In a world where organisations constantly face financial challenges and uncertainties, it’s critical they understand the capability of their assets to deliver the services their community needs now and into the future. Regardless of whether you’re a department, a local government, or a government owned corporation, a transparent asset management plan is not a nice to have – it’s a necessity.

An asset management plan contains the actions an organisation needs to take to deliver its asset management strategy. It also provides a roadmap for financial stability, risk mitigation, and long-term sustainability. But to achieve this, the plan must be transparent and refreshed regularly as major changes to your asset values and/or your operations occur. We observed in our report, Improving asset management in local government (Report 2: 2023–24), that the 5 councils’ plans we reviewed didn’t clearly demonstrate they could afford to deliver their services in the long term.

In this blog, we explore why transparency is crucial when it comes to asset management plans, and how it impacts an organisation’s sustainability and success.

What benefits does a transparent asset management plan provide?

Glean insights into financial sustainability

An organisation's financial health is its lifeblood. Poor financial forecasting can lead to unnecessary borrowing, services degrading when unexpected asset failures occur, or service levels not delivering the required capacity when the population increases. It's imperative that organisations manage assets in a way that guarantees financial stability in the long run (10 years or longer). Forecasting future maintenance, asset upgrades, and asset renewals gives your organisation time to plan and budget so funds are ready when you need them.

An asset management plan should clearly show how and when an organisation will maintain, upgrade, and replace assets over time. This helps to avoid costly surprises, such as unexpected maintenance or asset replacement costs. Importantly, it should provide a scenario that can deliver affordable levels of service targets within long term financial plan scenarios, while managing and communicating risk.

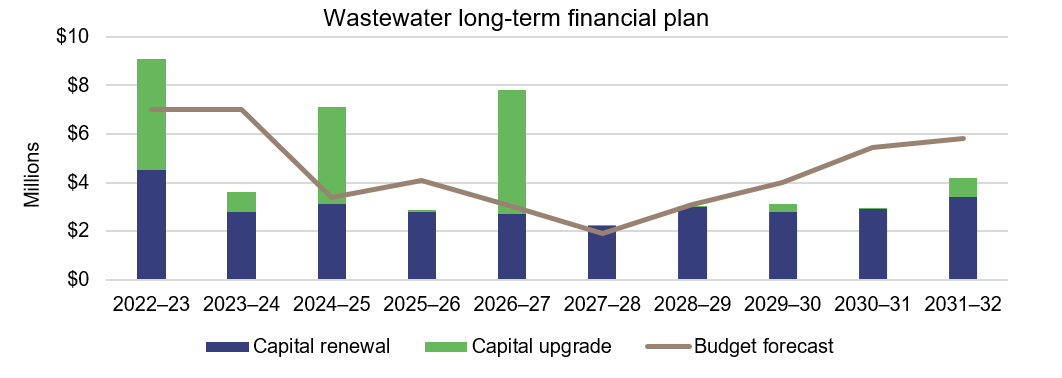

In the example below from one council, the planned renewals for wastewater assets (in blue) over the next 10 years are fairly constant – between $2 to $4 million annually. But forecast population increases are driving high upgrade costs of $15 million (in green) in the first 5 years.

Based on the budget forecast, the council can afford to deliver its capital works program over the next 10 years. But it will need to consider funding shortfalls in 3 of the first 5 years, and reprioritise projects or the budget itself. Because without the necessary wastewater infrastructure in the short term, new housing developments could be delayed.

With a 10-year outlook, such as in this example, decision-makers have the evidence they need to make trade-off decisions between service objectives, revenues, appropriate levels of debt, and risks. All while ensuring value for money. Management may need to consider several options so the scenario reduces the gap between what the assets are going to cost and what the organisation can afford.

Provide stakeholders with confidence

A transparent, well-structured and sustainable plan builds trust among stakeholders, whether they are shareholders, other government entities, or the general public. This trust can mean they are more likely to support the organisation and understand why it needs to change service levels or charges/fees. Transparent decisions can also help funding entities make decisions about any additional borrowings or grants. Conversely, where organisations don’t make transparent decisions, stakeholders may be sceptical and lose confidence in the organisation.

Demonstrate compliance with regulations

Many organisations are subject to regulatory requirements that mandate long-term financial planning and stability. Transparent plans not only help an organisation stay compliant with these regulations, but also to avoid legal complications and penalties. Moreover, they showcase the organisation's commitment to following best practices.

Prioritise long-term sustainability

Without a clear focus on long-term sustainability, organisations might prioritise short-term gains. Having a transparent plan serves as a constant reminder of the importance of planning for the future. They encourage organisations to make decisions in the best interest of their longevity rather than quick fixes which, although popular, could prove unaffordable later.

Mitigate the risk of assets not being able to deliver services

Long-term plans provide a framework to assess and mitigate risks associated with critical assets, such as technological obsolescence, the impact of climate change, or natural disasters. By maintaining a clear view of these risks, organisations can make proactive decisions to safeguard their services and operations.

Identify gains in efficiencies and reductions in costs

An up-to-date, comprehensive plan ensures organisations optimise their assets for maximum efficiency. This can lead to significant cost reductions over time, as they use resources more effectively and minimise wastage. By illustrating these cost-saving strategies in their asset management plan, organisations can demonstrate their financial responsibility.

Support adaptation to changing circumstances

The business and operational landscape is constantly evolving. Construction costs are going up and new technologies are providing better information on the condition of assets (particularly underground assets, which have traditionally been difficult to inspect). Transparent plans enable organisations to adapt to changing circumstances – to introduce new technologies, methodologies, and better practices – and ensure the organisation remains competitive and efficient over the long term. Good decisions can allow organisations to dispose of older, obsolete assets and replace them with more modern ones that are cost efficient.

Promote public accountability

For public sector entities, transparency is essential to maintain public trust. A thorough plan shows the community that the entity is using their taxes, rates, and utility charges responsibly and is committed to serving the public for years to come. In our report we found that councils’ asset management plans didn’t support public accountability, as they lacked clear measures and targets. Without these, the councils could not report on whether their assets were delivering the levels of service their communities expect.

Where to from here?

By demonstrating a commitment to the long-term delivery of services and operations, organisations can build trust, ensure compliance, and stay resilient. It's time to recognise that the real value of asset management plans goes beyond the numbers – they are the key to prosperous and enduring communities.

Look out for the next blogs in our asset management series, which will discuss asset investment decisions, maintenance, and how to approach reporting.

Other resources

Reports to parliament where we mention or cover asset management:

- Improving asset management in local government (Report 2: 2023)

- Local government 2022 (Report 15: 2022–23), 2021 (Report 15: 2021–22),and 2020 (Report 17: 2020–21)

- Education 2022 (Report 16: 2022–23), 2021 (Report 19: 2021–22), and 2020 (Report 18: 2020–21)

- Health 2022 (Report 10: 2022–23)

- Investing in vocational education and training (Report 1: 2019–20)

- Efficient and effective use of high value medical equipment (Report 10: 2016–17)

- Forecasting long-term sustainability of local government (Report 2: 2016–17)

- Maintenance of public schools (Report 11: 2014–15).

Prior blog posts that mention asset management: