduct investigations about financial waste and mismanagement raised by elected members, state and local government employees, and the public

- share the wider learnings and best practice, from our work, with state and local government entities, and our professional networks, industry, and peers.

The outcomes from our work include:

- improving financial management and reporting

- maintaining confidence in accountability, transparency, and reporting

- supporting Queenslanders by providing recommendations to our clients on how they can improve their delivery of public services

- giving parliament independent assurance over public sector performance.

|

Location of QAO's audit clients Our clients are Queensland’s state and local government entities, located far and wide across our beautiful state. The Queensland Parliament is our client as we provide it with independent assurance. |

Our people and culture

Our greatest asset will always be our people. Their skills and commitment are vital to our ability to deliver our vision of better public services.

Celebrating our diverse and valued team

Our workforce comprises 190 full-time equivalents, who are a mix of auditors, specialists, and support team members. This year, 19 audit service providers joined our team to perform 44 per cent of our audits, supporting us across Queensland.

At QAO, we respect individuals and appreciate the immense value our different backgrounds, experiences, and talents bring to our workforce. Many come from non-English speaking backgrounds; 26.8 per cent. Fifty-four per cent are women—including 31 per cent of directors and above and a third of our executive management group. We also represent a wide range of age demographics.

We are committed to creating a positive environment that ensures all people feel like they belong.

|

On International Women’s Day, 8 March, we committed to #eachforequal. We remembered the history of women’s rights at the audit office, including our first female auditor, Doreen Martin in 1969; our first female audit manager, Debra Stolz, in 1997; and first female executive leader, Jenny England, in 1994. Our first female Assistant Auditor-General was Terry Campbell in 2004. |

Implementing our new operating model

This year, we started implementing QAO’s new operating model in line with our strategic workforce plan. Our new model ensures we are providing valuable services for our clients now and into the future, and it anticipates inevitable transformations in our internal and external environments.

Our new approach enables us to share our insights more seamlessly as one business. It means we can better develop our workforce and offer our people more varied experiences. Importantly, our new way of working includes our audit service providers, who are critical to our service delivery.

Think and Act OneQAO

The overarching tenet for our operating model is ‘Think and Act OneQAO’. Think and Act OneQAO focuses us on our vision, and is led by three guiding themes:

- building capability—developing infrastructure and staffing arrangements that support new ways of working and maximise the benefits of shared resourcing

- relationships—ensuring QAO’s future success by improving the quality of our relationships with our clients, stakeholders, and colleagues

- being valued—contributing to better public services by enriching our clients’ experiences and integrating our services and insights.

In line with these themes, this year we:

- reorganised our structure to provide strategic leadership over all our client services and reduce inflexible hierarchy

- changed how we resource our services to operate more efficiently and distribute our expertise across our teams

- updated some of our methodologies to cater for the changing audit environment

- refreshed our values so they resonate externally as well as internally.

The new way of working was—and continues to be—a big change for many. It is important that staff feel valued and respected during the change process. The Executive Management Group (EMG) held QAO-wide briefings, and we developed an intranet microsite to house information for staff. Project champions regularly shared updates across the business, and we set up an ‘Ask the AG’ inbox where staff could send their questions or feedback.

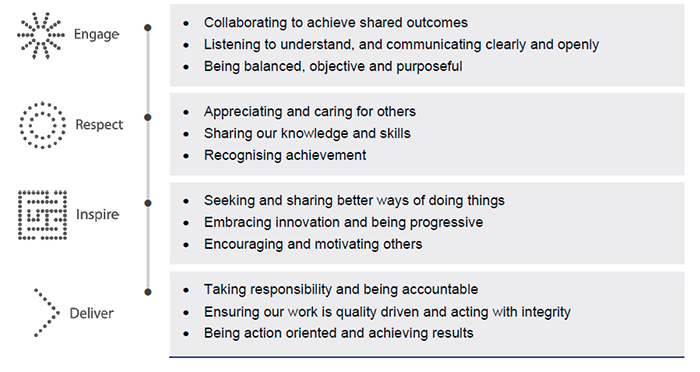

Refreshing our values

We promote an organisational culture based on looking after our relationships—internally with our people, and externally with our clients and stakeholders.

Our culture is articulated by our four core values, which set our expectations for behaviour. We regularly reflect on our culture and ensure our staff are living our values.

This year, QAO revisited its values to check that they were accurately representing who we are and our direction as one team. We changed two of our values to reflect more of an external perspective as well as internal. We replaced ‘challenge’ with ‘inspire’ and broadened ‘care’ to ‘respect.’

All QAO staff were involved in the refresh, providing feedback and voting for the final selection. Overall, staff were passionate about the project, which we believe shows a great sense of ownership of our values.

Recognising our staff

Recognising performance is an important part of living our values and key to growing our culture. As part of the refresh of our values, we started designing some new and exciting ways to show appreciation for our team members. Next year, we will launch a ‘recognition portal’ in our intranet and revamp our annual, pinnacle staff award to time with QAO’s 160th birthday in September 2020.

Investing in our people

Developing our people is fundamental to their work satisfaction and to our service delivery and culture. Our strategy for developing our capability entails a mix of professional training and in-house, bespoke training, as well as specialised courses attended by individuals.

This year, we provided our audit workforce with an average of 61.8 hours of professional development per person, not including the hours provided by mentors for our graduates. Along with technical training, we gave our staff opportunities to develop higher capability in client engagement, leadership, and people management.

Our senior managers attended training on how effective governance helps shape organisational culture. This will enable our staff to identify any risks our clients may have around their culture—and the behaviours that lead to these risks—so that we design our audits to address them.

As a recognised CPA Australia employer, we continued to provide an optimal learning environment and give our staff opportunities to attain professional development hours that are recognised by CPA.

Of our training and development this year, one of our audit seniors, Jodie L, said:

‘Being new to QAO I found the training week a great way to interact with people who I don’t get to work with on an everyday basis. The facilitators and participants all adapted really well to training virtually and the technology that we have access to is excellent.’ Jodie L, June 2020.

Next year, QAO will explore sharing our training courses and materials with our audit service providers.

|

Our commitment to providing high quality professional development and training continued successfully during COVID-19. We successfully transitioned our traditional face-to-face training to the virtual environment through live streams and online small group workshops. |

Recruiting great teams

Attracting and retaining the right people will position us well for the future of work. We know that many of the skills we are seeking are in high demand across both the public and private sectors.

We appointed seven graduates for 2020, and they joined us between October 2019 and early 2020. During COVID-19, we gave each newcomer specialised support to ensure their learning continued when working remotely. When restrictions lifted, we prioritised bringing graduates and their ‘buddies’ back into the office to give them the earliest opportunity for in-person connection. QAO’s buddy system provides a network of experienced mentors to support our graduates. One of our graduate auditors said:

‘Mentors are always willing to lend a hand. The guidance and constructive feedback provided through the buddy system in particular is invaluable. Graduates are encouraged to provide their own input, which enhances their confidence to do the same in future audits tenfold. My knowledge of auditing has grown substantially through the buddy system’s collaborative team environment, and emphasis on encouragement. I look forward to providing the same guidance to future graduates.’ Nick J, June 2020.

Another said:

‘QAO has met the challenge of the changing world. I have worked on meaningful projects as QAO responded to disruption and supports its clients. As I started at QAO in February, I was a little worried about how I would go working without the face-to-face contact from my team. However, it has been easy, and I couldn’t have felt more supported.’ Eva D, May 2020.

This year, a candidate from the QUT Accountancy Work placement program also joined us, and we engaged three interns; one in internal systems audit and one in audit analytics.

|

We engage Queensland’s tertiary institutions that are growing our future generations of auditors. QAO is pleased to sponsor QUT Business School’s Academic Year awards, by each year recognising the student who achieved the best overall performance in Audit and Assurance in the Master of Business (Professional Accounting). |

Looking after our peoples’ wellbeing

We worked hard to improve how we support and engage our workforce. The COVID-19 period was a tough time for many, and we needed to keep our team safe, and feeling connected and purposeful.

More than ever, we were able to offer a more flexible working environment, redefine how we do our work, and leverage our modern technology systems. We believe our new operating model and our recent shift to activity-based working enabled a seamless transition to a COVID-19 working environment, and sound staff engagement.

As soon as COVID-19 appeared on the horizon, we immediately communicated with our workforce on how QAO was going to respond, how we would look after them, and how we would do our work. We provided:

- daily, and then weekly, emails from the Auditor-General to all staff

- regular live streams or video updates from the Auditor-General

- virtual meetings where we shared information and discussed concerns

- a microsite within our intranet that housed frequently asked questions, Queensland Health advice, copies of correspondence, information technology guides, tips on ergonomics, and importantly, resources from the Employee Assistance Program (EAP).

We made a lot of effort to encourage staff to stay in touch during COVID-19, including keeping a sense of fun, for example by using Yammer for weekly competitions.

More generally throughout the year, our wellbeing initiatives included providing flu vaccinations (via voucher when COVID-19 commenced), and we got behind ‘RU OK?’ day.

Our workplace health and safety committee raised issues relating to the health, safety, and wellbeing of our staff, and managed our practices or policies in response. The committee met five times this year.

As at 30 June, QAO staff had started returning to our physical office location at 53 Albert Street and to some client sites. We remain focused on delivering our audit and engagement services in a timely and effective manner, while bringing our staff back in a safe and organised manner.

Staff feedback on QAO’s response to COVID-19

Sourcing feedback from our staff during COVID-19 ensured we were providing them with the right support and the right information. We conducted several anonymous surveys that helped us respond to staff needs and prepare our return to office strategy.

The results of our last major survey for the financial year were strong.

Ninety per cent of managers agreed their teams were equally or more productive working remotely. Ninety-three per cent said they felt equally or more connected to the executive management group. However, only 69 per cent said they felt equally or more connected to their colleagues, with free text comments indicating they were missing in-person or ad hoc connections. We were also concerned about some early indications that innovation and brainstorming were not as strong when staff are working remotely.

Of our communications effort, a staff member said:

‘I really appreciate the effort that has gone into communicating with us. When it was first happening, the daily emails were reassuring and provided sufficient information, so I felt I was in the loop, I’ve also had directors who have been very understanding about my circumstances.’

Another said:

‘QAO has been doing very well during this time and I’m grateful for how the office has been able to continue its business. Thank you.’

As of 30 June, QAO continues to source staff feedback as we return to the office and our client sites.

Protecting human rights

This year, the Human Rights Act 2019 (the Act) came into effect. The Act protects the rights of every person in Queensland when they interact with government or any entities doing work for government. It puts people first by making sure that the public sector thinks about human rights when they deliver their services.

QAO implemented a range of activities to ensure we deliver the requirements of the Act and that we embed it as an important part of our culture. We educated our staff on what it means to put human rights first when making decisions. We:

- reflected the Act in our policies, for example around handling complaints

- confirmed that our contractual conditions and arrangements with our audit service providers reflect the requirement to comply with all applicable laws

- updated our staff role descriptions and job advertisements

- implemented a communications campaign that included an interactive presentation for all staff (and new starters thereafter) and bulletin board posts. We also updated our intranet and external website.

QAO has not received any human rights complaints.

Our leadership and governance

QAO’s leadership and governance is integral to achieving our organisational objectives.

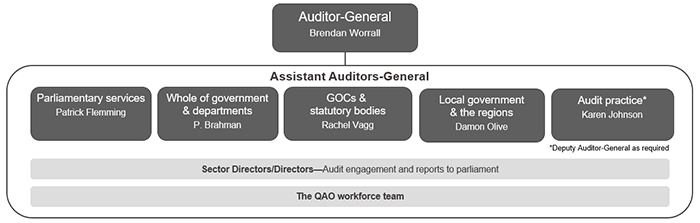

Our organisational structure

Implementing our new operating model involved an organisational restructure, enabling us to bring in new approaches and innovation. It also provides greater capacity to mentor staff, further developing our assurance capability.

Our organisational structure and governance framework did not change during the COVID-19 period. To strengthen our response, we stood up an additional Incident Response Group consisting of executive leaders and subject matter experts.

Executive leadership

QAO’s executive management group leads the delivery of QAO’s strategy. It monitors high performance, drives change and innovation, and manages our core business operations.

- Brendan Worrall, Auditor-General

- Karen Johnson, Assistant Auditor-General (Deputy Auditor-General when required)

- Patrick Flemming, Assistant Auditor-General

- Poopalasingam Brahman, Assistant Auditor-General

- Rachel Vagg, Assistant Auditor-General

- Damon Olive, Assistant Auditor-General.

Sector leadership

Our services are also supported by directors who provide deep knowledge of the industries that our clients operate in, and share specialist technical expertise and insights.

Our legislative framework

The Auditor-General Act 2009 (the Act) governs the powers and functions of the Auditor-General. It provides the legal basis for QAO’s access to information, and the freedom to report the findings from our audits. The Act promotes the independence of the Auditor-General and our auditors.

It also requires us to table in parliament the standards by which we perform our audits—the Auditor‑General of Queensland Auditing Standards. These standards require the adoption of standards issued by the Australian Auditing and Assurance Standards Board to the extent they are consistent with the requirements of the Act. In December 2019, we updated the standards to incorporate recommendations made in the 2017 Strategic Review of the Queensland Audit Office, and to reflect changes to audit practice and associated legislation.

Our governance bodies

Executive management group

This group includes all executive leaders. It determines strategy and budget, and regularly reviews QAO’s strategic and operating risks.

Senior management group

This group provides leadership for achieving the strategies outlined in QAO’s operational plans. Karen Johnson, as Deputy Auditor-General, was the chair in 2019-20 and the Auditor-General is a member by observation. The group met every eight weeks in 2019, and has since been disbanded in-line with QAO’s operating model.

Audit and Risk Management Committee

The Audit and Risk Management Committee (ARMC) is an independent advisory committee to the Auditor-General, comprised of three external members. Membership details are at Appendix B.

The ARMC provides effective oversight of risk, control and compliance frameworks, and fiscal responsibilities underpinning our corporate governance. This year it met four times.

In November 2019, QAO set up a new audit quality sub-committee to provide assurance to the ARMC that QAO’s audit activities are effective, efficient and comply with quality requirements.

Our approach to risk management

Over the past year we continued to review and develop our risk registers and improve our information management.

We focused on data governance and information security by developing and ratifying a new Data governance framework. This framework guides staff on how to make informed decisions on data management and how to ensure those decisions are properly governed.

We also continued to improve information security across the organisation through education and awareness campaigns, better controls and oversight, and a process of continuous improvement that internal audit backed up with ongoing oversight. We effectively deployed a new vulnerability assessment and management platform, and we increased our use of Information Protection systems.

QAO continues to work with the Queensland Government Customer Digital Group cyber security unit as we improve our information management security system (ISMS) and work toward continuous independent assurance.

Internal audit

Internal audit conducts independent and risk-based assurance activities over our operations, aiming to improve the operations of QAO. It works in accordance with an annual plan and its charter aligns with the International Standards for the Professional Practice of Internal Auditing.

QAO’s internal audit function is independent of our executive leadership group. The ARMC has oversight of the internal audit program and delivery. QAO engaged Protiviti to deliver its internal audit program; finalising five internal audits in 2019–20.

Our strategy

Our Strategic Plan 2019–23 outlines our objectives, risks, organisational strategies, and indicators of achievement.

Vision

Better public services.

Purpose

Independent, valued assurance and insights.

Who we serve

Queenslanders, through parliament, public sector entities, and local governments.

Approach

| Objectives | Strategic risks | Strategies | Indicators of achievement |

|---|---|---|---|

| We support and challenge our people to best serve parliament and our clients | We do not uphold our values or professional, ethical, and quality standards. | Supporting the Think and Act OneQAO workforce to meet parliament and our clients’ assurance needs. | Our people are engaged, professional and capable |

| Those we serve trust and value our services and insights. | We do not adapt our services in response to changing needs. | Enhancing relationships. | Our relationships are valued. |

| Our assurance services and insights are used to improve accountability and performance. | We do not sufficiently understand our clients' organisations and context deliver valuable services. | Adapting our assurance services to provide greater value. | Parliament and our clients benefit from the assurance services and insights we provide. |

Our strategic planning framework

We revise our strategic plan annually, or as required, to ensure we address emerging risks and new opportunities.

Our strategic plan is informed by our operational and workforce planning, our risk management framework, and our audit program.

The service delivery statement provides budgeted financial and non-financial information for the financial year and establishes our performance targets.

This year's performance

We met our strategic objectives throughout the year and our performance was strong, despite the changes we made to our work in response to COVID-19. However, areas for improvement remain and we are committed to identifying opportunities to increase the value and efficiency of our work.

Supporting our clients during COVID-19

When COVID-19 challenges first arose, we immediately communicated with our clients and stakeholders on how QAO was going to operate, and how we would collaborate with them to reflect the unique challenges many of them were facing. We actively focused on maintaining our relationships despite reduced in-person communication and travel to audit sites.

Our workforce continued to deliver its audit services, supported by our reliable and flexible technology platforms. Our ability to transfer data securely greatly assisted our clients and audit service providers, and enabled us to progress our remote and regional audits where some of the communities were locked down. To limit change and uncertainty, QAO also paused its annual procurement round for its audit service providers.

When it is safe to do so, it is crucial our auditors continue to visit or work at our clients’ sites. This ensures we see firsthand the unique environments or contexts our clients operate in, and that we have sufficiently full and accurate visibility of our clients’ operations.

Throughout the year, we continued to give our audit clients, parliament and the wider Queensland community confidence in government accountability and transparency. We identified the risks that our audit clients were facing, designed our audit work to respond to those risks, and continued to report on matters of significance.

We further reflected our clients’ circumstances by ensuring we conducted our work at the right time, and were focusing on relevant, valuable audit topics given the rapid changes to service delivery and community needs.

We recognised the need to give our clients specific advice on COVID-19 and published 10 blog posts on the matters we think our clients needed to place top of mind. Our blog covered a range of topics such as maintaining controls, managing cash reserves, managing volatile investments, cyber security risks, and financial reporting in uncertain times.

Our clients also mentioned the value of previous blog posts, such as how to electronically approve documents and how to ensure strong everyday controls to prevent fraud attempts. Since its launch in November 2018, our blog has been viewed over 67,000 times; over 46,000 times in 2019–20.

|

Since April 2020, five QAO staff members have been redeployed to the Queensland Government employee mobilisation service. Their skills were sought after, and we were pleased to be able to provide further assistance to agencies in need. |

Delivering our audit and reporting services

Throughout our audit program, we formed 397 audit opinions about the reliability of financial statements of state and local government entities. Our audit service providers delivered 173 of these opinions—44 per cent.

We tabled 16 reports to parliament. Seven of these were on the combined results of individual financial audits, and nine contained the findings, conclusions, and recommendations from our performance audits. Our number of tabled reports was less than last year’s total of 21 as we paused some of our work during COVID-19 to prevent placing pressure on impacted entities and to ensure we focused our efforts where we can provide the greatest value.

One way in which we measure the efficiency and effectiveness of our work is by tracking the full life cycle cost of each of our reports to parliament, and the time we take to produce them. We do not deliver our audits and reports as discrete services—our new operating model means we deliver integrated services and resource our work accordingly. However, our final deliverables vary in nature, so we report on the cost and timeliness of all our reports.

This year, we delivered our financial audit reports at an average of $124,600 per report, which was $15,400 below our target of $140,000, and $18,204 below last year’s average cost of $142,804. We were more efficient because we better planned and focused our reports, so we spent less time writing and reviewing them.

The average cost of our performance audits (which includes the audit work and report) was $453,878 $58,000 over our target of $395,000, and $136,100 more than last year. This was due to the complexity, scope, and sensitivities of most of this year’s audit topics, meaning we needed more time and depth during the audit conduct stage, for engaging clients and preparing the resultant reports. The cost of each report to parliament is available in QAO’s performance statement on page 53.

We measure the timeliness of our financial audit reports from our clients’ year end date to the tabling date of the report in parliament. This year, the average time to deliver our financial audit reports was 5.3 months—faster than our target of six months and last year’s average of 6.5 months.

We measure the timeliness of our performance audit reports from formal initiation of the audit to the tabling date. We delivered our performance audit reports on average in 10.9 months, which was 1.3 months over our target of nine months, and longer than last year’s result of 8.9 months. All our reports were full performance audits this year—we did not do any follow-up audits, which typically have a shorter time frame and cost, reducing our averages. We also paused our audit on Evaluating major infrastructure projects (Report 14: 2019–20) for two months to allow entities more time to respond to the preliminary report.

Despite the complexity of the audits, the value of our work remained high and many of our clients appreciated the time we took to consult with them.

Making valuable recommendations for our clients

We suggest better ways of delivering public services through our audit recommendations in our reports to parliament and across our audit engagements.

In our reports to parliament, we made 79 recommendations to our clients. The recommendations related mostly to strengthening controls, performance measurement and reporting, fraud risk, cyber security, effective governance and oversight, asset management and financial sustainability, strategic planning, and contract management.

We often receive interest in our recommendations from clients that were not specifically involved in the audit but find the recommendations and our insights to be useful. Following our report Managing coal seam gas activities (Report 12: 2019–20), several entities have asked us for additional detail on how we developed our process maps relating to regulating resource activities. We have helped entities where appropriate and they appreciate our support.

During our audit work, we make key findings and immediately provide recommendations to our clients on what they should do to address an issue. This year, we made over 800 recommendations, of which around 150 were significant (high-risk matters) meaning clients acted on them immediately.

In one example of our timely insights, during our audit testing we identified several duplicate payments that an entity was making. Our insights provided the entity with around $1 million in savings. We gave them recommendations on how they can improve their internal controls to prevent similar issues occurring again.

Following up entities’ implementation of our recommendations

The primary responsibility for implementing the recommendations from our reports to parliament rests with the accountable officers of the entities we address our recommendations to. To measure impact over time, each year we identify prior year audits to follow up; however, resources have limited us to one–two of these follow-ups per year.

We have started developing a new online tool that will enable entities to more efficiently and easily track their progress in implementing our recommendations and submit their status updates to us. This new approach will:

- give entities clarity over how many of their recommendations they report as fully implemented, partly implemented, or not implemented

- identify the recommendations we have made more broadly across government, which may be applicable or valuable to them

- provide parliamentary committees with an efficient way to oversee the status of recommendations

- provide an efficient and effective means for QAO to track the value of our work, select areas to further focus our future follow-up or audit work on, and, overall, provide greater assurance.

We will pilot this new approach and tool with some entities when the timing is right, given COVID‑19. When appropriate, we will table a new report to parliament collating entities’ self‑reported progress on implementing our recommendations.

Assisting and engaging with parliament

QAO’s new operating model provides for more focused and strategic leadership over our parliamentary services. The new approach aims to strengthen QAO’s relationship with parliament, specifically the Economics and Governance Committee (EGC), other portfolio committees, and individual members of parliament.

We continue to seek ways to give parliament timely insights and engage in ways that best suit their needs. QAO’s relationship with parliament is imperative for us achieving our vision of better public services. By ensuring we meet parliament’s needs, we better meet the needs of the public.

This year, QAO gave seven briefings to parliamentary committees, covering 12 of our reports to parliament. Our briefings provide an overview of our audit findings and allow for further questions from members about our audit work and recommendations. In April, we also briefed the EGC on QAO’s strategic direction and operations.

Members of parliament are invited to raise concerns about incidences of financial waste or mismanagement via our referrals process. This year we received 13 referrals from elected members, including councillors. We value their input and consider it as part of our strategic audit planning process—our selection of future audit topics.

Planning our strategic audit program

The sectors we audit are experiencing significant change, whether due to the impact of COVID‑19, digital transformation, pressures on revenue sources, ageing assets, new societal needs, increased demand for services or the constant requirement for efficiency savings.

In this context, we continue to focus our audit program on where we can provide the most value. In identifying and selecting our audit topics, we continually scan the environment that state and local government entities operate in to reflect emerging or systemic risk. We consult widely with entities, parliament, and other stakeholders, and welcome topic suggestions from the public.

Our work program is laid out in a three-year strategic audit plan. We review the plan annually, or when new circumstance arise, and publish it on our website to ensure transparency around our work, and to give entities sufficient notice to prepare for an audit.

The indirect and direct impacts of COVID-19 are revealing specific areas of risk that may benefit from further examination. In May 2020, we started to reassess our audit program to ensure the topics remain relevant, and to reprioritise the timing of current audits or introduce alternative topics. We will provide an acquittal of our revised strategic audit plan to the EGC and will communicate changes with our clients. We aim to deliver our Strategic Audit Plan 2021–24 in early 2021.

In the coming year, we aim to become more agile with our audit planning. We need to respond quickly to emerging or critical risks, and focus our audits on the matters that are most important to Queenslanders, at the right time and when they will provide the most value.

Garnering insights from our referrals process

We investigate financial waste and mismanagement raised by elected members, state and local government employees, and the public. We call these concerns or submissions ‘referrals’. When we receive a referral, we will investigate, if appropriate, per the Auditor-General Act 2009. These investigations aim to:

- strengthen and improve public sector performance, efficacy, and accountability

- address governance deficits in state and local government entities

- speak to systemic issues in service delivery

- uncover and mitigate fraud relating to financial waste or mismanagement.

Following the investigations, we recommend improvements to the respective entities where appropriate, and if the findings are significant, we include them in our reports to parliament. We also use the findings or broader emerging themes to inform our forward audit program. We work closely with other integrity agencies to pass on matters more relevant to them, such as those around fraud or corruption.

This year, we received 76 referrals, up six on last year, and we had finalised all of them at 30 June 2020. We expect to receive more referrals in the lead up to state and local government elections, both occurring in Queensland in 2020.

Over half of the referrals came from the general public (57 per cent), and the rest were from elected members, entity management and via public interest disclosures. Some referrals were also made anonymously.

We received referrals relating to 36 different state or local government entities. The predominant themes or topics of the referrals were financial mismanagement (40 per cent), expenditure (22 per cent), unethical behaviour (22 per cent), procurement (eight per cent) and governance (seven per cent). Forty of this year’s referrals related to departments, and 21 to local government matters. Fifteen referrals related to other agencies, such as government owned corporations and statutory bodies.

A key focus for us now is improving how we utilise the intelligence our referrals provide us. We will implement processes that enable more systematic analysis and highlight trends, risk, or consistent issues. This data will inform our forward audit program and audit work.

Evolving our audit methodology

This year, we undertook a major body of work to evolve the methodology we use to conduct our assurance reviews and performance audits to increase our audit flexibility and agility. We compared our approach to Australian Auditing and Assurance Standards and reflected pertinent elements of international best practice.

The main changes include clearer governance gateways, new approaches to budgeting and documentation, more targeted external communication, and a stronger whole-of-office perspective. Importantly, it focuses us on better managing the value of our audits by reporting to parliament on the right topics at the right time.

Next, we will further develop our capability across our business by providing in-depth training for our staff, ensuring we fully maximise the benefits the methodology provides our clients and our staff.

Developing our reporting to parliament

We are improving how quickly we can respond to risks emerging across government, share our findings and insights with our clients, and report to parliament on time-sensitive issues.

QAO examines many operational and service delivery issues, but not all of these automatically lead to a full performance audit. This year, we reviewed the types of reports to parliament that we produce. Three new publications will now complement our existing audit reports. They range in depth and degree of evaluation:

- Topic overviews—which may provide information on complex topics, set out key facts, identify underlying assumptions and summarise complex issues

- Information briefs—which may set out key facts, may involve some evaluation, and may include findings and recommendations for entities

- Auditor-General’s insights—which may provide further evaluation and often highlight recurring or future risks and issues. They may draw on other QAO work across government.

We of course continue to produce reports on the results of our audits.

Our new publications are produced under our existing legislative mandate, the Auditor-General Act 2009. They will give us more avenues to share the insights we gather from our audit work with entities, parliament, and the wider Queensland community. They enable us to respond quickly to the issues we see emerging across state and local government entities.

It is important we seek feedback on the value of these new publications, and indeed all our reports, and we will engage closely with our clients on our new approach.

Continuing our focus on audit quality

Audit quality is a serious matter, and we undertake a range of activities each year to improve and manage our effectiveness.

Our well-established governance mechanisms oversee and lead our audit quality practice and culture. In 2019, we established an audit quality sub-committee that reports to QAO’s Audit and Risk Management Committee. This sub-committee is led by independent, experienced audit professionals who are not only monitoring our audit quality journey, but also helping us develop contemporary, efficient, and more effective responses to audit quality.

Our system of quality control is built on the Auditor-General of Queensland Auditing Standards and Auditing and Assurance Standards Board—ASQC 1 Quality Control for Firms that Perform Audits and Reviews of Financial Reports and Other Financial Information, Other Assurance Engagements and Related Services Engagements.

As enabled by our new operating model, we now assign the responsibility of Engagement Quality Control Reviewer (EQCR) to Assistant Auditors-General for high-risk engagements.

A significant component of our quality assurance program is examining our audit service providers’ practices and audit engagement files. We are continuing to refine how we review their work so we can better and more efficiently inform them of improvement opportunities.

Each year, we develop comprehensive plans that cover all aspects of quality for our assurance services. In 2019–20 we completed more than 60 quality assurance reviews of audits delivered by QAO and our audit service providers. For specific audit engagement files, we completed 34 closed (‘cold’) file reviews, and 21 open (’hot’) file reviews.

We sought independent and expert advice on refining the program we use to conduct our closed audit file reviews. The refinements mean we are now more closely aligned to the Australian Securities and Investment Commission’s (ASIC) audit inspection approach for listed entities, while still encompassing the key requirements of professional accounting and auditing bodies, and the Australian Council of Auditors-General (ACAG).

Investing in quality assurance training

QAO’s audit quality ‘engine room’ is fuelled by our auditors’ commitment to best practice and learning. We invest in training our workforce to support excellence.

We developed, implemented, and tested a new root cause analysis program for audit engagements. This program offers us new insights into where auditors can improve, and effectively informs our next cycle of learning and development.

We share the results of our annual quality assurance reviews with our staff and audit service providers. Our latest quality reviews gave us important insights, and areas for us to focus on next year, mainly around documentation, and timeliness of completing procedures and locking down files.

Embracing technology and digital innovation

Our systems during a year of change

In response to COVID-19, we enacted our business continuity plan with speed and agility. Our digital and technology capability reflects the culmination of initiatives over the past few years, including:

- a cloud-first technology environment, with multi-factor authentication and robust virtual private network (VPN). By migrating or decommissioning on-premise and legacy systems, QAO was able to provide a near-seamless remote-working experience for all staff

- our activity-based working model, which allowed all staff to be flexible, observe better physical hygiene practices, and ease physical transition back to the office

- a highly mobile and more tech-savvy workforce where people understand and appreciate the importance of cyber security and awareness.

We also effectively live streamed QAO-hosted events and presented remotely at a range of online industry or client events.

Advancing our audit analytics capability

This year, we further incorporated analytics into our audit approaches, prepared for the future of analytics, and grew a team of specialists with backgrounds in audit, advanced mathematics, data science, and programming.

Our new operating model enabled us to better incorporate our analytics capability into our client services, enabling a more effective approach where we target our audit focus on areas of risk. This means we have fewer requests for our clients to provide documents during each audit visit.

We redesigned our analytics database to better harness the data we receive from our clients. This included implementing robotics into our data processing, and smarter error checking so we can more quickly prioritise and resolve issues with data supply. We can now also integrate external third-party data sets, such as the Australian Securities and Investment Commission (ASIC) and the Australian Business Register (ABR).

QAO also continued to share learnings from its analytics capability with our clients who are embarking on data journeys. Some presentations to industry included CPA Australia events, the Local Government Finance Professionals annual conference, and the Public Sector Network’s roadshow.

One of our directors is on the CPA Digital Transformation Centre of Excellence committee. The committee conducts research and provides thought leadership on digital transformations, and resultant impacts on the accountancy profession.

Next year, we will focus on better integrating analytics into our audits with the introduction of our new audit software.

|

Our analytics capability had a key part to play during COVID‑19. We expanded our data supply to facilitate remote auditing and minimise the impact of auditors not being able to attend audit sites in person. |

Rolling out our new audit software

We continued to improve our new audit software by finalising our public sector audit template and implementing it across university audits for 2020, ahead of our broader rollout.

We implemented functionalities that will enable us to take advantage of the software’s suite of electronic software programs, lead sheets, checklists, and standardised documents, specifically designed for public sector auditing in Australia. By linking to data within the software’s documents in real time, our audit system will benefit both auditors and reviewers. Further efficiencies include:

- standardising audit documentation office-wide

- ensuring all lead sheets, programs, checklists and working paper annotations are the same for all audit engagement files; ensuring each has a consistent look and feel

- better linking and referencing information in our electronic engagement files, meaning we only need to create something once—documents can be used repeatedly with minimal updates

- reducing the time it takes us to roll forward client engagement files into subsequent years.

The next phase of this project will be implementing and preparing for all remaining audit engagements. This will include a training program and ongoing support for our staff.

Sharing our insights and learnings

Our mandate gives us access to a wealth of information, which we collect and analyse during our audit work. We endeavour to share the emerging issues, opportunities for improvement, and examples of best practice we uncover.

Campaigning on cyber security

Protecting important information assets with secure systems is critical to Queensland’s economic and security interests, and security organisations are observing significant increases in cyber attacks.

In October 2019, we tabled our report Managing cyber security risks (Report 3: 2019–20). We selected three entities to audit and used expert consultants to compromise sensitive data.

While our audit was underway, we received a lot of anticipation for our final report. We implemented an intensive campaign to share the audit learnings through blog posts and event presentations for audit committee chairs and chief finance officers. We hosted two in-depth ‘cyber security insights’ sessions for entity governance leads (co-hosted with our contracted experts and the Queensland Government Customer Digital Group).

QAO’s audit director presented at external industry events such as the Corruption Prevention Network Queensland and the Local Government Internal Auditors Annual Conference. And we continue to receive presentation requests. The cumulative audience reach of these internal and external presentations alone was over 700 people.

Importantly, we briefed all our staff and audit service providers on the audit findings so they could share information directly with their clients on a day-to-day basis.

The messages throughout the report itself were well communicated via insight statements and case studies. We also gave each of the audited entities a face-to-face session with the expert consultant that penetrated their systems.

The interest in, and value of, this report continues to be high particularly as COVID-19 presents further risks for both public and private sector organisations. As of 30 June 2020, the report had been viewed over 4,300 times on our website.

A Queensland audit committee chair, who holds leadership positions across several audit committees, said:

‘The report was very easy to read and was not overly technical. The recommendations were very practical. I’ve also shared the report with a number of non-government agencies I work with.’

Another said that they were:

‘Very impressed with QAO’s cyber security presentation to audit committee chairs, and that QAO has done exceptionally well in the past couple of years by hosting such events and the topics being covered, along with our reports, blog posts and other resources.’

Learnings around ICT governance

Over the last couple of years, there have been several cancelled information and communication technology (ICT) projects in the public sector and, as a result, heightened interest in ICT governance and spending across government. We identified the need for greater disclosure by agencies about project cancellations, and for better oversight of ICT projects to mitigate the risks of failed or costly project delivery.

In February 2020, we tabled our report Effectiveness of the State Penalties Enforcement Registry ICT reform (Report 10: 2019–20). While the audit related specifically to the State Penalties Enforcement Registry (SPER) project, it contained pertinent insights for all entities. A ‘lessons learned’ section of the report provided advice on key ICT project governance matters. We shared our advice via our blog, a better practice guide, and across our various client and industry events. As at 30 June, the report had been viewed over 3,500 times.

This is a topic we continue to focus on and monitor closely. We have started work on an Auditor‑General’s insights report to parliament covering significant ICT projects. Planned for 2020–21, our report will highlight recurring issues that all entities need to manage, and provide information over and above what agencies currently report through the government’s digital projects dashboard.

Working with local government

We endeavour to help Queensland’s 77 local governments (councils) maintain their communities’ trust and discharge their responsibilities for stewardship, transparency, and accountability.

March 2020 saw local government elections in Queensland, resulting in 48 per cent of councils appointing a new mayor and changes in executive positions. Following the election, the Auditor‑General wrote to over 500 councillors offering support, providing an overview of our role, and seeking feedback on our services. We provided an information pack on the areas we focus on during our audits and topical issues councillors need to be aware of. These issues include financial sustainability, asset management, governance and culture, and fraud risk management—all of which we covered throughout the year during our audit work and via more concerted campaign efforts.

Each year we work closely with the Department of Local Government, Racing and Multicultural Affairs (DLGRMA) to review their guidance on local government financial statements, known as ‘Tropical’.

We present with DLGRMA at information sessions for council finance staff across the state, covering our insights and learnings from the previous year, and areas of focus for the current year‑end process. This year we held sessions in-person in Townsville, Cairns, Toowoomba, Longreach and one in Brisbane, and moved to online sessions during COVID-19.

In June, we also presented at the Local Government Association of Queensland’s first virtual Civic Leaders Conference via pre-recorded video presentation and live Q&A.

We are firm believers in the value of in-person engagement, and usually travel to as many client sites as possible to conduct our audit planning, interim and final audit testing, and to attend audit committee meetings. Given COVID-19, we continued to engage with remote or regional clients via video/teleconference with our strong relationships enabling our collaboration to continue.

Focusing on sustainability

With increasing uncertainty around future revenue sources, councils need to manage their costs and measure their performance to be sustainable in the longer term.

Our report Managing the sustainability of local government services (Report 2: 2019–20) assessed whether councils plan and deliver their services to support long-term financial sustainability.

We presented the important insights from this report to clients across Queensland, immediately following tabling, and will continue to focus on this topic in the year to come as it becomes even more pertinent following COVID-19.

We also developed supporting materials aimed at helping our clients apply the insights and recommendations from the report. These included a cost value tool to help councils identify key priorities for funding allocation, and fact sheets on measuring service performance and allocating corporate overhead costs to services.

An interactive data dashboard illustrated insights from our report. It allowed users to search for their council to view its financial performance and sustainability, and compare information between councils. As at 30 June 2020, the dashboard had been viewed over 1,600 times. The report had been viewed over 2,500 times.

A new financial reporting maturity model tool

In November 2019, we developed a financial reporting preparation maturity model that accommodates the different structures and sizes of the organisations we audit, and other client‑specific factors that influence reporting practices across the public sector.

Our new model enables our clients to determine their expected level of maturity against QAO’s financial reporting model. It outlines the key components that support high quality and timely financial reports, using a matrix approach, with four assessment components described across four levels of maturity. We do not expect that all entities will consistently sit in the top maturity categories of integrated and optimised, rather, their ratings are determined in line with the size, structure, and complexity of their organisations.

To support the model, we developed a self-assessment tool that provides a series of questions for each of the key components and helps entities calculate their level of maturity for each.

We consulted extensively with our clients when developing our new model and tool to ensure it is useful, accurate and understandable, and we used the feedback to refine the final product.

Better communicating our insights

We recognise that to influence improvement in the public sector, we must communicate in ways that make it easy for our clients and stakeholders to access and understand our work.

This year, we reviewed our reports to check they are effectively communicating our insights. We want to better connect with those readers who may not have detailed background knowledge on a certain topic, and ensure that our reports suit emerging digital technologies. We restructured and simplified our reports and now produce a ‘report on a page’ summary for each. We also continue to coach our staff on writing clearly.

This year, we journeyed further into data visualisation and provided interactive dashboards for some of our reports to parliament. These dashboards illustrate the insights we collect from our audit work and are an interactive way for audiences to explore our financial data in detail or view summarised information. This year’s dashboards covered our local government, health, energy, and education reports. Collectively, these dashboards had been viewed over 4,000 times as at 30 June 2020. Data visualisation will continue as a focus for us next year as we find useful and interesting ways to present our insights.

This year, we also implemented online HTML delivery of our reports to improve accessibility, provide a better user experience, and ultimately increase reach and readership. This year, our reports were collectively read over 30,000 times. Online delivery of our reports contributed to an additional overall readership for the year of around 10,000 pageviews when analysing PDF report and online views.

We will continue to listen to our clients and stakeholders and improve how we write our reports and communicate with them.

Learning from our clients’ feedback

Every year, we survey our clients to understand their satisfaction with our services so we can address any issues they may have. We view the quality of our service delivery holistically as one QAO, but we ask our clients for feedback at different points throughout the year based on our specific deliverables.

This year, we surveyed 320 clients and received 252 responses on our audit process, reporting, and value. The overall feedback from all our clients was positive and on par with previous years’ results. We achieved an average performance index of 81 points (ip). IP is the average of the aggregate indices for each area of performance that the survey explored. Our results have remained stable, and while consistently high, it indicates a need for us to seek out all further possible improvement opportunities and address client feedback at an individual entity level.

Clients’ satisfaction with our audit process remained steady and we achieved an index score of 79ip across all our services. We are looking at how we can improve the timeliness of our work, balancing it with audit quality and our need for independence.

Some clients continue to suggest that having the same auditor each year would mean QAO understands their operating environments more quickly. Our new operating model will provide for more harmonious service delivery, increased knowledge across QAO about more sectors, and consistent oversight from our engagement leaders.

Most of our clients were particularly happy with the professionalism of our auditors at 97 per cent, in line with 96 per cent last year, and 94 per cent gave us positive ratings around our skills and knowledge. We see no reason not to strive for a 100 per cent rating for this performance area in the future

The satisfaction with our audit reporting (meaning our audit documents and reports to parliament) ranged from 78ip to 80ip.

Nearly all clients agree they value our work—either the assurance and recommendations we provide around financial management and internal controls (93 per cent), or that our work will help them improve the performance of the audited activity (96 per cent).

As one client said:

‘The department values highly the assurance provided through QAO annual financial audit and trusts the expertise and professionalism shown by QAO staff. Continued good communication requires ongoing effort and attention and it is important that regular and early contact is maintained.’ QAO client, 2020.

|

We are currently conducting a deeper analysis of our client survey results to better understand where concerns and opportunities for improvement lie at the individual client level. We wish to gain more strategic insight into how our clients view and value our work both over time and in relation to our latest engagements, so we can adapt our work. |

Working with our peers and professional networks

We do not work alone. Our many and varied relationships across industry and with our peers provide opportunities to share information, best practice and learn from each other.

Central agencies

Central agencies for QAO include the Department of the Premier and Cabinet, the Public Service Commission, and Queensland Treasury.

We liaised early with Queensland Treasury during COVID-19 around potential impacts on the timing of agencies’ 2019–20 financial reports. We offered our support in the early stages of the government’s proposed response to the pandemic, including providing five staff to the Queensland Government COVID-19 employee mobilisation service, for agencies that needed support during the pandemic. We also continued to work closely with Treasury around financial accounting issues and how we can help entities address them.

Integrity agencies

Integrity agencies have powers to investigate matters relevant to their role. Members of the public may raise matters with them, or the agencies may identify matters when delivering their services. Integrity agencies regularly meet to share knowledge and business updates.

In April 2020, we participated in an integrity agencies joint advisory group, which provided advice for public sector leaders on risks and vulnerabilities during COVID-19. A paper co-written by the Crime and Corruption Commission, Queensland Ombudsman, Queensland Integrity Commissioner and QAO covered advice for chief executives on staff working from home, conflicts of interest, cyber security, and tone from the top.

Each year, QAO participates in a Local Government Quarterly Liaison meeting where the agencies that operate in the local government area meet to discuss any learnings that may assist each other. We offer insights from our respective work such as referrals, investigations, or public interest disclosures.

Peers

The Australian Council of Auditors-General (ACAG) is an association that shares information and intelligence between auditors-general from Australia and some Asia Pacific audit offices.

An executive committee guides and monitors ACAG’s engagement and achievement of objectives. The committee consists of three auditors-general and its membership rotates, with appointments determined on seniority. The convenor chairs the executive committee, acting as the designated ACAG spokesperson and representative. Queensland Auditor-General, Brendan Worrall, will assume the role of convenor for 2020–21. Brendan Worrall is also the current chair of the ACAG sub‑committee for audit analytics.

We collaborate to respond to proposed standards changes, benchmark our performance, and share expertise. This year, liaison between the offices was particularly valuable during COVID-19. We each shared how we are responding, supporting our clients, and where we will focus our audit programs going forward.

Overall, QAO participated in 24 ACAG meetings (most of which were virtual) covering audit, financial reporting and accounting, standards, audit analytics, and corporate services. ACAG responded to the Australian Accounting Standards Board and the Australian Audit and Assurance Board through the Financial Reporting and Accounting Committee ACAG and the Auditing Standard Committee. QAO actively participated or co-ordinated the ACAG technical responses to:

- Exposure Draft 298 General Presentation and Disclosures

- AASB 13 Fair Value Measurement, AASB 15 Revenue from Contracts with Customers, AASB 1058 Income of Not-for-Profit Entities—providing public sector perspectives to these standards

- Exposure Draft Proposed International Standard of Quality Management ISQM1 and ISQM2

- Exposure Draft Proposed International Standard on Audits of Financial Statements.

As a group, ACAG submitted a joint response to the Australian Parliamentary Joint Committee Corporations and Financial Services’ inquiry into the regulation of auditing in Australia. And it submitted a joint COVID-19 response to the Financial Reporting Council.

We also often engage with international audit offices, to question them about their recent successes in audit and engagement or on specific audit topics. We find it useful to share some of our tools. As a recent example, a county audit office in the United Kingdom reached out to us this year about adapting our Fraud and corruption self-assessment tool, which we were of course happy to permit.

We worked particularly closely with the Office of the Auditor General of Ontario, Canada, with our first employee exchange program commencing in December 2019. Unfortunately, due to COVID‑19, the exchange was cut short from a planned six to three months, but both managers had the chance to broaden their technical skills and share expertise.

QAO’s audit manager who headed to Canada said:

‘The exchange was an opportunity to see how approaches to auditing in the provincial ministries in Ontario apply to similar issues facing agencies here in Queensland. I obtained valuable insights into the practical application of audit tools such as CaseWare; and alternative approaches to performance audit, follow-up audits, report writing and stakeholder relations. It was also interesting to see new approaches to auditing Indigenous (First Nations) programs and services. All of this information and the contacts I have made internationally will be used to continuously improve QAO’s practices.’ John H, May 2020.

Our guest auditor from Canada, Jesse D said:

‘The exchange program was an incredible experience for me. I worked with a strong team and learned a lot from their approaches to performance audit. Everyone at QAO was welcoming and took the time to make me feel at home and teach me about their roles and the operations. I’m excited to bring all these great lessons learned back to my office in Canada.’ Jesse D, June 2020.

Industry and community groups

We engage with a wide range of industry and community groups based on the work we are doing. It helps us hear firsthand about issues with public service delivery and provides essential context for our audit work.

For our last report for the year, Licensing builders and building trades (Report 16: 2019–20), we held meetings early on with the Housing Industry Association, Master Plumbers Association, Master Builders Association, and the Board of Professional Engineers Queensland. These meetings informed the scope of our audit.

We engaged with a range of stakeholders for our report Managing coal seam gas activities Report 12: 2019–20) including the University of Queensland, CSIRO, resource companies, community groups, and industry bodies. We also liaised with other audit offices and integrity agencies on this topic.

For our current audit on regulating firearms (due to table in 2020–21) we have so far engaged the Australian Medical Association Queensland, Gun Control Australia, Women's Legal Services Queensland, and Public Health Association Australia.

We received 20 contributions from Queenslanders via our website, which informed the planning and conduct stages of our audits.

Professional networks

We enjoy liaising closely with professional accounting and auditing bodies, and standard-setting boards.

This year we continued to work closely with CPA Australia. We conducted general liaison on accounting standards and developments in financial reporting. One of our directors was appointed to a casual vacancy at the Queensland Divisional Council. And another was invited to join CPA Australia’s public sector committee, which represents the views of its members, bringing a wealth of experience from a variety of industries across Queensland.

Some of our presentations included the Queensland Public Sector Discussion Group, the Queensland Compliance and Management Reporting Discussion Group, and the Brisbane Congress—all on accounting standards updates. We also presented at the ACT Congress on understanding key standards.

Further afield, another QAO director joined CPA Australia members on a teleconference with 30 representatives of the Malaysian Accountant General’s Department, to provide advice on their move to accrual accounting.

We had the pleasure of working with the Institute of Public Works Engineering Australasia (IPEWA), Queensland. In their June issue of Engineering for Public Works, one of QAO’s Assistant Auditors‑General partnered with Brisbane City Council to respond to a community question on systems integration for effectively managing assets. We also provided some content for IPWEA’s learning hub on financial sustainability for senior public works engineers.

Also in the asset world, several QAO managers and directors participated in the Asset Institute’s Public Assets Collaborative Group, which is a special interest group comprising the peak bodies involved in asset management.

We helped the Queensland Local Government Finance Professionals (LGFP) celebrate their 40th year, presenting at their annual conference on the past and future of auditing local government. A QAO director discussed how audit teams are using data to increase efficiency and effectiveness, which is arguably the most significant change to audit over the past 40 years. This event was particularly timely for us given our own upcoming anniversary—our 160th on 27 September 2020.

Priorities for next year

QAO remains committed to its purpose of independent valued assurance and insights, and its vision of better public services. Next year, we will continue our journey towards more consistent client service delivery, deeper engagement, increased insights from our work, widely sharing our learnings, and improving our internal efficiencies.

A capable and high performing workforce that feels engaged and valued is paramount. We will grow the skills of our people to prepare us for the future. Bedding down our more strategic, systems‑approach to resourcing will enable us to partner the right expertise on the right audits. Reflected in our Strategic Plan 2020–24 is our need to strengthen and refine how we work with our audit service providers.

Our forward audit program will focus on the most important risks to government performance and the efficient and effective use of public money. We will need to balance the ongoing issues and challenges facing government with new ones emerging from COVID-19. We must seek out and share cross‑government insights to support Queensland’s recovery from the pandemic.

Following the Queensland state election in October 2020, we will reach out to parliament to better understand how we can best present our insights for them, so they understand the issues and opportunities for service improvement we are finding.

We want people to know about and use our work. We must ensure our knowledge is easily accessible for all our clients and stakeholders by catering for the varied ways our large and broad readers prefer to receive information.

To ensure maximum effectiveness of the recommendations we make in our reports and during our audit work, we wish to follow up entities’ implementation more rigorously. This will allow us to judge the effectiveness of our recommendations and provide both audit clients and parliament with status updates.

Changes to the audit landscape will present new demands and opportunities for audit professionals. We will continue to invest in quality—leading by example—and will deliver our updated methodologies and software. We will enhance our use of advanced data analysis to focus our audits and to provide valuable insights for our clients.

Operationally, we have several deliverables for information technology next year. We will continually improve our security posture, migrate away from legacy systems, implement new platforms such as SharePoint Online. We will apply our learnings from the COVID-19 period to advance our collaboration technology. There is also scope to improve our cloud-first approach.

On 27 September 2020, we celebrate 160 years of service to Queensland—a pertinent milestone to reflect on the integral role we have in Queensland’s system of government. We look forward to celebrating who we are and where we are going with our clients and stakeholders. Our staff are fiercely proud of the work they do and the contribution they make to Queensland.

In support of our submission to the Queensland Greats Awards this year, Sir Leo Hielscher, an admirable Queenslander and former QAO staff member said: ‘the Auditor-General’s department enjoys its integrity. It serves the people of Queensland with vigour and forthrightness.'

Financial statements and independent auditor's reports

QAO funds the costs of its operations from the financial audit fees we charge our clients and from parliamentary appropriation.

Our funding from parliament, received under the Appropriation (Parliament) Bill 2019, for 2019–20 was $7.1 million, marginally over our budget of $6.9 million with the increase relating to additional funding to support the public sector enterprise bargaining outcomes. Our appropriation is allocated to our reporting to parliament, delivering performance audit services, preparing the strategic audit plan, investigating referrals, and renumerating the Auditor‑General.

The income from our audit fees was $36.9 million, $1.6 million below our budget of $38.5 million, as we billed less work to our clients during the COVID-19 lockdown months.

Fortunately, the pandemic did not majorly affect our ability to do our job. On its outbreak, we anticipated and planned for less audit work from our clients and less travel to our regional clients. This had a resultant impact on our revenue. In response, we immediately reduced our discretionary spending, including by spending less on contracted audit resources and our planned audit program.

However, overall, we were able to deliver most of our audit services for most of our clients this year and did not need to secure additional funding. With reduced travel, we passed some cost savings on to our clients. Our overall total income from our continuing operations was $44.4 million, slightly under budget of $45.6 million.

QAO’s total expenses were $43.7 million, similar to last year at $43.1 million, and slightly under budget by $1.2 million. COVID-19 did not majorly impact our expenditure because we still had to pay of our staff, audit service providers and accommodation costs.

More than half of our expenses were staff costs at $23.9 million, and our next largest cost was our contracted audit service providers at $12.5 million. Our other expenses were conservative, covering some specialist consultants, rent and office services, and information technology or minor office equipment. Due to our investment in technology in previous years we did not need to make any large purchases to be able to continue our audit operations effectively.

We continue to operate as a sustainable and contemporary public sector audit practice.

The following pages of this report contain:

- the Queensland Audit Office’s financial statements

- the Queensland Audit Office’s performance statement

- the independent auditor’s report from Hall Chadwick Queensland.